Supplier Categorization

CN

CN

1/5

1/5

1/3

1/3

1/35

1/35

1/3

1/3

1/3

1/3

1/1

1/1

1/52

1/52

0

0

1/6

1/6

1/5

1/5

1/3

1/3

CN

CN

1/2

1/2

1/3

1/3

CN

CN

1/2

1/2

CN

CN

0

0

1/3

1/3

1/16

1/16

1/3

1/3

About supplier categorization

Where to Find Supplier Categorization Service Providers?

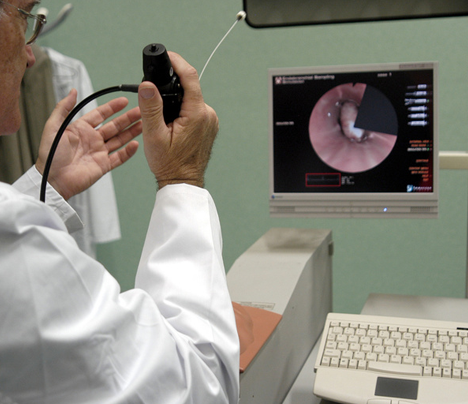

China remains a central hub for supplier categorization and sourcing support services, with key operational clusters in Zhejiang, Guangdong, and Sichuan provinces. These regions host specialized supply chain firms that integrate procurement intelligence, logistics coordination, and supplier verification systems. Zhejiang’s Yiwu and Hangzhou zones are known for dense networks of small-lot suppliers and express sourcing agents, enabling rapid product discovery across 1688.com and other domestic platforms. Guangdong's Shenzhen and Guangzhou corridors offer proximity to high-volume export channels and dropshipping infrastructure, supporting scalable e-commerce fulfillment. Meanwhile, Chengdu-based providers combine technical domain expertise with surgical and medical equipment sourcing precision, reflecting regional specialization in regulated product categories.

The industrial ecosystem supports tiered service models—from automated supplier tagging to full due diligence audits—facilitated by localized knowledge of manufacturing zones, language fluency, and compliance frameworks. Buyers benefit from reduced search times (often under 72 hours for initial supplier shortlisting), access to pre-vetted supplier databases (some exceeding 5,000 verified entities), and integrated logistics tracking. Cost efficiencies arise from low minimum order requirements (as low as 1 kg or 1 piece) and streamlined communication protocols, with many providers offering sub-7-hour response windows.

How to Choose Supplier Categorization Service Providers?

Effective partner selection requires structured evaluation across three core dimensions:

Service Scope & Expertise

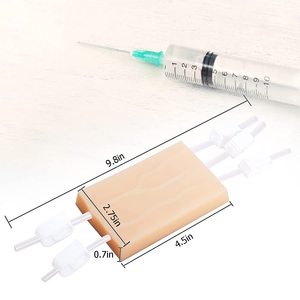

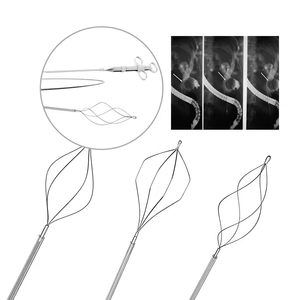

Assess whether the provider specializes in niche verticals (e.g., medical devices, pet supplies, apparel) or offers broad multi-category sourcing. Firms with documented customization capabilities—such as blade specifications for surgical trainers or packaging labels for cosmetics—demonstrate deeper integration into production workflows. Prioritize those disclosing main product lines and technical configuration options, which indicate hands-on supplier management rather than intermediary brokering.

Operational Performance Metrics

Evaluate reliability using quantifiable benchmarks:

- On-time delivery rate ≥90% indicates strong logistics control

- Reorder rate >25% reflects client retention and service consistency

- Average response time ≤3 hours enables agile decision-making

- Verified online revenue (e.g., US $250,000+) correlates with transaction volume and platform activity

Cross-reference these metrics with service scope to identify providers balancing responsiveness with scalability.

Due Diligence & Transaction Security

Confirm supplier verification mechanisms, including on-site factory assessments, document authentication, and quality inspection protocols. Look for evidence of multispecialty validation or trusted service designation, which may reflect third-party auditing. Utilize incremental engagement—start with sample orders or agent fee-based trials—to assess performance before committing to long-term contracts. Escrow arrangements and milestone-based payments mitigate financial exposure during initial collaborations.

What Are the Leading Supplier Categorization Service Providers?

| Company Name | Location | Core Services | Min. Order | Price Range (USD) | On-Time Delivery | Avg. Response | Online Revenue | Reorder Rate |

|---|---|---|---|---|---|---|---|---|

| Zhejiang Huihe International Logistics Co., Ltd. | Zhejiang, CN | Express sourcing, 1688 buying agency | 1 kilogram | $0.30–1.00 | 66% | ≤2h | US $400+ | 50% |

| PT5 CHINA SOURCING MANAGEMENT CO., LIMITED | Guangdong, CN | Dropshipping sourcing, procurement agency | 1 piece | $1.20 | 85% | ≤7h | US $10,000+ | <15% |

| Chengdu Great Long Hua Trade Co., Ltd. | Sichuan, CN | Medical simulation equipment sourcing | 1 set | $550–650 | 99% | ≤3h | US $390,000+ | 26% |

| VASLCARE | Guangdong, CN | Medical training model procurement | 50 pieces | $4.00 | 75% | ≤1h | US $10,000+ | - |

| Shenzhen Aise Supply Chain Co., Ltd. | Guangdong, CN | 1688 sourcing, wholesale purchasing | 21 kilograms | $0.50–2.50 | 96% | ≤7h | US $250,000+ | 27% |

Performance Analysis

Chengdu Great Long Hua sets a benchmark in reliability with a 99% on-time delivery rate and extensive customization transparency, making it ideal for technically complex procurements. Shenzhen Aise Supply Chain demonstrates strong operational maturity through high reorder (27%) and on-time delivery (96%) rates, supported by significant annual revenue. While PT5 CHINA SOURCING targets dropshipping clients with low per-unit pricing and single-piece MOQs, its sub-15% reorder rate suggests potential gaps in long-term client satisfaction. Zhejiang Huihe stands out for fast response times and moderate cost structure but lags in delivery performance. VASLCARE leads in responsiveness (≤1h) and serves medical equipment buyers with standardized models, though reorder data is unavailable. Buyers should align provider strengths with procurement objectives: speed-to-market favors Guangdong-based agents, while technical accuracy benefits from Sichuan’s specialized operators.

FAQs

How to verify supplier categorization service reliability?

Review disclosed performance metrics such as on-time delivery, response time, and reorder rate. Request case studies or references for specific product categories. Validate claims through independent buyer forums or transaction history analysis where available.

What is the typical lead time for supplier identification?

Standard supplier shortlisting takes 1–3 business days. Complex or highly regulated categories (e.g., medical devices) may require up to 7 days for comprehensive vetting, including factory checks and compliance verification.

Can these services handle customized product sourcing?

Yes, select providers offer deep customization support, particularly in engineered goods like surgical simulators or branded apparel. Confirm capability through detailed specification handling, prototype coordination, and material adaptation experience.

Do sourcing agents provide post-purchase support?

Service levels vary. High-performing firms include quality inspections, shipment tracking, and dispute mediation. Define support expectations contractually, especially for defect resolution and return logistics.

How are fees structured for supplier categorization services?

Pricing models include per-order commissions, hourly consulting rates, or flat fees per sourcing request. Some charge based on procurement value (typically 5–15%), while others offer subscription packages for recurring needs.