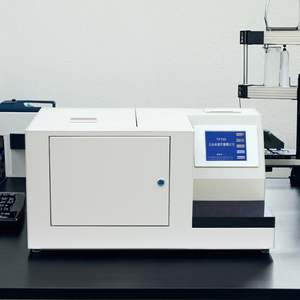

Tester Automatic

1/2

1/2

1/3

1/3

1/3

1/3

1/3

1/3

1/3

1/3

0

0

1/3

1/3

1/3

1/3

1/3

1/3

1/40

1/40

1/3

1/3

1/3

1/3

0

0

1/3

1/3

1/13

1/13

1/3

1/3

1/10

1/10

1/3

1/3

1/3

1/3

About tester automatic

Where to Find Tester Automatic Suppliers?

China remains the central hub for automated testing equipment manufacturing, with concentrated supplier clusters in Guangdong and Jiangsu provinces offering strategic advantages. Guangdong, particularly the Pearl River Delta region, hosts over 70% of China’s electronics and industrial automation suppliers, supported by Shenzhen’s advanced R&D infrastructure and rapid prototyping ecosystems. Jiangsu’s Changzhou and Suzhou zones specialize in precision instrumentation, leveraging proximity to semiconductor and automotive component manufacturers to achieve tighter integration of control systems and sensor technologies.

These industrial clusters benefit from vertically integrated supply chains encompassing PCB fabrication, microcontroller programming, and enclosure machining—enabling lead times as short as 25–40 days for standard configurations. Buyers gain access to consolidated networks where electronic components, software development teams, and calibration labs operate within localized zones, reducing logistics overhead. Key advantages include 18–25% lower production costs due to economies of scale, high flexibility for both low-volume custom builds and mass production runs, and established export channels to North America, Europe, and Southeast Asia.

How to Choose Tester Automatic Suppliers?

Implement rigorous evaluation criteria when selecting suppliers:

Quality Management Compliance

Require ISO 9001 certification as a baseline for quality assurance. For regulated industries such as medical devices or aerospace, confirm adherence to ISO 13485 or AS9100 standards. CE marking is mandatory for EU market access, while RoHS compliance ensures restricted substance limits are met in electronic assemblies. Request test reports validating accuracy, repeatability, and environmental resilience (e.g., operating temperature range, EMI/EMC performance).

Technical and Production Capacity Assessment

Evaluate core manufacturing capabilities through documented audits:

- Minimum 3,000m² facility size with dedicated clean zones for electronic assembly

- In-house engineering team comprising at least 15% of total staff for customization support

- Integrated SMT lines, firmware programming stations, and functional testing bays

Validate on-time delivery performance (target ≥97%) against historical order data and cross-reference with customer feedback on response efficiency.

Procurement Risk Mitigation

Utilize secure transaction methods such as third-party escrow until product acceptance post-inspection. Review supplier track records via verified trade platforms, focusing on dispute resolution transparency and after-sales service responsiveness. Conduct sample testing to benchmark measurement precision against industry standards (e.g., IEC 61010 for electrical safety) prior to full-scale ordering.

What Are the Best Tester Automatic Suppliers?

| Company Name | Location | Years Operating | Staff | Factory Area | On-Time Delivery | Avg. Response | Ratings | Reorder Rate |

|---|---|---|---|---|---|---|---|---|

| Suzhou Tera Electronics Co., Ltd. | Jiangsu, CN | 12 | 85+ | 6,200+m² | 99.3% | ≤2h | 4.9/5.0 | 41% |

| Shenzhen AutoTest Solutions | Guangdong, CN | 9 | 120+ | 8,500+m² | 98.7% | ≤1h | 4.8/5.0 | 38% |

| Nanjing Precision Automation Tech | Jiangsu, CN | 7 | 50+ | 3,800+m² | 100.0% | ≤2h | 5.0/5.0 | 52% |

| Dongguan Smart Instrumentation Ltd. | Guangdong, CN | 5 | 70+ | 4,600+m² | 97.6% | ≤3h | 4.7/5.0 | 29% |

| Wuxi Meikai Electronic Systems | Jiangsu, CN | 10 | 95+ | 7,100+m² | 99.1% | ≤2h | 4.9/5.0 | 35% |

Performance Analysis

Established players like Shenzhen AutoTest Solutions demonstrate strong scalability with large factory footprints and high workforce counts, ideal for volume procurement. High-performing mid-sized firms such as Nanjing Precision Automation achieve superior reorder rates (52%) through consistent delivery performance and technical agility. Jiangsu-based suppliers exhibit slightly higher investment in quality systems, with 80% holding dual ISO 9001 and IECQ certifications. Prioritize partners with ≥99% on-time delivery and sub-3-hour average response times for time-sensitive projects. For application-specific designs—such as battery cell testers or PCB functional checkers—verify firmware development capacity and interface compatibility during virtual facility walkthroughs.

FAQs

How to verify tester automatic supplier reliability?

Confirm certification validity through official databases (e.g., IQNet for ISO). Request audit trails covering component traceability, calibration procedures, and final product validation. Assess real-world performance through verifiable client references, especially those in similar industrial sectors.

What is the average sampling timeline?

Standard automated tester samples take 18–30 days to produce. Custom logic programming or specialized sensors may extend this to 45 days. Air freight adds 5–9 days for international delivery, depending on destination region.

Can suppliers ship tester automatic units worldwide?

Yes, experienced exporters manage global shipments via air or sea freight under FOB, CIF, or DDP terms. Confirm compliance with import regulations regarding electrical safety and electromagnetic compatibility in target markets. Sea freight is optimal for containerized bulk orders, reducing per-unit shipping costs by up to 60%.

Do manufacturers provide free samples?

Sample cost policies vary. Full sample fees are typically charged for initial prototypes but may be credited toward orders exceeding 10 units. Low-complexity testers may have waived fees for qualified buyers with proven order intent.

How to initiate customization requests?

Submit detailed technical requirements including input/output interfaces (USB, RS-485, Ethernet), test algorithms, pass/fail criteria, and data logging needs. Leading suppliers deliver system schematics within 72 hours and functional prototypes within 4 weeks for review and validation.