Supplier Relationship Management Testing Examples

CN

CN

About supplier relationship management testing examples

Where to Find Supplier Relationship Management Testing Equipment Suppliers?

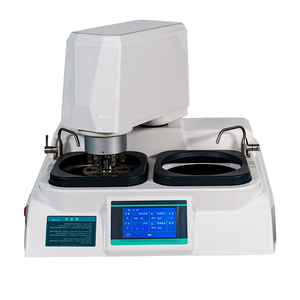

China remains the central hub for manufacturing advanced testing equipment used in supplier relationship management (SRM) systems, with key production clusters in Shaanxi, Shandong, Hebei, and Shandong provinces. Xi'an and Shijiazhuang host specialized electronics and civil engineering test instrument manufacturers leveraging regional expertise in high-precision measurement technologies. Taian and Jinan focus on automotive and industrial diagnostics, integrating software-driven analytics into physical testing platforms. These regions benefit from concentrated technical labor pools and access to component supply chains, enabling cost efficiencies of 20–35% compared to equivalent Western-produced instruments.

The industrial ecosystems support rapid prototyping and scalable production through vertically integrated operations—from PCB assembly to final calibration. Suppliers typically operate within compact logistics zones where raw materials, machining services, and export channels are accessible within 50 km. This infrastructure reduces lead times to 15–30 days for standard units and allows flexible responses to customized configurations. Buyers gain access to mature technical networks capable of delivering ISO-compliant, field-tested instrumentation across diverse sectors including energy, construction, and automotive maintenance.

How to Choose Supplier Relationship Management Testing Equipment Suppliers?

Procurement decisions should be guided by structured evaluation criteria focused on technical reliability, production transparency, and transactional accountability.

Technical Validation

Confirm that equipment meets recognized international standards such as IEC 60270 (for partial discharge testing), ASTM E4 (universal testing machines), or ISO 7500-1 (tensile strength verification). For SRM integration, verify data output compatibility with common enterprise resource planning (ERP) and CRM platforms. Request documented calibration certificates and operational test logs for critical components like high-voltage insulation testers or dynamic load sensors.

Production & Engineering Capacity

Assess supplier infrastructure using these benchmarks:

- Minimum R&D team size of 5+ engineers supporting firmware updates and diagnostic algorithms

- In-house capabilities in circuit design, embedded software development, and mechanical stress testing

- Customization support for interface languages, data export formats, and branding elements

Cross-reference on-time delivery performance (target ≥97%) with response time metrics (≤3 hours preferred) to evaluate operational responsiveness.

Transaction Security & Quality Assurance

Prioritize suppliers with verifiable revenue histories and transparent order fulfillment records. Utilize secure payment mechanisms such as escrow services until post-delivery acceptance testing is completed. Conduct sample evaluations against defined performance thresholds—for example, battery discharge testers should maintain ±2% accuracy over continuous 8-hour cycles. Require OEM/ODM documentation if integrating equipment into proprietary monitoring workflows.

What Are the Leading Supplier Relationship Management Testing Equipment Suppliers?

| Company Name | Location | Core Product Lines | Online Revenue | On-Time Delivery | Avg. Response | Reorder Rate | Customization Options |

|---|---|---|---|---|---|---|---|

| Jinan Hensgrand Instrument Co., Ltd. | Shandong, CN | Universal testers, plastic friction/wear analyzers, spring/digital force gauges | US $1,500,000+ | 100.0% | ≤3h | 62% | Color, material, size, logo, packaging, parameters, specifications |

| Taian Beacon Machine Manufacturing Co., Ltd. | Shandong, CN | Diesel injector testers, vehicle diagnostic tools, common rail calibration systems | US $770,000+ | 94.0% | ≤4h | 33% | Multi-language support, pump types, flow sensors, database customization, adapters, power testing, software editing |

| Shanghai Glomro Industrial Co., Ltd. | Shanghai, CN | Tensile, torsion, vacuum seal performance testers | US $450,000+ | 97.0% | ≤1h | <15% | Color, material, size, language, software, battery, heating power, model variants |

| Xi'an Sanxin Yida Electronic Technology Co., Ltd. | Shaanxi, CN | High-voltage DC testers, partial discharge detectors, underground cable path finders | US $400,000+ | 100.0% | ≤1h | <15% | Color, material, size, logo, packaging, label, graphic design |

| Shijiazhuang Glit Electronic Technology Co., Ltd. | Hebei, CN | Road dynamic plate testers, drop hammer impact systems, civil engineering pile/concrete testers | US $40,000+ | 100.0% | ≤1h | <15% | Color, material, size, logo, packaging, label, graphic, OEM/ODM available |

Performance Analysis

Jinan Hensgrand stands out with a 62% reorder rate—the highest among listed suppliers—indicating strong customer satisfaction in industrial materials testing. Despite lower online revenue, its 100% on-time delivery and comprehensive customization options make it a preferred partner for repeat procurement. Taian Beacon offers deep specialization in diesel engine diagnostics, supported by extensive database integration and multi-language interfaces, though its 94% delivery rate suggests moderate risk in urgent timelines. Shanghai Glomro and Xi’an Sanxin Yida both achieve sub-1 hour response times and near-perfect delivery records, ideal for time-sensitive sourcing. Shijiazhuang Glit provides entry-level pricing for civil engineering applications but has limited transaction volume, suggesting niche market positioning. For mission-critical SRM integrations, prioritize suppliers with documented calibration procedures, API/data export functionality, and proven after-sales technical support.

FAQs

How to verify testing equipment supplier credibility?

Validate certifications (ISO 9001, CE, RoHS) through official registries. Request factory audit reports or video walkthroughs confirming in-house production lines. Analyze historical transaction data focusing on delivery consistency and dispute resolution outcomes.

What is the typical lead time for custom testing instruments?

Standard units ship within 15–20 days. Custom-built systems with modified software, extended ranges, or unique mechanical designs require 30–45 days, depending on complexity. Add 7–14 days for air freight delivery to North America or Europe.

Do suppliers offer calibration and after-sales support?

Most leading suppliers provide one-year warranties and remote troubleshooting. Some offer on-site technician training or periodic recalibration services. Confirm service coverage and spare parts availability before purchase, especially for high-voltage or precision sensor-based equipment.

Are samples available for performance testing?

Yes, samples are generally available at full price or subsidized rates. Expect to pay 80–100% of unit cost, which may be credited toward bulk orders exceeding five units. Sample requests should specify required configurations to ensure representative evaluation.

Can testing devices integrate with existing SRM platforms?

Integration depends on data interface capabilities. Verify whether devices support USB, RS232, Ethernet, or wireless outputs, and whether they generate structured data (CSV, XML, JSON) compatible with your analytics environment. Suppliers like Taian Beacon and Jinan Hensgrand offer programmable APIs for enterprise deployment.