If you filed a federal income tax return in 2023, there may come a time when you need a copy of your Form 1040—whether for loan applications, financial aid, mortgage verification, or personal recordkeeping. Fortunately, the IRS provides several secure and straightforward methods to retrieve your official tax transcript or actual return. Unlike requesting a simple tax account transcript, obtaining a full copy of your submitted Form 1040 requires specific steps and verification. This guide walks you through each method with clarity, so you can quickly and confidently access your 2023 tax return.

Understanding Your Tax Return vs. Tax Transcript

Before diving into retrieval methods, it's important to distinguish between a tax transcript and a full tax return. A tax transcript is a summary document showing key line items from your return, such as adjusted gross income (AGI), taxable income, and payments made. It does not include schedules or attachments. In contrast, a tax return—specifically a \"Return Transcript\" or \"Account Transcript\"—can show more detail, but only the IRS Record of Account or a Photocopy of Your Original Return gives you the complete Form 1040 exactly as filed.

The IRS offers three types of transcripts:

- Tax Return Transcript: Shows most line items from your original Form 1040, including attached forms and schedules (e.g., Schedule A, B, C). Available for the current year and up to six prior years.

- Tax Account Transcript: Displays basic taxpayer data and any changes made after filing, such as audits or adjustments.

- Wage and Income Transcript: Includes information from Forms W-2, 1099, and other income statements reported to the IRS.

For most purposes requiring proof of income or complete tax documentation, the Tax Return Transcript is sufficient. However, if you need the exact image of your signed return—such as for identity verification or legal proceedings—you must request a photocopy of the original.

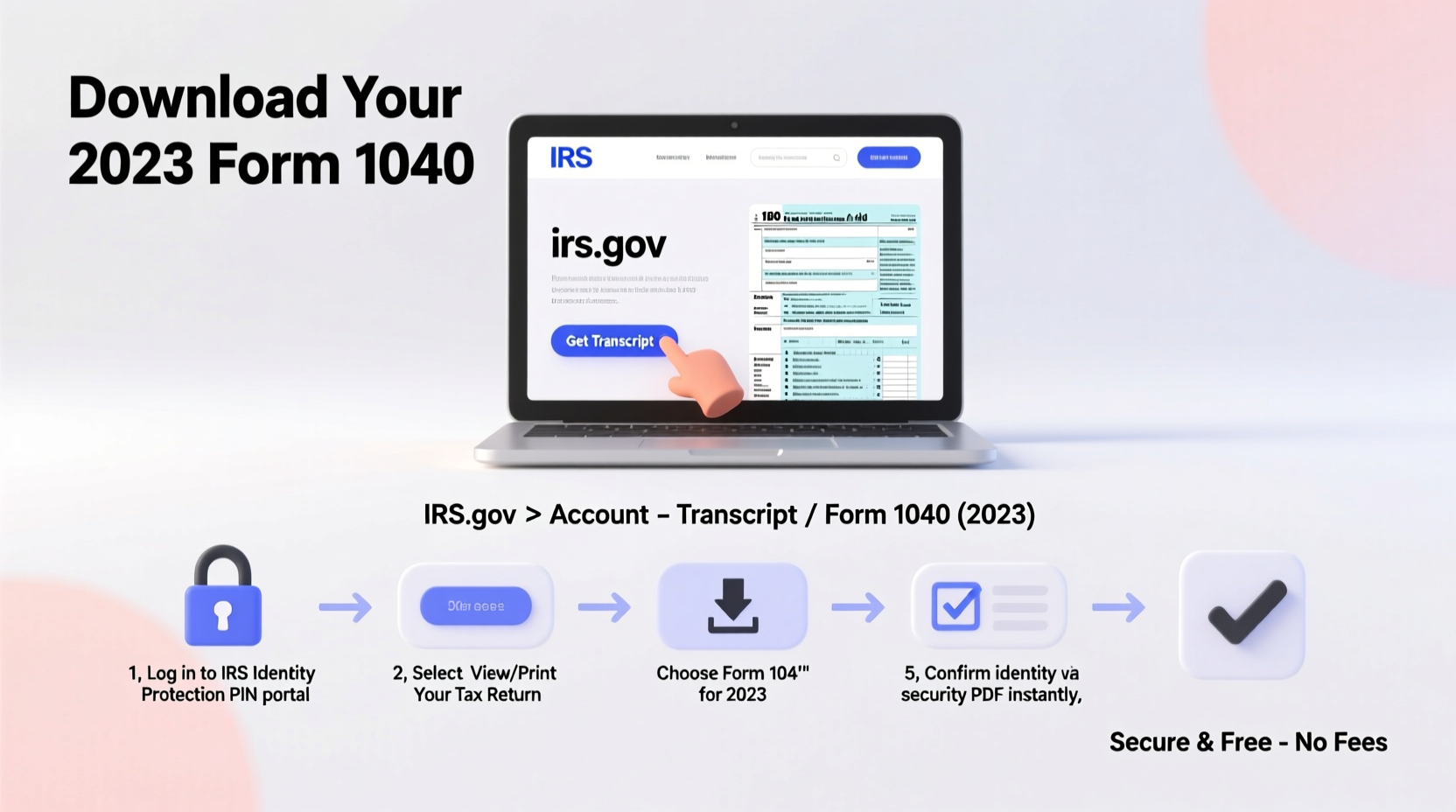

Step-by-Step: How to Download Your 2023 Form 1040 Online

The fastest and most convenient way to access your 2023 tax return is through the IRS’s online portal, IRS.gov/Individuals/Get-Transcript. Here’s how to use it effectively:

- Visit the IRS Get Transcript Portal: Navigate to IRS Get Transcript.

- Create or Log In to Your IRS Account: You’ll need an IRS Individual Online Account. If you don’t have one, registration takes about 10 minutes and requires identity verification via Social Security number, mailing address, and phone number.

- Verify Your Identity: The system uses multi-factor authentication, often sending a security code to your registered mobile device.

- Select “Tax Return Transcript”: Once logged in, choose this option and select the tax year 2023.

- Download or Save: The transcript will appear on-screen. You can view, print, or download it as a PDF file.

This process typically takes less than 15 minutes and provides immediate access to your return details. Note that while this is labeled a “transcript,” it includes all major entries from your Form 1040 and attached schedules.

Requesting a Photocopy of Your Original 2023 Return by Mail

If you need a true copy of the Form 1040 you originally filed—including signatures and any supporting documents—you must submit Form 4506, Request for Copy of Tax Return. This service costs $50 per return and takes approximately 20 business days to process.

To file Form 4506:

- Download the form from IRS.gov/Form4506.

- Complete all required fields, including your name, SSN, filing status, and tax year.

- Sign the form in ink—digital or electronic signatures are not accepted.

- Attach a check or money order for $50 payable to “United States Treasury.”

- Mail the package to the address listed on the form instructions based on your state of residence.

Once processed, the IRS will mail you a black-and-white photocopy of your entire 2023 return, including all forms and attachments.

“We recommend using Form 4506 only when absolutely necessary, such as for lender requirements or legal cases. For most verifications, a free Return Transcript suffices.” — Internal Revenue Service, Customer Service Operations

Alternative Methods: Phone and Paper Requests

Not comfortable using the internet? The IRS also supports offline retrieval options.

By Phone

You can call the IRS at 800-908-9946 to request a transcript. Automated services allow you to verify identity using your Social Security number, date of birth, and street number from your tax return. After verification, you can request that a transcript be mailed to your address on file within 5–10 business days.

By Paper (Form 4506-T)

If you prefer not to pay for a photocopy but still want a transcript, use Form 4506-T, Request for Transcript of Tax Return. This form is free and allows you to receive a paper transcript by mail within 5 to 10 weeks. It cannot be used to get a full image of your original return, but it does provide detailed line-item data.

Mail completed Form 4506-T to:

Internal Revenue Service

P.O. Box 12229

Charlotte, NC 28220-2229

Checklist: Retrieving Your 2023 IRS Form 1040

Use this checklist to ensure you’ve covered all bases when accessing your return:

- ✅ Determine whether you need a transcript or a full photocopy of your return.

- ✅ Gather your Social Security number, filing status, and AGI from last year.

- ✅ Create an IRS online account if you haven’t already.

- ✅ Use Get Transcript for instant digital access (recommended).

- ✅ Consider Form 4506 only if you require a signed, physical copy.

- ✅ Store your downloaded files securely—avoid unencrypted devices or public cloud storage.

- ✅ Contact the IRS directly if you encounter errors or delays beyond 10 business days.

Real Example: Maria Retrieves Her Return for a Home Loan

Maria, a teacher in Ohio, applied for a mortgage refinance in early 2024. Her lender requested copies of her 2022 and 2023 tax returns. Having misplaced her personal records, she turned to the IRS website. Using her existing IRS online account, she accessed the Get Transcript tool, selected “Tax Return Transcript” for 2023, and downloaded the PDF within minutes. She uploaded it directly to her lender’s portal and received approval within a week. By avoiding the $50 fee for a photocopy, she saved time and money—all because she knew the transcript was acceptable for mortgage verification.

Frequently Asked Questions

Can I get my 2023 Form 1040 if I e-filed?

Yes. Whether you e-filed or mailed your return, the IRS maintains a digital record. E-filers can usually access transcripts faster since processing begins immediately after submission.

How long does it take to receive a transcript by mail?

Paper transcripts requested via Form 4506-T typically arrive within 5 to 10 weeks. Online requests provide same-day access.

Is a tax transcript acceptable for college financial aid?

Yes. The U.S. Department of Education accepts IRS Tax Return Transcripts for FAFSA verification. Many schools even recommend using the IRS Data Retrieval Tool during FAFSA filing to auto-fill information.

Conclusion: Take Control of Your Tax Records Today

Accessing your 2023 IRS Form 1040 doesn’t have to be complicated or costly. With the right tools and knowledge, you can retrieve your tax return efficiently—often in under an hour. Whether you're applying for a loan, verifying income, or simply organizing your finances, the IRS provides reliable, secure pathways to obtain your records. Start by creating or logging into your IRS online account, and leverage the free Get Transcript service whenever possible. Keep your downloaded files safe and backed up, and remember that help is available if issues arise.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?