Tracking Vendor Performance

1/10

1/10

1/27

1/27

1/48

1/48

1/23

1/23

1/18

1/18

1/1

1/1

1/28

1/28

1/30

1/30

1/25

1/25

1/25

1/25

1/16

1/16

1/25

1/25

1/47

1/47

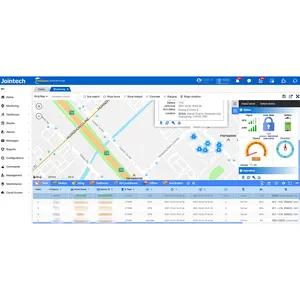

About tracking vendor performance

Where to Source Tracking Equipment and Vendor Performance Solutions?

China remains the global epicenter for GPS tracking equipment manufacturing, with Shenzhen and Guangzhou serving as primary hubs due to concentrated electronics supply chains and advanced R&D infrastructure. These cities host vertically integrated suppliers capable of producing hardware, firmware, and cloud-based monitoring platforms under one ecosystem. Shenzhen’s industrial cluster offers rapid prototyping and customization support, while Guangzhou provides cost-efficient mass production through established logistics corridors.

Suppliers in this region benefit from proximity to component manufacturers for SIM modules, GPS antennas, and battery systems, reducing lead times by 20–30% compared to offshore alternatives. The integration of 2G/3G/4G modems, dual-server platform redundancy, and multi-sensor compatibility (fuel, temperature, vibration) is standard across mid-to-high-tier vendors. Buyers gain access to scalable production capacities, with monthly outputs ranging from 10,000 to over 100,000 units per facility, supporting both OEM contracts and private-label deployments.

How to Evaluate Tracking Equipment Suppliers?

Effective supplier assessment requires a structured evaluation across technical, operational, and transactional dimensions:

Performance Metrics Verification

Prioritize suppliers with documented on-time delivery rates exceeding 97%, response times under 4 hours, and reorder rates above 25%. High reorder rates indicate customer satisfaction and product reliability. Verified transaction histories showing consistent online revenues above US $250,000 annually reflect market competitiveness and order volume stability.

Customization and Integration Capabilities

Assess flexibility in design and functionality:

- Support for color, size, logo, packaging, and label customization

- Firmware-level branding and white-label software solutions

- Hardware integration options: RFID readers, fuel sensors, dashcams, USB ports, SOS buttons, relay cutoffs

- Platform compatibility with third-party fleet management or asset monitoring systems

Confirm availability of demo accounts and API documentation for seamless integration testing.

Quality Assurance and Production Infrastructure

While formal certifications are not explicitly listed in available data, prioritize suppliers demonstrating robust internal quality controls. Look for evidence of waterproofing (IP67), wide operating temperature ranges, FOTA (Firmware Over-The-Air) updates, and compliance with regional network standards (e.g., LTE-M, NB-IoT). Custom manufacturers should offer proof of in-house testing protocols for signal accuracy, battery life, and shock resistance.

What Are the Leading Tracking Equipment Suppliers?

| Company Name | Location | Type | On-Time Delivery | Reorder Rate | Avg. Response | Annual Revenue (Est.) | Min. Order Flexibility | Key Customization Features |

|---|---|---|---|---|---|---|---|---|

| Shenzhen Istartek Technology Co., Ltd. | Shenzhen, CN | Custom Manufacturer | 100% | 21% | ≤2h | US $400,000+ | 1 piece | RFID, fuel sensor, camera, platform integration, FOTA, dual servers, remote cutoff, temperature monitoring |

| Guangzhou Canmore Technology Co., Ltd. | Guangzhou, CN | Standard Supplier | 98% | 34% | ≤4h | US $300,000+ | 1 piece | White-label software, logo, color, packaging |

| Rope Innovation Co., Ltd. | Shenzhen, CN | Multispecialty Supplier | 98% | 29% | ≤3h | US $280,000+ | 1 unit | Logo, material, size, packaging, platform integration |

| Shenzhen Daovay Technology Co., Ltd. | Shenzhen, CN | Multispecialty Supplier | 98% | 17% | ≤2h | US $190,000+ | 2 pieces | Battery life optimization, wireless design, logo, packaging |

| Shenzhen Xing An Da Technology Co., Ltd. | Shenzhen, CN | Custom Manufacturer | 97% | 26% | ≤6h | US $90,000+ | 10 sets | Color, material, logo, packaging, anti-theft features |

Performance Analysis

Shenzhen Istartek leads in technical depth, offering the most extensive customization options including sensor integration, dual-server redundancy, and FOTA updates—critical for enterprise-grade deployments. Guangzhou Canmore stands out with a 34% reorder rate, indicating strong end-user satisfaction despite fewer hardware integrations. Rope Innovation balances responsiveness and scalability, with sub-3-hour replies and flexible 1-unit MOQs ideal for pilot testing. Daovay and Xing An Da specialize in niche applications such as long-battery-life trackers and waterproof vehicle units, though higher minimum orders may limit small-scale buyers.

FAQs

How to verify tracking equipment supplier reliability?

Cross-check performance metrics such as on-time delivery and response time against transaction history. Request evidence of product testing, including location accuracy benchmarks, battery endurance reports, and environmental stress tests. Evaluate communication responsiveness and technical clarity during initial inquiries.

What is the typical MOQ and pricing range?

MOQs vary from 1 piece to 100 pieces depending on model and supplier. Entry-level GPS trackers start at $4.55/unit (200-piece MOQ), while advanced models with 4G connectivity and sensor integration range from $10–$89.90 with lower MOQs of 1–2 units, enabling cost-effective sampling.

Do suppliers support custom branding and software?

Yes, all listed suppliers offer logo, color, packaging, and label customization. Leading manufacturers like Istartek and Canmore provide white-label platform solutions with full UI rebranding, API access, and dedicated server configurations for SaaS deployment.

What are common lead times for bulk orders?

Standard production lead time ranges from 15–25 days after confirmation of specifications. For customized units requiring firmware adjustments or hardware modifications, expect 30–45 days. Air freight adds 5–10 days globally; sea freight requires 25–40 days depending on destination port.

Can I request a sample before placing a bulk order?

Yes, all suppliers allow single-unit purchases for evaluation. Sample costs typically reflect full retail price but can be credited toward future bulk orders. Suppliers with 1-piece MOQs facilitate low-risk testing of device accuracy, battery performance, and platform usability prior to scaling procurement.