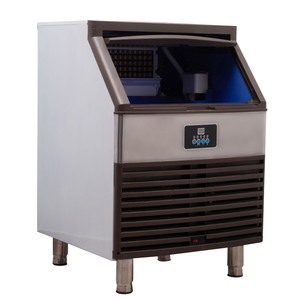

Undercounter Small Ice Maker

CN

CN

About undercounter small ice maker

Where to Find Undercounter Small Ice Maker Suppliers?

China remains the dominant hub for undercounter small ice maker manufacturing, with key production clusters in Guangdong, Shanghai, and Zhejiang provinces. These regions host vertically integrated supply chains that combine refrigeration engineering expertise, sheet metal fabrication, and compressor sourcing within tightly connected industrial ecosystems. Guangzhou and Ningbo are particularly notable for specialized cold storage equipment production, enabling rapid prototyping and scalable output.

Suppliers in these zones benefit from proximity to Tier-1 component manufacturers—such as Danfoss and Embraco compressors—and domestic steel suppliers, reducing material lead times by up to 40%. The average facility operates on a 3,000–8,000m² footprint, supporting monthly production capacities ranging from 500 to 2,000 units depending on model complexity. This infrastructure allows for competitive pricing, with base models starting below $300 and high-capacity commercial units priced between $1,000–$2,500.

How to Choose Undercounter Small Ice Maker Suppliers?

Procurement decisions should be guided by verified operational metrics and technical capabilities:

Quality Assurance & Compliance

Confirm adherence to international standards such as CE, RoHS, and ISO 9001. While not all suppliers list certifications explicitly, leading vendors implement internal QA protocols including leak testing, electrical safety checks, and condenser performance validation. For export markets, ensure compliance with local energy efficiency and noise emission regulations (e.g., DOE in the U.S., ErP in the EU).

Production Capacity Verification

Evaluate supplier scalability through measurable indicators:

- Minimum factory area of 3,000m² for sustained volume output

- In-house assembly lines with dedicated R&D or engineering support

- Access to CNC bending, welding automation, and foam insulation injection

Cross-reference online revenue data and order fulfillment rates: suppliers reporting over US $100,000 in annual digital sales typically maintain stable production cycles and inventory management systems.

Transaction Security & Lead Time Management

Prioritize partners with documented on-time delivery rates exceeding 97% and response times under 6 hours. Utilize secure payment frameworks where possible, especially for initial orders. Average production lead time ranges from 15–30 days for standard configurations; add 7–14 days for custom voltage, control panels, or branding. Air freight sampling takes 5–10 days globally, while sea freight requires 25–35 days depending on destination port.

What Are the Best Undercounter Small Ice Maker Suppliers?

| Company Name | Location | Main Products | Online Revenue | On-Time Delivery | Avg. Response | Reorder Rate | Customization | Min. Order |

|---|---|---|---|---|---|---|---|---|

| Guangzhou Koller Refrigeration Equipment Co., Ltd. | Guangdong, CN | Ice Machines, Cold Room Storage, Condensing Units | - | 100.0% | ≤6h | <15% | No | 1 set |

| Shanghai Bingsu Refrigeration Technology Co., LTD. | Shanghai, CN | Ice Machines, Ice Makers, Beverage Equipment | US $20,000+ | 100.0% | ≤1h | <15% | No | 1 piece/set |

| NINGBO KAISON ELECTRIC APPLIANCE CO.,LTD | Zhejiang, CN | Commercial Ice Makers, Countertop Units | US $120,000+ | 100.0% | ≤1h | 15% | Yes | 1–3 pieces |

| Shanghai Chuangli Refrigeration Equipment Co., Ltd. | Shanghai, CN | Commercial Cube Ice Makers, UV LED Models | US $16,000,000+ | 100.0% | ≤5h | 33% | Yes | 5 pieces |

| Qinyang Lede Trading Co., Ltd. | Henan, CN | Mini Ice Makers, Thermoelectric Units | US $20,000+ | 100.0% | ≤2h | <15% | No | 1–300 pieces |

Performance Analysis

Shanghai Chuangli stands out with the highest reported online revenue (US $16M+) and a 33% reorder rate, indicating strong market acceptance and repeat client engagement. NINGBO KAISON and Shanghai Chuangli offer full customization—including color, logo, packaging, and technical specifications—making them ideal for private-label buyers. Despite higher MOQs (5 pieces), their integration of design flexibility and consistent delivery performance supports long-term contract stability. In contrast, suppliers like Shanghai Bingsu and Qinyang Lede cater to low-volume testing or niche applications with sub-$300 entry-level models and one-piece ordering, though limited customization reduces differentiation potential.

FAQs

How to verify undercounter ice maker supplier reliability?

Validate through documented on-time delivery records, response time benchmarks, and transaction history. Request product test reports for temperature consistency, daily yield accuracy, and power consumption. For high-volume procurement, conduct virtual audits of production lines and quality inspection checkpoints.

What is the typical sampling timeline?

Standard sample production takes 7–15 days. Customized units require 15–25 days depending on modifications. Add 5–10 days for international air shipping. Some suppliers offer expedited 7-day sampling for validated buyers.

Can suppliers ship undercounter ice makers worldwide?

Yes, most established manufacturers support global logistics via FOB, CIF, or DDP terms. Confirm compatibility with regional voltage (110V/220V) and plug types. Sea freight is optimal for container loads; air freight suits urgent single-unit deliveries.

Do suppliers provide free samples?

Free samples are uncommon. Buyers typically pay full sample cost, which may be partially refunded upon placement of a bulk order. Sample fees range from $200–$1,500 depending on unit type and shipping method.

How to initiate customization requests?

Submit detailed requirements including daily ice yield (kg/24h), ice type (crescent, cube, nugget), cabinet dimensions, refrigerant type (R134a, R410a), and branding elements. Suppliers with customization tags can adjust mold designs, control interfaces, and insulation thickness within 2–4 weeks of approval.