Finding your bank account number doesn’t have to be a stressful or time-consuming task. Whether you're setting up direct deposit, authorizing automatic payments, or transferring funds between accounts, having quick access to your account number is essential. However, convenience should never come at the cost of security. With rising concerns about identity theft and financial fraud, it's crucial to retrieve this sensitive information using safe and verified methods. This guide outlines practical, secure, and efficient approaches to locate your bank account number—without exposing yourself to unnecessary risk.

Why Your Bank Account Number Matters

Your bank account number is a unique identifier assigned by your financial institution to distinguish your account from others. It’s required for many everyday banking functions, including electronic transfers, wire transactions, bill payments, and paycheck deposits. Unlike your routing number—which identifies your bank—your account number is specific to you. While it’s not as sensitive as your Social Security number, it still holds value to scammers who may use it in combination with other personal data to commit fraud.

Because of its importance, you should never share your account number freely or store it in insecure locations. Instead, rely on trusted channels to retrieve it when needed.

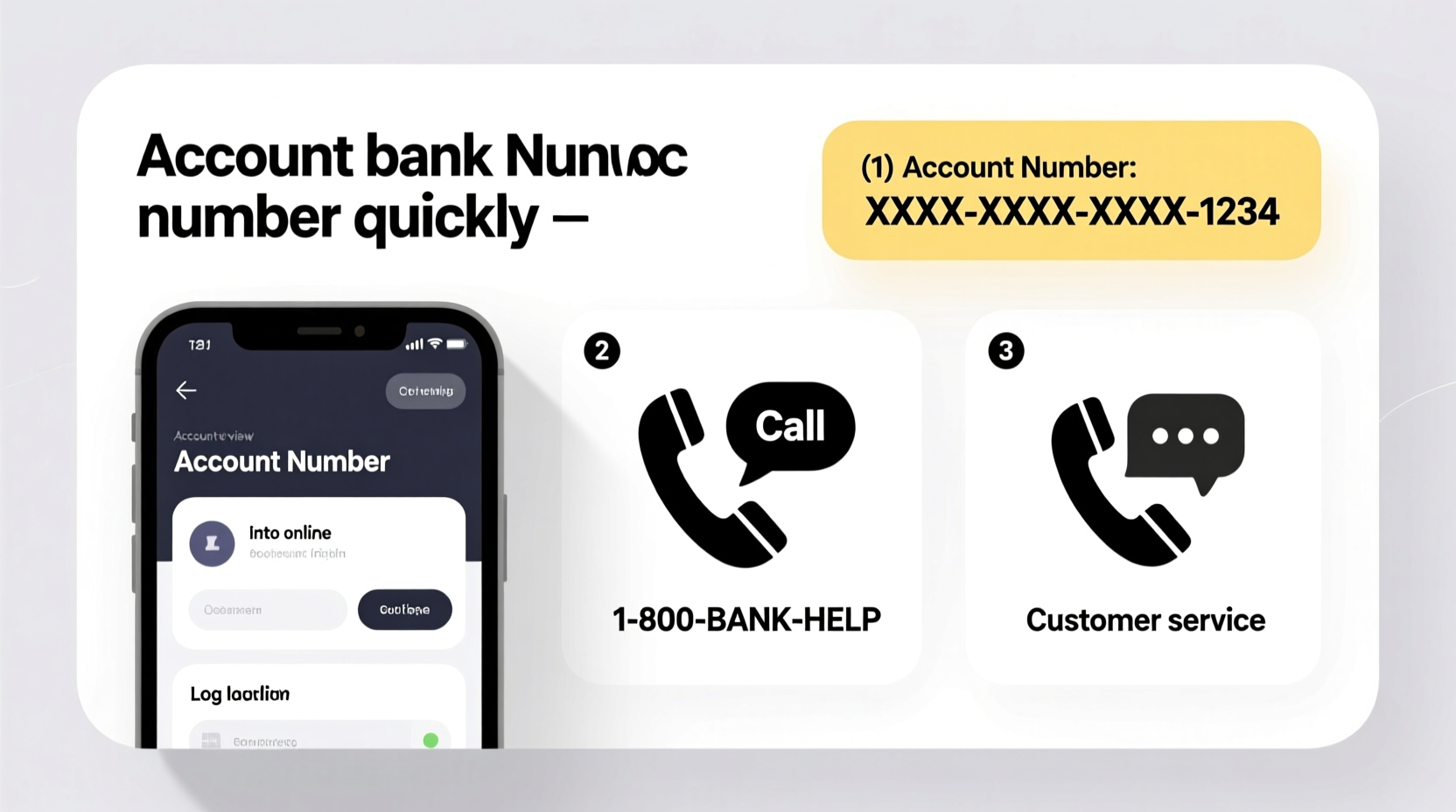

Secure Methods to Locate Your Account Number

The safest way to find your bank account number is through official and encrypted sources. Avoid third-party websites, unverified apps, or public forums that claim to help you recover account details. Stick to the following proven methods:

1. Check Your Online Banking Dashboard

Most banks display your account number directly on the main account overview page after you log in. While some institutions partially mask the number (e.g., showing only the last four digits), others allow full visibility under a “View Full Account Number” option—often protected by multi-factor authentication.

2. Review a Recent Paper or Digital Bank Statement

Every bank statement—whether physical or PDF—includes your full account number, usually near the top of the first page. This is one of the most reliable offline methods. If you’ve opted for paperless statements, simply log into your account and download the latest statement from the document center.

3. Look at a Voided Check

If you have checks linked to your account, the bottom contains three sets of numbers: the routing number (first set), your account number (second), and the check number (third). The account number is typically 10–12 digits long and appears in the middle. A voided check is often requested by employers or service providers precisely because it includes both routing and account numbers securely.

4. Call Your Bank’s Customer Service Line

Speaking with a live representative is a secure option if you can’t access digital tools. When calling, ensure you’re using the official phone number listed on your bank’s website—not one found via a search engine or email. The representative will verify your identity using security questions or two-factor authentication before disclosing any account details.

“Always confirm you’re on the legitimate bank line. Fraudsters often spoof customer service numbers to trick people into revealing personal information.” — James Reed, Senior Cybersecurity Analyst at FinTrust Solutions

5. Visit a Local Branch In Person

For those who prefer face-to-face interaction, visiting a local branch allows you to present valid ID and obtain your account number directly from a teller or banker. Bring government-issued identification such as a driver’s license or passport to expedite the process.

Step-by-Step Guide: How to Retrieve Your Account Number Safely

Follow this timeline to retrieve your bank account number efficiently while maintaining strong security practices:

- Step 1: Attempt online access – Log in to your bank’s official website or mobile app using a secure network.

- Step 2: Navigate to account summary – Open the relevant checking or savings account.

- Step 3: Locate account details – Click on “Account Information” or similar; look for an option to reveal the full number.

- Step 4: Verify authenticity – Ensure the site URL begins with \"https://\" and displays a padlock icon.

- Step 5: Use alternative methods if blocked – If online access fails, call customer service or visit a branch with proper ID.

- Step 6: Record securely – Write down the number only if necessary, and store it in a locked drawer or password manager—never on sticky notes or unsecured documents.

Common Mistakes That Compromise Security

While trying to retrieve account information quickly, people often make errors that expose them to risk. Below is a comparison of recommended actions versus risky behaviors:

| Do’s | Don’ts |

|---|---|

| Use your bank’s official website or app | Click links in unsolicited emails claiming to help recover account info |

| Verify caller ID before sharing information over the phone | Provide your account number to unknown callers, even if they seem legitimate |

| Store account numbers in encrypted password managers | Save screenshots of account details on cloud storage without protection |

| Enable two-factor authentication on your banking app | Log in from public Wi-Fi networks without a VPN |

Real Example: Recovering an Account Number After a Phone Loss

Sarah, a freelance graphic designer, lost her smartphone containing her banking app. She needed her account number urgently to receive a client payment but couldn’t access her phone. Instead of panicking, she followed protocol: she used a friend’s computer to navigate directly to her bank’s official website (typing the URL manually), logged in using her saved credentials and SMS-based two-factor authentication, and retrieved her account number from the dashboard. She then reported her lost phone to her carrier and remotely wiped the device. By relying on secure, verified channels, Sarah avoided potential breaches and got paid on time.

Checklist: Securely Find Your Account Number in Under 10 Minutes

- ☐ Confirm you are using a private, secure internet connection

- ☐ Access your bank’s website via a bookmarked link or typed URL

- ☐ Log in using strong credentials and enable two-factor authentication

- ☐ Navigate to your account’s detail page

- ☐ Reveal the full account number using the secure “Show” function

- ☐ Copy the number only to a secured location (e.g., encrypted note or password vault)

- ☐ Log out completely after retrieval

Frequently Asked Questions

Can someone steal my money with just my account number?

Not easily. While your account number alone isn’t enough to initiate unauthorized withdrawals, it can be dangerous when combined with your routing number and personal information. Scammers might attempt ACH fraud or social engineering attacks, so always protect your full banking details.

Why does my bank hide part of my account number online?

Banks mask portions of account numbers as a security measure to prevent exposure during data breaches or screen-sharing incidents. You can usually view the full number after passing additional identity verification steps within the platform.

Is it safe to give my account number to my employer?

Yes, it’s standard and safe to provide your account and routing numbers to your employer for direct deposit setup. They cannot withdraw funds—only deposit them. However, only share this information through secure HR portals or in person, never via unencrypted email.

Stay Informed, Stay Secure

Knowing how to quickly and safely retrieve your bank account number empowers you to manage your finances efficiently without falling prey to scams. The key is to rely on official channels, maintain strong digital hygiene, and remain vigilant against phishing attempts. Whether you're updating your payroll information or setting up a new utility payment, these methods ensure you stay in control of your financial data.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?