Obtaining an Employer Identification Number (EIN) is a critical step when setting up a business in the United States. Also known as a Federal Tax ID Number, an EIN is used by the IRS to identify your business for tax purposes. Whether you're launching a sole proprietorship, forming an LLC, or hiring employees, you’ll likely need one. The good news: the process is free, straightforward, and can be completed online in under 15 minutes—provided you know exactly what to do.

This guide walks you through every stage of securing your EIN efficiently, avoiding common pitfalls, and ensuring your application is approved on the first try.

What Is an EIN and Why Do You Need One?

An EIN is a nine-digit number assigned by the Internal Revenue Service (IRS) to identify businesses operating in the U.S. It functions similarly to a Social Security number but for your company. While not every business legally requires an EIN, most will benefit from having one.

You’ll need an EIN if you:

- Have employees

- Operate as a corporation or partnership

- File business tax returns (e.g., employment, excise, or alcohol/tobacco/firearms taxes)

- Withhold taxes on income paid to non-resident aliens

- Open a business bank account (most banks require it)

- Establish business credit

“An EIN is more than just a tax requirement—it’s a foundational element of your business identity.” — Sarah Lin, Small Business Tax Advisor

Eligibility Requirements for Applying Online

The IRS allows certain entities to apply for an EIN online, but not all. To qualify for the immediate online application, you must meet the following criteria:

| Requirement | Details |

|---|---|

| Principal Business Located in the U.S. or U.S. Territories | The legal address must be in one of the 50 states, District of Columbia, Puerto Rico, Guam, etc. |

| Applicant Must Be a Responsible Party | This is typically the owner, partner, corporate officer, or grantor with control, ownership, or entitlement. |

| Valid Taxpayer Identification Number (SSN, ITIN, or EIN) | The responsible party must have a valid SSN, Individual Taxpayer Identification Number (ITIN), or existing EIN. |

| One EIN Per Day Per Legal Entity | The IRS limits applicants to one EIN per day per responsible party. |

If your business is foreign-based or doesn’t meet these conditions, you’ll need to apply via Form SS-4 by fax or mail, which takes 4–6 weeks for processing.

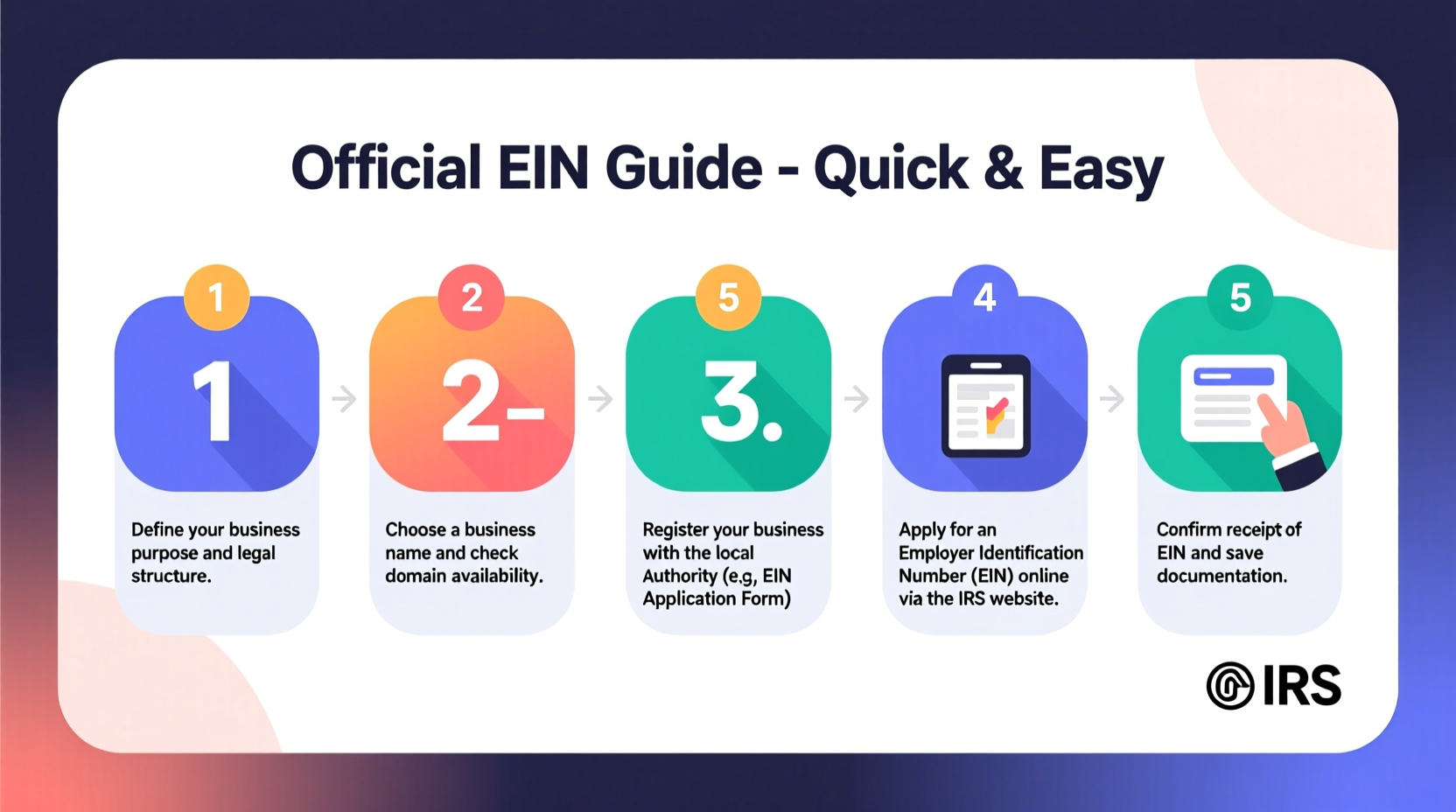

Step-by-Step Guide to Getting Your EIN Online

The fastest way to get an EIN is through the IRS’s online EIN application. Here's how to complete it correctly and efficiently.

- Gather Required Information

Before starting, ensure you have:- Legal name and address of your business

- Legal name and SSN/ITIN of the “responsible party”

- Type of entity (LLC, Corporation, Sole Proprietorship, etc.)

- Reason for applying (e.g., new business, hiring employees)

- Date business started or was acquired

- Industry and primary business activity

- Visit the IRS EIN Assistant Page

Go to the official IRS website: IRS EIN Assistant. Only use this link to avoid third-party sites that charge fees. - Start the Application

Click “Apply Online Now” and confirm your eligibility. The system will ask if your principal business is in the U.S.—select “Yes.” - Complete the Application Form

Fill out each section carefully. Key fields include:- Entity Type: Choose accurately (e.g., Single-Member LLC taxed as Sole Proprietorship vs. Corporation).

- Responsible Party: This cannot be changed later without submitting additional forms.

- Business Start Date: Use the date you began operations or incorporated.

- First Payroll Date: If applicable; otherwise, indicate “None.”

- Review and Submit

Double-check all entries. Typos or mismatched information cause delays. Once submitted, you cannot edit the application. - Receive Your EIN Instantly

If approved, the IRS will issue your EIN immediately. You can download and save a PDF confirmation letter (Form SS-4). This document is crucial—store it securely.

Common Mistakes That Delay EIN Approval

While the online process is fast, errors can result in rejection or processing delays. Avoid these frequent issues:

- Mismatched Responsible Party Info: The name and SSN/ITIN must exactly match IRS records. Even a typo in a middle initial can cause failure.

- Incorrect Entity Classification: Mislabeling an LLC as a corporation or partnership may trigger manual review.

- Using a Third-Party Number: The applicant must have their own SSN or ITIN—no exceptions.

- Multiple Applications in One Day: The IRS blocks duplicate submissions. Wait 24 hours before retrying if denied.

“We had a client who applied three times in one morning thinking the system failed. Their EIN was locked for days due to fraud alerts.” — James Reed, CPA at ClearLedger Accounting

What to Do After Receiving Your EIN

Getting the number is just the beginning. Here’s what comes next:

✅ EIN Action Checklist

- Store your EIN confirmation letter in digital and physical formats

- Use your EIN to open a business bank account

- Register for state and local taxes (sales tax, employer taxes, etc.)

- Apply for business licenses or permits requiring federal ID

- Set up payroll systems if hiring employees

- Include your EIN on 1099 forms and other tax filings

Note: An EIN does not expire and is generally not transferable. If you change your business structure (e.g., from sole proprietorship to LLC), you’ll likely need a new EIN.

Frequently Asked Questions

Can I get an EIN without an SSN?

Yes, but not online. Individuals without an SSN can apply using Form SS-4 by fax or mail, providing an ITIN or explaining why they don’t have one. Foreign applicants must include a completed Form W-7 or justification.

Is there a fee to get an EIN?

No. The IRS does not charge for EIN applications. Beware of third-party websites that charge $50+ for a service the IRS provides for free.

Can I use my EIN to build business credit?

Absolutely. Once you have your EIN, register with Dun & Bradstreet (D&B), Experian Business, and Equifax Business to start building a credit profile. Use the EIN when opening vendor accounts that report to business credit bureaus.

Real Example: How Maria Got Her EIN in 12 Minutes

Maria runs a freelance graphic design business and recently hired her first contractor. She needed an EIN to issue 1099s and open a separate business checking account.

She visited the IRS website directly, avoided third-party services, and had her LLC formation documents and SSN ready. She filled out the online form during her lunch break, double-checked her responsible party details, and submitted. Within 12 minutes, she received her EIN confirmation letter via PDF. By the end of the week, she’d opened a bank account and filed her first contractor payment paperwork.

Her key takeaway? “Going straight to the IRS saved me time and $79 I would’ve paid a ‘service’ site.”

Final Steps and Next Actions

Securing an EIN is one of the simplest yet most important administrative tasks in launching a legitimate business. With the right preparation, you can complete the entire process in less than 15 minutes—no waiting, no fees, no hassle.

Remember: accuracy matters more than speed. A correctly filed application means instant approval. A rushed one could delay your banking, hiring, or tax compliance by weeks.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?