For freelancers, small business owners, and independent contractors, the IRS allows a valuable tax break: the mileage deduction. If you use your personal vehicle for business purposes, every mile driven can translate into real savings at tax time. Yet many taxpayers leave money on the table due to poor recordkeeping, misunderstanding of rules, or failure to track all eligible trips. Understanding how to properly document, categorize, and claim your business mileage is essential—not just for maximizing deductions, but for staying compliant in case of an audit.

The standard mileage rate for 2024 is 67 cents per mile, up from 65.5 cents in 2023. While this may seem modest per mile, consistent tracking over thousands of miles adds up fast. A driver logging 10,000 business miles in a year could deduct $6,700—no receipts required beyond a log. But only if the records are accurate and complete.

Understanding Eligible Business Mileage

Not every mile you drive qualifies for a deduction. The IRS distinguishes between personal commuting and legitimate business use. Knowing which trips count—and which don’t—is the first step toward maximizing your claim.

Eligible business mileage includes:

- Driving from your office to meet clients or customers

- Travel between job sites or multiple business locations in a single day

- Trips to pick up supplies, deliver goods, or attend off-site meetings

- Travel related to rental property management (for landlords)

- Charitable, medical, or moving mileage under specific conditions (different rates apply)

Non-deductible mileage includes:

- Your regular commute from home to a permanent workplace

- Personal errands during business trips unless directly related to work

- Driving children to school while running business errands

“Many self-employed individuals assume they can’t claim any home-to-client travel, but once you’ve started your workday, those trips are fully deductible.” — Laura Simmons, CPA and Small Business Tax Advisor

Choosing Between Standard Mileage and Actual Expenses

You have two methods to deduct vehicle costs: the standard mileage rate or actual expenses. You cannot use both in the same year, so choosing wisely matters.

| Factor | Standard Mileage Rate | Actual Expenses |

|---|---|---|

| What It Covers | Average operating cost per mile (gas, maintenance, depreciation) | All verifiable costs: gas, repairs, insurance, registration, depreciation, lease payments |

| Recordkeeping | Simple: only mileage logs required | Detailed: receipts and expense categorization needed |

| Best For | Low-mileage drivers, simplicity seekers, leased vehicles | High-mileage drivers, newer cars with high depreciation, financed vehicles |

| Flexibility | Must choose by first year the car is used for business | Switching back requires special calculation |

If you’re unsure which method benefits you more, run a quick estimate: multiply your annual business miles by the current rate. Then tally your annual vehicle expenses and multiply by the percentage of business use. Whichever yields a higher deduction is likely the better option.

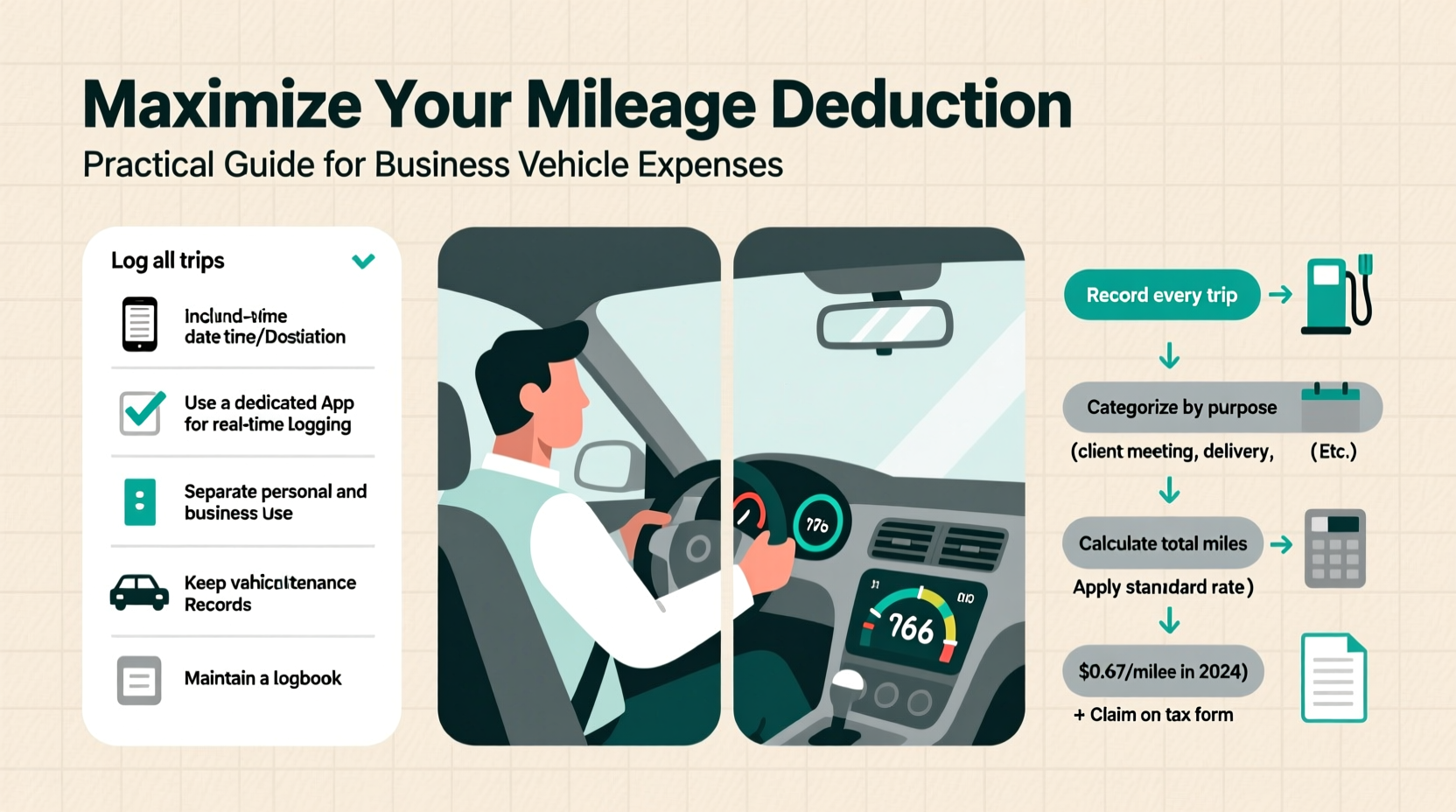

Step-by-Step Guide to Tracking and Claiming Mileage

Accurate documentation is non-negotiable. The IRS requires proof of date, destination, purpose, and miles driven. Here’s how to build a bulletproof system:

- Start a mileage log immediately. Use a notebook, spreadsheet, or dedicated app like MileIQ, Hurdlr, or Everlance. Digital tools automatically track trips and classify them using GPS.

- Record every business trip. At minimum, log the date, starting and ending odometer readings (or total miles), destination, and business purpose (e.g., “client consultation at ABC Corp”).

- Separate personal and business use. Don’t rely on memory—classify each trip as it happens.

- Reconcile monthly. Review entries for consistency. Flag any missing data before it becomes unverifiable.

- Store logs securely. Keep digital backups and printed copies for at least three years after filing.

- Calculate annual total. Sum all business miles and multiply by the applicable IRS rate for that year.

- Report on Form 2106 or Schedule C. Sole proprietors report on Schedule C; employees with unreimbursed expenses may use Form 2106 (if allowed under current tax law).

Common Mistakes That Reduce Your Deduction

Even honest taxpayers lose deductions through avoidable errors. Watch out for these pitfalls:

- Waiting until tax season to track miles: Memories fade, receipts disappear. Retroactive logging is risky and often incomplete.

- Mixing personal and business odometer readings: Without clear separation, auditors may disallow the entire claim.

- Overestimating round-trip distances: Using maps or apps to verify distances strengthens credibility.

- Failing to update for partial-year vehicle use: If you bought or sold a car mid-year, prorate accordingly.

- Ignoring state-specific rules: Some states don’t conform to federal mileage deductions—check local guidelines.

Real-World Example: Maximizing Deductions for a Freelance Consultant

Sarah runs a marketing consulting business from her home office. In 2024, she drives to client sites, networking events, and supply stores. Initially, she estimated her mileage at 7,000 miles based on memory. After implementing a mobile tracking app, she discovered she’d actually driven 11,200 business miles.

Her initial estimate would have yielded a $7,595 deduction (7,000 × $0.67). With accurate tracking, she claimed $7,504—wait, that seems lower? Actually, no: 11,200 × $0.67 = $7,504. But here's the catch—she also reviewed actual expenses. Her car payment, insurance, gas, and maintenance totaled $9,800 annually, with 68% business use (11,200 / 16,500 total miles). That came to $6,664—less than the standard rate.

She stuck with standard mileage and realized the true value wasn’t just in dollars, but in simplicity. No need to save hundreds of gas receipts or calculate depreciation. Still, she now reviews both methods yearly to ensure she’s optimizing.

Mileage Deduction Checklist

Use this checklist to ensure you're capturing every eligible mile and protecting your claim:

- ☑ Designate a tracking method (app, spreadsheet, or logbook)

- ☑ Record every business trip within 24 hours

- ☑ Note date, start/end location, purpose, and miles

- ☑ Separate business and personal use clearly

- ☑ Reconcile logs monthly

- ☑ Choose between standard mileage and actual expenses before year-end

- ☑ Save logs for at least three years

- ☑ Consult a tax professional if switching methods or driving company-owned vehicles

Frequently Asked Questions

Can I deduct mileage if I’m reimbursed by my employer?

No. If your employer fully reimburses your mileage under an accountable plan, you cannot claim the same expense again. However, unreimbursed employee business expenses are generally not deductible under current tax law (through 2025) due to the TCJA suspension of miscellaneous itemized deductions.

What if I use more than one vehicle for business?

You can claim mileage for multiple vehicles, but you must maintain separate logs for each. Apply the appropriate rate per year driven. You can use different methods (standard vs. actual) for different vehicles, provided the first-year election rule is followed for each.

Do I need to track every single mile, even short trips?

Yes. Short trips add up. A 2-mile drive to sign a contract counts if it’s for business. The IRS doesn’t set a minimum distance. Consistent logging—even for brief outings—supports the legitimacy of your overall claim.

Final Steps to Maximize Your Claim

Maximizing your mileage deduction isn’t about gaming the system—it’s about diligence, accuracy, and understanding the rules. Start today by setting up a reliable tracking system. Whether digital or manual, consistency is key. Review your method annually, especially if you buy a new vehicle or significantly change your driving patterns.

Remember: the IRS doesn’t expect perfection, but it does require reasonable effort and documentation. A well-kept log isn’t just a tax tool—it’s protection. And in the world of small business finance, every deductible mile is a step toward greater profitability.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?