Types Of Manufacturing Process In Mechanical Engineering

Top sponsor listing

Top sponsor listing

CN

CN

About types of manufacturing process in mechanical engineering

Where to Find Manufacturing Process Suppliers in Mechanical Engineering?

China remains a global hub for mechanical engineering manufacturing, with key supplier clusters concentrated in Shenzhen and Shandong—regions known for advanced precision machining ecosystems. Shenzhen hosts over 70% of high-precision CNC service providers, leveraging proximity to semiconductor and electronics industries to maintain tight tolerances (±0.005mm) and rapid prototyping capabilities. Shandong’s industrial base excels in heavy-duty metal processing, supported by localized steel and aluminum supply chains that reduce material costs by 15–25% compared to Western counterparts.

These regions offer vertically integrated production networks where mold design, CNC turning, milling, and surface treatment occur within compact geographic zones. This integration enables lead times as short as 7–14 days for prototype batches and 20–30 days for mass production. Buyers benefit from scalable operations, access to multi-axis machining centers, and flexible customization across materials such as aluminum alloys, stainless steel, and engineering plastics. The average minimum order quantity (MOQ) is 1 piece, accommodating low-volume prototyping and iterative design validation.

How to Choose Manufacturing Process Suppliers in Mechanical Engineering?

Effective supplier selection requires systematic evaluation across technical, operational, and transactional dimensions:

Technical Capabilities Verification

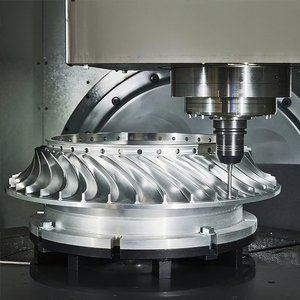

Confirm availability of core processes including CNC machining, casting, sheet metal fabrication, and injection molding. Prioritize suppliers with documented experience in five-axis machining or rapid prototyping, particularly for complex geometries. Material compatibility must align with project specifications—verify processing expertise for titanium, PEEK, or hardened steels if required.

Quality Management Systems

While ISO 9001 certification is not explicitly stated in available data, consistent on-time delivery rates above 98% serve as proxy indicators of process discipline. For regulated sectors (medical, aerospace), demand evidence of inspection protocols, first-article testing reports, and compliance with RoHS or REACH standards where applicable.

Production Capacity Assessment

Evaluate infrastructure through verifiable metrics:

- Minimum 100+ active product listings indicating diversified machining capacity

- In-house tooling and mold-making capabilities (indicated by “Moulds” as main product category)

- Response time under 3 hours and reorder rate above 30% reflecting customer retention

Cross-reference service volume—such as 871 listed machining services at one facility—with actual output capacity to assess scalability for large contracts.

What Are the Leading Manufacturing Process Suppliers in Mechanical Engineering?

| Company Name | Location | Main Services (Listings) | On-Time Delivery | Avg. Response | Reorder Rate | Online Revenue | Customization Options |

|---|---|---|---|---|---|---|---|

| Shenzhen Strongd Model Technology Co., Ltd. | Shenzhen, CN | Machining Services (871), Moulds (147) | 98% | ≤2h | 53% | US $50,000+ | Color, material, size, logo, packaging, label, graphic |

| Shenzhen X&y Technology Co., Ltd. | Shenzhen, CN | Machining Services (234), Moulds (22) | 100% | ≤3h | <15% | US $110,000+ | Not specified |

| Shenzhen Yanmi Model Co., Ltd. | Shenzhen, CN | Machining Services (187), Moulds (3) | 100% | ≤3h | <15% | US $1,000+ | Not specified |

| Shandong Taile Intelligent Technology Co., Ltd. | Shandong, CN | Machining Services (not listed) | 100% | ≤1h | 33% | US $5,000+ | Color, material, size, logo, packaging, label, graphic |

| Jinan Shengtai Intelligent Technology Co., Ltd. | Jinan, CN | Moulds (88), Machining Services (20) | 55% | ≤1h | 33% | US $700+ | Not specified |

Performance Analysis

Shenzhen-based suppliers dominate in service volume and ecosystem maturity, with Shenzhen Strongd leading in both listing density (871 machining services) and reorder rate (53%), suggesting strong client satisfaction and repeat business. Shandong Taile stands out for responsiveness (≤1h response time) and full customization flexibility despite lower revenue visibility. Notably, Jinan Shengtai exhibits the lowest on-time delivery rate (55%), signaling potential fulfillment risks despite fast communication. Suppliers with 100% on-time delivery—X&y and Yanmi—demonstrate logistical reliability, though their sub-15% reorder rates may indicate limited post-sale engagement or niche market positioning.

FAQs

What manufacturing processes are commonly offered?

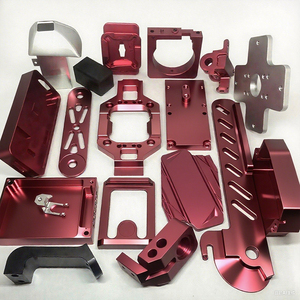

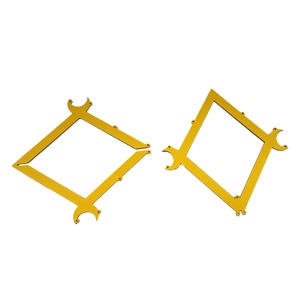

Primary services include CNC machining (turning, milling), mold making, casting, sheet metal fabrication, and 3D printing. Multi-axis CNC and anodizing are frequently paired for aerospace and consumer electronics components.

What is the typical MOQ and pricing structure?

Most suppliers list a minimum order of 1 piece, enabling prototype development. Unit prices range from $0.01 to $10.99 depending on complexity, material, and finishing requirements.

How extensive is customization capability?

Select suppliers support full customization including color, material grade, dimensional adjustments, branding (logo, labels), and packaging design—critical for OEM integration and private-label sourcing.

What quality assurance measures should be verified?

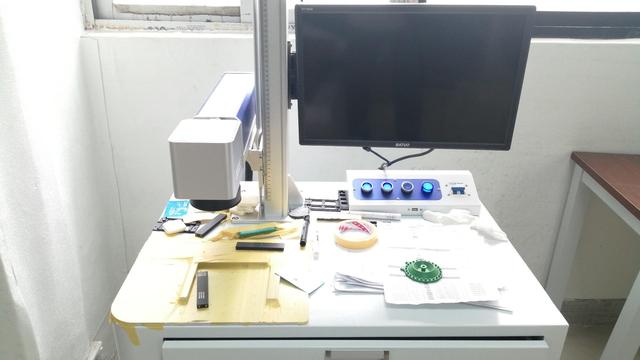

Request process control documentation, inspection checklists, and sample test reports. For critical applications, conduct remote audits via factory video tours to validate equipment condition and workflow organization.

Are there advantages to sourcing from Shenzhen vs. Shandong?

Shenzhen offers superior precision, faster iteration cycles, and stronger export infrastructure ideal for high-mix, low-volume orders. Shandong provides cost-efficient solutions for bulk metal parts due to proximity to raw material sources and lower labor costs.