Turning 18 marks more than just legal adulthood—it’s the perfect moment to begin shaping your financial future. One of the most powerful tools you can develop early is strong credit. A healthy credit score opens doors to better interest rates, loan approvals, apartment rentals, and even job opportunities. But unlike income or savings, credit isn’t something you inherit or earn overnight. It must be built intentionally, responsibly, and consistently. The good news? Starting at 18 gives you a significant advantage: time. With smart habits now, you can establish a solid credit history that pays dividends for decades.

Why Building Credit Early Matters

Your credit score reflects your reliability as a borrower. It's calculated based on payment history, credit utilization, length of credit history, types of credit used, and new credit inquiries. Because one of these factors—length of credit history—favors those who start early, beginning at 18 puts you ahead of peers who wait until their mid-20s.

For example, someone who opens their first credit card at 18 and uses it responsibly will have a longer track record by age 25 than someone starting at 22. That extra four years of positive history can significantly boost their FICO score, often pushing them into the “excellent” range (750+), which unlocks the best loan terms and lowest insurance premiums.

“Starting early with credit is like compounding interest in reverse—the earlier you begin building trust with lenders, the more financial freedom you gain later.” — Laura Simmons, Certified Financial Planner

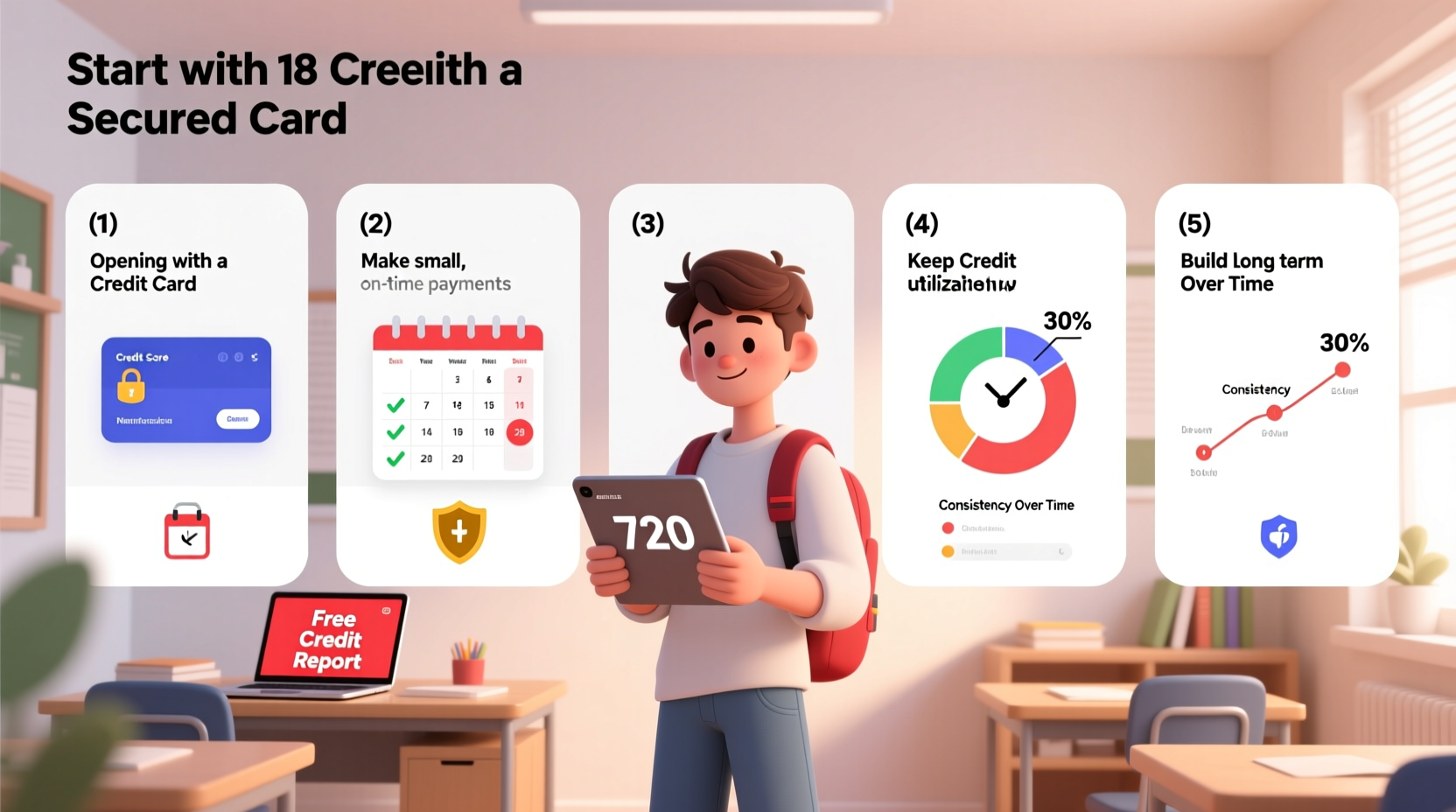

Step-by-Step Guide to Building Credit at 18

Building credit doesn’t require complex strategies. It starts with informed decisions and disciplined habits. Follow this timeline to lay a strong foundation:

- Check if You’re Already on a Parent’s Account (Age 18)

If your parents added you as an authorized user on their credit card, you may already have a credit history. Request a free copy of your credit report from AnnualCreditReport.com to see if any accounts are listed under your name. - Apply for a Starter Credit Card (Ages 18–19)

Look for student credit cards or secured credit cards designed for beginners. These typically have lower credit limits and fewer approval requirements. Examples include the Discover it® Student Cash Back or Capital One Secured Mastercard. - Use the Card Strategically (Ongoing)

Make small, regular purchases—like gas, groceries, or streaming subscriptions—and pay off the balance in full each month. This builds a consistent payment history without accumulating debt. - Monitor Your Credit Utilization (Monthly)

Aim to use less than 30% of your available credit limit. Ideally, keep it below 10% to maximize your score impact. For example, if your limit is $500, try not to carry a balance above $50 at any time. - Add Another Type of Credit (After 1 Year)

Once you’ve established responsible credit card use, consider applying for a credit-builder loan or becoming an authorized user on another account. Diversifying your credit mix strengthens your profile.

Do’s and Don’ts of Early Credit Building

| Do | Don’t |

|---|---|

| Pay all bills on time, every time | Max out your credit card to its limit |

| Keep old accounts open (even if unused) | Open multiple credit cards in a short period |

| Review your credit report annually | Ignore statements or due dates |

| Start with a secured or student card | Carry a balance just to “build credit” |

| Use less than 30% of your limit | Co-sign loans unless absolutely necessary |

Real Example: How Maya Built Her Score by 20

Maya turned 18 during her freshman year of college. With guidance from a campus financial wellness workshop, she applied for a student credit card with a $300 limit. She used it only for her monthly Spotify subscription ($10.99) and set up autopay through her checking account.

By age 19, her credit score was 682—solid for someone with less than two years of history. At 20, she applied for a credit-builder loan through her local credit union, paid it off over 12 months, and saw her score rise to 741. Now, she qualifies for low-interest auto loans and was approved for an apartment without needing a cosigner.

Her strategy wasn’t complicated: consistent, timely payments and minimal credit usage. She never carried a balance, avoided unnecessary applications, and checked her credit report twice a year for errors.

Essential Tools and Resources

- Free Credit Monitoring: Services like Credit Karma, Experian Free, and NerdWallet offer free access to your credit score and report summaries.

- Budgeting Apps: Use apps like Mint or YNAB (You Need A Budget) to track spending and ensure you don’t overspend on your credit card.

- Credit Simulators: Some platforms let you simulate how actions—like paying down debt or opening a new card—might affect your score.

Frequently Asked Questions

Can I build credit without a credit card?

Yes, though it’s more challenging. Alternatives include credit-builder loans, rent reporting services (like RentTrack or Piñata), or being added as an authorized user on a family member’s well-managed account. However, a starter credit card remains the most accessible and effective method for most 18-year-olds.

Will checking my credit hurt my score?

No—checking your own credit is considered a “soft inquiry” and does not impact your score. Only “hard inquiries,” such as those made when you apply for new credit, can have a minor, temporary effect.

How long does it take to build good credit from scratch?

You can establish a basic credit score within 6 months of opening your first account. Reaching a “good” score (670+) typically takes 12–18 months of consistent, responsible use. Achieving an “excellent” score (750+) may take 3–5 years, depending on your habits and credit mix.

Build Smart Habits Now, Reap Rewards Later

Building strong credit at 18 isn’t about quick fixes or shortcuts. It’s about making thoughtful choices today that compound into financial strength tomorrow. Every on-time payment, every low balance, and every avoided impulse application shapes a profile that lenders trust.

You don’t need a high income or a perfect budget to start. You just need discipline, awareness, and a willingness to treat credit as a tool—not a convenience. The habits you form now will influence your ability to buy a car, rent an apartment, secure a mortgage, or even qualify for certain jobs.

“Your credit score is one of the few numbers that follows you for life. Treat it with care from day one.” — Marcus Reed, Consumer Credit Counselor

Take Action Today

The best time to start building credit was yesterday. The second-best time is now. Whether you're still in high school, starting college, or entering the workforce, take one step today: check your credit status, research a starter card, or talk to a parent about becoming an authorized user. Small moves now create massive advantages later.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?