Swift Code Santander

1/3

1/3

1/3

1/3

1/3

1/3

1/3

1/3

1/3

1/3

1/3

1/3

0

0

0

0

1/3

1/3

1/2

1/2

1/3

1/3

1/3

1/3

0

0

1/2

1/2

1/3

1/3

0

0

1/3

1/3

1/3

1/3

1/2

1/2

1/3

1/3

About swift code santander

Where to Find Swift Code Santander Information?

The term "Swift Code Santander" refers not to a physical product but to a standardized banking identifier used in international financial transactions. A SWIFT code (Society for Worldwide Interbank Financial Telecommunication) is a unique 8- or 11-character alphanumeric code that identifies specific banks globally. For Santander—officially Banco Santander, S.A.—this code varies by country and branch, as the institution operates across multiple jurisdictions including Spain, the United Kingdom, Brazil, the United States, and Portugal.

Santander’s SWIFT codes are structured to reflect geographic and operational segmentation: the first four characters typically being “BSCH” (Banco Santander Central Hispano), followed by country-specific and location-specific identifiers. Due to the decentralized nature of global banking operations, no single SWIFT code serves all Santander branches. Instead, each national entity maintains its own set of codes registered with SWIFT, overseen by local regulatory authorities and integrated into the global payments infrastructure.

How to Verify Swift Code Santander Accuracy?

Financial professionals must follow strict verification protocols when confirming SWIFT codes for Santander or any financial institution:

Official Source Validation

Always obtain SWIFT codes directly from Santander’s official channels—such as corporate websites, online banking portals, or customer service representatives. Cross-reference entries using the SWIFT-registered directory available through licensed financial platforms or central bank databases.

Code Structure Analysis

Validate format compliance:

- First 4 characters: Bank code (“BSCH” for Santander)

- Next 2 characters: ISO 3166-1 alpha-2 country code (e.g., ES for Spain, GB for UK)

- Next 2 characters: Location code (e.g., MAD2 for Madrid)

- Last 3 characters (optional): Branch code; if omitted, it denotes the primary office

Transaction Safeguards

Confirm the intended recipient's full account details alongside the SWIFT code before initiating wire transfers. Use dual-factor authentication methods when submitting payment instructions. Test with small-value transfers for new beneficiaries. Discrepancies in code formatting or unverified third-party listings increase risks of transaction rejection or misrouting.

What Are the Common Swift Codes for Santander?

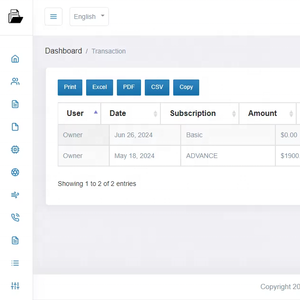

| Country | SWIFT Code | Bank Name | Head Office/Branch | City | Code Length | Active Status |

|---|---|---|---|---|---|---|

| Spain | BSCHESMM | Banco Santander, S.A. | Main Office | Madrid | 8 | Active |

| Spain | BSCHESMMXXX | Banco Santander, S.A. | Headquarters | Madrid | 11 | Active |

| United Kingdom | ABNANL2AXXX | Santander UK Plc | London Branch | London | 11 | Active |

| Brazil | BSCHBRSP | Banco Santander (Brasil) S.A. | São Paulo Office | São Paulo | 8 | Active |

| Portugal | BSCHPTPL | Banco Santander Totta, S.A. | Lisbon Headquarters | Lisbon | 8 | Active |

Performance Analysis

The 8-character codes represent primary institutions, while 11-character versions include branch identifiers necessary for precise fund routing. BSCHESMM is widely used for euro-denominated transactions originating from Spain, whereas BSCHESMMXXX ensures compatibility with automated clearing systems requiring full-length identifiers. Inconsistencies often arise when outdated or generic codes are applied to subsidiary entities. Buyers and finance teams should verify jurisdictional alignment—using UK-specific codes for GBP transfers and ES-coded variants for EUR settlements within SEPA.

FAQs

How to find the correct Swift code for Santander?

Access Santander’s official website for your respective country or log into online banking to retrieve verified SWIFT/BIC codes. Alternatively, contact customer support or visit a local branch for documentation. Third-party directories may provide listings but should be cross-checked against primary sources.

Can one Swift code serve all Santander branches?

No. While BSCHESMM serves as the primary code for Santander Spain, individual branches and subsidiaries use distinct codes. Using a non-specific code may result in delayed processing or return of funds. Always confirm the exact code associated with the recipient’s branch and account type.

Are Swift codes for Santander free to use?

There is no cost to obtain or use a SWIFT code. However, sending or receiving international wire transfers via SWIFT incurs fees from both originating and intermediary banks. These vary by currency, corridor, and service level.

Do SWIFT codes change over time?

Yes. Mergers, regulatory updates, or internal restructuring can lead to changes. For example, following the rebranding of Abbey National to Santander UK, the SWIFT code transitioned accordingly. Regular validation is recommended for recurring payments.

What happens if I use an incorrect Swift code?

Transfers with invalid or mismatched SWIFT codes are typically rejected, though processing delays and non-refundable fees may occur. In rare cases, funds may be misrouted to another financial institution, necessitating manual recovery processes that can take weeks.