Tracking Device For Phone Distributor

1/33

1/33

1/16

1/16

1/11

1/11

1/25

1/25

1/18

1/18

1/2

1/2

1/10

1/10

About tracking device for phone distributor

Where to Find Tracking Device for Phone Distributor Suppliers?

China remains the central hub for tracking device manufacturing, with key supplier clusters concentrated in Shenzhen and Wuhan. These regions host vertically integrated electronics supply chains that support rapid prototyping and high-volume production of GPS tracking solutions tailored for phone distributors. Shenzhen, as a national technology epicenter, offers access to advanced R&D infrastructure, component suppliers, and export logistics networks, enabling streamlined production cycles.

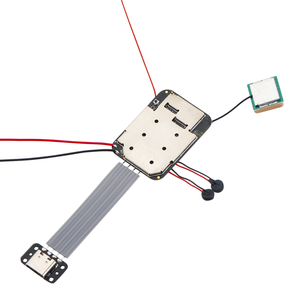

The industrial ecosystem supports diverse product categories—from compact personal trackers to vehicle-mounted 4G GPS systems—leveraging localized access to PCB fabrication, firmware development, and wireless module integration. Suppliers benefit from proximity to Tier-1 component manufacturers, reducing material lead times by 20–30% compared to offshore alternatives. This geographic concentration enables faster order fulfillment, with standard production lead times averaging 15–25 days for MOQ-compliant orders. Economies of scale further drive down unit costs, particularly for bulk procurement of entry-level Bluetooth locators and mid-tier GPS tracking units.

How to Choose Tracking Device for Phone Distributor Suppliers?

Selecting reliable partners requires rigorous evaluation across technical, operational, and transactional dimensions:

Product Range and Technical Capability

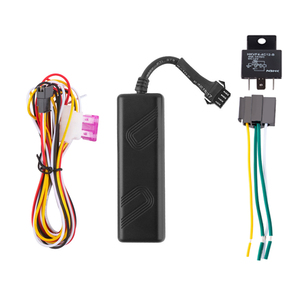

Assess suppliers based on their portfolio diversity and technological depth. Leading manufacturers offer multi-functional devices supporting real-time GPS tracking, geofencing, low-power Bluetooth connectivity, and mobile app integration. Verify compatibility with major smartphone operating systems (iOS/Android) and evaluate software stability through demo units or SDK access. Prioritize suppliers with documented firmware update protocols and cloud platform redundancy.

Quality Assurance and Compliance

Confirm adherence to international standards including CE, RoHS, and FCC certifications, which are essential for market entry in Europe and North America. Request test reports for critical parameters such as battery life under continuous transmission, signal accuracy in urban environments, and IP-rated waterproofing where applicable. While ISO 9001 certification is not universally listed, suppliers with structured quality management systems typically demonstrate higher on-time delivery performance and lower defect rates.

Production and Fulfillment Metrics

Evaluate scalability using verifiable indicators:

- Minimum Order Quantity (MOQ) ranging from 1–20 pieces, with flexible options for test sampling

- Monthly output capacity inferred from online revenue and reorder rate trends

- In-house assembly lines capable of handling both surface-mount technology (SMT) and final system testing

- Response time under 8 hours and on-time delivery rate exceeding 95%

Cross-reference these metrics with transaction history data to assess reliability. High reorder rates (e.g., 35%) suggest customer satisfaction and consistent product quality.

Procurement Safeguards

Utilize secure payment mechanisms such as escrow services to mitigate risk during initial transactions. Conduct sample testing before full-scale ordering, focusing on location accuracy, app responsiveness, and battery longevity. For customized firmware or private labeling, ensure contractual clarity on intellectual property rights and post-delivery support obligations.

What Are the Best Tracking Device for Phone Distributor Suppliers?

| Company Name | Main Products | Price Range (USD) | Min. Order | On-Time Delivery | Response Time | Reorder Rate | Online Revenue |

|---|---|---|---|---|---|---|---|

| PAPOULAKIS LEONIDAS KAI SIA EE | GPS Tracker, Smart Locator, Pet Tracker, Electronics Repair Parts | $26.71–89.39 | 5 pcs | - | ≤10h | - | - |

| Wuhan Dai Cheng Xin Yu Technology Co., Ltd. | Mini Trackers, Key Finders, Wireless Locators | $1.69–6.99 | 2 pcs | 100% | ≤2h | <15% | US $1,000+ |

| Shenzhen Deaoke Electronic Co., Ltd. | Real-Time GPS Trackers, Car & Portable Devices | $8.60–26.50 | 2 pcs | 95% | ≤8h | 35% | US $130,000+ |

| Shenzhen Xiongju Technology Co., Ltd. | 4G GPS Trackers, Solar-Powered & Vehicle Models | $7–37 | 1–2 pcs | 100% | ≤5h | 25% | US $30,000+ |

| Shenzhen Coban Electronics Co., Ltd. | Vehicle Trackers, Mobile Phone Call Trackers, Tracking Software | $11.60–25 | 10–100 pcs | 100% | ≤5h | - | - |

Performance Analysis

Shenzhen-based suppliers dominate in both volume and technical specialization. Shenzhen Deaoke Electronic stands out with a 35% reorder rate and competitive pricing across portable and vehicle tracking models, indicating strong market acceptance. Wuhan Dai Cheng Xin Yu Technology offers the lowest price points (from $1.69) and fastest response time (≤2h), making it suitable for budget-conscious buyers seeking small-lot trials. Shenzhen Xiongju and Coban Electronics report 100% on-time delivery, with Coban catering to higher-MOQ contracts ideal for large-scale distribution channels. PAPOULAKIS LEONIDAS KAI SIA EE provides premium-priced Teltonika-based devices, targeting users requiring industrial-grade reliability.

FAQs

How to verify tracking device supplier reliability?

Validate compliance documentation (CE/RoHS), analyze on-time delivery records, and review historical transaction data. Request functional samples to assess hardware build quality and software interface performance. Prioritize suppliers with transparent communication, consistent pricing structures, and proven export experience.

What is the typical MOQ for tracking devices?

MOQs vary from 1 piece (for basic models) to 10–100 units for specialized or software-integrated devices. Many suppliers allow mixed-product orders at minimal increments (2–5 pieces) to facilitate sampling and pilot deployment.

Do suppliers offer customization options?

Yes, most manufacturers support OEM/ODM services including logo printing, packaging design, firmware modification, and private app branding. Minimum thresholds for customization typically start at 100 units, though some accept smaller batches for established buyers.

What are the average lead times for sample and bulk orders?

Sample production takes 5–10 days, with express shipping adding 3–7 days internationally. Bulk order lead times range from 15–25 days depending on order complexity and production load. Solar-powered or 4G-enabled models may require additional calibration time.

Can tracking devices be integrated with existing fleet or asset management platforms?

Many suppliers provide API access or SDKs for third-party system integration. Confirm protocol compatibility (e.g., TCP/IP, HTTP APIs) and data format standards (JSON/XML) before procurement. Some vendors offer white-label cloud platforms with customizable dashboards and user access controls.