Wheel Visualizer

1/11

1/11

1/17

1/17

1/12

1/12

1/2

1/2

1/3

1/3

0

0

1/3

1/3

0

0

1/3

1/3

1/3

1/3

1/3

1/3

1/3

1/3

1/3

1/3

1/3

1/3

0

0

1/17

1/17

1/3

1/3

1/14

1/14

CN

CN

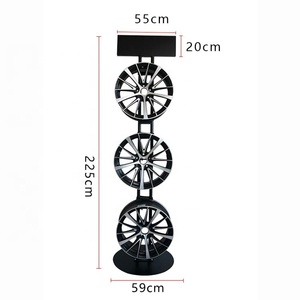

About wheel visualizer

Where to Find Wheel Visualizer Suppliers?

China leads global production of wheel visualizers, with key manufacturing hubs in Guangdong and Shanghai offering specialized capabilities. Shenzhen and Guangzhou in Guangdong province host advanced electronics manufacturers focused on LED-based automotive lighting systems, leveraging proximity to semiconductor suppliers and SMT assembly lines. These clusters support rapid prototyping and high-volume output for RGB, single-row, and quad-row LED wheel lights integrated with remote or app control functionalities.

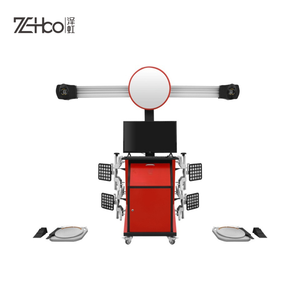

Shanghai-based suppliers specialize in diagnostic and alignment equipment that incorporates visual display technologies, including 3D graphical interfaces and LCD panels used in advanced wheel balancing systems. The region benefits from established automotive technology ecosystems, enabling integration of digital visualization with mechanical calibration tools. Vertical integration across PCB fabrication, surface mounting, and final assembly allows lead times as low as 15–20 days for standard orders, while localized supply chains reduce component procurement costs by 18–25% compared to non-specialized regions.

How to Choose Wheel Visualizer Suppliers?

Procurement decisions should be guided by technical capability, compliance verification, and operational reliability metrics:

Product & Technical Validation

Confirm compatibility with target vehicle models (e.g., tire diameter, hub configuration). For LED-based visualizers, assess luminance ratings (minimum 8,000–12,000 lumens), IP67 waterproofing certification, and color accuracy (RGBW spectrum coverage). Suppliers must provide test reports for EMI/RFI interference, especially for wireless-controlled units operating at 2.4GHz frequencies.

Quality Management Systems

Prioritize suppliers with ISO 9001-certified quality processes. CE, RoHS, and REACH compliance is essential for European market access. Verify adherence through documented inspection protocols covering solder joint integrity, wire harness durability, and thermal performance under continuous operation (≥72 hours at full brightness).

Production Capacity Assessment

Evaluate the following indicators of scalability:

- Monthly output exceeding 5,000 units for mass production readiness

- In-house PCB design and firmware development teams

- Automated SMT lines and aging test chambers

Cross-reference online revenue data and reorder rates (>20% indicates customer retention) with on-time delivery performance (target ≥95%) to gauge operational consistency.

Customization & Transaction Security

Require clear documentation of customization options: color patterns, logo engraving, fiber length, voltage specifications (12V/24V), and Bluetooth/Wi-Fi module variants. Use secure payment structures such as escrow services with milestone releases. Insist on pre-shipment inspection clauses and sample testing before bulk order release.

What Are the Best Wheel Visualizer Suppliers?

| Company Name | Location | Verified As | Online Revenue | On-Time Delivery | Reorder Rate | Avg. Response | Customization Options | Min. Order Quantity |

|---|---|---|---|---|---|---|---|---|

| Shenzhen Kingshowstar Technology Co., Limited | Shenzhen, CN | Custom Manufacturer | US $1,900,000+ | 99% | 22% | ≤3h | Color, size, logo, wire material, LED rows, bundle configuration | 1–2 sets |

| Guangzhou Tengyue Electronic Technology Co., Ltd. | Guangzhou, CN | Custom Manufacturer | US $140,000+ | 96% | 15% | ≤4h | Color, size, logo, packaging, graphic labeling | 1 set |

| Shanghai Coalition Technology Co., Ltd. | Shanghai, CN | Multispecialty Supplier | US $40,000+ | 88% | 26% | ≤3h | Limited (focused on alignment/balancer systems) | 1 set |

| Shanghai Shinetoola Automotive Technology Co., Ltd. | Shanghai, CN | Multispecialty Supplier | US $10,000+ | 85% | <15% | ≤4h | Color, material, logo, packaging, graphic interface | 1 piece |

| Shanghai Amerigo Trading Co., Ltd. | Shanghai, CN | Trading Entity | US $10,000+ | 100% | 28% | ≤7h | Limited (wheel alignment-focused systems) | 1 set |

Performance Analysis

Shenzhen Kingshowstar stands out with the highest online revenue and near-perfect on-time delivery, indicating robust production infrastructure and export experience. Its broad customization scope—from fiber optics to branding—supports OEM/ODM partnerships. Guangzhou Tengyue offers competitive pricing ($61–70/set) and strong delivery reliability, though lower reorder rates suggest room for service improvement. Shanghai-based suppliers like Coalition Technology and Amerigo focus on high-end wheel alignment systems with integrated visualization, commanding premium prices ($2,500–$7,500/set), suitable for professional automotive workshops.

FAQs

How to verify wheel visualizer supplier reliability?

Cross-check ISO and CE certifications with accredited bodies. Request factory audit reports or video tours confirming SMT line operations and QC stations. Analyze transaction history, focusing on dispute resolution speed and post-sale technical support availability.

What is the average lead time for wheel visualizers?

Standard orders take 15–25 days after confirmation. Custom designs with unique firmware or optical layouts may require 30–40 days. Air freight adds 5–7 days internationally; sea shipping takes 25–35 days depending on destination port.

Do suppliers offer free samples?

Sample policies vary. Established manufacturers often refund sample costs upon placement of a full order (typically MOQ 50–100 units). Expect to pay 50–70% of unit price for evaluation units, especially for customized configurations.

Can wheel visualizers be customized for OEM branding?

Yes, leading manufacturers support private labeling, custom packaging, and tailored color sequences. Minimum branding thresholds typically start at 100 units. Suppliers with in-house firmware development can embed proprietary startup animations or mobile app interfaces.

What are typical payment terms?

Common structures include 30% deposit with balance before shipment, or use of trade assurance platforms for secured transactions. Large-volume buyers may negotiate LC payments or staggered milestones for development and production phases.