Tax Relief Refund (TRR) discounts are a lifeline for many taxpayers struggling with IRS debt. These programs, often referred to in online forums like Reddit, offer relief through reduced settlement amounts under the Offer in Compromise (OIC) or other resolution pathways. However, one of the most frequently asked questions—especially among first-time applicants—is: How long does it actually take for a TRR discount to be applied? Drawing from firsthand accounts shared across Reddit communities such as r/taxhelp and r/personalfinance, combined with procedural knowledge and expert input, this article breaks down the timeline, influencing factors, and what you can realistically expect.

What Is a TRR Discount?

The term “TRR discount” is commonly used in online discussions to describe a negotiated reduction in tax debt through IRS programs like the Offer in Compromise (OIC), Currently Not Collectible (CNC) status, or installment agreements that result in paying less than the full balance owed. While \"TRR\" isn't an official IRS acronym, it's widely understood in taxpayer forums as referring to any formal reduction in assessed liability.

These discounts aren’t automatic. They require documentation, financial disclosure, and time. The IRS evaluates your income, assets, expenses, and ability to pay before approving any settlement. Once approved, the discount must then be reflected in your account—which leads to the central question: How long until the change appears?

Typical Timeline: From Approval to Application

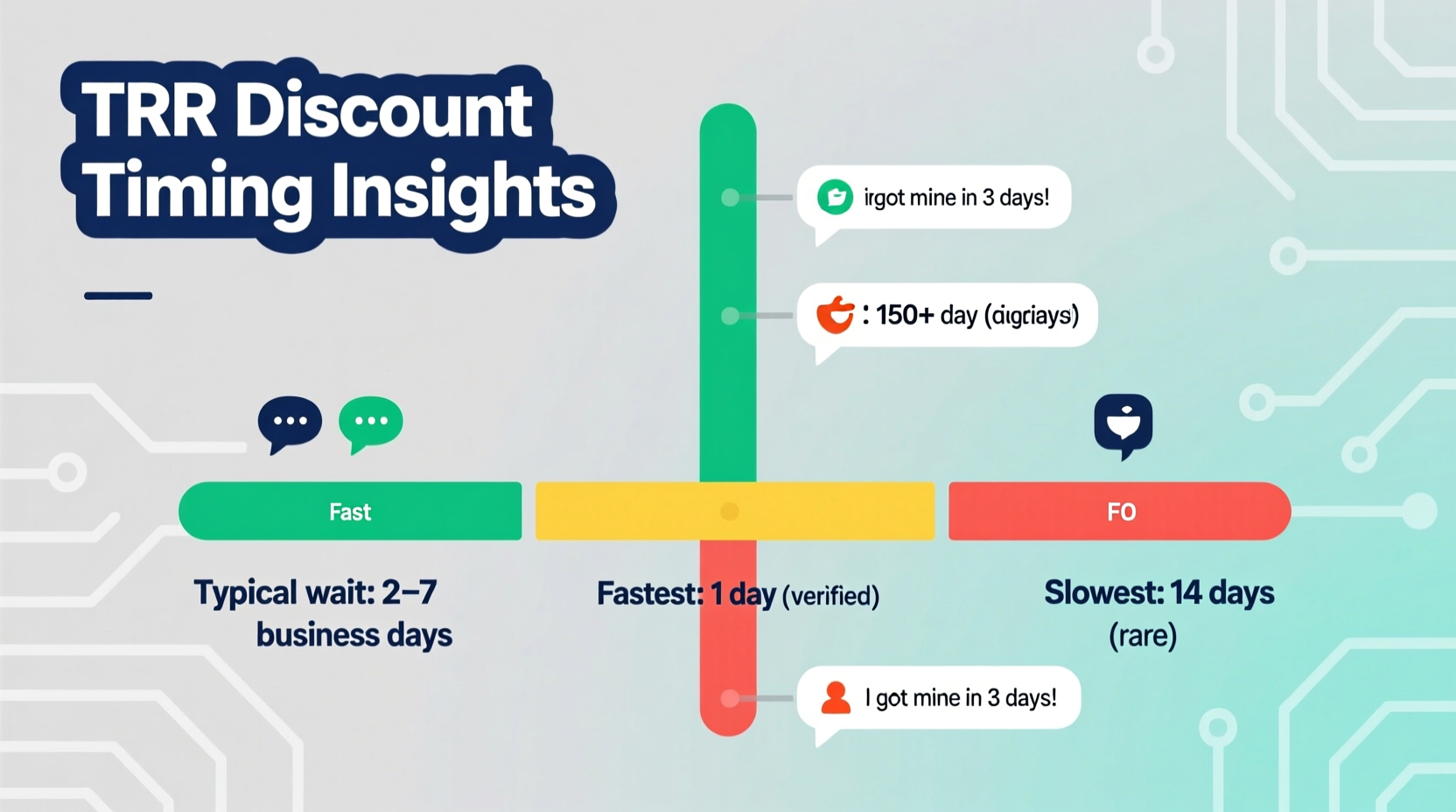

Based on aggregated Reddit reports from 2020–2024, the average time between OIC approval and the actual application of the discount to the taxpayer’s account ranges from 2 to 6 weeks. However, outliers exist—some users report seeing updates within 7 days; others waited over two months.

This delay occurs because approval doesn’t instantly update your account balance. After the IRS Centralized Offer Acceptance Site (COAS) approves your offer, internal processing teams must manually adjust your record, notify collection units, and close related enforcement actions (e.g., liens or levies).

“After getting my OIC approval letter, I checked my account weekly. It took exactly 23 days for the balance to reflect the settled amount. No calls were returned during that time.” — u/TaxWarrior2022, Reddit comment (r/taxhelp, March 2023)

Step-by-Step Guide: What Happens After TRR Approval

- Approval Letter Issued: You receive an official IRS letter confirming acceptance of your offer (Form 656-L or 656).

- Data Entry & Verification: Your case moves to administrative processing. This includes verifying payments and updating master files.

- Account Adjustment: The IRS adjusts your tax account to reflect the compromise amount as paid in full.

- Lien Withdrawal Initiated: If a federal tax lien was filed, the IRS begins the process to withdraw it (within 30 days of payment). <5> Final Confirmation: You may receive a closing letter, and your online account will show a zero balance or updated status.

Factors That Influence Processing Speed

Not all cases move at the same pace. Several variables affect how quickly a TRR discount appears on your record:

- IRS Workload: Processing times spike during tax season (January–April) and dip in summer.

- State Location: Cases handled by Memphis (TN) or Holtsville (NY) service centers vary in backlog.

- Method of Submission: Electronically filed offers via Form 656-L Fast Track may process faster than paper submissions.

- Completeness of Documentation: Missing forms or unclear financials cause delays even post-approval.

- Existing Enforcement Actions: Active levies or liens add steps to the closure process.

Real Example: A Reddit User’s Journey

In a detailed post on r/taxhelp, user u/DebtFreeEngineer documented their OIC experience. They submitted a $12,000 offer to settle $68,000 in back taxes due to low income and high medical expenses. The IRS requested additional proof of expenses twice during review. After five months, the offer was accepted.

They noted: “I got the approval email on June 10th. My bank auto-paid the lump sum the next day. By June 25th, nothing had changed online. I called the number on the letter and spoke to a specialist who said the system ‘hadn’t synced yet.’ On July 2nd—22 days after approval—my account finally showed $0 balance and ‘Offer Accepted.’”

Their takeaway? Approval is not the finish line—it’s a checkpoint.

Do’s and Don’ts While Waiting for Your Discount to Apply

| Do | Don’t |

|---|---|

| Keep copies of all correspondence and payment confirmations | Assume the discount is active just because you were approved |

| Monitor your IRS online account regularly | Stop making required payments if part of a payment plan |

| Contact the assigned IRS representative if no update after 30 days | Panic if the balance hasn’t changed immediately |

| Request a lien withdrawal once the offer is fully paid | Close your tax file completely without confirmation |

Expert Insight: What Professionals Say

“The IRS has made strides in digital processing, but legacy systems still create lags between decision and implementation. Even after approval, manual handoffs between departments can introduce delays. Taxpayers should treat the post-approval phase as part of the process—not the end.” — Sarah Lin, Enrolled Agent and IRS Representation Specialist

Lin emphasizes that while technology like Direct Debit Installment Agreements or e-filing improves efficiency, the OIC program remains labor-intensive due to its case-by-case evaluation nature. She advises clients to budget for a minimum 30-day gap between approval and account adjustment.

Checklist: Ensuring Smooth TRR Discount Application

- ✅ Confirm receipt of official IRS approval letter

- ✅ Make final payment (if required) within the deadline

- ✅ Save payment confirmation (bank statement, IRS receipt)

- ✅ Log into IRS Online Account weekly to monitor changes

- ✅ Call the contact number on the approval letter if no update after 30 days

- ✅ Request federal tax lien withdrawal if applicable

- ✅ Retain all records for at least seven years

Frequently Asked Questions

Why hasn’t my balance changed after receiving approval?

The IRS must manually update your account after approval. This backend process typically takes 2–6 weeks. As long as you’ve met all payment obligations, the change will eventually appear. Continue monitoring your IRS online account and avoid duplicate payments.

Can I get in trouble if I don’t pay the original amount after approval?

No. Once your offer is accepted, you’re only responsible for the agreed-upon amount. The IRS legally cannot pursue the remaining balance. However, ensure the discount is officially applied before assuming the debt is resolved.

Does the IRS ever lose track of approved offers?

Rarely, but it happens—especially with paper filings or misdirected payments. Reddit threads include stories of users having to fax approval letters to collection agents who claimed “no record” existed. Always keep physical and digital copies of key documents.

Conclusion: Patience and Persistence Pay Off

Understanding how long it takes for TRR discounts to apply requires balancing hope with realism. Approval brings relief, but the final step—seeing that zero balance—demands patience. Based on consistent Reddit user feedback and expert validation, a 3- to 5-week wait post-approval is normal. Delays beyond that warrant proactive follow-up, not panic.

Every taxpayer’s journey is unique, but preparation, documentation, and persistence remain universal keys to success. If you're navigating this process now, know you're not alone—and thousands before you have reached resolution, one step at a time.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?