Transferring money or assets to loved ones can be a meaningful way to support family, reduce future estate taxes, or simply share prosperity. However, the Internal Revenue Service (IRS) imposes rules on such gifts—specifically, the federal gift tax. Fortunately, most individuals can give substantial amounts without ever paying a dime in gift tax, thanks to the annual gift tax exclusion and lifetime exemption. Understanding how these rules work—and how to plan around them—is essential for anyone considering large financial transfers.

Understanding the Annual Gift Tax Exclusion

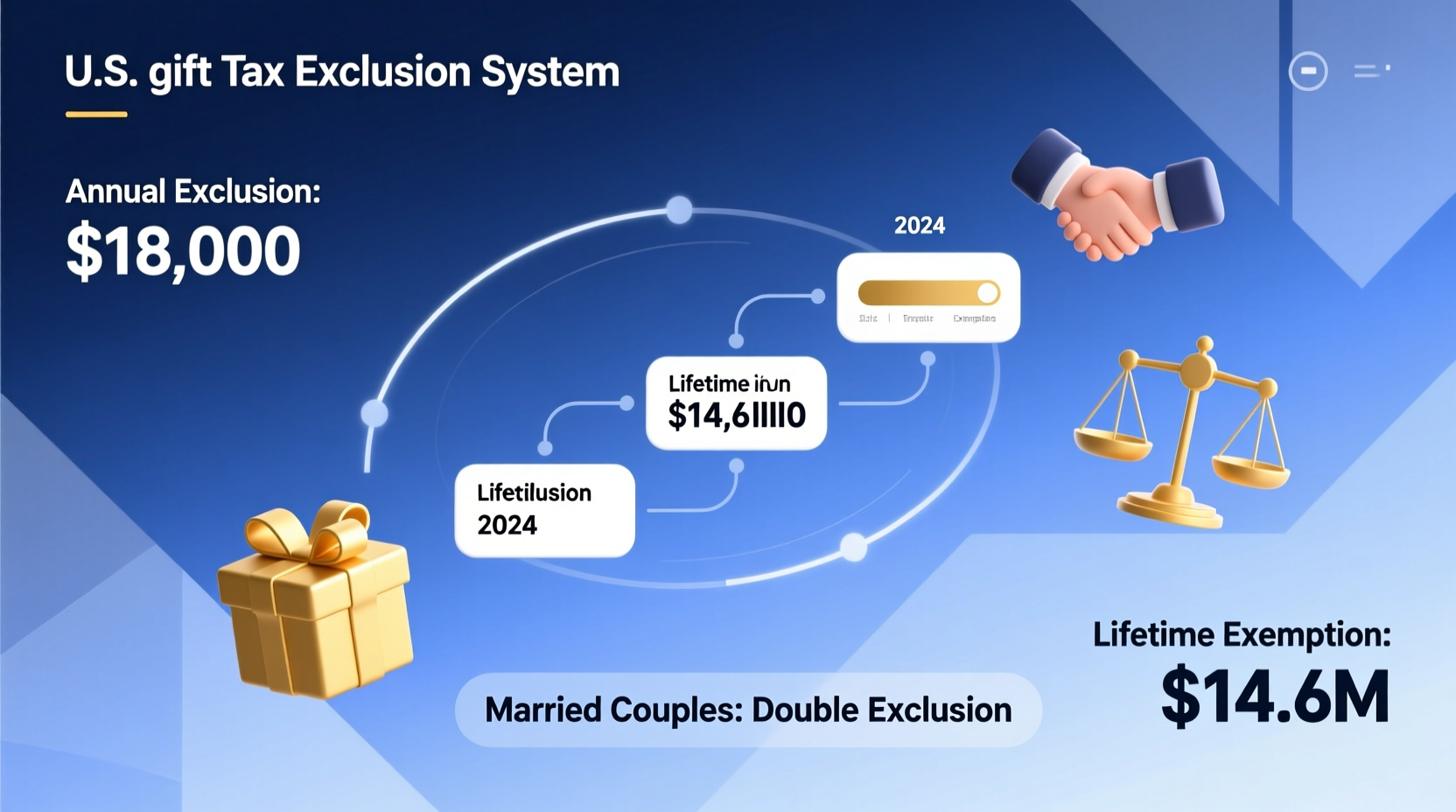

The IRS allows individuals to give a certain amount of money each year to any number of people without triggering gift tax reporting requirements. This is known as the annual gift tax exclusion. For 2024, the exclusion stands at $18,000 per recipient. If you're married, you and your spouse can together gift up to $36,000 to a single individual using gift splitting.

This exclusion applies per donor and per recipient. That means you can give $18,000 to your daughter, $18,000 to your son, $18,000 to a friend, and so on—with no limit on the number of recipients. These gifts do not count against your lifetime exemption and require no IRS filing.

Lifetime Gift and Estate Tax Exemption

Beyond the annual exclusion, the IRS provides a much larger lifetime exemption that covers both gifts made during life and assets transferred at death. For 2024, this unified credit exempts up to $13.61 million per individual ($27.22 million for married couples) from federal gift and estate taxes.

If you exceed the annual exclusion with a single gift—for example, giving your child $50,000 in one year—you must file IRS Form 709 (United States Gift (and Generation-Skipping Transfer) Tax Return). The excess amount ($32,000 in this case) will be counted against your lifetime exemption, but no tax is due unless you’ve already used up the full $13.61 million.

It's important to note that the lifetime exemption is scheduled to sunset after 2025, potentially dropping to around $6–7 million (adjusted for inflation), depending on future legislation. This makes strategic gifting before 2026 especially valuable for high-net-worth individuals.

Key Gifting Strategies and Planning Techniques

Smart gift tax planning isn't just about avoiding taxes—it’s about preserving wealth, supporting heirs early, and simplifying estate administration. Consider these proven approaches:

- Leverage Both Spouses’ Exclusions: Married couples can combine their annual exclusions to gift $36,000 per recipient without reporting. This is automatic if both spouses consent to split the gift.

- Front-Load 5-Year Exclusions for 529 Plans: You can contribute up to five years’ worth of annual exclusions into a 529 college savings plan at once—$90,000 per donor ($180,000 for couples)—without using any of your lifetime exemption.

- Pay Medical and Educational Expenses Directly: Payments made directly to medical providers or educational institutions for someone else’s benefit are exempt from gift tax, regardless of amount.

- Use Irrevocable Trusts for Larger Transfers: Transferring assets into an irrevocable trust removes them from your estate and can utilize your lifetime exemption efficiently while still providing controlled benefits to beneficiaries.

| Year | Annual Exclusion (Per Recipient) | Lifetime Exemption (Per Individual) |

|---|---|---|

| 2022 | $16,000 | $12.06 million |

| 2023 | $17,000 | $12.92 million |

| 2024 | $18,000 | $13.61 million |

| 2025 (Projected) | $18,000 | $13.61 million (estimated) |

Common Mistakes to Avoid

- Failing to File Form 709 When Required: Even if no tax is due, you must report gifts exceeding the annual exclusion. Failure to file can delay IRS processing of your estate later.

- Mixing Joint Gifts Without Agreement: If spouses want to split a gift, both must consent on Form 709. One spouse cannot unilaterally apply both exclusions.

- Gifting Appreciated Assets Without Strategy: Giving stocks or real estate with high appreciation may trigger capital gains for the recipient. Consider basis and timing carefully.

- Ignoring State-Level Rules: While federal gift tax is national, some states impose inheritance or estate taxes that could affect your planning.

“The gift tax system is designed to prevent wealth transfer avoidance, but it also offers powerful tools for intergenerational planning. Those who plan ahead can significantly reduce future tax burdens.” — Laura Simmons, Estate Planning Attorney and CPA

Real-World Example: The Johnson Family Gifting Plan

The Johnsons, a married couple with four children and eight grandchildren, wanted to reduce their taxable estate while helping their family. In 2024, they implemented the following strategy:

- Each parent gave $18,000 to each child and grandchild—totaling $18,000 × 12 recipients = $216,000 per spouse.

- Together, they gifted $432,000 under the annual exclusion with no reporting required.

- They also contributed $180,000 to 529 plans for their grandchildren—$90,000 each, utilizing five years of exclusion in one lump sum.

- This single-year move transferred $612,000 out of their estate tax-free and set up education funding for the next generation.

By repeating this annually, the Johnsons could shift millions over a decade—well within IRS allowances and without touching their lifetime exemption.

Step-by-Step Guide to Annual Gifting

- Inventory Your Recipients: List all individuals you plan to gift to—children, grandchildren, friends, charities.

- Calculate Total Potential Annual Gifts: Multiply $18,000 by the number of recipients. Add spousal contributions if applicable.

- Determine Payment Method: Use checks, wire transfers, or direct payments (especially for tuition/medical bills).

- Document Each Gift: Keep records of dates, amounts, and recipients. Save bank statements and notes.

- File Form 709 If Necessary: Required only if you exceed the annual exclusion per recipient or make a gift to a non-citizen spouse.

- Review With Your Advisor: Coordinate with your CPA or estate attorney to ensure alignment with broader financial goals.

Frequently Asked Questions

Do I have to pay taxes when I receive a gift?

No. Recipients of gifts never owe federal gift tax. The giver is responsible for any reporting or potential tax liability.

Can I give more than $18,000 to someone without paying tax?

Yes. You can give any amount, but anything over $18,000 per recipient in a year must be reported on Form 709 and will reduce your lifetime exemption. No tax is due until that exemption is exhausted.

What happens if I go over my lifetime exemption?

If you use more than the $13.61 million exemption (in gifts and estate value combined), the excess is taxed at 40%. Most people won’t reach this threshold, but high-net-worth individuals should plan accordingly.

Final Checklist: Smart Gifting in 2024

- ✅ Confirm the 2024 annual exclusion is $18,000 per recipient.

- ✅ Identify all intended recipients for gifting.

- ✅ Decide whether to split gifts with your spouse.

- ✅ Consider front-loading 529 plans for education.

- ✅ Pay tuition or medical bills directly when possible.

- ✅ Document all gifts and file Form 709 if required.

- ✅ Consult an estate planning professional for complex assets.

Take Action Today

Gift tax rules don’t have to be intimidating. With careful planning, you can transfer wealth efficiently, strengthen your family’s financial foundation, and minimize future tax exposure. The annual and lifetime exclusions offer powerful tools—if you use them wisely and consistently. Now is the time to review your options, calculate your potential gifting capacity, and take deliberate steps toward smarter wealth transfer. Whether you’re helping a child buy a home or funding a grandchild’s education, thoughtful gifting can make a lasting difference.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?