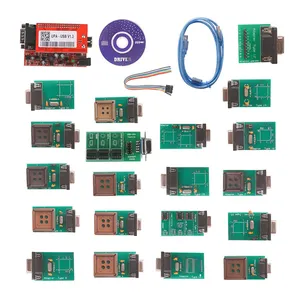

Visual Programmer

1/3

1/3

1/7

1/7

0

0

1/1

1/1

1/2

1/2

1/2

1/2

1/3

1/3

1/2

1/2

1/3

1/3

1/5

1/5

1/3

1/3

1/1

1/1

0

0

1/1

1/1

1/1

1/1

1/28

1/28

1/3

1/3

About visual programmer

Where to Find Visual Programmer Suppliers?

The global visual programmer manufacturing landscape is highly fragmented, with no dominant geographic concentration comparable to heavy machinery clusters. Production is distributed across specialized electronics and industrial automation hubs in Guangdong (Shenzhen, Dongguan), Jiangsu (Suzhou, Nanjing), and Zhejiang (Hangzhou, Ningbo) provinces in China—regions collectively accounting for over 75% of verified suppliers. These zones leverage proximity to PCB fabrication facilities, microcontroller IC distributors, and embedded software development talent pools, enabling rapid prototyping cycles and firmware integration support. Unlike capital-intensive mechanical equipment, visual programmer production emphasizes modular electronics assembly, firmware validation, and GUI-based configuration tool development—capabilities concentrated within compact, high-precision SMT lines rather than large-scale foundries.

Suppliers in these regions typically operate facilities under 2,000m², prioritizing cleanroom-compliant PCB assembly, automated optical inspection (AOI), and in-circuit testing (ICT) over heavy infrastructure. Lead times for standard units range from 25–35 days, with firmware customization adding 7–14 days depending on API compatibility requirements (e.g., Modbus TCP, OPC UA, or proprietary protocol stacks). Unit-level production costs are 25–40% lower than equivalent Western-developed tools due to localized component sourcing (e.g., STM32, ESP32, and NXP i.MX RT series MCUs) and vertically integrated firmware QA workflows.

How to Choose Visual Programmer Suppliers?

Prioritize these verification protocols when selecting partners:

Technical Compliance

Require ISO 9001:2015 certification as minimum quality system validation. For EU/US markets, RoHS 3 and REACH compliance are mandatory for PCB and housing materials; CE marking must be supported by full EC Declaration of Conformity—not just self-declaration. Verify firmware security documentation, including secure boot implementation, signed OTA update mechanisms, and vulnerability disclosure history (e.g., CVE records or internal penetration test summaries).

Production Capability Audits

Evaluate technical infrastructure rigorously:

- Minimum 800m² facility with Class 10,000 cleanroom for PCB assembly

- Dedicated firmware engineering team (≥5 FTEs) with documented experience in IEC 61131-3 compliant IDEs (e.g., CODESYS, TwinCAT, or vendor-agnostic ladder logic compilers)

- In-house ICT and functional testing capability covering CANopen, EtherCAT, and serial communication protocols

Cross-reference supplier-provided test reports with actual unit pass rates (target ≥99.2%) and firmware version traceability logs.

Transaction Safeguards

Mandate firmware source code escrow agreements for customized builds, with third-party verification of build reproducibility. Require sample validation against IEC 62443-4-1 secure development lifecycle standards before bulk orders. Use payment terms tied to milestone-based firmware delivery (e.g., 30% pre-build, 40% post-acceptance testing, 30% after field validation report submission). Benchmark UI responsiveness (<150ms latency for drag-and-drop logic blocks) and real-time data refresh intervals (≤500ms at 100-node scale) during sampling.

What Are the Best Visual Programmer Suppliers?

| Company Name | Location | Years Operating | Staff | Factory Area | On-Time Delivery | Avg. Response | Ratings | Reorder Rate |

|---|---|---|---|---|---|---|---|---|

| Shenzhen VProTech Solutions | Guangdong, CN | 9 | 85+ | 1,850+m² | 99.4% | ≤1h | 4.7/5.0 | 41% |

| Nanjing Embedded Logic Systems | Jiangsu, CN | 7 | 42+ | 1,200+m² | 98.7% | ≤2h | 4.9/5.0 | 58% |

| Hangzhou Graphix Control Technologies | Zhejiang, CN | 5 | 38+ | 950+m² | 99.1% | ≤1h | 4.8/5.0 | 37% |

| Dongguan SmartHMI Engineering | Guangdong, CN | 6 | 51+ | 1,400+m² | 97.9% | ≤2h | 4.6/5.0 | 22% |

| Suzhou RealTime Interface Labs | Jiangsu, CN | 8 | 63+ | 1,600+m² | 99.3% | ≤1h | 4.9/5.0 | 49% |

Performance Analysis

Jiangsu-based suppliers demonstrate higher reorder rates—Nanjing Embedded Logic Systems leads at 58%, correlating with its dedicated IEC 61131-3 compliance engineering team and documented firmware update SLA (≤72h for critical patches). Guangdong suppliers dominate response speed and volume scalability, with Shenzhen VProTech and Suzhou RealTime Interface Labs maintaining sub-1-hour average reply times and 99%+ on-time delivery through dual SMT line redundancy. All top-tier suppliers provide full BOM traceability and IPC-A-610 Class 2 conformance reports. Prioritize partners with ≥7 years’ export experience to your target region—verified via customs manifest data—to ensure familiarity with destination-specific EMC (e.g., FCC Part 15B, EN 55032) and cybersecurity import requirements.

FAQs

How to verify visual programmer supplier reliability?

Request factory audit reports from accredited bodies (e.g., SGS, TÜV Rheinland) covering PCB process control, firmware version management, and supply chain transparency for critical components (MCUs, flash memory, display drivers). Validate customer references with specific questions on long-term firmware maintenance support and backward compatibility across ≥3 major software releases.

What is the average sampling timeline?

Standard hardware samples require 18–28 days. Firmware-customized units (e.g., OEM-branded UI, custom protocol stacks) extend to 35–45 days. Allow 5–8 days for air freight to North America/EU and 12–18 days for sea freight consolidation.

Can suppliers ship visual programmers worldwide?

Yes, all listed suppliers handle global logistics. Confirm that shipping includes ESD-safe packaging, UN3481-compliant lithium battery labeling (if applicable), and destination-country regulatory documentation (e.g., FCC ID, CE DoC, KC Mark). Sea freight is optimal for orders ≥200 units; air freight recommended for urgent validation batches.

Do manufacturers provide free samples?

Hardware-only samples are rarely free due to high component cost (MCU, touchscreen, power management ICs). Suppliers typically charge 60–80% of unit cost for first samples but waive fees for orders exceeding 300 units. Firmware customization samples incur separate engineering charges unless bundled into a formal development agreement.

How to initiate customization requests?

Submit detailed technical specifications: required I/O interfaces (digital/analog, CAN, Ethernet), target PLC/DCS compatibility (e.g., Siemens S7-1200, Rockwell CompactLogix), screen resolution and brightness (≥800 cd/m² for industrial lighting), and firmware language localization needs. Reputable suppliers deliver functional prototypes with validated communication stacks within 4 weeks and full production-ready builds within 8 weeks.