Moving money between banks is a common financial task, whether you're switching accounts, consolidating funds, paying bills, or supporting family. While the process may seem straightforward, choosing the wrong method can lead to delays, fees, or even security risks. With so many options available—from wire transfers to mobile apps—it’s essential to understand which method suits your needs in terms of speed, cost, and reliability.

This guide breaks down the most dependable ways to transfer money between banks, compares their strengths and limitations, and provides practical advice for making secure, efficient transactions.

Understanding Bank Transfer Methods

Not all bank transfers are created equal. The right choice depends on how quickly you need the funds delivered, how much you’re sending, and whether the transfer is domestic or international. Each method operates under different rules, timelines, and fee structures. Understanding these differences helps avoid surprises.

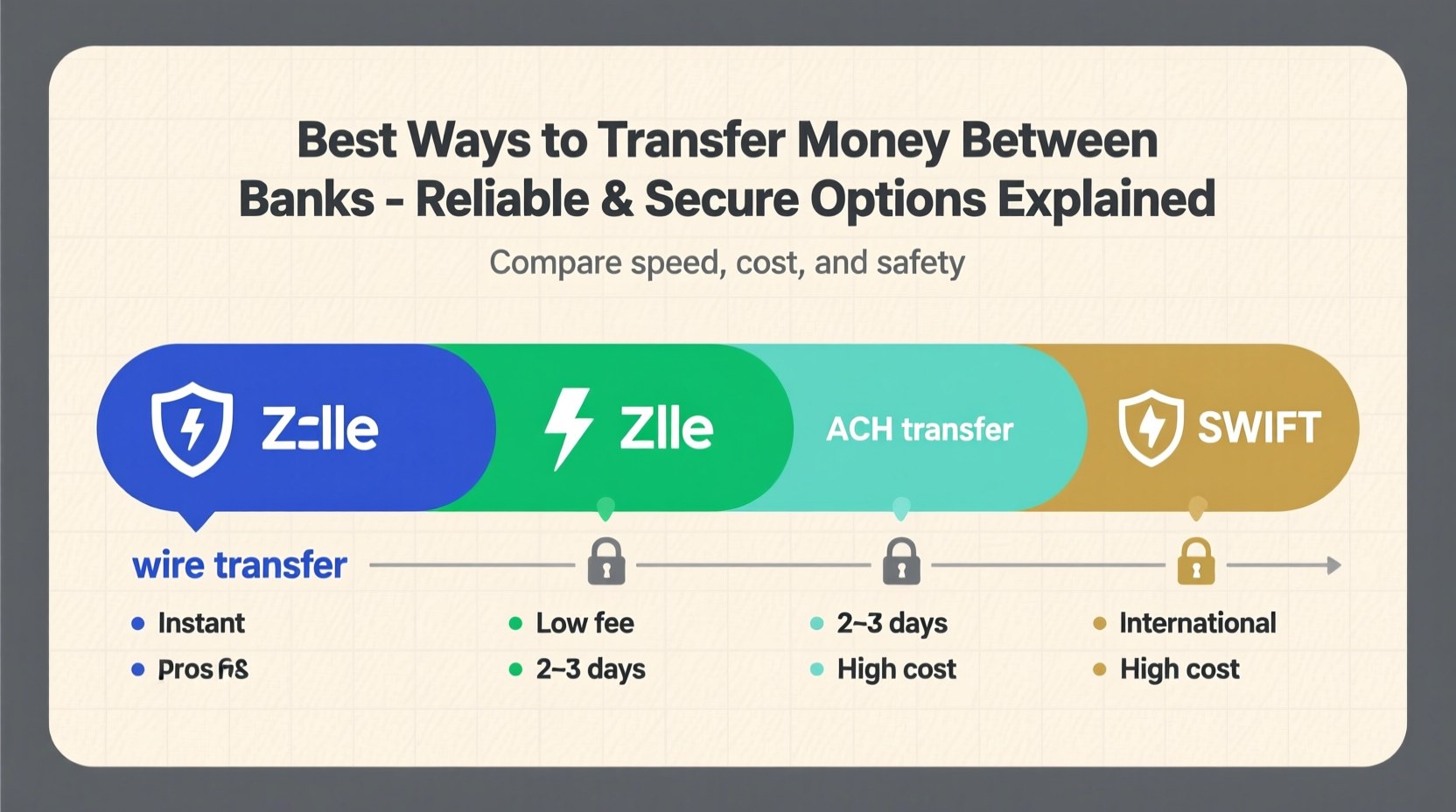

The primary methods include:

- Automated Clearing House (ACH) transfers

- Wire transfers (domestic and international)

- Peer-to-peer (P2P) payment apps

- Bank-to-bank linking via online banking

- Prepaid card or virtual account routing

Each has its place, but only a few offer the ideal balance of speed, low cost, and reliability.

Top 5 Reliable Ways to Transfer Money Between Banks

1. ACH Transfers – Best for Low-Cost, Scheduled Transfers

The Automated Clearing House network processes billions of electronic transactions annually in the U.S., including direct deposits, bill payments, and interbank transfers. ACH is operated by Nacha and is one of the safest and most widely used systems.

ACH transfers typically take 1–3 business days and are often free or low-cost. Many banks allow external transfers through their online portals using ACH routing.

2. Wire Transfers – Best for Urgent, High-Value Transfers

Wire transfers are near-instantaneous electronic movements of funds between banks, processed through networks like Fedwire or SWIFT. Domestic wires usually settle within hours; international wires may take 1–5 days.

While fast, they come with higher fees—typically $25–$30 for outgoing domestic wires and up to $50 for international. Receiving banks may also charge incoming fees.

“Wire transfers remain the gold standard for time-sensitive, large-sum transactions where certainty of delivery is critical.” — James L. Reed, Senior Banking Analyst at Finovate Advisory

3. Peer-to-Peer Payment Apps – Best for Small, Personal Transfers

Services like Zelle, Venmo, Cash App, and PayPal allow quick transfers between individuals using linked bank accounts. Zelle, in particular, is integrated with most major U.S. banks and offers instant transfers at no cost.

Zelle is ideal for sending money to friends or family when both parties are enrolled. However, it lacks buyer protection—if you send money to the wrong person, recovery is nearly impossible.

4. Bank-to-Bank Linking via Online Banking

Many banks let you link external accounts through their online platforms. This allows recurring or one-time transfers using ACH without leaving your primary bank’s interface.

To set this up, you’ll need the other bank’s routing and account numbers. Verification usually takes 1–3 days via micro-deposits or instant validation if supported.

5. International Transfer Services (Wise, Revolut, OFX)

For cross-border transfers, traditional bank wires often come with poor exchange rates and hidden fees. Specialized services like Wise (formerly TransferWise), Revolut, and OFX offer transparent pricing, real mid-market exchange rates, and faster processing.

Wise, for example, routes money locally to minimize intermediary charges and typically completes transfers in 1–2 days. It also provides full tracking and customer support.

Comparison Table: Transfer Methods at a Glance

| Method | Speed | Fees | Best For | Security Level |

|---|---|---|---|---|

| ACH Transfer | 1–3 business days | $0–$3 | Recurring, low-value transfers | High |

| Domestic Wire | Same day–24 hours | $25–$30 | Urgent, high-value transfers | Very High |

| Zelle | Nearly instant | Free | Personal transfers (U.S.) | High (but irreversible) |

| PayPal/Venmo | Minutes–3 days | Free (standard), ~2.9% (instant) | Social or small payments | Moderate |

| Wise/Revolut | 1–3 days | Low, transparent fees | International transfers | Very High |

Step-by-Step: How to Safely Transfer Money Between Banks

- Determine the purpose and urgency: Is this a one-time payment, recurring transfer, or emergency fund move?

- Choose the appropriate method: Use Zelle for quick personal transfers, ACH for scheduled moves, and wire for large or urgent transactions.

- Gather required details: You’ll typically need the recipient’s full name, bank name, routing number, account number, and account type (checking/savings).

- Verify the information: Double-check all digits—especially routing and account numbers—to prevent misdirected funds.

- Initiate the transfer: Log into your bank or service platform and follow the prompts. Save confirmation numbers.

- Monitor the transaction: Track the status via your bank’s app or the service provider. Allow extra time for weekends or holidays.

- Confirm receipt: Contact the recipient or check your linked account to ensure funds arrived.

Mini Case Study: Sarah’s Cross-State Move

Sarah relocated from Chicago to Denver for a new job and needed to transfer $15,000 from her local credit union to a new Colorado bank. She considered multiple options:

- Writing a check would take too long and require mailing a large paper check.

- A wire transfer was fast but cost $30 and required a branch visit.

- Her credit union offered free ACH external transfers through online banking.

She chose the ACH option. She linked her new bank account via micro-deposit verification (took two days), then initiated the transfer. The money arrived in three business days—on time for her rent payment—and cost nothing. Sarah saved money and avoided risk by not using a wire unnecessarily.

Checklist: Before You Transfer Money Between Banks

✔️ Confirm daily transfer limits with your bank

✔️ Check for fees (outgoing and incoming)

✔️ Ensure sufficient account balance

✔️ Use secure internet connection (avoid public Wi-Fi)

✔️ Save transaction reference number

✔️ Enable two-factor authentication on your banking app

Frequently Asked Questions

How long does a bank-to-bank transfer take?

It depends on the method. ACH transfers usually take 1–3 business days. Wire transfers are same-day or next-day for domestic transactions. P2P apps like Zelle can complete transfers in minutes if both users are enrolled.

Are bank transfers safe?

Yes, when conducted through official banking channels or reputable services. ACH and wire transfers are encrypted and monitored. However, never share bank details over unsecured channels, and double-check recipient information to prevent fraud.

Can I cancel a bank transfer after it’s sent?

It depends. ACH transfers can sometimes be reversed within 24 hours if not yet settled. Wire transfers are generally final once processed. P2P apps like Zelle do not allow cancellations after the recipient receives funds.

Final Tips for Reliable Transfers

Conclusion

The best way to transfer money between banks depends on your priorities: speed, cost, or convenience. For everyday use, ACH and Zelle offer excellent value and reliability. For large or urgent transfers, domestic wires are unmatched. And for international needs, services like Wise provide transparency and efficiency that traditional banks often lack.

No matter which method you choose, always verify details, monitor transactions, and keep records. A little caution goes a long way in protecting your finances.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?