Supplier Database Access

CN

CN

About supplier database access

Where to Find Supplier Database Access Providers?

The global market for supplier database access solutions is primarily driven by technology-focused firms in China and India, where cost-efficient development infrastructure and specialized software expertise converge. Chinese suppliers, particularly those based in Shenzhen and Beijing, leverage mature tech ecosystems with access to skilled IT labor pools and integrated digital service stacks. Indian providers, concentrated in regions like Hyderabad and Pune, benefit from strong English-language proficiency and legacy strengths in enterprise software outsourcing, enabling seamless integration with Western business systems.

These regions support rapid deployment of database administration, cloud data management, and ETL (Extract, Transform, Load) solutions at competitive pricing. Suppliers typically operate within agile development frameworks, offering scalable engagement models ranging from one-time licensing to ongoing managed services. Buyers gain access to modular platforms that support API integrations, multi-tenant architectures, and compliance-ready configurations—critical for procurement, supply chain analytics, and vendor risk assessment applications.

How to Choose Supplier Database Access Providers?

Selecting reliable partners requires a structured evaluation across technical, operational, and transactional dimensions:

Technical Capability Verification

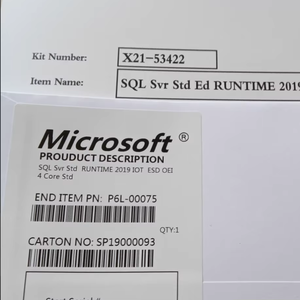

Confirm direct experience in database architecture design, including support for Oracle, Microsoft SQL, and cloud-native platforms like AWS Redshift or Snowflake. Evaluate product listings for specificity: generic claims ("best database provider") should be scrutinized versus detailed service descriptions (e.g., "Oracle 11g/12c license provisioning" or "ETL pipeline development"). Prioritize vendors offering documented system uptime, encryption protocols, and role-based access controls.

Service Delivery Metrics

Assess responsiveness and reliability using verifiable performance indicators:

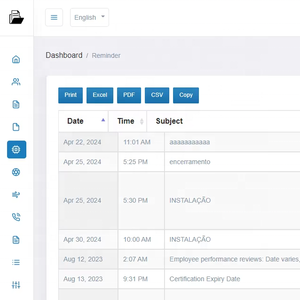

- Response time ≤2 hours indicates high operational availability

- On-time delivery rate ≥94% reflects consistent service fulfillment

- Reorder rate below 15% may suggest limited customer retention despite initial satisfaction

Cross-reference these metrics with service scope to identify specialists versus generalists.

Transaction and Risk Mitigation Protocols

Utilize secure payment mechanisms such as escrow services for initial engagements. Require proof of prior project delivery through case studies or anonymized client references. For high-value contracts (>$1,000), insist on contractual SLAs covering data security, breach liability, and service restoration timelines. Pre-deployment testing of demo environments is recommended to validate functionality before full rollout.

What Are the Leading Supplier Database Access Providers?

| Company Name | Location | Main Products (Listings) | On-Time Delivery | Avg. Response | Min. Order Value | Reorder Rate | Customization |

|---|---|---|---|---|---|---|---|

| Chaolian (Shenzhen) Import And Export Co., Ltd. | Shenzhen, CN | Software (1,090) | 99% | ≤2h | $0.99 | <15% | No |

| HINDUSTANSOFT CORPORATION | India | Software (891) | - | ≤1h | $180 | - | No |

| Shenzhen Kuaiji Interactive Technology Co., Ltd. | Shenzhen, CN | Data Integration & Cloud Solutions | 100% | ≤6h | $100 | - | Logo branding |

| Yantai Yuling Heavy Industry Co., Ltd. | Yantai, CN | Construction Machinery Parts (77) | 100% | ≤1h | $180 | 50% | No |

| Beijing StarRiver Leading Technology Co., Ltd. | Beijing, CN | Networking Storage (73), Software (55) | 94% | ≤2h | $235 | <15% | No |

Performance Analysis

Shenzhen Kuaiji Interactive Technology stands out with a 100% on-time delivery record and offerings in enterprise-grade data warehouse and low-code platform development, positioning it as a technically robust option for customized integrations. HINDUSTANSOFT CORPORATION demonstrates ultra-fast response times (≤1h), indicating strong customer service orientation, though absence of delivery and reorder metrics limits risk assessment. Chaolian (Shenzhen) offers the lowest entry barrier ($0.99 MOQ), suitable for small-scale trials, but its low reorder rate suggests limited long-term engagement. Yantai Yuling’s 50% reorder rate is an outlier, potentially reflecting niche appeal or non-database core competencies. Beijing StarRiver provides mid-range pricing with verifiable transaction volume, making it a balanced choice for standardized Oracle database services.

FAQs

How to verify supplier database access reliability?

Cross-check technical claims with product-specific documentation such as user manuals, API specifications, or compliance certificates. Request trial access to sandbox environments. Validate company registration details and historical transaction patterns through available trade data. Prioritize suppliers with transparent service level definitions and audit trails.

What is the typical lead time for database access setup?

Standard licensing or cloud instance provisioning typically takes 24–72 hours post-payment. Custom deployments involving data migration, API integration, or OEM branding require 5–15 business days depending on complexity. Expedited setup (within 12 hours) is available from select providers at premium rates.

Can suppliers offer customized database solutions?

Limited customization is available, primarily restricted to logo branding and basic UI adjustments. Full architectural modifications or proprietary feature development are not offered by current listed suppliers. Buyers requiring bespoke systems should engage dedicated software development firms with proven portfolios in database engineering.

What are common minimum order requirements?

Minimum order values range from $0.99 for software licenses to $1,700 for comprehensive enterprise packages. Most providers require per-unit purchases rather than subscription models. Bulk pricing is rarely disclosed, suggesting opportunities for negotiation on orders exceeding five units.

Do providers support international compliance standards?

Explicit certifications (e.g., ISO 27001, GDPR, SOC 2) are not stated in available listings. Buyers in regulated industries must independently verify data handling practices, encryption standards, and jurisdictional compliance. Providers based in China and India may be subject to local data sovereignty laws affecting cross-border transfers.