Determining the true cost of a product is one of the most critical yet overlooked aspects of running a profitable business. Many entrepreneurs set prices based on intuition or market averages, only to discover later that their margins are thinner than expected—or worse, they're operating at a loss. The foundation of sound pricing lies in a clear, accurate understanding of cost price: what it includes, how to calculate it, and why it matters. This guide breaks down the components of cost price, provides actionable methods for calculation, and shows how precise costing leads to smarter business decisions.

What Is Cost Price—and Why It’s Not Just the Purchase Price

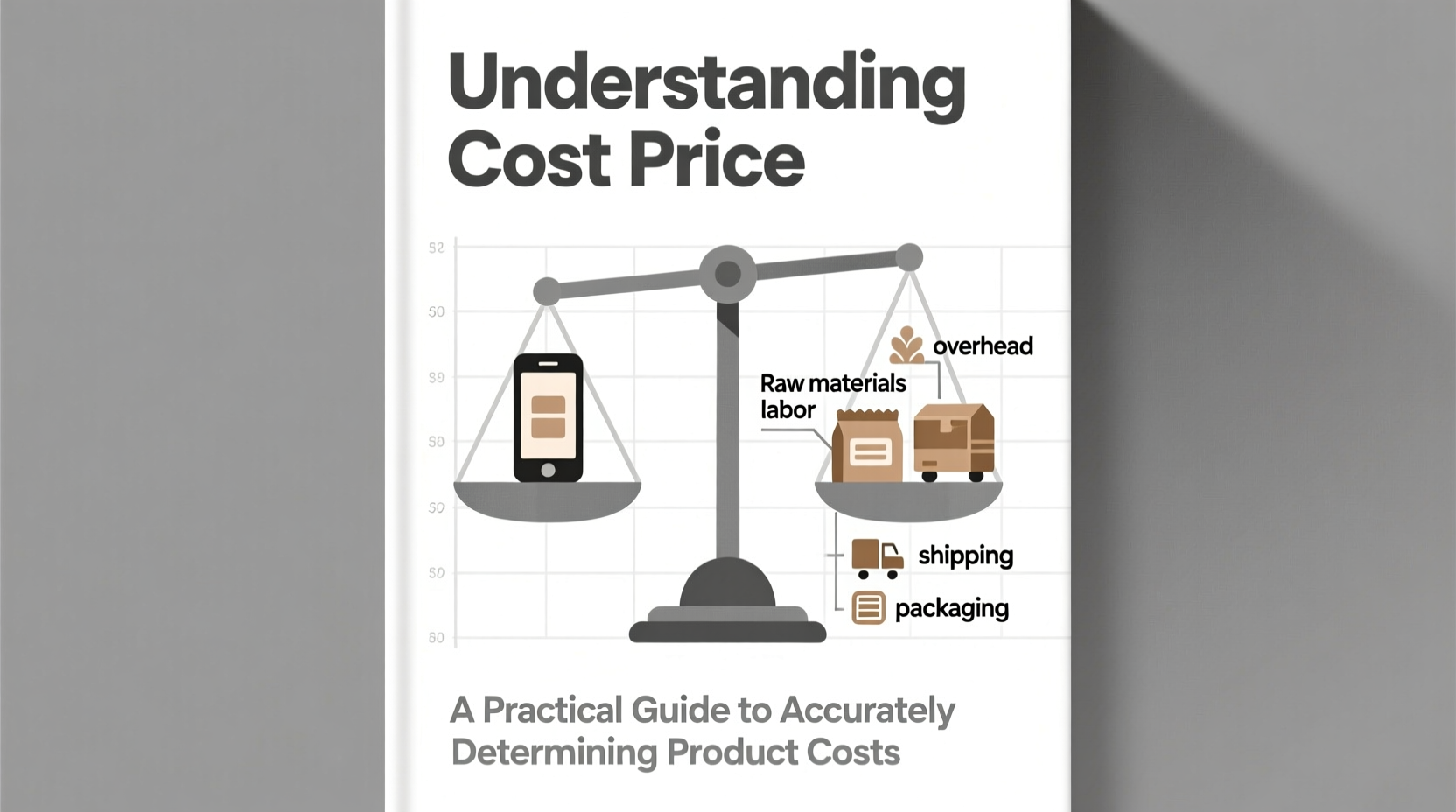

Cost price refers to the total expense incurred to bring a product to a sellable state. It extends far beyond the sticker price paid to a supplier or manufacturer. While many assume cost price is simply the amount listed on an invoice, this narrow view often omits essential expenses that directly impact profitability.

For example, if you import handmade candles from overseas, your cost isn’t just the $5 per unit charged by the factory. It also includes shipping fees, import duties, insurance, handling charges, warehousing, and even quality inspection labor. Ignoring these elements can lead to underpricing and eroded profits.

“Accurate cost pricing separates sustainable businesses from those that appear profitable on paper but bleed cash behind the scenes.” — Marcus Lin, Supply Chain Analyst & Profitability Consultant

Breaking Down the Components of Cost Price

To determine cost price accurately, businesses must account for three primary categories of cost: direct, indirect, and landed. Each plays a vital role in forming a complete financial picture.

1. Direct Costs

These are expenses directly tied to the production or acquisition of a single unit. They vary with output volume and include:

- Raw materials or purchased inventory

- Direct labor (e.g., assembly line workers)

- Manufacturing supplies (e.g., packaging, labels)

2. Indirect Costs (Overheads)

These are fixed or semi-variable expenses necessary to run operations but not attributable to a single unit. While they don’t scale directly with production, they must be allocated across products. Examples include:

- Rent for warehouse or workshop space

- Utilities (electricity, water)

- Administrative salaries

- Software subscriptions (inventory management, accounting)

3. Landed Costs

Particularly relevant for imported goods, landed cost includes all expenses required to deliver a product to your door. These often surprise businesses new to global sourcing:

- Freight charges (air, sea, or land transport)

- Customs duties and tariffs

- Insurance during transit

- Brokerage fees

- Port handling and inland freight

A Step-by-Step Guide to Calculating Accurate Cost Price

Follow this structured process to arrive at a reliable cost price for any product.

- Identify the base unit cost: Start with the purchase price per unit from your supplier.

- Add direct production costs: Include materials, labor, and consumables used specifically for that item.

- Allocate overheads proportionally: Divide monthly fixed costs by the number of units produced or sold to assign a per-unit share.

- Factor in logistics and handling: Calculate shipping, customs, and receiving costs per unit.

- Include waste and spoilage: Adjust for breakage, returns, or defects—e.g., if 3% of items are damaged, increase cost accordingly.

- Sum all components: Add every element to determine the final cost price per unit.

Example Calculation: Hand-Poured Soy Candle

| Cost Component | Amount Per Unit |

|---|---|

| Wax, wick, fragrance oil | $2.10 |

| Label and packaging | $0.65 |

| Labor (pouring, labeling) | $1.20 |

| Allocated overhead (rent, utilities, software) | $0.75 |

| Shipping & import duty (landed cost) | $0.90 |

| Waste allowance (5%) | $0.28 |

| Total Cost Price | $5.88 |

This comprehensive approach reveals that while the candle may have been sourced for $4.00, the true cost exceeds $5.80—nearly 50% higher. Pricing below this threshold would result in a loss.

Common Mistakes That Skew Cost Price Accuracy

Even experienced business owners make errors that distort their understanding of real costs. Avoid these pitfalls:

- Ignoring overhead allocation: Treating rent or admin as “background” costs leads to underpriced products.

- Using outdated supplier quotes: Failing to update cost models after price increases causes margin erosion.

- Overlooking transaction fees: Payment processing (e.g., PayPal, Stripe) should be factored into net cost, especially for direct-to-consumer sales.

- Estimating instead of tracking: Guessing shipping costs or waste rates introduces inaccuracies. Use actual data whenever possible.

“Businesses that track cost price down to the cent gain leverage in negotiations, pricing strategy, and long-term planning.” — Priya Mehta, CFO of Sustainable Goods Co.

Mini Case Study: How a Small Soap Maker Saved Her Business

Sophie ran a boutique soap brand selling lavender-scented bars at local markets. She priced each bar at $8, believing her cost was $3.50 based on ingredient costs and hand-mixing time. After six months, revenue looked strong—but her bank balance kept shrinking.

Upon reviewing her books with an accountant, she discovered unaccounted expenses: $120 monthly booth rental split over 200 bars ($0.60/unit), $0.40 in packaging tape and boxes, $0.35 in card payment fees, and $0.25 for soap wasted due to inconsistent curing. Her true cost? $5.10 per bar.

With this insight, Sophie raised her price to $9.50, introduced wholesale options with bulk discounts, and negotiated lower shipping rates. Within three months, her net profit margin improved from -8% to +22%.

Checklist: Ensuring Accurate Cost Price Calculation

Use this checklist before finalizing any product pricing:

- ✅ Included all material and labor inputs per unit

- ✅ Allocated a portion of fixed overheads (rent, utilities, software)

- ✅ Added shipping, insurance, and import costs (if applicable)

- ✅ Accounted for transaction fees (credit card, marketplace commissions)

- ✅ Factored in spoilage, damage, or return rates

- ✅ Verified current supplier pricing (not last year’s quote)

- ✅ Reviewed landed costs using Incoterms (for international orders)

- ✅ Recalculated quarterly or after major cost changes

Frequently Asked Questions

How often should I recalculate my product’s cost price?

Review cost price at least quarterly, or immediately after changes in supplier pricing, shipping rates, or operational expenses. Seasonal fluctuations (e.g., fuel surcharges) may require more frequent updates.

Should I include marketing costs in cost price?

No—marketing is typically treated as a period expense, not part of product cost. However, for specific campaigns tied directly to a product launch, some businesses allocate a portion as a startup cost. Generally, keep marketing separate to maintain clarity in unit costing.

Can software help me automate cost price calculations?

Yes. Inventory and accounting platforms like QuickBooks, Xero, or TradeGecko allow you to build cost templates, link suppliers, and auto-update landed costs. Integrations with shipping providers can feed real-time freight data into your system.

Master Your Margins by Mastering Cost Price

Understanding cost price isn’t just an accounting exercise—it’s a strategic imperative. When you know exactly what each product costs to produce and deliver, you gain control over pricing, promotions, and profitability. You avoid the trap of “growing broke,” where increasing sales volume hides declining margins.

Take the time to map out every cost component, challenge assumptions, and refine your models regularly. Whether you sell handmade crafts or manage a retail chain, precision in cost pricing builds resilience, informs smarter decisions, and fuels sustainable growth.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?