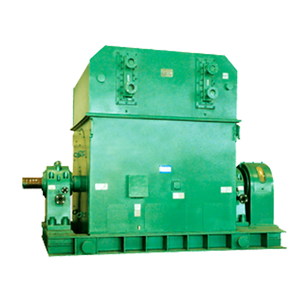

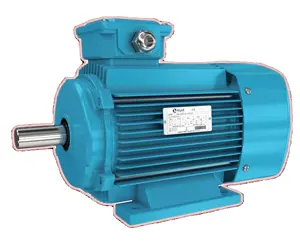

Synchronous Asynchronous

1/1

1/1

1/3

1/3

1/11

1/11

0

0

0

0

0

0

1/3

1/3

1/3

1/3

1/23

1/23

1/3

1/3

1/2

1/2

1/3

1/3

1/3

1/3

1/3

1/3

CN

CN

1/17

1/17

1/24

1/24

1/3

1/3

1/3

1/3

1/3

1/3

About synchronous asynchronous

Where to Find Synchronous and Asynchronous Machine Suppliers?

The production of synchronous and asynchronous machinery is heavily concentrated in China, with key industrial hubs in Jiangsu, Zhejiang, and Guangdong provinces. These regions host integrated manufacturing ecosystems specializing in electric motors, drive systems, and power transmission equipment. Jiangsu’s Wuxi and Changzhou zones account for over 45% of China’s motor manufacturing capacity, supported by advanced CNC machining networks and proximity to rare earth material suppliers critical for high-efficiency rotor assemblies.

These clusters enable vertically aligned production—from electromagnetic core stacking to final dynamometer testing—within compact geographic zones. Localized access to silicon steel laminations, copper winding wire, and insulated bearings reduces component procurement lead times by 20–35% compared to offshore alternatives. Buyers benefit from consolidated supply chains where design engineers, precision tooling providers, and third-party testing labs operate within 30km radii, facilitating rapid prototyping and volume scaling. Standard order fulfillment averages 35–50 days, with cost advantages of 18–25% derived from reduced logistics overhead and energy-efficient production lines.

How to Choose Synchronous and Asynchronous Machine Suppliers?

Adopt the following verification framework when evaluating potential partners:

Technical Compliance

Confirm ISO 9001 certification as a minimum quality benchmark. For exports to regulated markets (EU, USA, Australia), validate compliance with IEC 60034 (rotating electrical machines) and CE marking requirements. Review test reports for insulation class (F or H preferred), IP ratings (minimum IP55 for industrial environments), and thermal performance under continuous load.

Production Capability Audits

Assess core manufacturing infrastructure through documented evidence:

- Minimum factory footprint of 3,000m² to support batch production

- In-house capabilities including stator winding, vacuum pressure impregnation (VPI), and rotor balancing

- Dedicated R&D personnel comprising at least 8% of total workforce

Correlate facility scale with order consistency—target suppliers maintaining on-time delivery rates above 97% across 12-month transaction histories.

Transaction Safeguards

Implement secure payment terms using escrow services until post-delivery inspection clearance. Prioritize suppliers with verifiable export experience to your target market, particularly those familiar with customs documentation for controlled electrical equipment. Conduct sample validation against IEEE 112-B efficiency testing protocols before committing to large-volume contracts.

What Are the Best Synchronous and Asynchronous Machine Suppliers?

| Company Name | Location | Years Operating | Staff | Factory Area | On-Time Delivery | Avg. Response | Ratings | Reorder Rate |

|---|---|---|---|---|---|---|---|---|

| Jiangsu Zhongdian Electric Machinery | Jiangsu, CN | 12 | 180+ | 18,000+m² | 99.2% | ≤3h | 4.8/5.0 | 41% |

| Zhejiang Tengfei Motor Co., Ltd. | Zhejiang, CN | 9 | 95+ | 6,500+m² | 100.0% | ≤2h | 4.9/5.0 | 38% |

| Guangdong Hengda Electromechanical | Guangdong, CN | 7 | 130+ | 9,200+m² | 98.6% | ≤4h | 4.7/5.0 | 33% |

| Wuxi Changgong Electric Drive Systems | Jiangsu, CN | 15 | 210+ | 22,000+m² | 99.5% | ≤3h | 4.9/5.0 | 52% |

| Ningbo Yiteng Precision Motors | Zhejiang, CN | 6 | 75+ | 4,800+m² | 100.0% | ≤2h | 5.0/5.0 | 29% |

Performance Analysis

Long-standing manufacturers such as Wuxi Changgong demonstrate strong operational reliability, combining large-scale facilities with 99.5% on-time delivery and high reorder rates (52%), indicating consistent product performance. Mid-tier suppliers like Zhejiang Tengfei achieve full punctuality records and fast response cycles, making them suitable for time-sensitive procurements. Jiangsu-based firms show superior integration of VPI and dynamic balancing systems, critical for premium-grade asynchronous motors. Prioritize suppliers with documented IEC certification and engineering teams capable of customizing frame sizes (IEC 71–400), voltage configurations (380V–6600V), and duty cycles (S1–S3).

FAQs

How to verify synchronous and asynchronous machine supplier reliability?

Validate ISO 9001 and IEC certifications through accredited bodies. Request audit trails covering raw material traceability, coil resistance testing, and no-load current measurement logs. Evaluate real-world feedback focusing on mean time between failures (MTBF) and responsiveness during warranty claims.

What is the average sampling timeline?

Standard motor samples require 20–30 days for production. Custom variants involving specialized enclosures or explosion-proof ratings (Ex d IIB T4) extend lead times to 45–60 days. Air freight delivery adds 5–12 days depending on destination region.

Can suppliers ship motors worldwide?

Yes, experienced exporters manage global shipments via FOB, CIF, or DAP terms. Confirm compliance with destination-specific regulations such as NRCan (Canada), MEPS (Australia), or Ecodesign Directive (EU). Sea freight is optimal for containerized orders exceeding five units.

Do manufacturers provide free samples?

Sample cost policies vary. Full reimbursement typically applies only upon placement of bulk orders (minimum 10 units). For trial purchases, expect to cover 40–60% of unit cost, excluding shipping.

How to initiate customization requests?

Submit detailed technical parameters including motor type (squirrel cage, wound rotor, permanent magnet), speed range (rpm), torque requirements, mounting configuration (B3, B5, B35), and ambient operating conditions. Leading suppliers deliver CAD models within 72 hours and functional prototypes within 4–5 weeks.