Wireless Bridge Long Range Producer

About wireless bridge long range producer

Where to Find Wireless Bridge Long Range Producer Suppliers?

China remains the central hub for wireless bridge long range production, with Shenzhen emerging as a key manufacturing cluster due to its concentration of telecommunications hardware developers and RF engineering expertise. The city hosts numerous specialized producers operating integrated facilities that combine R&D, surface-mount technology (SMT) assembly lines, and environmental testing labs under one roof. These vertically aligned operations enable end-to-end control over product development—from circuit design and firmware integration to waterproof housing fabrication and antenna tuning.

Suppliers in this ecosystem benefit from proximity to component suppliers for critical parts such as MT7621A/MT7628 chips, high-gain directional antennas, and PoE injectors, reducing material lead times by up to 40%. Most long-range wireless bridge manufacturers in Shenzhen maintain in-house molding capabilities for enclosures, supporting rapid prototyping and customization of outdoor-rated IP65/IP67 housings. This industrial density allows for efficient order scaling, with typical production cycles ranging from 15–25 days for standard configurations and MOQs starting at 2 pieces.

How to Choose Wireless Bridge Long Range Producer Suppliers?

Selecting reliable partners requires systematic evaluation across technical, operational, and transactional dimensions:

Production & Engineering Capability

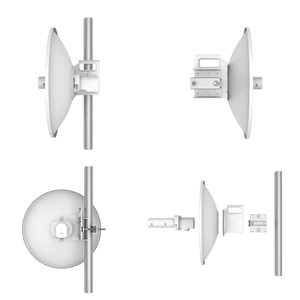

Prioritize suppliers advertising "own production line" verification and in-house SMT facilities. Confirm access to essential testing equipment including spectrum analyzers, anechoic chambers, and ESD immunity testers. Evaluate firmware development capacity—advanced providers offer customizable features such as dual-band operation, VLAN tagging, signal strength monitoring, and support for protocols like TDMA or WDS. For industrial deployments, verify compatibility with 2G/3G/4G/5G networks, PoE powering standards (802.3af/at), and industrial temperature ranges (-30°C to +70°C).

Quality Assurance and Compliance

While formal ISO 9001 certification is not universally declared in available data, assess quality performance through proxy indicators: on-time delivery rates exceeding 98%, response times under 2 hours, and participation in verified trade programs. Look for evidence of compliance with RoHS and FCC Part 15 regulations, particularly for export-bound units. Request test reports for key parameters including transmission distance (tested under real-world line-of-sight conditions), interference resistance, and mean time between failures (MTBF).

Customization and Scalability

Leading producers support OEM/ODM services covering:

- Logo, packaging, and label printing

- Firmware modifications (language, default settings, admin interface)

- Antenna gain selection (18dBi–23dBi common range)

- Housing color and material adjustments

- Integration of signal amplifiers or lightning protection modules

Cross-reference customization claims with supplier transaction volume; entities reporting online revenues above US $100,000 demonstrate sustained output and post-sale service infrastructure.

Procurement Safeguards

Utilize secure payment mechanisms that release funds upon product verification. Conduct sample testing before bulk orders, evaluating setup simplicity, link stability over required distances (e.g., 3km, 10km, 20km), and throughput consistency under load. Confirm warranty terms (typically 12–24 months) and availability of technical documentation, including user manuals, configuration guides, and SDKs for system integration.

What Are the Best Wireless Bridge Long Range Producer Suppliers?

| Company Name | Verified Status | Main Products | Online Revenue | On-Time Delivery | Avg. Response | Reorder Rate | Customization Options | Min. Order | Price Range (USD) |

|---|---|---|---|---|---|---|---|---|---|

| Shenzhen Weizhi Internet Technology Co., Ltd. | Custom Manufacturer | Long-range CPEs, outdoor bridges, WiFi repeaters | US $50,000+ | 99% | ≤2h | <15% | Extensive (firmware, SIM, band, module, logo, etc.) | 2 pcs | $11–$64 |

| Shenzhen Huachuangyilian Electronics Co., Ltd. | Not specified | Outdoor CPEs, routers, repeaters, switches | US $100,000+ | 98% | ≤2h | <15% | Limited public details | 1–2 pcs | $17.99–$36 |

| Lanbowan Communication Ltd. | Custom Manufacturer | Wireless CPEs, high-power APs, antennas | US $30,000+ | 100% | ≤5h | <15% | Color, size, logo, packaging, graphic | 2–10 pcs | $27–$46 |

| Shenzhen Huaxufeng Technology Development Co., Ltd. (Brand Holder) | Brand Holder | Industrial bridges, OEM/ODM models, long-range kits | US $280,000+ | 99% | ≤2h | 21% | Comprehensive (Poe, modes, firmware, SDK, etc.) | 1–2 pcs/pairs | $12.69–$170 |

| Shenzhen Huaxufeng Technology Development Co., Ltd. (Multispecialty Supplier) | Multispecialty Supplier | OEM waterproof bridges, auto-pairing units | US $30,000+ | 100% | ≤4h | 15% | Logo only | 2 pcs | $12–$37 |

Performance Analysis

Shenzhen Huaxufeng Technology Development Co., Ltd. operates dual supply roles, indicating strong brand ownership and distribution reach. As a Brand Holder with US $280,000+ in reported online revenue, it offers premium industrial-grade solutions priced up to $170 per pair, suggesting focus on high-reliability applications. Its extensive customization portfolio—including SDK access, OTA updates, and engineering consultation—positions it as a strategic partner for integrators and network operators.

Shenzhen Weizhi Internet Technology stands out for deep technical configurability, enabling clients to modify modem types, frequency bands, and even U-Boot firmware—critical for niche deployments requiring regulatory or interoperability compliance. Meanwhile, Lanbowan Communication Ltd. and the multispecialty Huaxufeng entity achieve perfect on-time delivery records (100%), signaling robust internal logistics despite lower revenue volumes.

Buyers seeking cost-effective entry-level solutions can consider sub-$15 options from multiple suppliers, though these typically serve short-range (<3km) use cases. For mission-critical links beyond 10km, prioritize vendors offering high-gain (>20dBi) antennas, TDMA protocol support, and industrial hardening. Reorder rates below 21% across most suppliers suggest competitive markets with limited customer lock-in—emphasizing the need for differentiation through reliability and post-sale support.

FAQs

How to verify wireless bridge long range producer reliability?

Cross-check self-reported metrics such as on-time delivery and response time against transaction history where possible. Request evidence of factory audits, product certifications (FCC, CE, RoHS), and third-party test results for transmission range and environmental durability. Engage suppliers in technical discussions to assess engineering depth—particularly regarding interference mitigation and network topology support.

What is the average sampling timeline for customized units?

Standard samples ship within 7–10 days. Customized units requiring firmware changes or molded parts take 15–25 days depending on complexity. Allow additional time for compliance testing if new radio certifications are needed for target markets.

Can suppliers support global shipping and import compliance?

Yes, established exporters provide FOB, CIF, and DDP shipping options. Confirm adherence to destination-country regulations for radio frequency devices, including power output limits and license-exempt band usage (e.g., 5.8GHz ISM band). Documentation should include CE/FCC declarations and English-language manuals.

Do manufacturers offer free samples?

Free samples are uncommon but negotiable for large-volume commitments. Most suppliers charge 50–100% of unit cost for initial samples, with fees partially or fully credited toward first orders exceeding 50–100 units.

How to initiate OEM/ODM customization?

Submit detailed specifications including desired form factor, antenna type, firmware features, branding elements, and packaging requirements. Reputable suppliers will respond with feasibility assessments, 3D renderings, and prototype timelines within 72 hours. Ensure contractual clarity on IP ownership, minimum batch sizes, and retooling costs.