Tsmc And Intel

CN

CN

About tsmc and intel

Where to Find TSMC and Intel Semiconductor Suppliers?

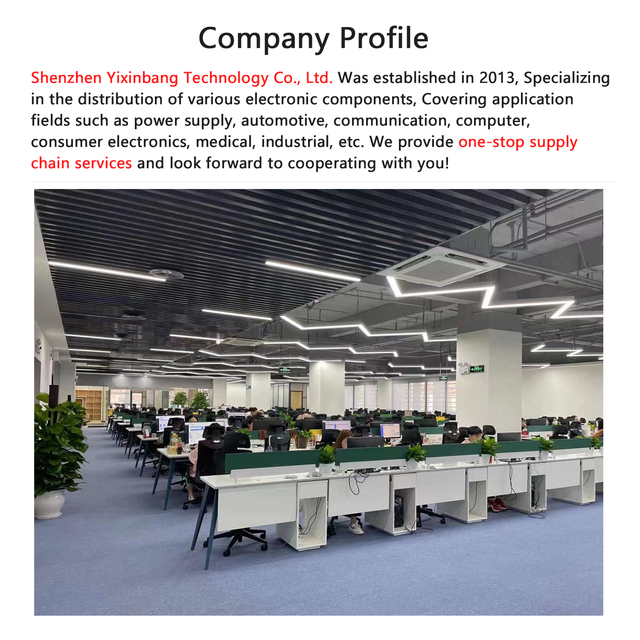

The global semiconductor supply chain is anchored by leading manufacturers like TSMC and Intel, but downstream sourcing of compatible components and wafers is increasingly facilitated by specialized suppliers across China. These suppliers operate within mature electronics manufacturing ecosystems in Shenzhen, Guangzhou, and Xiamen—regions known for dense clusters of IC distributors, wafer processors, and RF component fabricators. Shenzhen alone accounts for over 40% of China’s semiconductor distribution network, supported by proximity to Hong Kong’s logistics infrastructure and a highly skilled technical workforce.

Suppliers in this sector typically focus on post-fabrication services such as testing, packaging, and resale of original or refurbished integrated circuits (ICs), alongside raw materials like optical-grade silicon wafers. The availability of vertically integrated support—from PCB assembly to connector integration—enables rapid prototyping and low-volume fulfillment. Buyers benefit from localized supply chains that reduce lead times by 20–35% compared to Western-distributed inventories, with standard order cycles averaging 7–14 days for in-stock items. Cost advantages range from 15–30% due to lower overhead and direct access to regional production lines.

How to Choose TSMC and Intel Semiconductor Suppliers?

Selecting reliable partners requires rigorous evaluation across three core dimensions:

Technical Alignment

Confirm supplier product compatibility with TSMC- or Intel-based architectures, particularly for microcontrollers, FPGAs, and RF amplifiers. Verify part authenticity through batch traceability and datasheet validation. For high-frequency applications (e.g., 5GHz wireless systems), demand performance specifications aligned with JEDEC or IEEE standards.

Production and Inventory Capability

Assess operational scale and responsiveness:

- Minimum online revenue of US $10,000+ indicating consistent transaction volume

- On-time delivery rate exceeding 90% as a proxy for logistical reliability

- Average response time under 7 hours to ensure timely communication

Prioritize suppliers listing dedicated semiconductor inventory (e.g., mixers, frequency doublers, amplifiers) over general electronic component vendors to minimize substitution risks.

Transaction and Quality Assurance

Evaluate reorder rates as an indicator of customer satisfaction—rates above 25% suggest dependable quality and service. Where available, review compliance with RoHS and ISO 9001 standards. Conduct sample testing for electrical parameters such as noise figure, gain stability, and power handling before scaling procurement. Use secure payment methods with escrow protection to mitigate counterparty risk, especially for first-time engagements.

What Are the Best TSMC and Intel Semiconductor Suppliers?

| Company Name | Main Products | Online Revenue | On-Time Delivery | Reorder Rate | Avg. Response | MOQ | Price Range |

|---|---|---|---|---|---|---|---|

| Guangzhou Xinwei Technology Co., Ltd. | RF Amplifiers, Microcontrollers, Processors, FPGA, Other ICs | US $20,000+ | 66% | 33% | ≤7h | 1 piece | $0.10 |

| Shenzhen Hongchuang Technology Co., Ltd. | Microcontrollers, Processors, FPGA, PCBA, Electronic Modules | US $800,000+ | 25% | <15% | ≤14h | 1–10 pieces | $0.70–0.90 |

| Xiamen Yingfei Connection Technology Co., Ltd. | Semiconductors, Silicon Wafers (2–12 inch) | US $5,000+ | 100% | <15% | ≤1h | 10 units | $4.50–8.50 up to $21–39 |

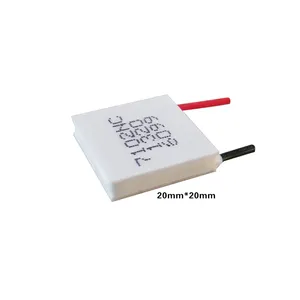

| Qinhuangdao Fulianjing Electronics Co., Ltd. | Semiconductors, Thermoelectric Coolers (TEC) | - | 100% | - | ≤16h | 50 pieces | $20–$40 |

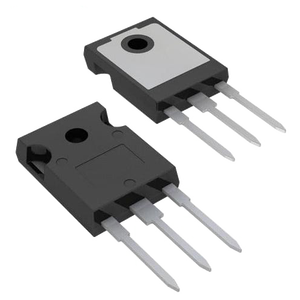

| Shenzhen Sif Technology Co., Limited | Original ICs, RF Amplifiers, Transistors, Ultrasonic Sensors | US $10,000+ | 100% | 28% | ≤7h | 1 piece | $0.10–0.18 |

Performance Analysis

Xiamen Yingfei and Shenzhen Sif Technology stand out for operational reliability, both achieving 100% on-time delivery. Sif Technology combines fast response times (≤7h) with a strong 28% reorder rate and ultra-low MOQs, making it ideal for R&D and prototype-stage buyers. Xiamen Yingfei specializes in silicon wafers with competitive pricing across multiple diameters, serving foundry and research clients needing standardized substrates. Guangzhou Xinwei offers broad IC variety at aggressive pricing ($0.10 per unit) despite moderate delivery performance. In contrast, Shenzhen Hongchuang reports high revenue volume but lags in delivery (25%) and customer retention (<15%), signaling potential fulfillment risks. Qinhuangdao Fulianjing serves niche thermal management needs with high-power semiconductor coolers, though its 50-piece MOQ limits suitability for small-scale testing.

FAQs

How to verify semiconductor supplier authenticity?

Cross-reference product listings with manufacturer-partner databases. Request lot numbers, date codes, and packaging photos to detect remarking. Prefer suppliers offering "new original" or "genuine" tags backed by traceable purchase histories.

What is the typical lead time for semiconductor components?

In-stock items ship within 1–5 business days. Backordered or globally sourced ICs may require 4–8 weeks. Wafer deliveries average 7–10 days given domestic processing capacity.

Can suppliers provide samples for testing?

Yes, most allow single-piece orders for evaluation. Sample costs typically reflect full unit pricing without markup, especially for low-MOQ suppliers like Guangzhou Xinwei and Shenzhen Sif Technology.

Are there minimum order requirements for bulk procurement?

MOQs vary: IC suppliers often accept 1-piece orders, while wafer and cooler providers require 10–50 units. Volume discounts generally begin at 1,000 pieces for ICs and 100 units for wafers.

Do these suppliers support custom semiconductor configurations?

Most offer standard off-the-shelf components. Custom design or fabrication services are limited; buyers requiring bespoke TSMC/Intel-compatible chips should engage directly with OEMs or authorized foundries.