Accessing cash when you're short on funds can be stressful, especially if traditional banking options aren't available. Many people turn to their credit cards for emergency liquidity, but doing so often comes with steep costs—high interest rates, cash advance fees, and penalty APRs. However, with the right knowledge and planning, it’s possible to extract value from your credit line while minimizing financial damage. This guide outlines practical, low-cost methods to access cash responsibly, helping you avoid common pitfalls and maintain control over your finances.

Understanding Credit Card Cash Access Costs

Before exploring alternatives, it's essential to understand why standard cash advances are so costly. Most credit card issuers treat cash withdrawals differently than regular purchases. They typically impose:

- A cash advance fee (usually 3%–5% of the amount withdrawn)

- An immediate high interest rate (often 24%–30%, with no grace period)

- Daily interest accrual starting the moment funds are accessed

- Limited availability through ATMs or bank tellers

These factors make traditional cash advances one of the most expensive forms of borrowing. But not all ways of accessing credit card value fall into this category. Some lesser-known strategies allow cardholders to obtain liquid funds at significantly lower cost—if used wisely.

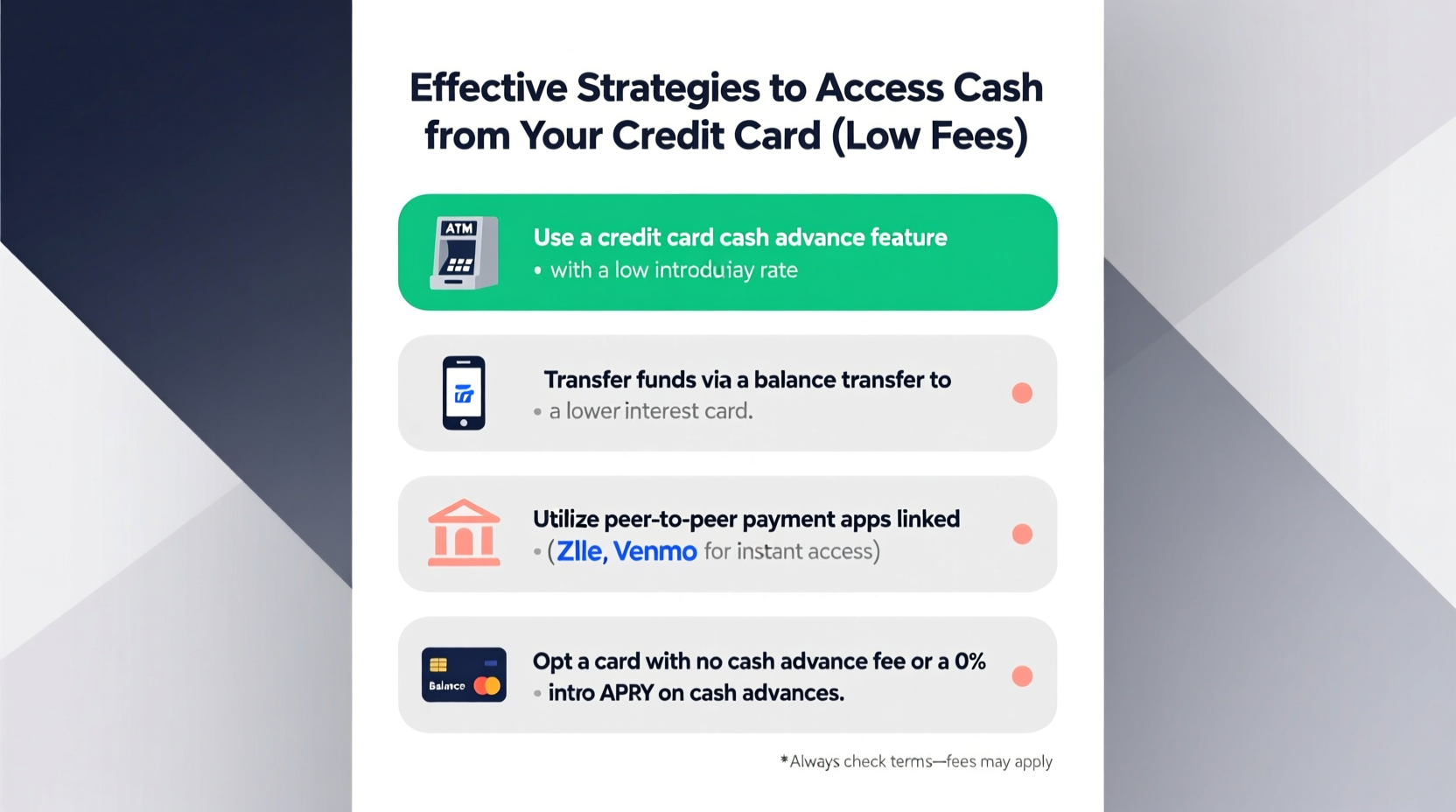

Strategy 1: Use a Balance Transfer with No Introductory Fee

Balance transfers are commonly associated with moving debt between cards, but they can also serve as a tool to access cash indirectly. Some credit cards offer promotional periods with 0% interest on balance transfers for 12–21 months, sometimes waiving transfer fees entirely during limited-time offers.

Here’s how it works: You transfer a balance from your credit card to another financial product that allows cash disbursement—such as a personal loan account or even a linked checking account via certain fintech platforms. While technically a form of cash access, this approach avoids direct cash advance fees and interest—if managed within the promotional window.

“Balance transfers can be a strategic workaround for short-term liquidity needs, provided the user has strong discipline and a clear repayment plan.” — Marcus Reed, Consumer Finance Advisor at ClearPath Financial Group

Step-by-Step Guide to Using Balance Transfers for Cash Access

- Identify a credit card offering a 0% intro APR on balance transfers with no fee (rare, but occasionally available).

- Apply and get approved for the new card.

- Initiate a balance transfer from an existing card or use convenience checks tied to the new card.

- Deposit the funds into your bank account.

- Repay the full amount before the promotional period ends to avoid interest charges.

Strategy 2: Leverage Credit Card Convenience Checks

Some credit card issuers provide convenience checks linked to your credit line. These resemble regular checks but draw directly from your available credit. While many come with fees similar to cash advances, some premium cards waive these fees or offer promotional terms.

The key is knowing which cards offer favorable conditions. For example, certain travel rewards cards may issue checks with only a small flat fee instead of a percentage-based charge. Others allow you to redeem points for statement credits that function like cash deposits.

| Method | Avg. Fee | Interest Start Date | Best For |

|---|---|---|---|

| Standard ATM Cash Advance | 5% + $10 | Day of withdrawal | Emergencies only |

| Convenience Check (fee-waived promo) | $0–$5 | After grace period expires | Planned short-term needs |

| Reward Redemption (cash-back or statement credit) | None | N/A | Low-cost access |

| Balance Transfer (0% intro APR) | 0%–3% | After promo ends | Large, temporary needs |

Strategy 3: Maximize Cash-Back Rewards and Direct Payouts

If you regularly use your credit card for purchases, consider redirecting accumulated rewards toward direct financial benefit. Many cards now allow you to redeem cash-back earnings as:

- Direct bank account transfers (no fees)

- Check issuance (may have small processing delay)

- Bill payments (effectively freeing up cash elsewhere)

This isn’t “free money,” but it represents real purchasing power already earned through responsible spending. By treating cash-back redemptions as part of your monthly budget strategy, you can boost liquidity without touching your credit limit directly.

Mini Case Study: Sarah’s Emergency Car Repair

Sarah needed $600 for unexpected brake repairs. Instead of taking a cash advance at 27% APR, she reviewed her credit card account and realized she had $420 in unredeemed cash-back rewards. She transferred the full amount to her checking account via the issuer’s app—no fees, no interest. She covered the remaining $180 with a temporary shift in her grocery and entertainment budget. Within three months, she replenished her discretionary fund. Total cost: $0.

Strategy 4: Peer-to-Peer Transactions Using Credit Cards

While controversial and against the terms of service of most issuers, some users leverage peer-to-peer payment apps or third-party marketplaces to convert credit lines into cash. Examples include:

- Buying gift cards from others using a credit card and reselling them at a slight discount

- Using platforms that accept credit card payments for services (e.g., freelance gigs) and requesting early payouts

- Engaging in trusted person-to-person transactions where someone pays cash in exchange for a credit card payment on their behalf (e.g., paying a friend’s utility bill)

These methods carry risk. Misuse can lead to account suspension, fraud alerts, or even credit score damage. However, when conducted infrequently and transparently between trusted parties, such exchanges can provide short-term relief without formal fees.

FAQ: Common Questions About Low-Cost Cash Access

Can I get cash from my credit card without a fee?

Yes, but options are limited. Redeeming cash-back rewards, using fee-free convenience checks during promotions, or transferring balances with $0 fees are the primary no-fee pathways. Traditional ATM withdrawals almost always incur fees.

Does using a convenience check hurt my credit score?

Not directly. Like any credit usage, it affects your utilization ratio. If you max out your card or carry a high balance, your score may drop temporarily. But the act of writing the check itself does not trigger a negative reporting event.

Are there legal risks in converting credit to cash through third parties?

There are no criminal penalties for lawful peer transactions, but violating your cardholder agreement (e.g., by laundering payments or inflating transactions) could result in account closure, retroactive interest application, or being flagged for suspicious activity.

Action Plan Checklist: Access Cash Responsibly

- Review current credit card benefits and reward balances

- Check for active 0% balance transfer offers or waived-fee promotions

- Explore cash-back redemption options with instant bank transfer

- Calculate total cost of any potential advance (fees + interest)

- Avoid ATM cash advances unless absolutely necessary

- Create a repayment timeline before accessing funds

- Monitor statements closely for unexpected charges or policy changes

Conclusion: Make Smart Moves When Cash Is Tight

Needing quick access to funds doesn’t mean accepting predatory fees. With careful planning and awareness of your credit card’s features, you can extract liquidity at minimal cost. The smartest strategies rely not on impulse withdrawals, but on leveraging existing benefits—rewards, promos, and flexible redemption tools—that many cardholders overlook. By prioritizing low-interest pathways and avoiding high-cost traps, you protect both your immediate budget and long-term financial health.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?