Sending money through Venmo has become second nature for millions of users who rely on the app for splitting bills, paying rent, or reimbursing friends. But what happens when a payment was sent in error, duplicated, or no longer needed? Whether you're correcting a typo in the amount or refunding a friend after returning borrowed cash, knowing how to reverse a transaction quickly is essential.

While Venmo doesn’t offer a one-click “undo” button, sending money back—essentially issuing a refund—is straightforward once you understand the process. Unlike traditional banks with lengthy reversal procedures, Venmo allows users to manually return funds with just a few taps. This guide walks you through everything you need to know about safely and efficiently sending money back on Venmo.

Understanding Venmo’s Refund Mechanism

Venmo treats every transaction as a peer-to-peer payment. If you’ve sent money to someone by mistake or need to reverse a charge, the platform doesn't automatically cancel the original transfer. Instead, the recipient must either return the funds voluntarily or you initiate a new payment *to yourself* from their account—but only if they approve it first.

In practice, this means that to “refund” a payment, you (or the recipient) simply send an equal amount back via a new transaction. It's not a formal refund system like those found in e-commerce platforms, but rather a manual reversal using standard sending features.

“Venmo is built for social transactions between trusted contacts. That’s why refunds require cooperation—there’s no forced reversal unless fraud is involved.” — Jordan Lee, Fintech Analyst at PayTrends

This cooperative model works well among friends and family but requires clear communication when handling mistaken or disputed payments.

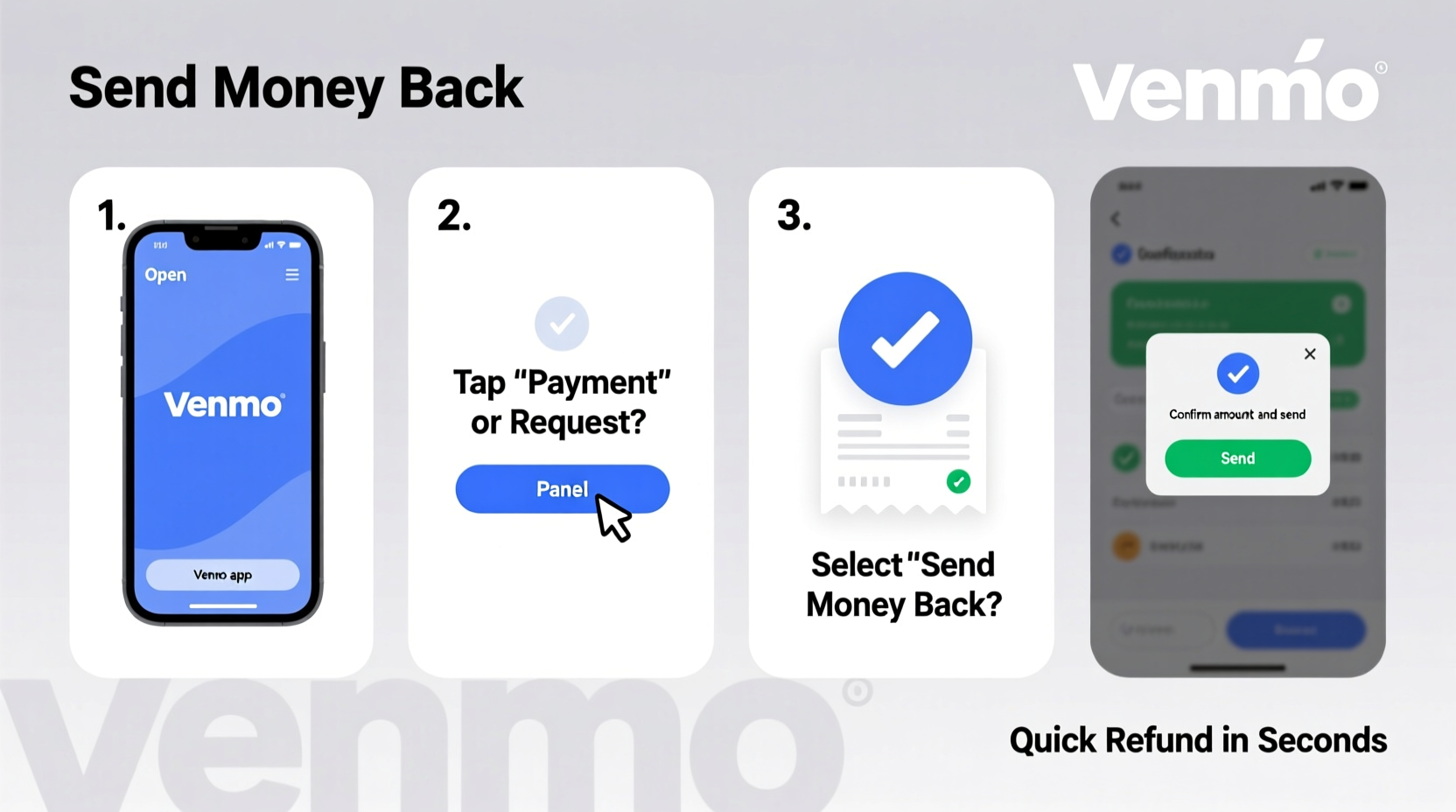

Step-by-Step Guide to Sending Money Back on Venmo

If you’re the sender who made an error, or the recipient asked to return funds, follow these steps to complete the refund:

- Open the Venmo app and log into your account.

- Navigate to the Home tab, where your recent transactions appear.

- Find the payment you want to refund. Tap on it to view details.

- Note the person’s username and the exact amount sent.

- Tap the Pay/Request button at the bottom center of the screen.

- Since you're refunding, ensure the toggle says Pay, not Request.

- Type the person’s name or username in the search field and select their profile.

- Enter the same amount you wish to return (e.g., $15.00).

- Add a note such as “Refund for dinner” or “Oops – wrong amount” to clarify intent.

- Select your preferred funding source (bank, balance, or card).

- Tap Pay to send the money back.

The recipient will receive a notification, and the funds will be added to their Venmo balance immediately. From there, they can transfer it to their bank or use it for future purchases.

When You Can’t Get a Refund Immediately

Not all situations allow for instant cooperation. If the recipient hasn’t accepted your refund request or refuses to return funds, here are your options:

- Send a message: Use Venmo’s chat feature to politely explain the situation and ask them to return the money.

- Request the amount: Instead of waiting, create a \"Request\" for the same sum. While not guaranteed, many users will approve it promptly.

- Contact Venmo Support: If you suspect fraud or unauthorized charges, report the transaction within 24 hours for potential dispute resolution.

Remember, Venmo generally does not intervene in user-to-user disputes unless illegal activity is suspected. Transactions between friends are considered final unless reversed mutually.

Do’s and Don’ts When Refunding on Venmo

| Do’s | Don’ts |

|---|---|

| Confirm the correct recipient before sending | Assume the other person will automatically refund you |

| Add a clear note explaining the refund | Use vague messages like “this” or “that thing” |

| Keep a record of both transactions (original and refund) | Delete transaction history before confirming completion |

| Use Venmo’s built-in messaging to coordinate | Threaten or pressure someone into returning money |

| Check your funding source availability | Try to cancel a completed payment instead of sending a refund |

Real Example: Correcting a Double Payment

Alex was splitting rent with his roommate Jamie and meant to send $750 via Venmo. Distracted, he hit “Pay” twice—sending two identical transfers within minutes. Realizing the mistake, Alex opened the app and checked his transaction feed. He saw both payments clearly listed.

He tapped the Pay button, searched for Jamie, entered $750, and wrote: “Accidental duplicate payment – refunding one.” He used his linked bank account as the funding source and completed the transaction. Jamie received the message, verified the reason, and accepted the refund without issue. Within seconds, the correction was done.

This scenario highlights how fast and effective manual refunds can be when both parties communicate clearly and act responsibly.

Frequently Asked Questions

Can I cancel a Venmo payment instead of sending a refund?

You can only cancel a payment if the recipient hasn’t accepted it yet. Once accepted, the money is in their account, and the only way to get it back is to have them return it manually or issue a refund yourself if you were the recipient.

How long does a refund take on Venmo?

A refund sent via Venmo appears instantly in the recipient’s balance. Standard transfers to a bank account still take 1–3 business days unless using Instant Transfer (which incurs a small fee).

Is there a fee to send a refund on Venmo?

No. Personal refunds using your Venmo balance, bank account, or debit card are free. However, if you fund the refund with a credit card, Venmo charges a 3% transaction fee.

Pro Tips for Avoiding Future Mistakes

- Enable transaction notifications: Get alerts for every payment so you catch duplicates immediately.

- Review notes and amounts carefully: Take two seconds to verify before tapping “Pay.”

- Use recurring payments for shared expenses: Set up automatic splits for rent or utilities to reduce errors.

- Label frequent contacts clearly: Customize nicknames (e.g., “Jamie – Roommate”) to avoid confusion.

Final Thoughts: Make Refunds Part of Your Financial Habit

Mistakes happen—even with digital payments. The key isn’t avoiding errors entirely but knowing how to fix them quickly and courteously. Sending money back on Venmo is designed to be simple because it relies on trust and transparency between users.

By following the steps outlined here, you maintain good relationships, keep your finances accurate, and contribute to a smoother experience for everyone using the platform. Whether you're refunding $5 or $500, doing it right reflects financial responsibility and respect.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?