Navigating the world of credit cards can feel overwhelming, especially if you're new to building credit or returning after a financial setback. Yet, with the right preparation and mindset, applying for a credit card doesn’t have to be intimidating. A well-chosen card can help you manage expenses, earn rewards, and build a solid credit history. The key is approaching the process with clarity, purpose, and informed decision-making.

Understand Your Credit Standing

Your credit score is the foundation of any credit card application. It tells lenders how responsibly you’ve managed debt in the past and helps them assess risk. Before applying, know where you stand. In the U.S., credit scores typically range from 300 to 850 and are categorized as:

| Credit Score Range | Category | Card Eligibility |

|---|---|---|

| 300–579 | Poor | Secured cards, credit-builder loans |

| 580–669 | Fair | Limited unsecured options, higher APRs |

| 670–739 | Good | Standard rewards and travel cards |

| 740–799 | Very Good | Premium rewards, lower interest rates |

| 800–850 | Exceptional | Top-tier cards with elite benefits |

You can check your credit score for free through many banks, credit unions, or services like Credit Karma and Experian. Review your full credit report annually at AnnualCreditReport.com to catch errors or signs of fraud.

Define Your Financial Goals and Spending Habits

A credit card should align with your lifestyle and financial objectives. Ask yourself: What do I want this card to help me achieve?

- Build or rebuild credit?

- Earn cash back on everyday purchases?

- Travel more affordably with points and miles?

- Consolidate existing debt with a 0% intro APR offer?

For example, if you spend heavily on groceries and gas, a flat-rate cash-back card might be ideal. If you travel twice a year, a travel rewards card with airport lounge access could add real value. Matching your card to your habits prevents overspending just to earn rewards and ensures long-term usefulness.

“Choosing a card based on actual spending—not aspirational spending—is one of the most overlooked yet critical steps.” — Lisa Chen, Certified Financial Planner

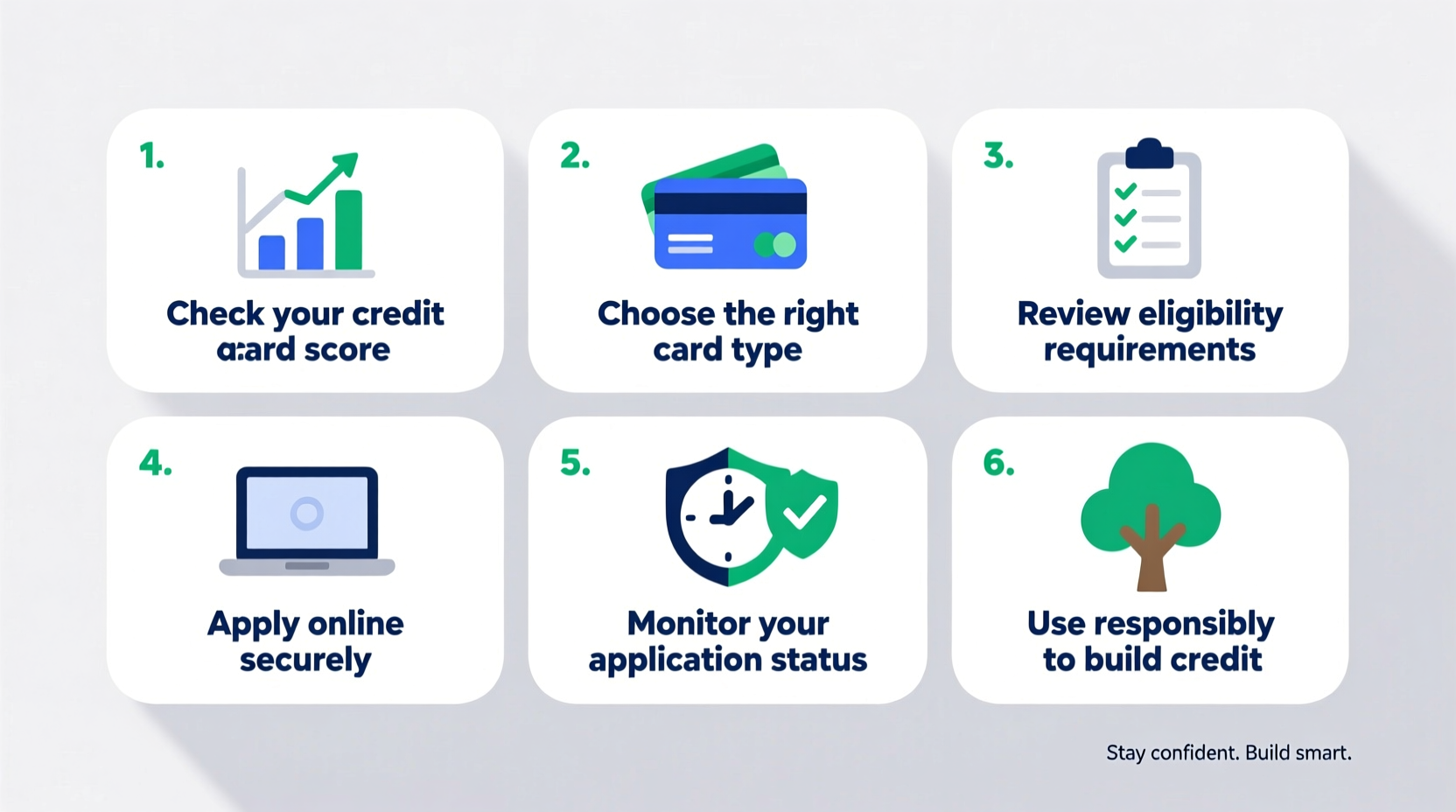

Step-by-Step Guide to Applying for a Credit Card

Confidence comes from preparation. Follow this timeline to ensure a smooth and successful application process.

- Assess your credit score using a free service or your bank’s portal.

- Research 3–5 cards that match your credit tier and goals.

- Compare features: APR, annual fees, rewards structure, sign-up bonuses, and foreign transaction fees.

- Pre-qualify when possible. Many issuers offer soft-check tools that show eligibility without impacting your credit.

- Gather required documents: government ID, Social Security number, proof of income (pay stubs, tax returns).

- Submit your application online or in person—most decisions are instant.

- Review terms carefully before activating the card.

- Use it responsibly: make small purchases and pay in full each month.

This methodical approach reduces guesswork and increases approval odds. Rushing into an application without research often leads to rejection or choosing a card with hidden costs.

Common Pitfalls to Avoid

Even with good intentions, applicants fall into traps that damage credit or lead to financial stress. Recognize these red flags:

| Do’s | Don’ts |

|---|---|

| Pay your balance in full each month | Carry a balance to “build credit” (interest isn’t necessary for credit growth) |

| Set up automatic payments for at least the minimum | Miss payments—even one late payment can drop your score significantly |

| Keep credit utilization under 30% | Max out your card or use more than half your limit regularly |

| Read the fine print on fees and promotions | Assume 0% intro APR means no interest forever |

Real Example: From Rejection to Approval

Jamal, a 28-year-old graphic designer, applied for a travel rewards card and was denied. His score was 610 due to a medical bill sent to collections years ago. Instead of reapplying immediately, he took action:

- Disputed the outdated collection entry (successfully removed).

- Opened a secured credit card with a $500 deposit.

- Used it for small monthly expenses and paid it off automatically.

- After eight months, his score rose to 695.

He reapplied for the same travel card—and was approved with a $5,000 limit. By focusing on credit health first, Jamal turned a setback into a strategic win.

Essential Checklist Before You Apply

Run through this checklist to ensure you’re truly ready:

- ✅ Checked my credit score and report for accuracy

- ✅ Identified my primary goal (rewards, credit building, low APR)

- ✅ Researched at least three card options that fit my profile

- ✅ Used pre-qualification tools to gauge approval odds

- ✅ Gathered personal and financial information needed for the application

- ✅ Confirmed I can pay off the balance monthly

- ✅ Understood the card’s fees, rewards, and grace period

Skipping even one item increases the risk of denial or misaligned expectations. Completing this list takes less than an hour but can save months of financial friction.

Frequently Asked Questions

Can I get a credit card with no credit history?

Yes. Secured credit cards, student cards, or becoming an authorized user on someone else’s account are effective ways to start building credit. Secured cards require a refundable deposit, which usually becomes your credit limit.

Does applying for a credit card hurt my credit score?

A single hard inquiry typically lowers your score by 5–10 points and only affects it for up to 12 months. Multiple inquiries in a short period can have a larger impact, so space out applications unless rate shopping for loans.

How soon can I request a credit limit increase?

Most issuers allow requests after six months of on-time payments. However, automatic increases may occur sooner if you demonstrate responsible use. Avoid frequent requests, as each triggers a hard pull.

Take Control of Your Financial Future

Getting a credit card with confidence isn’t about having perfect credit—it’s about understanding your finances, knowing what you need, and taking deliberate steps forward. Whether you're establishing credit for the first time or upgrading to a premium card, the process should empower, not intimidate. With the right knowledge and discipline, a credit card becomes a tool for growth, convenience, and security.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?