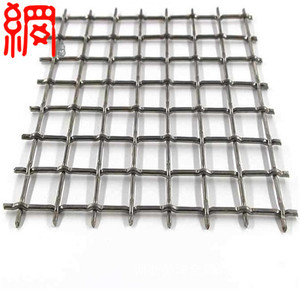

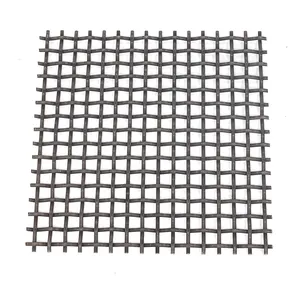

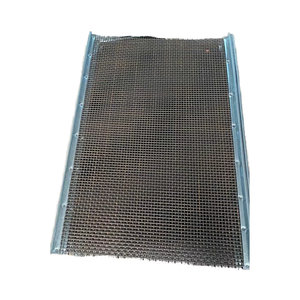

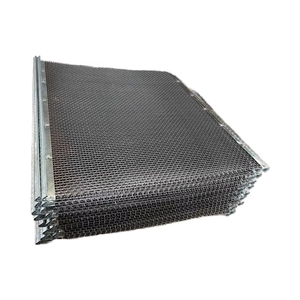

Wire Mesh Screen Factories

1/3

1/3

1/3

1/3

1/2

1/2

1/3

1/3

1/3

1/3

1/3

1/3

1/3

1/3

1/3

1/3

0

0

1/3

1/3

1/3

1/3

1/3

1/3

0

0

0

0

1/3

1/3

0

0

1/3

1/3

1/3

1/3

1/7

1/7

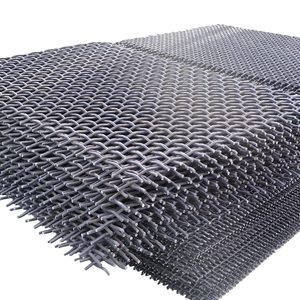

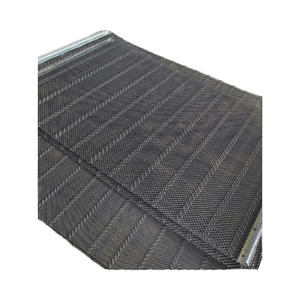

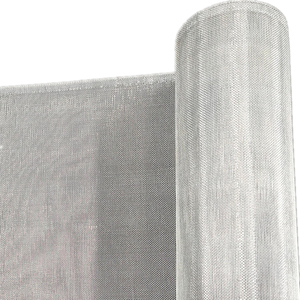

About wire mesh screen factories

Where to Find Wire Mesh Screen Factories?

China remains the global hub for wire mesh screen manufacturing, with concentrated industrial clusters in Hebei, Anhui, and Guangdong provinces driving production efficiency and export capacity. Hebei, particularly the Anping County region, hosts over 70% of China’s wire mesh producers, leveraging decades of metallurgical expertise and proximity to major steel mills in Tangshan. This strategic location reduces raw material lead times by 25–40% compared to offshore alternatives.

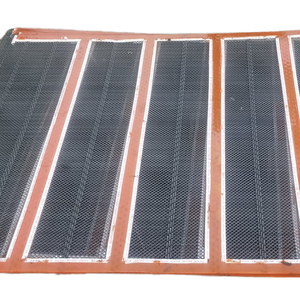

These manufacturing zones feature vertically integrated operations—from wire drawing and weaving to surface treatment and final assembly—enabling end-to-end control over production cycles. Facilities within these clusters typically operate on-site galvanizing lines, PVC coating plants, and precision welding stations, supporting diverse product variants including stainless steel, aluminum, and coated welded mesh. Buyers benefit from localized supply ecosystems where ancillary services such as packaging, testing, and customs brokerage are available within a 30km radius, facilitating faster turnaround and lower overheads.

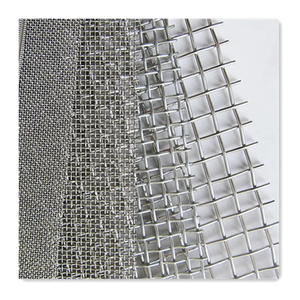

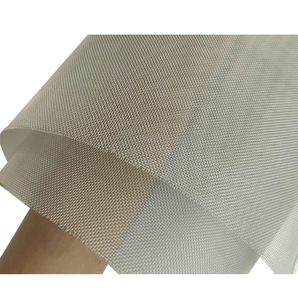

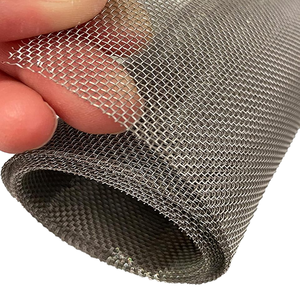

Production scalability is a key advantage, with standard order lead times averaging 20–35 days depending on complexity and volume. Cost efficiencies range from 18–30% below Western or Southeast Asian suppliers due to optimized labor distribution, bulk material procurement, and mature technical workforces. Customization capabilities are widely available, covering aperture size, wire gauge (ranging from 0.2mm to 6.0mm), roll dimensions, and anti-corrosion treatments such as hot-dip galvanization or electropolishing.

How to Choose Wire Mesh Screen Factories?

Effective supplier selection requires systematic evaluation across three core areas:

Quality Management Standards

Confirm ISO 9001 certification as a baseline for consistent process control. For applications in food processing, pharmaceuticals, or outdoor infrastructure, verify compliance with additional standards such as ISO 3601 (for sealing performance), ASTM A479/A240 (stainless steel grades), or RoHS for restricted substances. Request test reports on tensile strength, weld shear resistance, and coating thickness uniformity, especially for galvanized or polymer-coated products.

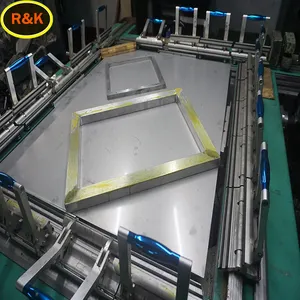

Production Infrastructure Assessment

Evaluate operational scale and technical autonomy through the following indicators:

- Minimum factory footprint of 3,000m² to ensure batch processing stability

- In-house wire drawing and weaving lines (avoiding outsourced core processes)

- Dedicated surface treatment facilities (e.g., continuous galvanizing lines or powder coating booths)

- Automated inspection systems for aperture tolerance (±0.1mm) and weld integrity

Cross-reference facility size with monthly output capacity—leading factories report 500–1,200 tons/month—to validate scalability claims.

Procurement Risk Mitigation

Implement transaction safeguards including third-party pre-shipment inspections (e.g., SGS or Bureau Veritas) and staged payment terms tied to production milestones. Prioritize suppliers with documented export experience to your target market, particularly those familiar with import regulations for construction materials, filtration media, or architectural cladding. Pre-production sampling is critical—test samples against specified mesh count, open area ratio, and corrosion resistance before full-scale orders.

What Are the Best Wire Mesh Screen Factories?

No supplier data available for comparative analysis.

Performance Considerations

In the absence of specific supplier metrics, buyers should focus on regional benchmarks: Anping-based manufacturers typically offer superior cost-performance ratios for standard welded and woven mesh, while Guangdong factories specialize in high-precision decorative and architectural meshes with tighter aesthetic tolerances. Long-standing operations (10+ years) often maintain higher equipment utilization rates and better-trained QC teams, translating into on-time delivery performance above 95%. When evaluating new partners, request video audits of weaving looms, tension testers, and coating lines to confirm operational transparency.

FAQs

How to verify wire mesh screen factory reliability?

Validate certifications through issuing bodies and request audit trails covering raw material sourcing (e.g., mill test certificates), in-process inspections, and final product testing. Analyze customer feedback focused on dimensional accuracy, coating adhesion, and packaging integrity during transit.

What is the average sampling timeline?

Standard mesh samples take 7–14 days to produce, depending on material availability and processing requirements. Complex variants involving custom alloys, micro-weaving, or multi-layer laminates may require 20–30 days. Air freight adds 5–8 days for international delivery.

Can wire mesh screen factories ship globally?

Yes, most established manufacturers support FOB, CIF, and DAP shipping terms. Confirm container loading protocols—rolls are typically palletized and stretch-wrapped, while panels are banded and crated. Ensure compliance with ISPM 15 for wooden packaging when shipping to North America, Australia, or EU countries.

Do factories provide free samples?

Sample policies vary. Many suppliers waive fees for initial small-format samples (up to 30cm x 30cm) if followed by a purchase. For larger or customized samples, expect charges covering 40–60% of production cost, often redeemable against future orders exceeding MOQ thresholds.

What are typical MOQs and customization options?

Standard product MOQs range from 500–1,000 linear meters or 50–100 panels. Custom tooling (e.g., specialty weaves or perforation dies) may require MOQs of 5,000+ meters. Common customization includes wire diameter adjustments, cut-to-size panels, grommet installation, and hybrid coatings (e.g., zinc + epoxy). Submit detailed technical drawings or CAD files to initiate engineering review.