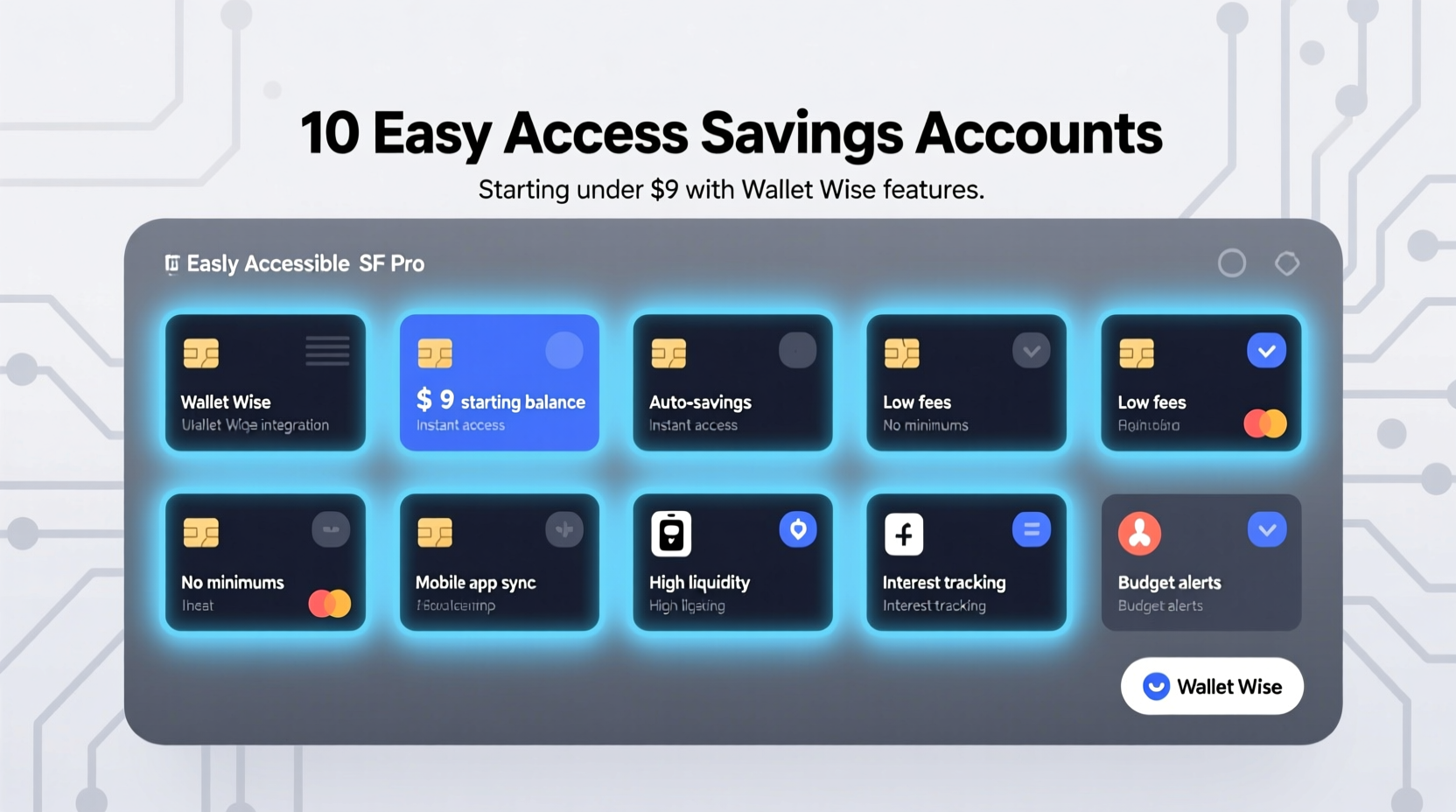

In today’s fast-moving financial landscape, accessibility and affordability are non-negotiables for smart savers. Whether you're building an emergency fund, saving for a vacation, or simply trying to earn more from idle cash, the right savings account can make a real difference. The good news? You don’t need to pay high fees or lock up your money to benefit from strong interest rates and intelligent banking tools. This guide explores 10 easy access savings accounts that cost less than $9 per month—many of which are completely free—and come equipped with wallet-wise features like automated savings, spending analytics, and instant transfers.

What Makes a Savings Account “Wallet-Wise”?

A truly wallet-wise savings account goes beyond just offering competitive interest. It integrates seamlessly into your daily financial life by providing intuitive digital tools that help you save smarter. Key features include:

- Automated round-up savings: Turns spare change from purchases into effortless deposits.

- Goal-based saving buckets: Lets you create separate virtual pots for different objectives (e.g., rent, travel).

- Budgeting dashboards: Offers real-time insights into income, spending, and saving trends.

- No monthly maintenance fees: Keeps costs low and transparency high.

- Instant or same-day transfers: Ensures liquidity without delays when you need access.

Top 10 Easy Access Savings Accounts Under $9

The following accounts were selected based on APY (Annual Percentage Yield), accessibility, mobile app functionality, customer support, and overall value. All offer easy withdrawals, no long-term commitment, and advanced digital features designed to encourage consistent saving behavior.

| Bank/Provider | APY | Monthly Fee | Key Wallet-Wise Features | Minimum Deposit |

|---|---|---|---|---|

| Ally Bank Online Savings | 4.20% | $0 | Round-ups, Savings Buckets, No ATM Fees | $0 |

| Capital One 360 Performance Savings | 4.10% | $0 | AutoSave, Spending Insights, Mobile Check Deposit | $0 |

| Discover Online Savings | 4.25% | $0 | Autosave, Cashback Checking Link, Budget Watchlist | $0 |

| SoFi Active Savings | 4.60% | $0 | Automatic Transfers, Round-Ups, Vaults | $0 |

| Varo Savings Account | 4.75% (on balances up to $5k) | $0 | Round-Up Saver, Early Paycheck Access, Spending Analytics | $0 |

| Chime High-Yield Savings | 4.60% | $0 | Automatic Savings, Round-Ups, No Overdraft Fees | $0 |

| Simple Checking + Save | 3.90% | $0 | Goals-Based Saving, Smart Budgeting Tools | $0 |

| FNBO Direct Savings | 4.30% | $0 | Free Bill Pay, No Minimum Balance, Mobile App Alerts | $0 |

| Barclays Online Savings | 4.05% | $0 | Dedicated Support, Strong Security, Easy Transfers | $0 |

| UFB Direct Savings | 4.80% | $0 | No Fees, Fast Transfers, 24/7 Phone Support | $0 |

“High-yield savings accounts with smart automation tools are redefining how Americans build financial resilience.” — Lisa Chen, Senior Financial Analyst at MoneyForward Insights

How to Maximize Your Wallet-Wise Experience

Opening a savings account is just the first step. To truly benefit from these tools, integrate them into your routine. Here’s how:

- Link it to your primary checking account: Enable seamless transfers between accounts so surplus funds move automatically.

- Set up recurring round-ups: Let every coffee purchase fuel your savings without feeling the pinch.

- Create named savings goals: Whether it’s “New Laptop” or “Rainy Day Fund,” giving your money a purpose increases accountability.

- Review weekly summaries: Use built-in dashboards to track progress and adjust habits accordingly.

- Turn on rate alerts: Some banks notify you when their APY changes—this helps you stay competitive.

Mini Case Study: How Maria Grew Her Emergency Fund in 8 Months

Maria, a freelance graphic designer from Austin, struggled to save consistently due to irregular income. She opened a SoFi Active Savings account and connected it to her Chime checking account. By enabling automatic round-ups and setting a rule to transfer 10% of each payment into savings, she built a $2,400 emergency fund within eight months—without ever manually initiating a single deposit. “I didn’t even notice the money was gone,” she said. “But seeing the balance grow gave me real peace of mind.”

Common Pitfalls to Avoid

Even the best accounts won’t help if used incorrectly. Watch out for these mistakes:

- Ignoring transfer limits: Federal Regulation D once limited savings withdrawals to six per month; while formally lifted, some banks still enforce internal caps.

- Overlooking promotional rates: Some accounts offer elevated APYs for the first few months, then drop significantly.

- Assuming all apps are equal: A clunky interface can discourage regular use—test the app before committing.

- Not comparing total ecosystem value: If your checking and savings are split across incompatible platforms, syncing becomes harder.

Your Action Checklist: Opening a Smarter Savings Account

Follow this checklist to ensure you choose and set up your wallet-wise savings account effectively:

- ✅ Research current APYs across top online banks

- ✅ Confirm there are no hidden fees or balance requirements

- ✅ Verify FDIC insurance coverage ($250,000 per depositor)

- ✅ Test the mobile app experience via app store previews

- ✅ Enable automated savings rules immediately after funding

- ✅ Set up bi-weekly balance alerts to monitor growth

- ✅ Review performance quarterly and switch if rates decline

Frequently Asked Questions

Are online savings accounts safe?

Yes. Most reputable institutions are FDIC-insured up to $250,000 per depositor, per ownership category. Look for HTTPS encryption, two-factor authentication, and clear privacy policies.

Can I have multiple savings accounts?

Absolutely. In fact, using multiple accounts for different goals (e.g., vacation, car repair) can improve focus and reduce temptation to dip into funds.

Why do online banks offer higher rates?

They operate with lower overhead—no physical branches means reduced costs, which they pass on to customers through better yields and fewer fees.

Start Small, Think Big

You don’t need a large sum or complex strategy to begin building wealth. With the right easy access savings account, even modest incomes can benefit from compound interest, behavioral nudges, and frictionless banking. The ten options listed here all cost less than $9—most cost nothing—and deliver powerful tools that put smart saving on autopilot. What matters most isn’t the initial deposit, but the consistency of action. Open one of these accounts today, activate the wallet-wise features, and let technology do the heavy lifting while you focus on what really matters.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?