Car registration is a necessary expense for every vehicle owner, but many overpay due to lack of awareness about fee structures, eligibility discounts, and renewal timing. Unlike one-time purchases, registration renews annually or biennially and varies significantly by state, vehicle type, and even county. Understanding how these costs are calculated—and where you can reduce them—can save hundreds over time. This guide breaks down the components of registration fees, provides actionable savings strategies, and walks you through real-world examples to help you make informed decisions.

Understanding How Car Registration Fees Are Calculated

Registration fees are not arbitrary. They’re determined by a combination of fixed charges, variable assessments, and local regulations. While each state uses its own formula, most base costs on several key factors:

- Vehicle weight or class: Heavier vehicles often incur higher fees due to road wear.

- Market value or purchase price: Some states use depreciation models based on MSRP.

- Age of the vehicle: Older cars may have lower valuation-based fees.

- County or municipality surcharges: Urban areas may add public transit or environmental fees.

- Fuel type: Electric and hybrid vehicles sometimes face additional fees to compensate for lost gas tax revenue.

For example, in California, the base fee is 0.65% of the vehicle’s value, plus a $46 California Highway Patrol (CHP) fee and any local district charges. In contrast, Florida assesses a flat $30.50 tag fee plus discretionary county taxes that can double the total.

“Most drivers don’t realize their registration isn’t just a flat renewal—it’s recalculated based on depreciation, location, and policy changes.” — Laura Simmons, State Motor Vehicle Policy Analyst

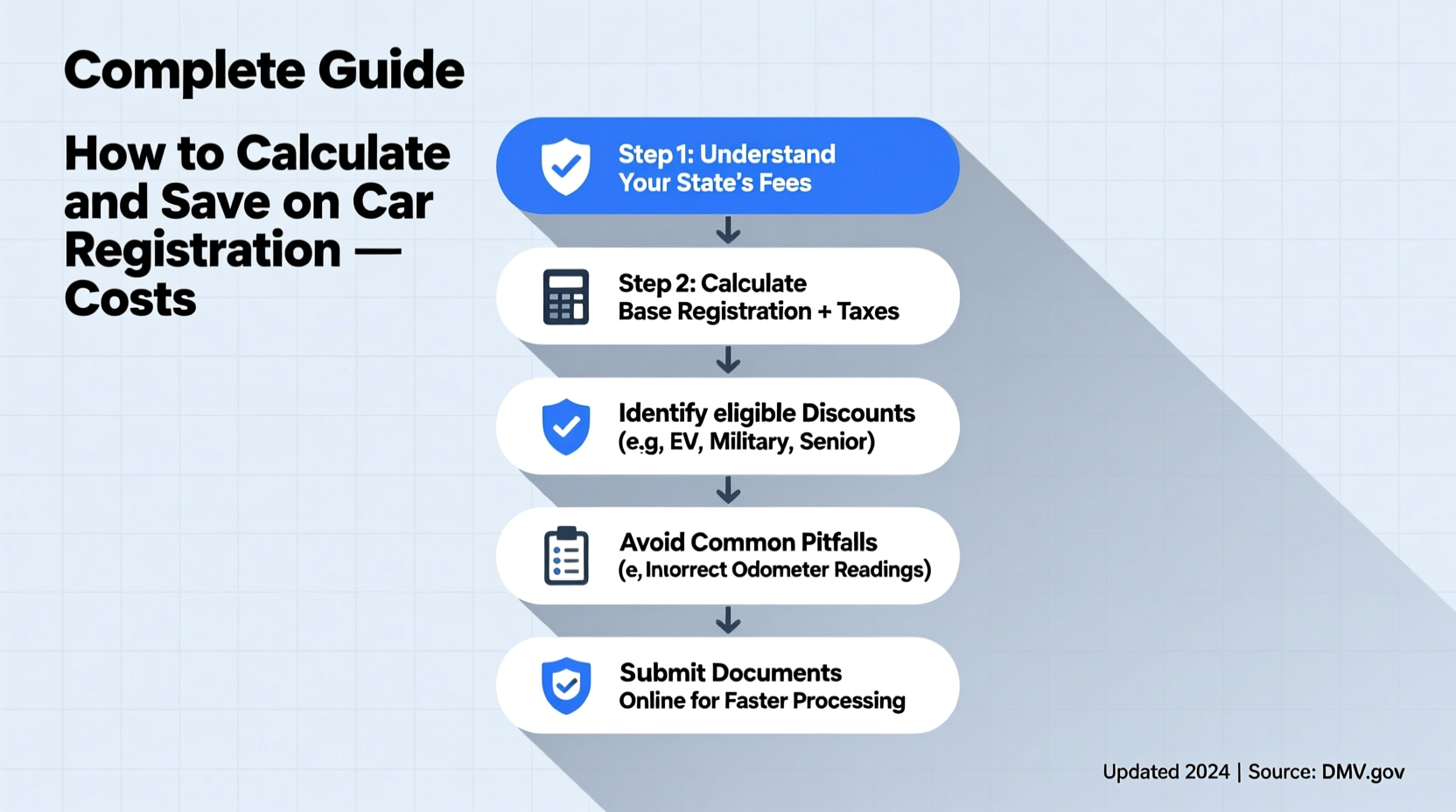

Step-by-Step: How to Calculate Your Registration Cost

To estimate what you’ll owe at renewal, follow this practical process:

- Gather your current registration renewal notice or vehicle details (make, model, year, VIN).

- Determine your vehicle’s assessed value. Use Kelley Blue Book (KBB) or NADA Guides for an accurate market estimate.

- Check your state’s fee structure. Visit your DMV website and locate the registration fee calculator or fee schedule.

- Add mandatory fees such as title transfer (if applicable), plate issuance, and environmental surcharges.

- Factor in local taxes from your county or city—these can range from negligible to over $100.

- Apply known discounts like senior, disabled, or military exemptions if eligible.

Smart Ways to Save on Registration Costs

Registration fees aren’t set in stone. Strategic planning and eligibility checks can lead to meaningful savings:

1. Time Your Renewal Strategically

In some states, renewing early (but not too early) avoids late fees while locking in current rates before potential hikes. Others allow grace periods with no penalty—use them wisely.

2. Challenge Overvalued Assessments

If your state bases fees on vehicle value, you can appeal if the assessed amount exceeds market value. Submit comparable KBB or Edmunds printouts showing lower valuations for similar vehicles.

3. Opt for Biennial Renewal

Where available, choosing a two-year registration instead of annual can reduce processing fees and administrative surcharges over time.

4. Leverage Exemptions

Many states offer reduced or waived fees for seniors (65+), veterans, disabled individuals, and low-income drivers. Check your DMV’s exemption page and apply with documentation.

5. Downsize or Switch to a Lighter Vehicle

Heavier SUVs and trucks cost more to register in weight-based systems. If you drive a full-size pickup, downsizing to a midsize model could cut fees by 30% or more.

6. Avoid Unnecessary Plate Upgrades

Premium, personalized, or specialty plates come with added annual fees—sometimes $40–$80 extra. Stick to standard plates unless the benefit outweighs the cost.

State Comparison: What You Could Pay for a 2020 Honda Civic

| State | Avg. Registration Fee | Key Factors | Savings Tip |

|---|---|---|---|

| California | $320/year | Value-based (0.65%), CHP fee, smog check | Appeal high valuation; bundle smog + renewal |

| Texas | $120/year | Flat fee + local county taxes | Negotiate county surcharge cap; renew online |

| New York | $150/year | Weight-based + MTA congestion zone surcharge | Reside outside NYC to avoid MTA fee |

| Colorado | $85/year | Ownership tax based on depreciation | Use decal extension during winter months |

| Florida | $275/year | High county discretionary fees (e.g., Miami-Dade) | Relocate registration to lower-tax county if possible |

Mini Case Study: Saving $180 on a Renewal in Texas

Mark, a resident of Harris County, Texas, received a renewal notice for $245 for his 2018 Toyota Camry. Confused—he remembered paying $160 the year before—he investigated. He discovered a new $75 “county mobility fee” had been added without clear explanation. After calling the county tax office, he learned the fee was optional for certain vehicle classes and could be deferred for one year. Additionally, Mark qualified for a $20 senior citizen discount he hadn’t claimed. By applying the exemption and deferring the mobility fee, he lowered his payment to $165—saving $80 immediately and pushing another $75 to next year. He also switched to biennial renewal, avoiding a future processing fee.

This case shows how proactive inquiry and knowledge of local policies can yield significant savings—even when fees appear non-negotiable.

Checklist: Maximize Your Registration Savings

- ✅ Review your renewal notice at least 60 days before due date

- ✅ Verify the assessed value of your vehicle using KBB or NADA

- ✅ Confirm eligibility for senior, veteran, or disability discounts

- ✅ Compare this year’s total to last year’s—flag unexplained increases

- ✅ Research county-specific surcharges and whether they’re mandatory

- ✅ Consider switching to biennial renewal if available

- ✅ Appeal incorrect valuations or duplicate fees via DMV portal

- ✅ Choose standard license plates unless specialty plates offer real value

Frequently Asked Questions

Can I lower my registration fee if my car is old or rarely driven?

Some states offer low-mileage or “limited use” classifications for vehicles driven under a certain threshold (e.g., 5,000 miles/year). These can reduce fees significantly. Contact your DMV to see if such programs exist in your state.

Why did my registration cost go up even though my car is older?

While vehicle value typically decreases over time, registration fees can rise due to new local surcharges, inflation adjustments, or increased administrative costs. States may also impose one-time fees for system upgrades or environmental programs.

Do electric vehicles really pay more to register?

Yes, many states now charge additional annual fees on EVs and hybrids to offset the loss of gasoline tax revenue. For example, Washington charges EV owners $200 extra per year, and Virginia adds $64 for hybrids and $120 for EVs. These are in addition to standard registration costs.

Final Thoughts: Take Control of Your Registration Costs

Car registration doesn’t have to be a blind expense. With a clear understanding of how fees are structured and which levers you can pull, you gain control over a recurring cost that many accept without question. Whether it’s appealing an inflated valuation, claiming an overlooked exemption, or simply timing your renewal right, small actions compound into real savings. Don’t treat your DMV notice as a bill—treat it as a statement open to review.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?