Filing your taxes is only half the journey. Once you’ve submitted your return—whether electronically or by mail—the next critical phase begins: tracking its progress. Knowing the status of your tax return helps you anticipate when your refund will arrive, identify potential issues early, and confirm that the IRS has processed your information correctly. With millions of returns flowing through the Internal Revenue Service each year, delays and discrepancies can occur. But with the right tools and knowledge, you can stay informed every step of the way.

When Can You Start Checking Your Tax Return Status?

The IRS typically processes most e-filed returns within 21 days, though some may take longer depending on complexity or errors. If you mailed a paper return, processing can take up to 21 days just to be entered into the system, followed by several weeks of review.

You should wait at least 24 hours after e-filing—or four weeks after mailing a paper return—before attempting to check your status. Attempting to check too soon often leads to confusion because the system may not yet have received or logged your submission.

“Taxpayers who file electronically and use direct deposit receive their refunds in less than three weeks in most cases.” — Internal Revenue Service Official Statement

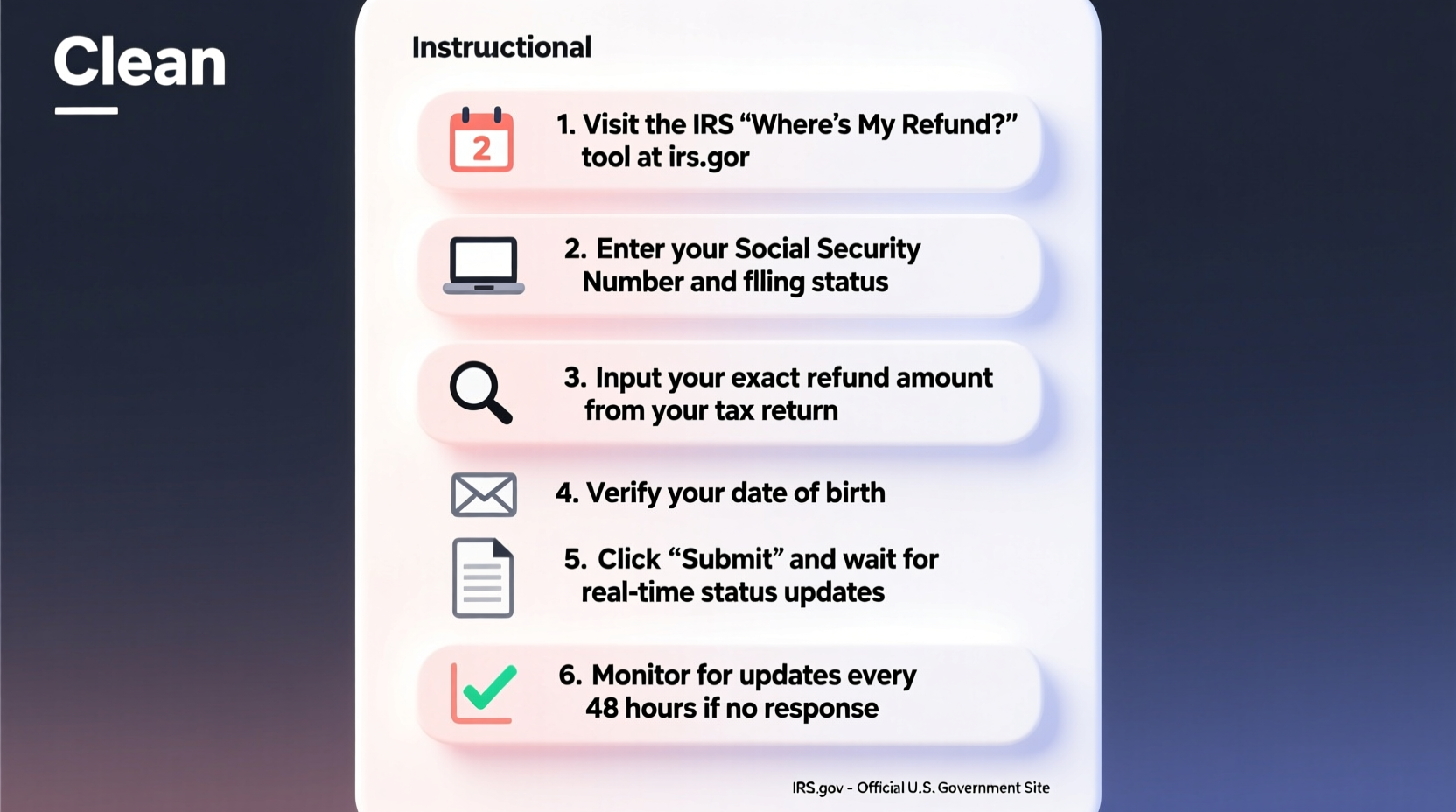

Step-by-Step: How to Check Your Tax Return Status Online

The most reliable method for checking your tax return status is the IRS’s official “Where’s My Refund?” tool. This secure, real-time platform provides accurate updates based on your personal filing data.

- Visit the official IRS website: Go to IRS.gov/refunds. Avoid third-party sites that mimic the IRS interface.

- Select “Where’s My Refund?”: Click the link to access the tracker tool.

- Enter your personal information: You’ll need:

- Your Social Security Number (or Individual Taxpayer Identification Number)

- Your filing status (Single, Married Filing Jointly, etc.)

- The exact amount of your expected refund as shown on your return

- Submit the form: The system will instantly retrieve your return status if it’s available.

- Review the displayed status: You’ll see one of three phases:

- Return Received: The IRS has accepted your return.

- Refund Approved: Your refund is being prepared for issuance.

- Refund Sent: The payment has been dispatched via direct deposit or mail.

Understanding the Three Stages of Refund Processing

Once your return appears in the system, it moves through a clear sequence of stages. Each phase offers insight into where your refund stands.

| Stage | What It Means | What to Do |

|---|---|---|

| Return Received | The IRS has accepted your tax return and is beginning processing. | No action needed. Wait for the next update. This stage usually lasts 1–3 days after e-filing. |

| Refund Approved | Your refund amount has been verified and approved for disbursement. | Prepare for receipt. If using direct deposit, funds typically arrive within 5 business days. |

| Refund Sent | The IRS has issued your payment via direct deposit or mailed a check. | Check your bank account or mailbox. Allow additional time for physical checks to arrive. |

If your status remains unchanged for more than two weeks during peak season (January–April), it may indicate a review is underway. Common triggers include math errors, identity verification needs, or claims for certain credits like the Earned Income Tax Credit (EITC) or Child Tax Credit (CTC).

Using the IRS2Go App for Mobile Tracking

For taxpayers on the go, the IRS offers a free mobile app called IRS2Go. Available for both iOS and Android, this tool provides the same functionality as the desktop version of “Where’s My Refund?” with added convenience.

- Download the IRS2Go app from your device’s official app store.

- Open the app and select “Refund Status.”

- Enter the same information required on the web version: SSN, filing status, and expected refund amount.

- Receive instant access to your current processing stage.

The app also allows you to find local tax assistance offices, learn about deadlines, and access tax tips throughout the year. Push notifications are not currently supported, but the interface is streamlined for quick daily checks.

What to Do If Your Refund Is Delayed

Delays happen. While most refunds are issued within 21 days, certain factors can extend processing time. These include incomplete forms, mismatched income statements (like Forms W-2 or 1099), or claims requiring additional scrutiny.

Before contacting the IRS directly, ensure you’ve waited the recommended period—21 days for e-filers, six weeks for paper filers. If no update appears after that, consider these steps:

- Double-check all input data in “Where’s My Refund?” A typo in your SSN or refund amount can prevent results from loading.

- Verify that your financial institution hasn’t received the deposit. Sometimes banks post transactions before the IRS updates its portal.

- Call the IRS at 1-800-829-1040 if eligible. Live assistance is available Monday through Friday, 7 a.m. to 7 p.m. local time.

Mini Case Study: Resolving a Stalled Refund

Sarah, a freelance graphic designer from Colorado, filed her 2023 return in mid-February. She used a popular tax software and selected direct deposit. After 10 days, she checked “Where’s My Refund?” but saw no record of her return.

She waited another week, then rechecked—this time seeing “Return Received.” Two days later, it changed to “Refund Approved,” and finally, “Refund Sent” three days after that. Her bank credited the funds the following morning.

The delay was normal; her return included self-employment income, which triggered a slightly longer initial review. By waiting and checking consistently, Sarah avoided unnecessary calls and confirmed everything was on track.

Common Mistakes That Delay Refund Tracking

Many taxpayers encounter confusion not because of IRS errors, but due to simple missteps. Avoid these common pitfalls:

- Entering the wrong refund amount: Always refer to Line 20 of Form 1040 (the “Amount you owe” or “Amount you’re owed”) when entering data.

- Using last year’s information: The system resets annually. Ensure you’re entering details from your most recently filed return.

- Checking too frequently: The system updates once per day—usually overnight. Refreshing multiple times per hour won’t speed things up.

- Mailing a paper return without confirmation: Consider using certified mail with tracking to verify delivery.

FAQ: Frequently Asked Questions About Tax Return Status

Can I check my tax return status without a Social Security Number?

No. The IRS requires your SSN or ITIN to verify identity and protect against fraud. There is no public lookup system based on name or address.

Why does my status say “Still Being Processed”?

This message means the IRS has your return but hasn’t completed review. It replaces older status messages and may persist for several weeks, especially if claiming certain credits or if corrections are needed.

What happens if I moved after filing?

If you provided a new address on your return, the IRS will mail any physical check to that location. For faster access, update your banking information through your tax preparer before e-filing or contact the IRS to change deposit details—if allowed.

Final Checklist: Track Your Refund Successfully

- ✅ Wait 24 hours (e-file) or 4 weeks (paper file) before checking

- Ensures your return has been logged into the system.

- ✅ Gather required info: SSN, filing status, and exact refund amount

- Have your completed return handy for reference.

- ✅ Use IRS.gov/refunds or the IRS2Go app

- Only official platforms provide real-time, secure updates.

- ✅ Monitor daily—but only once per day

- The system refreshes nightly; multiple checks yield no extra benefit.

- ✅ Contact the IRS only after 21 days (e-file) or 6 weeks (paper)

- Reduces strain on support lines and ensures your case is ready for review.

Take Control of Your Tax Timeline

Tracking your tax return doesn’t have to be stressful. With the IRS’s transparent online tools and a bit of patience, you can confidently monitor your refund from submission to deposit. Whether you're a first-time filer or a seasoned taxpayer, understanding how and when to check your status empowers you to act quickly if something seems off—and rest easier when everything is progressing normally.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?