Finding your bank account number doesn’t have to be a frustrating experience. Whether you're setting up direct deposit, linking an external account, or filling out payment forms, knowing where to look can save time and reduce stress. While the process varies slightly between banks and account types, there are consistent, secure ways to retrieve this essential piece of financial information. This guide walks you through reliable methods, highlights security best practices, and helps you avoid common mistakes.

Understanding Your Bank Account Number

Your bank account number is a unique identifier assigned to your specific account at a financial institution. Unlike your routing number—which identifies the bank itself—your account number ensures funds go to the correct person and account. It typically ranges from 8 to 12 digits, though some institutions use longer sequences.

It's important not to confuse it with other numbers such as:

- Routing number: Identifies your bank (used for domestic transfers).

- Credit/debit card number: Tied to a payment card, not your full account.

- IBAN/SWIFT code: Used internationally; not standard in the U.S.

Keeping your account number secure is crucial. Never share it publicly or via unsecured channels like text messages or social media.

Step-by-Step Guide to Finding Your Account Number

- Check a Paper Check

If you have checks, your account number is located at the bottom. A standard check displays three sets of numbers:- First set (9 digits): Routing number

- Second set (account length varies): Your account number

- Third set: Check number

123456789 0987654321 1001

Here, \"0987654321\" is the account number. - Log In to Online Banking

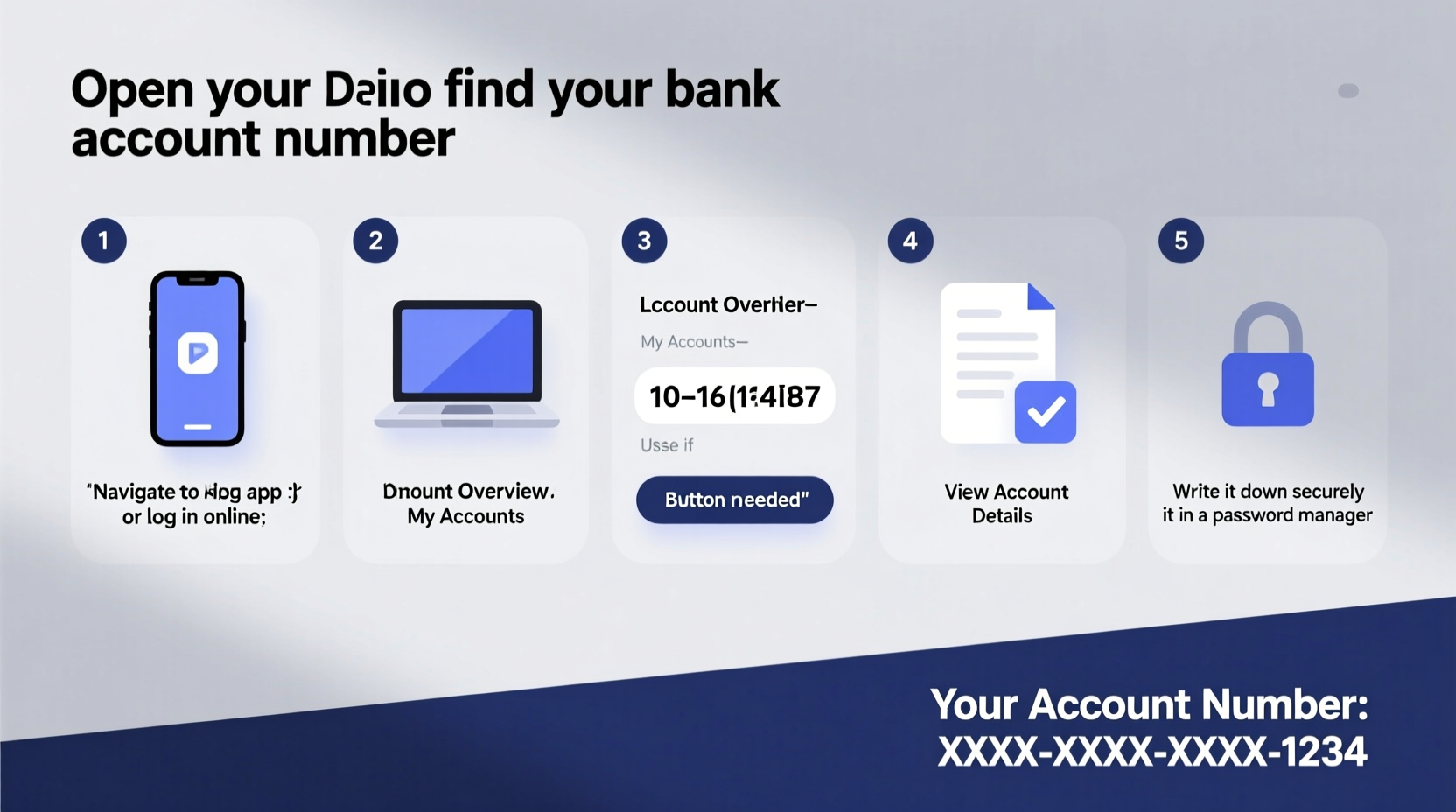

Most major banks display your account number in the account summary section. Steps:- Go to your bank’s official website or app.

- Log in using your credentials.

- Navigate to “Accounts” or “Account Summary.”

- Select the relevant account.

- Look for “Account Details” — your number may be partially masked for security.

- Click “Show Full Number” (if available) after verifying identity.

- Review Bank Statements

Both paper and digital statements often include the last few digits of your account number for reference. Some banks list the full number in the header or footer under “Account Information.” If only partial digits appear, contact customer service for confirmation. - Call Customer Service

If online access isn’t possible, call the number on the back of your debit card or your bank’s official site. After authenticating your identity—usually through security questions or two-factor verification—an agent can provide your account number over the phone. - Visit a Local Branch

Bring valid government-issued ID and any account-related documents. A teller can assist in retrieving your account number securely. This method is especially helpful if you’ve lost access to digital platforms.

Do’s and Don’ts When Handling Your Account Number

| Do’s | Don’ts |

|---|---|

| Store your account number in a password-protected digital vault or locked physical file. | Never write it on sticky notes or store it in unencrypted files. |

| Use multi-factor authentication when accessing online banking. | Avoid sharing your login details or account number via email or messaging apps. |

| Verify recipient details before initiating automatic payments. | Don’t give your account number to unknown parties claiming to offer refunds or services. |

| Monitor your account regularly for unauthorized activity. | Don’t reuse passwords across financial accounts. |

Real-Life Scenario: Recovering Access After Moving Abroad

Sophie, a freelance designer based in Barcelona, needed to update her U.S. bank account details for a client’s wire transfer. She no longer had checks and couldn’t log into her mobile app due to region restrictions. After verifying her identity through a video call with her bank’s international support team, she received a secure message with her full account number. The bank also guided her through enabling global access to her account moving forward.

This case illustrates the importance of having multiple access points and knowing how to authenticate identity remotely. Banks increasingly offer tools for customers abroad, but proactive setup—like enabling travel alerts and updating contact info—is key.

“Your account number is sensitive data. Treat it like a Social Security number—necessary for transactions, but dangerous in the wrong hands.” — James Reed, Senior Fraud Analyst at National Financial Security Group

Quick Checklist: How to Safely Retrieve Your Account Number

- Locate a recent check and identify the middle number sequence.

- Log in to your online banking portal and navigate to account settings.

- Download a PDF statement and search for “Account Number.”

- Contact customer service using verified phone numbers only.

- Confirm identity securely—never disclose PINs or passwords.

- Record the number in a secure location once retrieved.

Frequently Asked Questions

Can I find my account number without a check or online access?

Yes. You can retrieve it by calling your bank’s customer service line or visiting a local branch in person with proper identification. Some banks also allow secure retrieval through their mobile app using biometric authentication.

Is it safe to show my account number on a photo of a check?

No. Sharing images of checks—even digitally—exposes both your account and routing numbers, increasing fraud risk. If someone needs proof of account ownership, use an official letter from the bank instead.

Why does my bank only show the last four digits online?

This is a security measure to protect your information. Full account numbers are hidden until you complete additional verification steps, such as answering security questions or receiving a one-time code via text or email.

Protecting Your Financial Identity

Accessing your account number is just one part of responsible financial management. Equally important is protecting it. Cybercriminals often target account numbers for fraudulent transfers or identity theft. Enable transaction alerts, freeze your account temporarily if suspicious activity occurs, and consider using virtual account numbers for online subscriptions.

Banks like Chase, Bank of America, and Wells Fargo now offer dashboard features that let users generate temporary account details for specific payees—limiting exposure. Take advantage of these tools when available.

Final Thoughts and Next Steps

Knowing how to find your bank account number efficiently—and securely—empowers you to manage finances confidently. Whether you're setting up payroll, applying for loans, or transferring money between accounts, having quick access to accurate information streamlines the process.

The methods outlined here—checks, online banking, statements, customer service, and branch visits—are all proven and widely accepted. Combine them with strong digital hygiene and awareness of scams to maintain control over your financial data.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?