In an increasingly digital world, writing a check may seem like a fading skill. Yet checks remain essential for rent payments, tax filings, charitable donations, and personal transactions where electronic transfers aren’t accepted. Despite their simplicity, mistakes on a check—such as misspelled names, incorrect amounts, or missing signatures—can delay processing or invalidate the payment entirely. Knowing how to write a check correctly ensures your funds are transferred smoothly and professionally.

The Anatomy of a Check

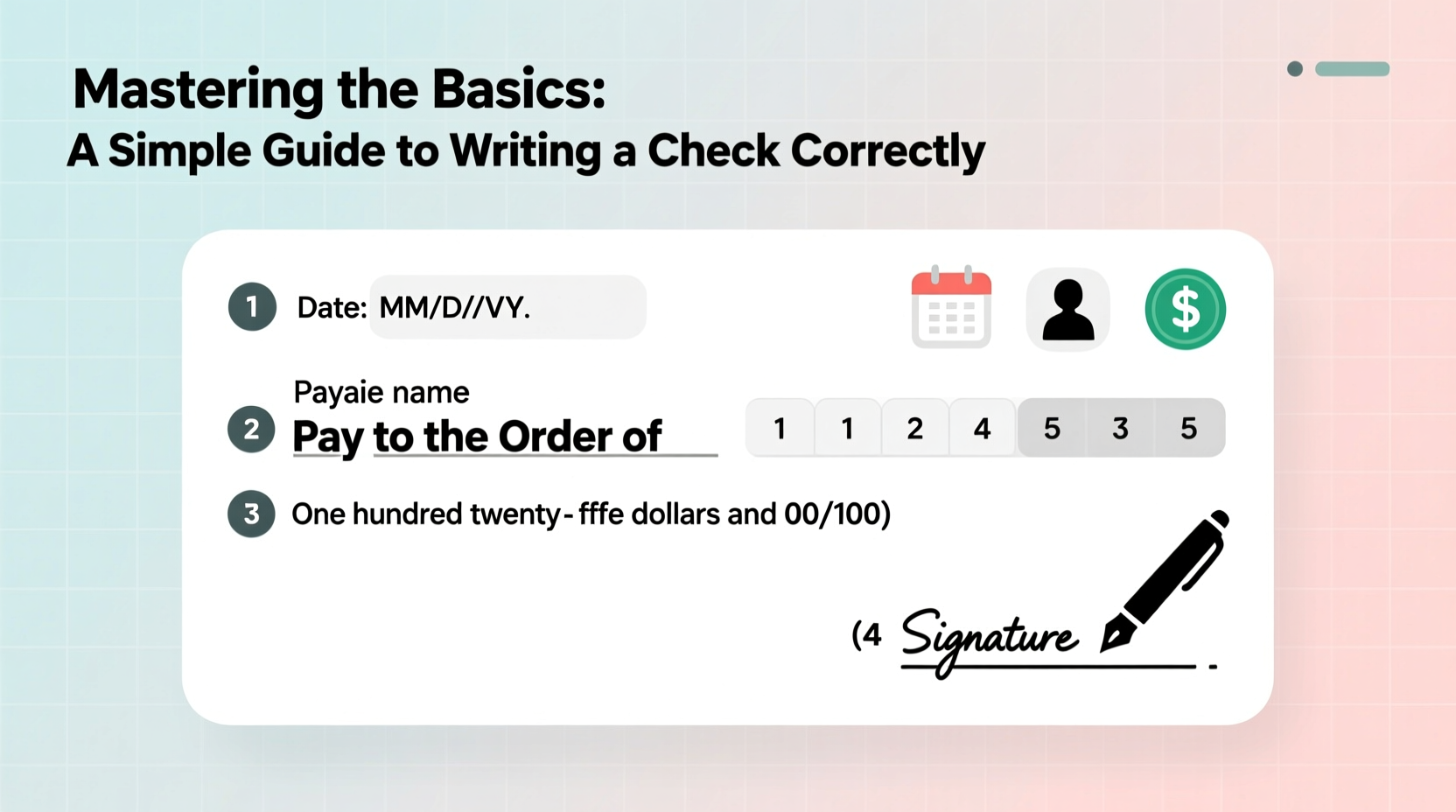

Before filling out a check, it’s important to understand its structure. Every standard personal check contains six key fields:

- Date line – When the check is issued.

- Payee line – Who will receive the money.

- Amount in numbers – The dollar value written numerically.

- Amount in words – The same amount spelled out to prevent fraud.

- Signature line – Your authorized signature to approve the payment.

- Memo line (optional) – Notes about the purpose of the check.

Beneath these are routing and account numbers, which identify your bank and account but are pre-printed and not filled by you.

Step-by-Step Guide to Writing a Check Correctly

Follow this sequence to ensure accuracy and avoid common errors.

- Write the date. On the top right corner, enter the current date. If you're post-dating the check (making it valid at a later time), include that future date instead. Note that banks may still cash post-dated checks unless you’ve formally requested a hold.

- Fill in the payee. On the “Pay to the order of” line, clearly print or write the full name of the individual or organization receiving the check. For businesses, use the exact legal name as it appears on invoices.

- Enter the amount numerically. In the small box to the right, write the amount using numbers (e.g., 125.75). This field helps with automated processing, so precision matters.

- Write the amount in words. On the longer line beneath, spell out the dollar amount in words. For example, “One hundred twenty-five and 75/100.” Include cents as a fraction over 100. This prevents alteration and serves as a verification step.

- Sign the check. On the bottom right line, sign your name exactly as it appears on the account. An unsigned check is invalid.

- Use the memo line (optional). While not required, adding a note—like “June rent” or “Birthday gift”—helps track the purpose and aids the recipient in recordkeeping.

Common Mistakes and How to Avoid Them

Even experienced check writers make errors. Here are the most frequent missteps—and how to prevent them.

| Mistake | Consequence | Solution |

|---|---|---|

| Incorrect spelling of the payee | Bank may refuse to cash it | Verify the correct spelling before writing |

| Leaving blanks after the amount in words | Risk of someone adding extra digits | Draw a line from the end of the words to the end of the line |

| Signing before filling all fields | Potential for fraud if the check is lost | Always fill in all details first, then sign last |

| Using vague or missing memo notes | Recipient may not know what the payment is for | Be specific: “Car repair – Jones Auto” |

| Post-dating without notice | Check might be cashed early | Inform the recipient and consider alternatives like money orders |

“Over 30% of rejected checks are due to mismatched amounts or missing signatures. Taking 30 seconds to review prevents weeks of hassle.” — Lisa Tran, Senior Banking Advisor, National Credit Union Administration

Real-Life Example: A Rental Payment Gone Wrong

Sarah moved into a new apartment and wrote her first rent check to the landlord. She wrote “$950” in the box and “Nine hundred fifty dollars” on the line—but forgot to add “and 00/100.” A few days later, the landlord deposited the check, only for the bank to flag it for ambiguity. Though the amount was clear, the missing fraction delayed processing by three business days, triggering a late fee.

Had Sarah followed the proper format—writing “Nine hundred fifty and 00/100”—the check would have cleared immediately. This minor omission cost her $50. It’s a reminder that even small details matter.

Check-Writing Checklist

Before handing over any check, run through this quick checklist:

- ✅ Date is clearly written

- ✅ Payee name is accurate and complete

- ✅ Amount in numbers matches amount in words

- ✅ Cents are expressed as a fraction (e.g., 45/100)

- ✅ No blank spaces after the written amount

- ✅ Signature is present and legible

- ✅ Memo line includes helpful details (if applicable)

- ✅ Used permanent ink, no corrections

Frequently Asked Questions

Can I write a check to myself?

Yes. Write your name on the payee line and deposit it at a bank or ATM. This is commonly done when transferring money between your own accounts at different banks.

What happens if I write the wrong amount?

If caught before depositing, void the check. If already cashed, you’re responsible for the amount as written. The bank honors the check based on its final form, not your intent.

Do checks expire?

Most banks consider personal checks stale after six months (180 days) and may refuse them. Some institutions accept older checks at their discretion, but it’s best to issue a new one if needed.

Modern Alternatives and When to Use Checks

Digital payments via Zelle, Venmo, or direct deposit are faster and more convenient for many uses. However, checks still serve vital roles:

- Rent payments – Many landlords require paper checks for recordkeeping.

- Tax payments – The IRS accepts checks for federal taxes.

- Gifting – Checks offer flexibility and are widely accepted for weddings, birthdays, or graduations.

- Small businesses – Contractors or freelancers may prefer checks for formal accounting.

While going cashless is growing, checks provide a paper trail, legal validity, and control over payment timing. They’re also useful when internet access or banking apps aren't available.

Conclusion: Confidence Comes from Clarity

Writing a check correctly isn’t complicated—but it does require attention to detail. From aligning numerical and written amounts to signing only after completion, each step protects you and ensures the payment goes smoothly. Whether you're paying rent, sending a gift, or settling a personal debt, a properly completed check reflects responsibility and professionalism.

Financial literacy includes mastering foundational skills, even as technology evolves. By understanding how to write a check accurately, you maintain control over your finances and avoid preventable setbacks.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?