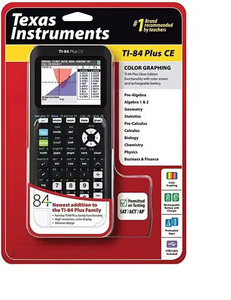

Texas Instruments National Semiconductor

CN

CN

About texas instruments national semiconductor

Where to Find Texas Instruments and National Semiconductor Suppliers?

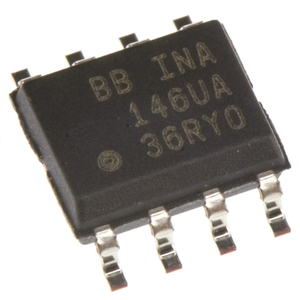

Shenzhen, China, serves as a central hub for semiconductor component sourcing, particularly for legacy and active Texas Instruments (TI) and former National Semiconductor product lines. The region hosts a dense network of authorized distributors, independent brokers, and specialized electronic component suppliers with access to both new original and surplus inventory. These suppliers benefit from proximity to major logistics ports and integration within broader electronics manufacturing ecosystems, enabling rapid order processing and global shipping.

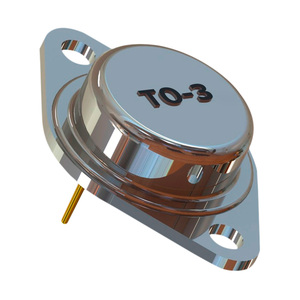

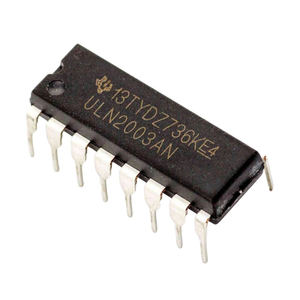

The Shenzhen-based supplier cluster offers diversified sourcing channels for TI and National-branded semiconductors, including operational amplifiers, logic ICs, power management units, and microcontrollers. Suppliers in this region typically maintain extensive catalogs covering discontinued, active, and hard-to-find parts, supporting BOM fulfillment for industrial control, telecommunications, and consumer electronics applications. Economies of scale are achieved through consolidated procurement networks and digital storefronts that streamline part searchability and pricing transparency.

How to Choose Texas Instruments and National Semiconductor Suppliers?

Selecting reliable suppliers requires rigorous evaluation across technical, operational, and transactional dimensions:

Product Authenticity & Traceability

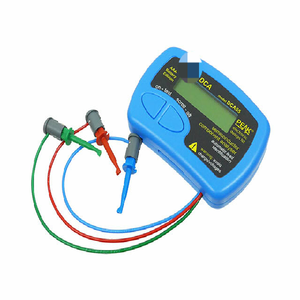

Verify component origin through batch traceability, factory packaging confirmation, and date-code alignment. Prioritize suppliers who provide datasheets, manufacturer markings, and authenticity guarantees. For critical applications, request sample testing via third-party labs to confirm electrical performance against TI specifications.

Supply Chain Reliability Metrics

Assess key performance indicators embedded in supplier profiles:

- On-time delivery rate exceeding 90% indicates logistical efficiency

- Reorder rate above 40% reflects customer satisfaction and supply consistency

- Response time under 3 hours enables faster procurement cycles

Cross-reference these metrics with order volume history and client feedback where available.

Transaction Security and Inventory Transparency

Favor suppliers offering incremental ordering (MOQ of 1–10 pieces) to support prototyping and low-volume production. Confirm whether stock is physically held or drop-shipped from secondary markets. Utilize secure payment escrow systems when purchasing high-value or obsolete components to mitigate risk of non-delivery or counterfeit goods.

What Are the Best Texas Instruments and National Semiconductor Suppliers?

| Company Name | Main Products | Price Range (USD) | Min. Order | On-Time Delivery | Avg. Response | Reorder Rate | Online Revenue |

|---|---|---|---|---|---|---|---|

| Shenzhen Qingfengyuan Technology Co., Ltd. | Other ICs, Microcontrollers, FPGA, Discrete Semiconductors | $0.48–2.68 | 1–10 pcs | 100% | ≤3h | 50% | US $1,000+ |

| Shenzhen Mingdewei Electronics Limited | Amplifiers, Logic ICs, RF Transceivers | $0.50–2.00 | 1–10 pcs | 100% | ≤2h | 20% | US $120,000+ |

| Shenzhen Hongchuang Technology Co., Ltd. | Microcontrollers, FPGA, PCBA Kits | $0.70–0.90 | 10 pcs | 28% | ≤13h | <15% | US $800,000+ |

| Shenzhen Yixinlian Electronic Technology Co., Ltd. | Other ICs, Sensors, Programmable Devices | $0.10–1.00 | 1 pc | 92% | ≤2h | 46% | US $40,000+ |

| Story Enterprise Limited | Power Management ICs, Connectors, MCUs | $7–45 | 1 pc | 91% | ≤2h | <15% | US $50,000+ |

Performance Analysis

Shenzhen Qingfengyuan Technology stands out with a 100% on-time delivery record and 50% reorder rate, indicating strong reliability and customer retention despite lower revenue volume. Shenzhen Mingdewei Electronics demonstrates robust transaction volume and responsiveness but has a moderate reorder rate, suggesting potential variability in post-purchase satisfaction. Story Enterprise and Shenzhen Yixinlian offer single-piece MOQs and competitive pricing, ideal for prototype development, though higher per-unit costs reflect niche market positioning for specific legacy ICs. Notably, Shenzhen Hongchuang reports significant revenue but only 28% on-time delivery, signaling possible fulfillment bottlenecks or inventory inaccuracies—warranting due diligence before large-scale engagement.

FAQs

How to verify Texas Instruments semiconductor supplier credibility?

Cross-check listed products against official TI datasheets and part number nomenclature. Request evidence of sourcing channels, such as distributor agreements or warehouse audit logs. Analyze response consistency and technical detail in communications to assess expertise level.

What is the typical lead time for TI and National semiconductor orders?

Standard orders from in-stock suppliers ship within 1–7 days. Backordered or obsolete components may require 4–8 weeks if sourcing from secondary markets. Expedited handling is often available for an additional fee.

Can suppliers provide samples for testing?

Yes, most suppliers offer single-unit purchases suitable for functional validation. Pricing for samples aligns with retail rates and may not reflect bulk discounts. Confirm whether samples are new original or pulled from existing batches.

Are RoHS and REACH compliance standards enforced?

Compliance depends on supplier tier and stock type. New original components generally meet RoHS and REACH requirements. For recycled or salvaged parts, explicit certification should be requested, as environmental conformity cannot be assumed without documentation.

How to manage risk when sourcing discontinued National Semiconductor parts?

Focus on suppliers with verifiable testing procedures and clear labeling of product condition (new, used, refurbished). Use incremental ordering to validate quality before scaling. Consider partnering with suppliers who specialize in obsolescence management and have established screening protocols for aging components.