Vendor Database Management System

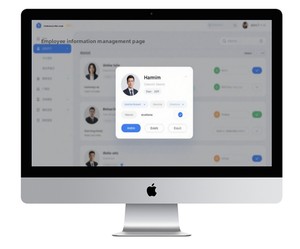

About vendor database management system

Where to Find Vendor Database Management System Suppliers?

Global supplier concentration for vendor database management systems is centered in technology-driven outsourcing hubs across South Asia and Southeast Asia, where mature software development ecosystems support scalable delivery. India and Vietnam emerge as dominant sourcing regions due to deep pools of certified developers, competitive labor efficiency, and robust digital infrastructure. Indian suppliers, particularly those based in Hyderabad and Bangalore, leverage a workforce fluent in enterprise-grade database platforms such as Oracle, SQL Server, and MongoDB, enabling end-to-end system design and administration services.

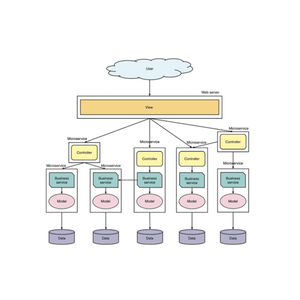

Vietnam’s software sector, led by Hanoi and Ho Chi Minh City, offers vertically integrated development teams specializing in cloud-native database architectures and SaaS-based solutions. These regions benefit from government-backed IT industrial parks that ensure high-bandwidth connectivity and data security compliance, reducing project deployment cycles by 20–30% compared to Western development firms. Buyers gain access to agile development models, with most suppliers offering modular coding, API integration, and DevOps support as standard components. Typical advantages include cost efficiency (development rates 40–60% below North American benchmarks), rapid prototyping (within 2–4 weeks), and strong post-deployment maintenance frameworks.

How to Choose Vendor Database Management System Suppliers?

Selecting reliable partners requires structured evaluation across technical, operational, and transactional dimensions:

Technical Competency Verification

Confirm expertise in core database technologies including relational (RDBMS), NoSQL, and distributed databases. Evaluate supplier portfolios for evidence of multi-vendor marketplace systems, contract management modules, or supply chain databases—direct indicators of domain-specific experience. Prioritize vendors with documented experience in secure cloud database deployment (AWS, Azure, Google Cloud) and data encryption protocols (TLS/SSL, AES-256).

Development Capacity Assessment

Analyze organizational scale and specialization through the following criteria:

- Minimum 500+ software listings indicating sustained market presence

- Dedicated R&D or engineering teams reflected in product versioning and update frequency

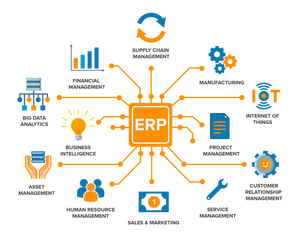

- Proven capability in custom CRM, IoT integration, or ERP-linked database systems

Cross-reference response times (target ≤2 hours) and on-time delivery consistency to assess service reliability.

Procurement Risk Mitigation

Utilize milestone-based payment structures tied to deliverables such as system architecture diagrams, test environment deployment, and user acceptance testing (UAT). Require source code escrow agreements for long-term maintainability. Validate claims of "OEM versions" or "enterprise services" through direct inquiry into licensing rights and redistribution permissions. Conduct sample testing on demo instances to benchmark performance under concurrent user loads and data transaction volumes.

What Are the Best Vendor Database Management System Suppliers?

| Company Name | Location | Main Products (Listings) | Software Listings | Avg. Price Range | Min. Order | Response Time | Online Revenue | Reorder Rate |

|---|---|---|---|---|---|---|---|---|

| KAEM SOFTWARES PRIVATE LIMITED | India | Software, POS | 1,271 | $95 | 2 units | ≤2h | US $8,000+ | - |

| INTELLISENSE TECHNOLOGY | India | PCBA, Software, Alarm Systems | 7,961 | $7–$500 | 1–3 units | ≤4h | - | - |

| HINDUSTANSOFT CORPORATION | India | Software | 891 | $180–$1,800 | 1 unit | ≤1h | - | - |

| STEPMEDIA SOFTWARE VIET NAM COMPANY LIMITED | Vietnam | Software | 251 | $5,000–$50,000 | 1 unit | ≤2h | - | - |

| SERVEDECK INNOVATION SDN. BHD. | Malaysia | Software | 90 | $10–$20 | 5 units | ≤1h | - | - |

Performance Analysis

KAEM SOFTWARES and INTELLISENSE TECHNOLOGY demonstrate high-volume output with diversified software portfolios, suggesting established development pipelines. HINDUSTANSOFT CORPORATION leads in responsiveness (≤1h) and premium pricing, indicating focus on high-touch client engagement. STEPMEDIA stands out for enterprise-scale offerings, with average project values between $5,000–$50,000, reflective of complex, customized database deployments. SERVEDECK INNOVATION targets mid-tier clients with low-cost entry points ($10–20) and higher MOQs, suitable for standardized vendor contract management tools. Indian suppliers dominate listing volume and price diversity, while Vietnamese firms specialize in high-value, full-cycle development projects.

FAQs

How to verify vendor database management system supplier credibility?

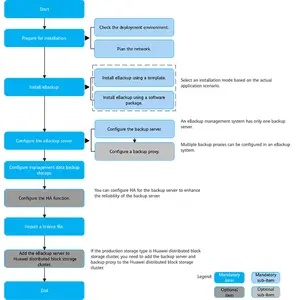

Assess technical legitimacy through GitHub repositories, live demo environments, or sandbox access. Request documentation of past deployments, including ER diagrams, backup/recovery protocols, and user role hierarchies. Validate company registration details and cross-check revenue claims via third-party business intelligence tools.

What is the typical lead time for custom database systems?

Standard implementations require 4–6 weeks. Complex systems involving multi-vendor integrations, real-time analytics, or hybrid cloud setups extend to 8–12 weeks. Agile development models allow phased delivery, with core modules deployable within 3 weeks.

Can suppliers provide white-label or OEM versions?

Yes, multiple suppliers offer OEM licensing, allowing rebranding and resale. Clarify intellectual property ownership, update responsibilities, and support obligations before contracting. Some vendors charge tiered fees based on redistribution scope.

What are common minimum order quantities?

MOQs range from 1 unit (for enterprise licenses) to 5 units (for lower-priced administrative tools). Volume discounts typically begin at 10+ units, with negotiated SLAs available for large-scale deployments.

Do suppliers support international data compliance standards?

Leading vendors adhere to GDPR, CCPA, and ISO 27001 frameworks upon request. Confirm compliance readiness during scoping, especially for clients in regulated sectors such as healthcare, finance, or public procurement.