Uhf Rfid Reader Module Supplier

1/21

1/21

1/21

1/21

1/25

1/25

1/13

1/13

About uhf rfid reader module supplier

Where to Find UHF RFID Reader Module Suppliers?

China remains the global epicenter for UHF RFID reader module manufacturing, with key supplier clusters concentrated in Shenzhen, Nanjing, and Guangzhou. These regions host vertically integrated supply chains spanning chip procurement, PCB assembly, firmware development, and final testing—enabling rapid prototyping and scalable production. Shenzhen's electronics ecosystem supports over 70% of China’s IoT hardware suppliers, offering access to semiconductor distributors, antenna designers, and RF testing labs within a 20km radius.

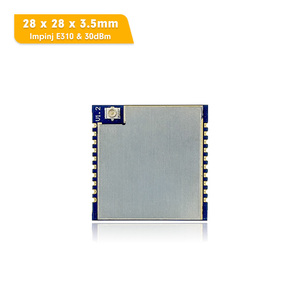

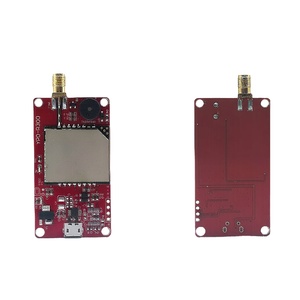

The industrial advantage lies in modular design frameworks and standardized interfaces (UART, USB, SPI), which reduce time-to-market by up to 40%. Suppliers leverage automated surface-mount technology (SMT) lines capable of producing 5,000–10,000 units monthly per facility. Integration of Impinj R2000, E710, and Indy chips is common, supporting global frequency bands (860–960 MHz) and compliance with EPCglobal Gen2v2 standards. Buyers benefit from cost efficiencies driven by localized component sourcing, with average BOM costs 25–35% below Western equivalents.

How to Choose UHF RFID Reader Module Suppliers?

Procurement decisions should be guided by technical capability, operational reliability, and transactional transparency:

Technical Validation

Confirm support for required protocols (ISO 18000-6C, Gen2v2) and output power range (28–33 dBm). Evaluate sensitivity levels (typically –82 dBm to –90 dBm) and multi-tag reading performance (up to 700 tags/second). For outdoor or industrial deployments, verify IP-rated enclosures and operating temperature ranges (–30°C to +70°C).

Production and Quality Assurance

Assess supplier infrastructure through verifiable metrics:

- Minimum 1,000m² production area with ESD-protected SMT and testing zones

- In-house RF anechoic chambers for antenna tuning and read-range validation

- Automated burn-in testing for 48+ hours to detect early-life failures

Prioritize suppliers reporting on-time delivery rates ≥95% and response times ≤3 hours, indicators of operational discipline.

Sourcing Risk Mitigation

Utilize secure payment mechanisms such as escrow services for initial orders. Request sample units to validate read accuracy, interference resistance, and integration compatibility with existing middleware. Analyze product listings for consistent firmware update support and SDK availability across Android, Linux, and Windows platforms.

What Are the Best UHF RFID Reader Module Suppliers?

| Company Name | Main Products | Online Revenue | On-Time Delivery | Reorder Rate | Avg. Response | Min. Order Quantity | Price Range (USD) | Key Features |

|---|---|---|---|---|---|---|---|---|

| Hitech RFID Limited | Access Control Card Readers, IoT Solutions, Garment Labels | US $8,000+ | 64% | 42% | ≤3h | 2 pieces | $75–$239.90 | High-speed reading, long-range (up to 10m), Impinj E710-based modules |

| Shenzhen Yuannuode Communication Co., Ltd. | Access Control Cards, Turnstiles, Other Access Control Products | US $30,000+ | 100% | <15% | ≤4h | 1 piece | $9.80–$114 | Embedded antenna designs, low-cost YRM100 module, compact form factor |

| Nanjing Bohang Electronics Co., Ltd. | EAS Systems, Animal Tags, Warehousing Supplies | US $30,000+ | 100% | 20% | ≤1h | 2–50 pieces | $68–$799 | Industrial-grade builds, Android-integrated models, wide voltage input |

| Guangzhou Tenhanyun Technology Co., Ltd. | Access Control Card Readers, Access Control Cards | US $50,000+ | 100% | <15% | ≤1h | 1 piece | $41.90–$108 | Impinj E710 and E310 chipsets, 4-port configurations, micro-size modules |

| S4a Industrial Co., Limited | Smart Locks, Biometric Access Control, Turnstiles | US $50,000+ | 85% | 15% | ≤3h | 1 piece | $41–$74 | USB-powered desktop readers, factory-direct pricing, passive tag support |

Performance Analysis

Guangzhou Tenhanyun and Nanjing Bohang demonstrate strong operational consistency with 100% on-time delivery and sub-3-hour response times, indicating robust internal coordination. While reorder rates are modest (<20% for most), high online revenue volumes suggest broad market reach and export experience. Hitech RFID stands out with a 42% reorder rate, reflecting customer retention likely tied to performance-focused engineering. Entry-level modules start below $10, suitable for prototyping, whereas high-power, multi-port E710-based units exceed $200 for enterprise applications. Suppliers offering single-piece MOQs provide flexibility for R&D teams, while bulk pricing (e.g., Nanjing Bohang at 50 pcs) favors volume deployment in logistics or retail asset tracking.

FAQs

How to verify UHF RFID reader module supplier reliability?

Cross-check claimed certifications (CE, FCC, RoHS) via official databases. Request evidence of conducted radiated emission tests and ERP compliance documentation. Review transaction history for dispute resolution patterns and validate company registration details through national business registries.

What is the typical lead time for samples and mass production?

Sample units ship within 3–7 days for in-stock models. Custom firmware or enclosure modifications extend timelines to 15–20 days. Mass production lead times range from 15–30 days depending on order size, with express shipping options available for urgent deployments.

Do suppliers support customization?

Yes, most offer PCB layout adjustments, unique antenna designs, private labeling, and tailored SDKs. Minimum customization thresholds vary—some accept requests at 500-unit quantities, while others accommodate smaller batches with NRE fees.

Are UHF RFID modules compliant with international frequency regulations?

Top suppliers configure modules for regional standards: 902–928 MHz (FCC) for North America, 865–868 MHz (ETSI) for Europe, and 919–923 MHz for parts of Asia. Confirm programmable frequency locks to prevent unauthorized band usage.

What packaging and logistics options are available?

Standard anti-static packaging is used for all shipments. Suppliers with US $50,000+ annual online revenue typically offer DDP (Delivered Duty Paid) terms via express couriers (DHL, FedEx) or sea freight consolidation for container loads. Lead times average 5–10 days via air, 25–35 days via ocean.