Paying bills, sending rent, or making secure payments often requires more than just a personal check. Money orders offer a trusted alternative—safer than cash and accepted where personal checks aren’t. While traditionally purchased in person at post offices, banks, or retail stores, many now wonder: can you get a money order online? The answer is yes—but with important caveats. This guide walks you through the legitimate ways to obtain a money order online, how to do it safely, and which services actually deliver real, usable instruments.

Understanding Online Money Orders: What’s Possible?

A true money order is a prepaid payment instrument issued by a financial institution or authorized provider. Unlike digital transfers (e.g., Zelle or Venmo), a money order is a physical document that includes key details like the payee name, amount, date, and issuer. Historically, these could only be bought in person. However, some financial institutions and fintech platforms now offer digital equivalents or facilitate the purchase of physical money orders via online ordering.

It's critical to distinguish between:

- True online money orders: Digitally initiated but result in a printed, mail-delivered paper instrument.

- Digital payment alternatives: Services like PayPal or Western Union “send money” features that mimic money orders but are not technically the same.

- Fraudulent services: Websites claiming to email PDF money orders—these are not valid and often used in scams.

“While no major U.S. bank currently allows you to download a printable money order, several reputable services let you buy one online and have it mailed directly to you or your recipient.” — Financial Security Institute Report, 2023

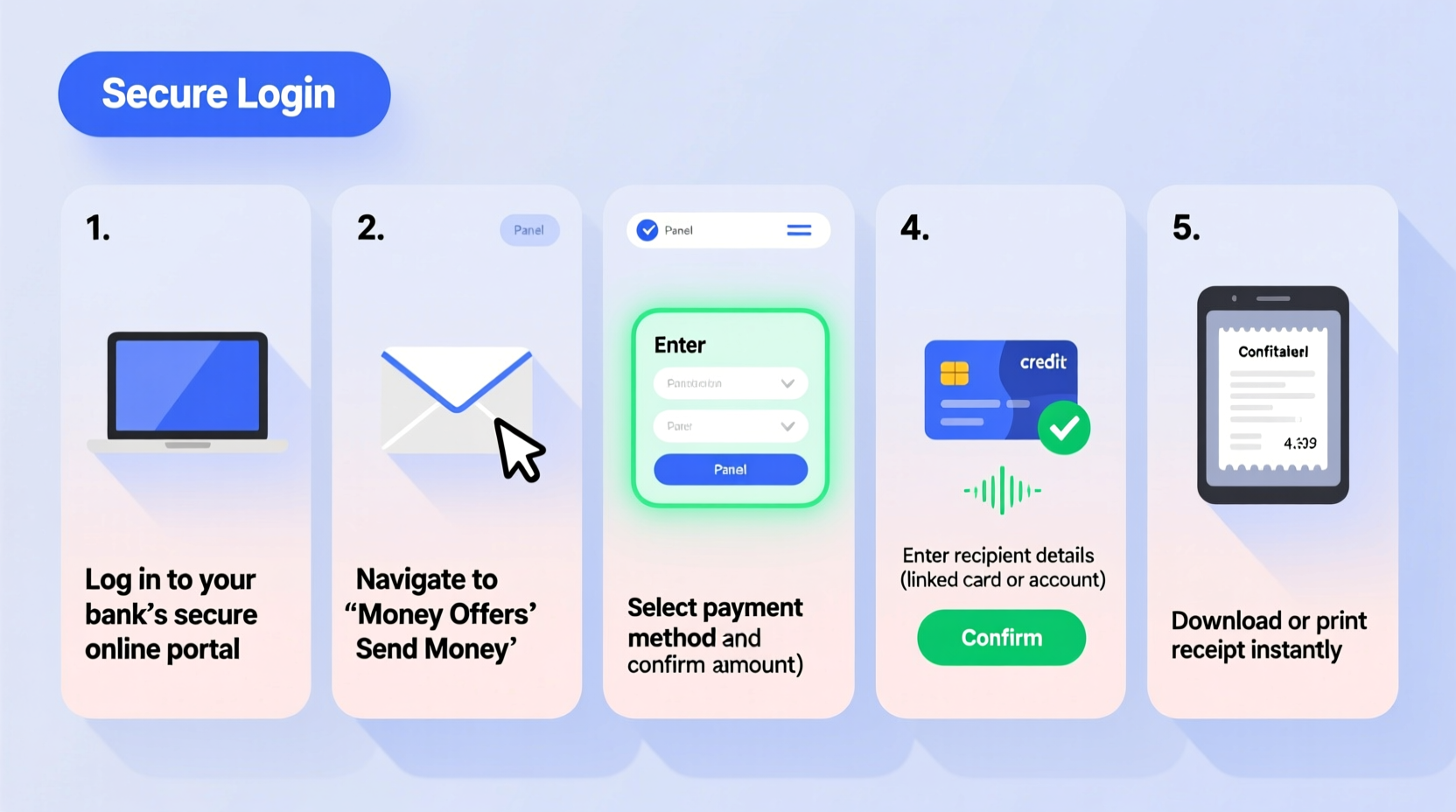

Step-by-Step Guide to Getting a Money Order Online

Obtaining a legitimate money order online involves careful selection of service providers, verification steps, and awareness of delivery timelines. Follow this sequence for a secure and successful transaction:

- Verify if You Need a True Money Order

Ask the recipient whether they accept alternatives like cashier’s checks, certified checks, or digital payments. Some landlords, government agencies, or utility companies specifically require a paper money order. - Choose a Reputable Online Service

Only use established financial platforms that partner with recognized issuers. Top options include:- MoneyGram: Offers “Send a Money Order” online—purchase online, delivered by USPS.

- Western Union: Allows electronic money transfer with money order-style delivery in select cases.

- 7-Eleven (via Western Union): Buy online, pick up in-store after payment confirmation.

- Credit unions with online bill pay: Some issue cashier’s checks (functionally similar) by mail upon request.

- Create an Account and Verify Identity

Most platforms require identity verification (SSN, ID upload, address confirmation). This complies with anti-fraud regulations and ensures legitimacy. - Enter Recipient and Payment Details

Provide:- Recipient’s full legal name

- Accurate mailing address

- Exact amount (fees typically apply: $1–$5)

- Your funding source (bank account, debit card)

- Review and Confirm Purchase

Double-check all details. Once issued, money orders cannot be altered. Keep the tracking number and receipt. - Receive or Track Delivery

Physical money orders are usually mailed within 1–2 business days via USPS. Delivery takes 3–7 days. You’ll receive tracking info to monitor progress.

Comparison: In-Person vs. Online Money Orders

| Feature | In-Person Purchase | Online Purchase |

|---|---|---|

| Availability | Immediate (post office, Walmart, etc.) | Delayed (mail delivery in 3–7 days) |

| Cost | $1–$2 (typically) | $1–$5 + possible shipping fees |

| Convenience | Requires travel | Accessible from home |

| Security | You control handoff | Relies on secure mailing; trackable |

| Issuer Trust | USPS, Western Union, banks | Same providers, but third-party platforms may vary |

| Fraud Risk | Low (if bought in person) | Moderate (verify platform legitimacy) |

Common Pitfalls and How to Avoid Them

The rise of fake “online money order generators” has led to increased fraud. Scammers create counterfeit PDFs that look official but hold no value. Others pose as legitimate services to steal banking information.

To protect yourself:

- Avoid any site offering instant downloadable money orders. No legitimate provider offers this.

- Never use credit cards for money order purchases. Many services block this due to chargeback risks, and interest charges may apply.

- Check website security: Look for HTTPS, contact information, and customer reviews before entering data.

- Confirm the recipient accepts mailed instruments. If they require in-person delivery, online isn’t suitable.

“Over 60% of money order fraud reported to the FTC in 2022 involved fake online ‘issuers’ who sent non-negotiable documents.” — Federal Trade Commission, Consumer Sentinel Network

Real Example: Sending Rent Securely Across State Lines

Sophia lives in California but rents a storage unit in Texas. The facility requires monthly payment via money order—no digital options. Previously, she drove to the post office every month, costing time and gas.

She discovered MoneyGram’s online money order service. For a $1.50 fee, she entered her landlord’s name and address, paid from her bank account, and received a tracking number. The money order was printed and mailed by MoneyGram via USPS, arriving in 4 days. Sophia now schedules these purchases on the first of each month, saving time and ensuring on-time payment without leaving home.

This solution worked because:

- The recipient accepted mailed money orders.

- She used a verified provider (MoneyGram).

- She kept the receipt and tracking details for proof of payment.

Best Practices Checklist

- Confirmed recipient accepts mailed money orders

- Selected a trusted provider (MoneyGram, Western Union, credit union)

- Verified website URL and security (HTTPS, contact info)

- Used a debit card or linked bank account (not credit)

- Entered accurate payee name and address

- Retained transaction ID and tracking number

- Set up payment reminder for recurring needs

Frequently Asked Questions

Can I print a money order at home?

No. Legitimate money orders cannot be printed at home. Any service offering a downloadable PDF is fraudulent. Real money orders are issued and printed by authorized institutions only.

How long does an online money order take to arrive?

Processing takes 1–2 business days. Delivery via USPS typically takes 3–7 days depending on location. Expedited options are rare but may be available through certain providers.

What if my money order gets lost in the mail?

Contact the issuer immediately with your transaction number. Most services allow you to request a replacement or refund after a waiting period (usually 30 days). Keep your receipt—it’s essential for claims.

Final Thoughts and Next Steps

Obtaining a money order online is both possible and practical—if done correctly. The key lies in using only reputable, well-established services that issue real, negotiable instruments. While it doesn’t offer the instant gratification of walking out of a post office with a slip in hand, the convenience of ordering from home, especially for recurring payments, makes it a valuable tool.

As digital finance evolves, expect more integration between traditional payment methods and online access. For now, stay cautious, verify every step, and prioritize security over speed.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?