Understanding how much you earn per hour is essential for making smart financial decisions—whether you're evaluating a job offer, comparing freelance rates, or budgeting for side income. While many employees are paid an annual salary, their actual take-home value often depends on the number of hours they work. Converting an annual salary into an accurate hourly rate reveals the true cost of your time and helps you assess whether your compensation aligns with your effort.

This guide walks you through the precise calculations, adjustments for real-world variables, and practical insights so you can determine your effective hourly wage with confidence.

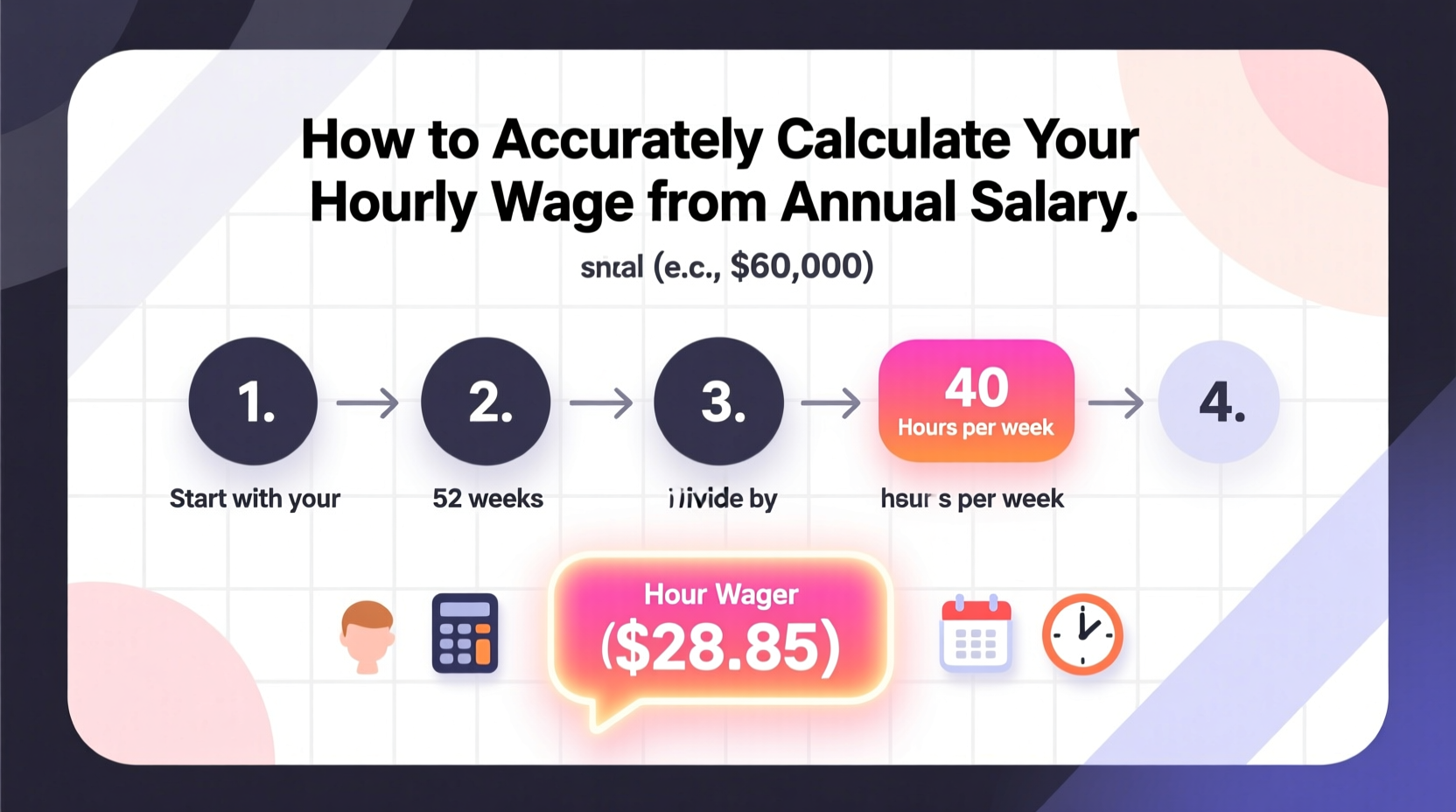

Step 1: Understand the Basic Formula

The foundation of calculating your hourly wage from an annual salary is simple:

Hourly Wage = Annual Salary ÷ Total Work Hours Per Year

Most full-time employees in the U.S. work 40 hours per week. With 52 weeks in a year, that comes to:

- 40 hours/week × 52 weeks = 2,080 hours per year

Using this standard, if you earn $52,000 annually:

$52,000 ÷ 2,080 = $25 per hour

This calculation gives you a baseline—but it assumes you work every single week without unpaid leave. In reality, most salaried workers receive vacation days, holidays, or unpaid time off, which affects the actual hours worked.

Step 2: Adjust for Paid vs. Unpaid Time Off

To get a more accurate picture, consider how many days you actually work each year. The federal government recognizes 10 public holidays annually, but not all employers observe them. Additionally, paid time off (PTO) varies widely.

Let’s assume you have:

- 2 weeks (10 days) of paid vacation

- 6 observed holidays

- No unpaid leave

That means you don’t work 16 days during the year. Since there are 260 working days in a typical year (5 days × 52 weeks), subtracting 16 gives you 244 actual workdays.

Multiply by 8 hours per day:

244 days × 8 hours = 1,952 hours worked per year

Now recalculate your hourly wage:

$52,000 ÷ 1,952 ≈ $26.64 per hour

This figure is higher than the initial $25/hour because you’re being paid the same amount for fewer working hours—essentially earning a premium during paid leave periods.

Why This Matters

If you only use the standard 2,080-hour figure, you may undervalue your effective hourly rate when benefits like PTO are included. Conversely, if you take unpaid leave, your effective hourly rate drops because you’re spreading your salary over fewer paid hours.

Step 3: Account for Overtime and Extra Hours

Many salaried professionals regularly work beyond 40 hours per week. If you consistently put in 50-hour weeks, your effective hourly wage decreases—even though your annual pay stays the same.

For example, working 50 hours per week over 52 weeks equals:

50 × 52 = 2,600 hours per year

At a $52,000 salary:

$52,000 ÷ 2,600 = $20 per hour

Despite having a stable salary, your time is effectively valued at $20/hour—significantly less than the $25 derived from a 40-hour baseline.

“Salaried roles often mask the true cost of long hours. Employees who track their time realize when they’re being undercompensated per hour.” — Laura Simmons, Career & Compensation Analyst

Step 4: Compare Across Employment Types

Freelancers and contractors often quote hourly rates, but their income lacks employer-provided benefits such as health insurance, retirement contributions, or paid leave. To make fair comparisons, adjust your calculated hourly wage to reflect these hidden costs.

A common rule of thumb is to add 20–30% to a contractor’s rate to account for benefits and taxes. So, a freelancer charging $65/hour might be comparable to a salaried worker earning:

$65 × 1.25 = $81.25 equivalent hourly rate

Using our earlier formula, that translates to roughly:

$81.25 × 2,080 = $169,000 annual salary

In contrast, someone earning $70,000 on a standard schedule makes only about $33.65/hour—less than half the effective value when benefits are factored in.

Do’s and Don’ts When Calculating Hourly Value

| Do’s | Don’ts |

|---|---|

| Use actual hours worked, not just scheduled time | Assume all 2,080 hours are worked equally |

| Factor in paid vacation and holidays | Ignore unpaid leave or sabbaticals |

| Include overtime if consistent | Treat occasional加班 as regular workload |

| Compare against industry benchmarks | Compare gross salary directly to freelance rates without adjustment |

Mini Case Study: Evaluating a Job Offer

Sophia receives two job offers:

- Job A: $65,000/year, 40-hour workweek, 15 days PTO + 6 holidays

- Job B: $60,000/year, expected 50-hour workweeks, 10 days PTO + 4 holidays

She calculates her effective hourly wages:

Job A:

- Total non-work days: 15 vacation + 6 holidays = 21

- Work days: 260 – 21 = 239

- Hours: 239 × 8 = 1,912

- Hourly rate: $65,000 ÷ 1,912 ≈ $33.99/hour

Job B:

- Worked weeks: 52 (no unpaid leave)

- Hours: 50 × 52 = 2,600

- Hourly rate: $60,000 ÷ 2,600 ≈ $23.08/hour

Although Job A pays $5,000 less annually, Sophia earns nearly $11 more per hour—and likely enjoys better work-life balance. This insight helps her choose based on value, not just headline salary.

Checklist: How to Accurately Calculate Your Hourly Wage

- Determine your annual gross salary (before taxes)

- Calculate total hours worked per year:

- Standard: 40 hrs/wk × 52 wks = 2,080

- Adjust for actual weekly hours if different

- Subtract unpaid leave days (if any) from total workdays

- Multiply remaining workdays by 8 to get actual paid hours

- Divide annual salary by total paid hours

- Add back value of benefits (healthcare, retirement match, bonuses) for full picture

- Compare result to market rates in your field

Frequently Asked Questions

What if I’m a part-time salaried employee?

Apply the same method using your actual annualized salary and hours. For example, if you work 25 hours per week (1,300 hours/year) and earn $32,500, your hourly rate is $32,500 ÷ 1,300 = $25/hour.

Should I include bonuses in my calculation?

If bonuses are guaranteed or highly predictable (e.g., annual performance bonus with historical consistency), include them in your total compensation. For variable or discretionary bonuses, calculate both scenarios—with and without—to understand best- and worst-case hourly values.

Does this calculation apply to exempt vs. non-exempt employees?

Yes, but carefully. Exempt employees (typically salaried) aren’t eligible for overtime pay, so extra hours lower their effective rate. Non-exempt salaried workers may be entitled to overtime, which should be added to total earnings before dividing by hours worked.

Final Thoughts: Know the True Value of Your Time

Your annual salary is just one piece of the puzzle. By converting it into an accurate hourly wage, you gain clarity on how much your time is truly worth. This knowledge empowers you to negotiate better, evaluate job offers critically, and decide whether additional responsibilities are fairly compensated.

Whether you’re planning a career shift, freelancing on the side, or simply reviewing your current role, taking the time to calculate your real hourly rate is one of the most valuable financial habits you can adopt.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?