Supplier Segmentation Matrix

About supplier segmentation matrix

Where to Find Supplier Segmentation Matrix Suppliers?

The global supplier base for segmentation matrix products is concentrated in China, with key manufacturing clusters in Guangdong, Tianjin, and Hunan provinces. These regions host specialized industrial ecosystems focused on precision-engineered components for niche markets such as dental instrumentation and stage lighting systems. Guangdong Province, particularly Guangzhou and Shanghai, serves as a hub for advanced photoelectric technology production, offering vertically integrated supply chains that support rapid prototyping and high-volume output. Meanwhile, Tianjin and Changsha specialize in medical-grade consumables, leveraging localized steel and polymer processing facilities to maintain cost efficiency and consistent quality.

These regional hubs benefit from mature logistics networks and proximity to component suppliers, enabling lead times averaging 20–35 days for standard orders. The co-location of R&D centers, CNC machining units, and packaging specialists within 50km radii allows suppliers to offer competitive pricing—typically 18–25% below Western manufacturers—while supporting both bulk procurement and low-volume customized runs. Buyers gain access to agile production environments capable of accommodating technical modifications in materials, dimensions, and functional integration.

How to Choose Supplier Segmentation Matrix Suppliers?

Selecting reliable partners requires adherence to structured evaluation criteria:

Technical Specialization & Product Alignment

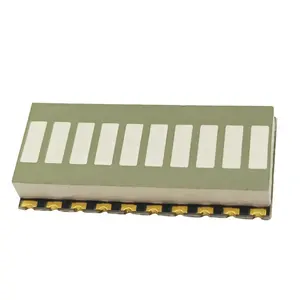

Verify that the supplier’s core product lines align with your application domain. For instance, companies like Changsha Easyinsmile Medical Instrument Co., Ltd. list over 500 dental consumable SKUs, indicating deep expertise in medical-grade matrix bands. Conversely, Guangzhou-based firms such as Huineng Photoelectric focus on LED-based visual systems with configurable pixel segments, signal protocols (e.g., DMX512), and structural accessories like flight cases and mounting hardware.

Production Capacity & Scalability Indicators

Assess operational scale using available metrics:

- Minimum monthly output capacity exceeding 10,000 units for high-demand items

- In-house tooling and molding capabilities for custom configurations

- Documented order fulfillment performance (on-time delivery ≥95%)

Cross-reference online revenue data and reorder rates—suppliers with reorder rates above 30%, such as Changsha Easyinsmile (36%), demonstrate sustained customer satisfaction and product reliability.

Quality Assurance & Transaction Security

Prioritize suppliers who provide verifiable quality benchmarks. While formal certifications (ISO 9001, CE, RoHS) are not explicitly stated in the dataset, strong proxies include on-time delivery records (ranging from 85% to 100% across suppliers) and response times under 7 hours. Use third-party transaction platforms to enable payment escrow until post-delivery inspection. Request physical or digital samples to validate material integrity, dimensional accuracy, and functional compatibility before scaling orders.

What Are the Best Supplier Segmentation Matrix Suppliers?

| Company Name | Location | Main Product Focus | Listings Count | On-Time Delivery | Reorder Rate | Avg. Response Time | Online Revenue | Min. Order Quantity |

|---|---|---|---|---|---|---|---|---|

| Guangzhou Huineng Photoelectric Technology Co., Ltd. | Guangdong, CN | LED Stage Lighting Systems | 4 | 93% | 26% | ≤2h | US $1.3M+ | 2–4 pieces |

| Tianjin Spider Impex Co., Ltd. | Tianjin, CN | Dental Matrix Bands | 3 | 100% | <15% | ≤2h | US $250K+ | 50 pieces |

| Changsha Easyinsmile Medical Instrument Co., Ltd. | Hunan, CN | Dental Sectional Matrices | 5 | 96% | 36% | ≤7h | US $240K+ | 50–200 boxes |

| Shanghai Shuodi Technology Co., Ltd. | Shanghai, CN | Dental Transparent Matrices | 5 | 100% | <15% | ≤5h | US $5K+ | 30–50 packs/rolls |

| Guangzhou Botai Photoelectric Equipment Co., Ltd. | Guangdong, CN | Programmable LED Matrix Lights | 4 | 85% | 36% | ≤4h | US $680K+ | 10 boxes |

Performance Analysis

Guangzhou-based suppliers dominate in photoelectric applications, offering advanced features such as RGBW pixel control, ArtNet compatibility, and modular assembly. Despite lower reorder rates, Tianjin Spider Impex and Shanghai Shuodi maintain perfect on-time delivery records, suggesting robust internal logistics despite limited market visibility. Changsha Easyinsmile stands out in the dental sector with a 36% reorder rate and extensive catalog (893+ listings), reflecting strong market penetration and product consistency. Guangzhou Botai, while exhibiting slightly lower punctuality (85%), supports complex customization in lumen output, strobe effects, and channel programming, making it suitable for technically demanding installations. Buyers should prioritize suppliers with proven specialization, transparent MOQ structures, and responsiveness under 5 hours for mission-critical sourcing.

FAQs

How to verify supplier segmentation matrix product compatibility?

Request technical specifications including material composition (e.g., stainless steel vs. transparent polymer), segment count, pixel pitch (for LED matrices), and interface standards (DMX512, signal cables). Validate against end-use requirements through sample testing under real-world operating conditions.

What are typical minimum order quantities?

MOQs vary by application: dental matrix bands typically require 50–200 units per order, while LED-based segmentation matrices are sold in box quantities starting at 2–10 units. Some suppliers offer mixed batches for initial trials at negotiated pricing.

Do suppliers support customization?

Yes, multiple suppliers offer tailored solutions in color, size, labeling, packaging, and functional components (e.g., detachable cables, foam flight cases, die-cut inserts). Confirm feasibility via direct inquiry and request design proofs or prototypes prior to production.

What is the average lead time for sample delivery?

Sample processing typically takes 7–15 days, with an additional 5–10 days for international shipping via express carriers. Complex customizations may extend timelines to 25 days depending on tooling requirements.

Are there options for private labeling and OEM manufacturing?

Several suppliers indicate support for logo imprinting, custom packaging, and graphic labeling. Establish OEM terms early in negotiations, including IP protection, mold ownership, and volume-based pricing tiers.