Gift cards are convenient, versatile, and often given for birthdays, holidays, or as rewards. But too many go unused—or underused—simply because people don’t know how to check their value or spend them wisely. Whether you’ve received a physical card, an e-gift card, or found one tucked in an old wallet, knowing how to find the balance and stretch every dollar is essential. This guide walks you through reliable methods to check your gift card value, avoid common pitfalls, and turn that balance into maximum value.

How to Check Your Gift Card Balance Accurately

The first step in using any gift card is knowing exactly how much is on it. The process varies depending on the retailer, but most follow predictable patterns. Here’s how to get accurate information without frustration.

For major retailers like Amazon, Walmart, Target, or Starbucks, checking your balance is usually straightforward:

- Visit the official website: Navigate to the gift card section and look for “Check Balance.” Enter the card number and PIN (if applicable).

- Call customer service: Use the toll-free number printed on the back of the card. Automated systems typically provide balance info within seconds.

- In-store inquiry: Bring the card to a physical location. Most stores can scan it at customer service with no purchase required.

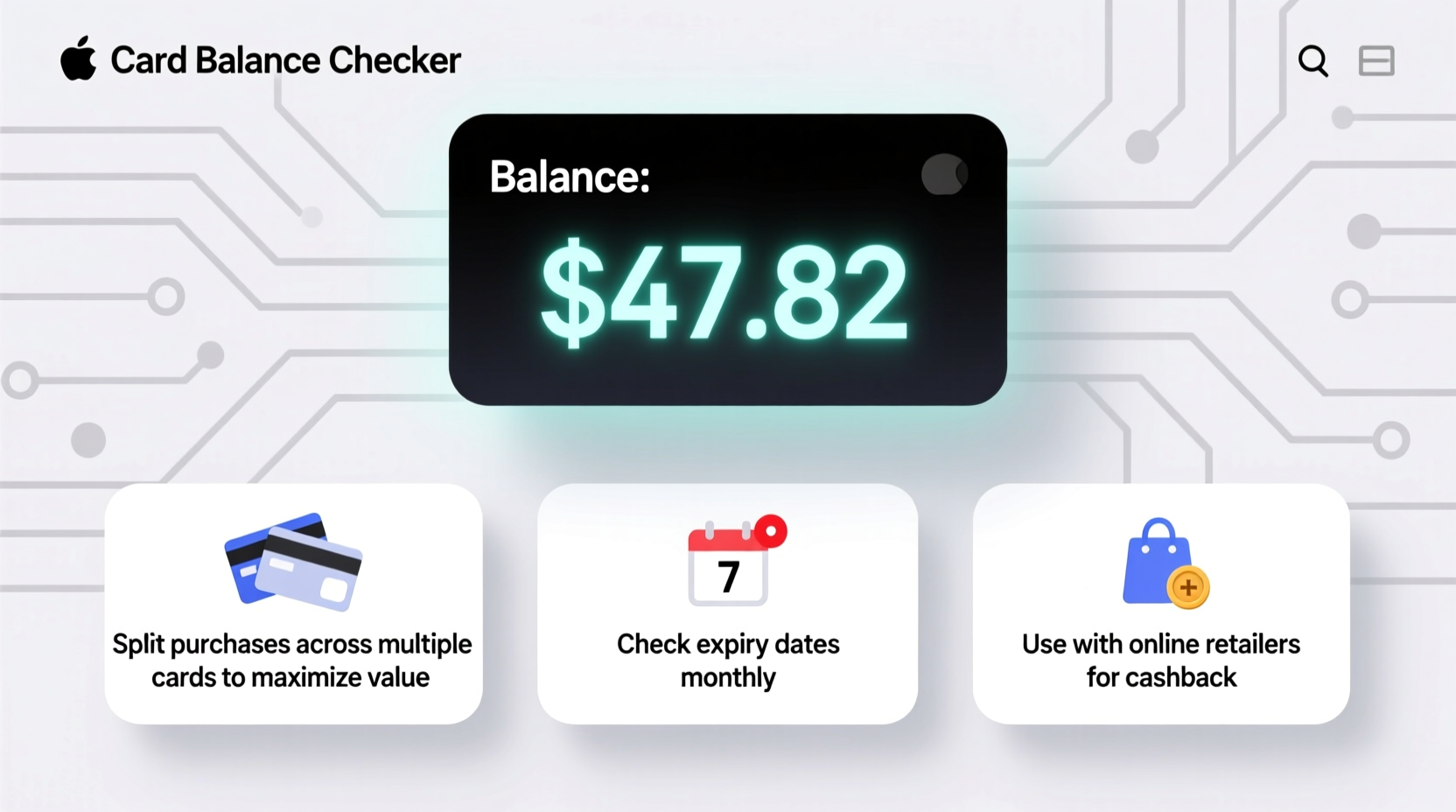

- Mobile apps: Retailers like Starbucks or Sephora offer app-based balance tracking once you register your card.

Step-by-Step Guide to Finding Any Gift Card Balance

- Locate the card number and PIN: Scratch off the protective coating if necessary. Keep this information secure.

- Identify the issuer: Determine whether it's a closed-loop (store-specific) or open-loop (Visa, Mastercard) card.

- Go to the official site: Search “[Retailer] gift card balance” and ensure you’re on the correct domain.

- Enter required details: Input the card number, PIN, and any CAPTCHA prompts.

- Record the balance: Write it down or save it in a password manager for future reference.

- Set a reminder: Schedule a monthly check if you plan to use the card over time.

Smart Spending Tips to Maximize Your Gift Card Value

Knowing your balance is only half the battle. Using it wisely ensures you get the most out of every dollar loaded onto the card.

Start by planning purchases strategically. Avoid impulse buys just because you have available funds. Instead, treat the gift card like cash and align spending with needs or high-value opportunities.

- Wait for sales: Combine your gift card balance with store promotions, discounts, or loyalty rewards to stretch its value.

- Use partial payments: Many retailers allow splitting payments between gift cards and other methods. This lets you preserve cash while clearing the full gift card amount.

- Consolidate small balances: If you have multiple low-balance cards from the same brand, use them together on one purchase.

- Watch for expiration and fees: While federal law limits dormancy fees, some state rules and card types still allow them after long inactivity periods.

| Tactic | Benefit | Best For |

|---|---|---|

| Pair with seasonal sales | Buy more items per dollar | Clothing, electronics, home goods |

| Use during holiday promotions | Get free shipping or bonus items | Online shopping (Amazon, Target) |

| Combine with cashback apps | Earn rewards even when using gift cards | Open-loop cards (Visa, Amex) |

| Buy digital content | No tax, instant delivery | Streaming services, games, software |

Mini Case Study: Turning $75 Into $120 Worth of Value

Sarah had a $75 Target gift card she received during the holidays. Rather than spending it immediately on random items, she waited two weeks until Target launched its weekly ad featuring 20% off select home goods and an extra 10% off for Circle members (free to join). She also clipped digital coupons from the app.

By timing her purchase and combining discounts, Sarah bought a $100 set of kitchen containers for just $72 after all reductions. She paid the difference with her gift card and saved $28 compared to the original price—all while fully depleting the card.

“Strategic gifting isn’t just about giving—it’s about empowering recipients to make smarter choices. A little patience can double the effective value of a gift card.” — Laura Bennett, Consumer Finance Analyst at SpendWell Insights

Avoiding Common Gift Card Mistakes

Mistakes can cost you money—or your entire balance. Stay aware of these frequent errors:

- Not registering the card: Especially important for open-loop cards (Visa, Mastercard). Registration helps protect against loss and enables online use.

- Assuming all cards are reloadable: Most retail gift cards cannot be reloaded. Once used, they’re done.

- Ignoring terms and conditions: Some cards exclude certain categories (e.g., tobacco, gift cards), limiting where you can spend them.

- Losing the card number: Take a photo or write down the number and PIN before using it. You’ll need it for balance checks and disputes.

Checklist: What to Do When You Receive a Gift Card

- ✅ Immediately check the initial balance to confirm it matches expectations.

- ✅ Register the card online if possible (especially for bank-issued cards).

- ✅ Record the card number and PIN in a safe place.

- ✅ Review expiration dates and fee policies.

- ✅ Sign up for the retailer’s newsletter or loyalty program to receive exclusive deals.

- ✅ Plan your first purchase around upcoming sales or promotions.

Frequently Asked Questions

Can I combine multiple gift cards on one online order?

Yes, most major retailers—including Amazon, Walmart, and Best Buy—allow you to apply multiple gift cards during checkout. You may need to enter each one separately, especially if paying partially with another method.

What should I do if my gift card shows a zero balance but I haven’t used it?

Contact customer service immediately. Provide the card number and purchase details. If it was stolen or compromised, some issuers may offer a replacement, especially if reported quickly. Always keep proof of purchase for physical cards.

Do Visa or Mastercard gift cards expire?

Federal law requires that gift cards remain valid for at least five years from the date of issue. However, inactivity fees can apply after 12 months of no use. Check the fee schedule included with the card to avoid surprises.

Final Thoughts: Make Every Dollar Count

Gift cards represent real purchasing power—but only if you take control of them. From checking your balance accurately to timing purchases for maximum impact, small actions lead to smarter spending. Don’t let forgotten cards gather dust or fall victim to hidden fees. Use the tools and strategies outlined here to unlock full value, avoid common traps, and turn what might seem like a simple present into a powerful financial tool.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?