Paying your power bill doesn’t have to be a chore. With the rise of digital tools and flexible payment options, managing your electricity expenses has never been easier. Whether you prefer the convenience of one-click payments or the reliability of traditional methods, there’s a solution that fits your routine. This guide walks you through every available option, offering practical advice, real-world examples, and expert-backed strategies to help you stay on top of your bills—without stress.

Why Payment Convenience Matters

Late fees, service interruptions, and credit score impacts are common consequences of missed utility payments. According to the U.S. Energy Information Administration, nearly 30% of households report difficulty paying energy bills at least once a year. The good news? Most power companies now offer multiple payment channels designed to reduce friction and improve accessibility.

Choosing the right method isn't just about speed—it's about aligning with your financial habits. A retiree on a fixed income may benefit from automatic bank drafts, while a busy professional might rely on mobile app alerts and instant payments. Understanding your options empowers you to make smarter, more consistent decisions.

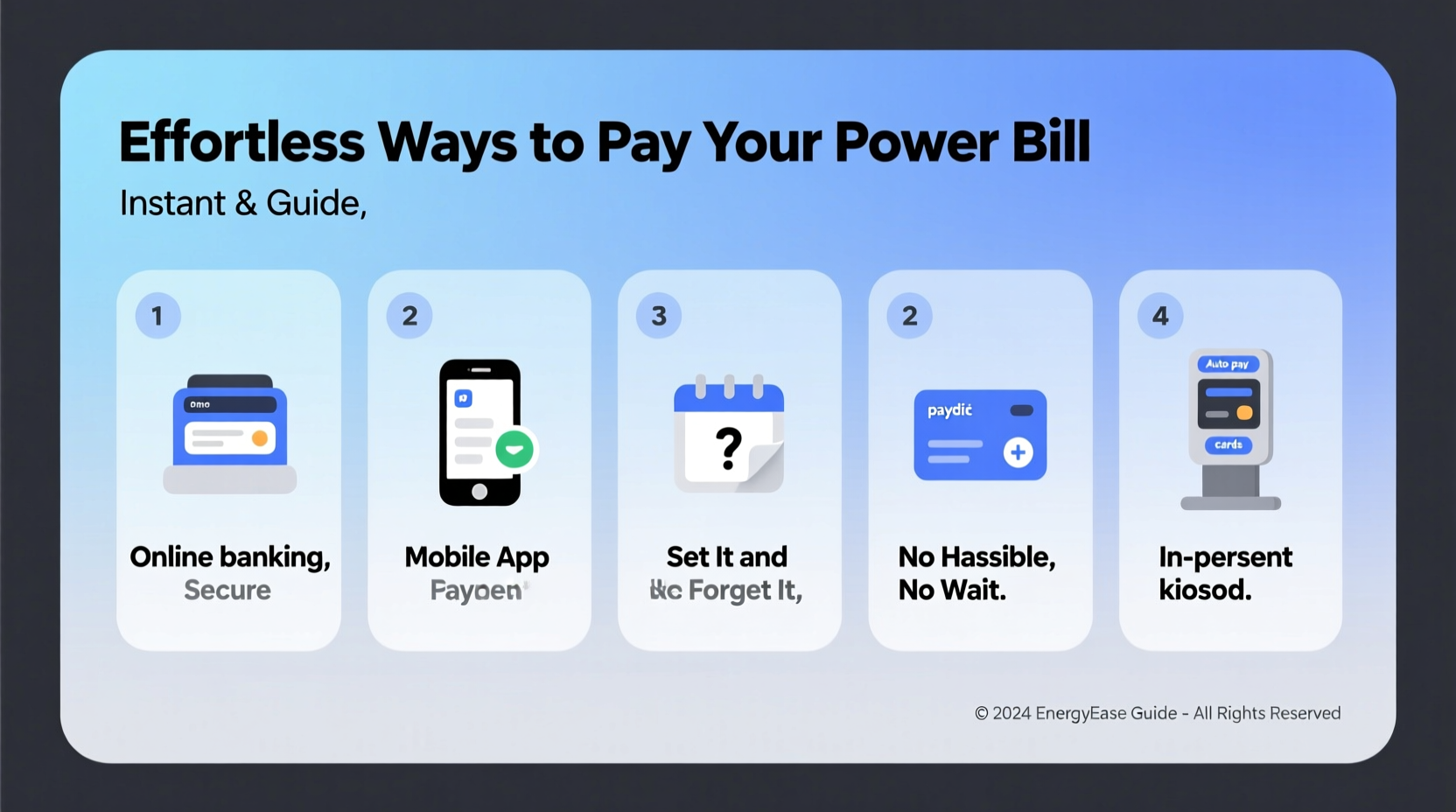

Top 5 Ways to Pay Your Power Bill

Electricity providers support a range of payment methods. Here’s a breakdown of the most common—and how each can work for you.

1. Online Account Portal

Most utility companies provide secure customer portals where you can view usage history, download invoices, and make payments. All you need is an account and a linked payment method (credit card, debit card, or bank account).

- Log in to your provider’s website

- Navigate to the “Pay Bill” section

- Select payment amount and method

- Confirm and save confirmation number

2. Mobile App Payments

Utility-specific apps or third-party platforms like PayPal, Zelle, or your banking app allow quick payments on the go. Many apps include features such as barcode scanning, push notifications, and digital receipt storage.

For example, Duke Energy’s mobile app lets users pay with a saved card, track daily usage, and receive outage alerts—all from a smartphone.

3. Automatic Bank Drafts (ACH)

This hands-free method links your checking account directly to your utility provider. On the due date, the payment is automatically withdrawn. It’s ideal for those who want consistency without manual input.

No late fees. No forgotten payments. Just peace of mind.

4. In-Person & Retail Payments

If you don’t use online banking or prefer cash transactions, many utilities partner with retail locations like Walmart, 7-Eleven, or ACE Cash Express. Simply bring your account number or QR code, pay the cashier, and get a printed receipt.

This method is especially valuable for unbanked or underbanked populations. Over 7 million U.S. households lack access to traditional banking, making cash-based options essential.

5. Phone & IVR Systems

Dial your provider’s toll-free number and use the interactive voice response (IVR) system to pay via credit/debit card. Some companies also offer live agent support during business hours.

While not the fastest method, it’s accessible for older adults or those less comfortable with technology.

Step-by-Step Guide: Setting Up Auto-Pay in 5 Minutes

Automating your power bill takes little effort but delivers long-term benefits. Follow this timeline to set it up today:

- Log in to your utility provider’s website or app (e.g., PG&E, Con Edison, Xcel Energy).

- Navigate to “Payment Settings” or “Auto Pay.”

- Select your preferred funding source: bank account or card.

- Verify account details and confirm authorization.

- Choose whether to pay the full balance or minimum due each month.

- Save and test with your next billing cycle.

Once active, you’ll receive email confirmation when each payment processes. You can still view statements and adjust settings anytime.

“Setting up auto-pay reduces human error and ensures uninterrupted service. It’s one of the simplest financial automations a household can implement.” — Lisa Tran, Consumer Finance Advisor

Comparison Table: Pros and Cons of Each Payment Method

| Method | Speed | Fees | Accessibility | Best For |

|---|---|---|---|---|

| Online Portal | Fast (instant processing) | None or small card fee | High (requires internet) | Tech-savvy users |

| Mobile App | Very Fast | Minimal | High | On-the-go payers |

| Auto-Draft (ACH) | Scheduled | None | Moderate | Hands-off management |

| In-Person/Retail | Immediate | $1–$5 convenience fee | Very High | Cash users |

| Phone (IVR) | Moderate | Small transaction fee | High | Non-digital users |

Mini Case Study: How Maria Eliminated Late Fees

Maria, a single mother in Austin, Texas, used to juggle three jobs and often forgot her monthly Oncor electric bill. She incurred $35 in late fees over six months and even faced a disconnection warning.

After speaking with customer service, she switched to automatic bank drafts using her savings account. She also enabled low-balance alerts through her bank to ensure sufficient funds.

Within two months, Maria had no late fees, improved her budget predictability, and regained confidence in managing household expenses. “It feels like I’ve reclaimed time and reduced stress,” she said.

Checklist: Optimize Your Power Bill Payments

Use this actionable checklist to streamline your process:

- ✅ Register for an online account with your utility provider

- ✅ Link a reliable payment method (bank account or card)

- ✅ Enable paperless billing and e-receipts

- ✅ Set up payment reminders (email/text)

- ✅ Enroll in auto-pay if your income is stable

- ✅ Review your bill monthly for accuracy

- ✅ Update contact info and payment details promptly

Frequently Asked Questions

Can I pay my power bill with a credit card?

Yes, most utility companies accept major credit cards through their website, app, or phone system. Be aware that some charge a processing fee (typically 2–3%). However, using a rewards card responsibly can earn travel points or cash back—effectively offsetting the cost.

What happens if I miss a payment?

If you miss a payment, your provider will typically send a reminder notice before applying a late fee. Continued non-payment may result in service disconnection. Many companies offer hardship programs or payment extensions if contacted early.

Are mobile payments secure?

Yes. Reputable utility apps and banking platforms use end-to-end encryption and multi-factor authentication. Avoid public Wi-Fi when making payments, and always log out after completing transactions.

Final Thoughts: Make Paying Your Power Bill Effortless

Managing your power bill doesn’t require constant attention or complex strategies. By choosing the right payment method and setting up systems that work with your lifestyle, you can eliminate late fees, prevent service disruptions, and gain greater control over your finances.

Whether you automate everything or prefer occasional manual payments, the key is consistency and awareness. Take five minutes today to review your current setup. If you’re still writing checks or relying on memory, consider upgrading to a digital solution that saves time and reduces risk.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?