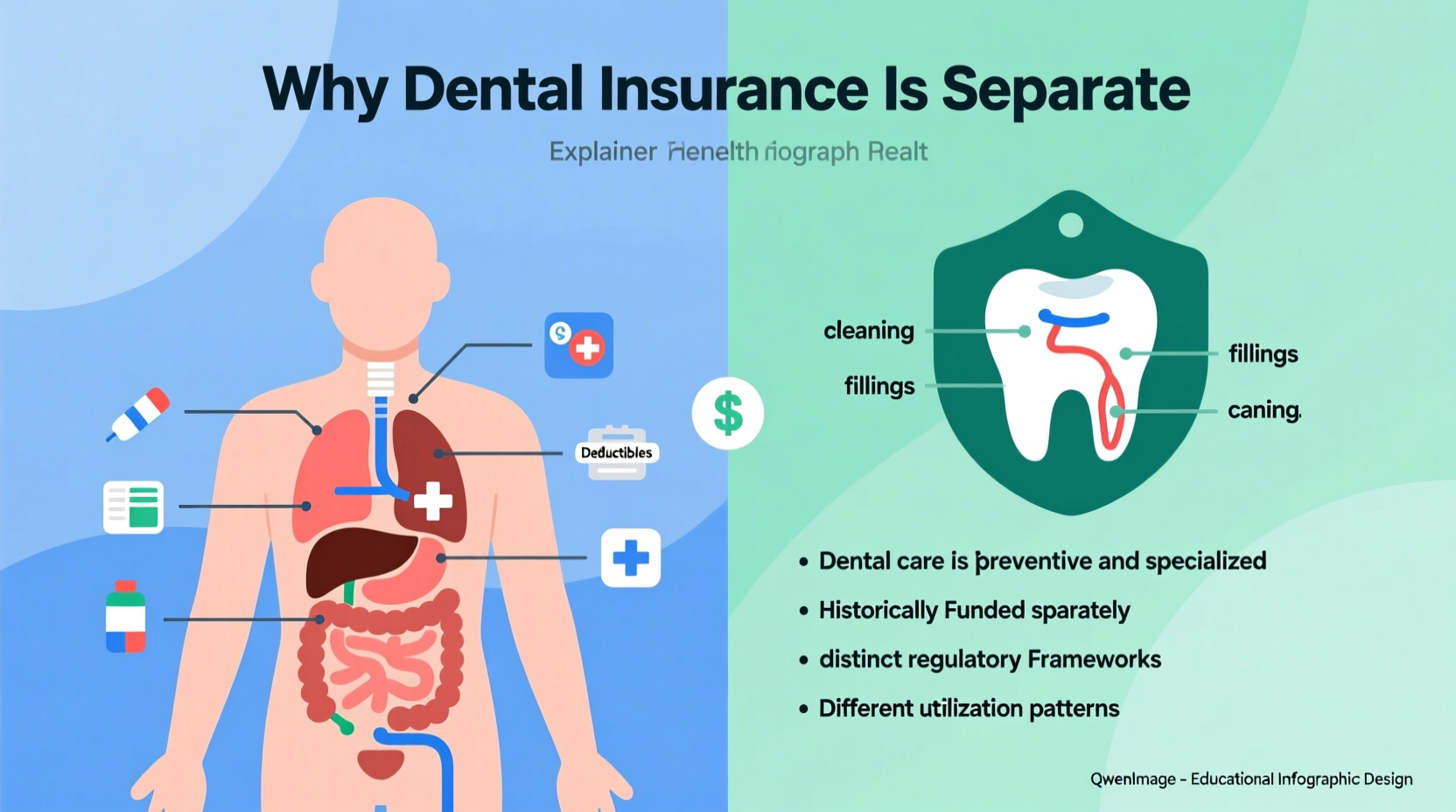

In the United States, most people receive medical care and dental care through entirely different insurance systems. While a single health plan may cover everything from annual physicals to emergency surgeries, dental visits—such as cleanings, fillings, or root canals—are typically handled by a separate policy. This division often confuses patients, especially when they expect routine dental services to be included in their general health benefits. The separation isn’t arbitrary; it stems from historical, structural, and economic factors that have shaped the American healthcare system over more than a century.

Understanding why dental insurance remains distinct from medical coverage helps consumers make informed decisions about their benefits, anticipate out-of-pocket costs, and advocate for better integration in the future. It also highlights opportunities for improvement in how oral health is treated within broader wellness frameworks.

Historical Roots of the Divide

The separation between dental and medical care dates back to the 19th century. At the time, dentistry was not considered part of mainstream medicine. Dental procedures were often performed by barbers, blacksmiths, or self-taught practitioners rather than licensed physicians. Even as formal dental schools emerged—starting with the Baltimore College of Dental Surgery in 1840—dentistry evolved as its own profession, with separate training, licensing, and practice standards.

When employer-sponsored health insurance began expanding during World War II, dental care was largely excluded. Employers added dental benefits later, in the 1950s and 1960s, as a way to attract talent. These plans were designed independently, using different networks, billing codes (CDT codes vs. CPT codes), and reimbursement models. Once established, this bifurcated system became entrenched in both public and private insurance markets.

“Dentistry grew up alongside medicine but never merged into it. That institutional independence created parallel systems that still operate separately today.” — Dr. Linda Greenwall, Oral Health Policy Researcher, Columbia University

Different Coverage Models and Cost Structures

Medical and dental insurance differ significantly in structure and philosophy. Health insurance generally follows an illness-based model: premiums are pooled, and high-cost events (like hospitalizations or chronic disease management) are covered comprehensively. In contrast, dental insurance operates more like a prepaid benefits plan with strict annual maximums, waiting periods, and tiered coverage.

For example, most dental plans use a 100-80-50 breakdown:

- Preventive care (cleanings, exams): 100% covered

- Basic procedures (fillings, extractions): 80% covered

- Major work (crowns, root canals): 50% covered

This contrasts sharply with medical insurance, where preventive services are also fully covered under the Affordable Care Act, but major treatments are covered at higher rates and without low annual caps. Many dental plans cap benefits at $1,000–$1,500 per year—easily exceeded by a single complex procedure.

Why Integration Has Been Slow

Despite growing recognition of the link between oral and systemic health—periodontal disease is associated with diabetes, heart disease, and adverse pregnancy outcomes—integration remains limited. Several barriers persist:

- Separate Provider Networks: Dentists are not typically part of medical provider directories, making coordination difficult.

- Different Billing Systems: Medical claims use ICD and CPT codes; dental uses CDT and ADA codes. Interoperability is poor.

- Reimbursement Disparities: Dental procedures are reimbursed at lower rates, discouraging integration with higher-paying medical practices.

- Lack of Incentives: Payers (insurers and employers) see little financial motivation to merge plans unless cost savings are clear.

Some integrated models exist, particularly in Medicaid managed care organizations and accountable care organizations (ACOs), where coordinated care improves patient outcomes. However, these remain exceptions rather than the norm.

Real Example: A Missed Opportunity in Chronic Care

Consider Maria, a 58-year-old woman with type 2 diabetes and gum disease. Her primary care physician monitors her HbA1c levels and prescribes medication, but her dental issues are managed separately. She avoids seeing a dentist due to high copays and a $1,200 annual limit on her dental plan. Over time, her untreated periodontitis worsens, leading to elevated blood sugar and more frequent medical visits. If her dental and medical providers had shared records and coordinated treatment, early intervention could have reduced her overall healthcare costs and improved her quality of life.

Comparing Key Differences Between Dental and Health Insurance

| Feature | Health Insurance | Dental Insurance |

|---|---|---|

| Primary Focus | Treatment of illness and injury | Prevention and maintenance of oral health |

| Annual Maximum | Rarely capped (high deductibles instead) | Typically $1,000–$1,500 |

| Waiting Periods | Uncommon | Common (3–12 months for major work) |

| Billing Codes | CPT, ICD-10 | CDT (ADA) |

| Network Overlap | Hospitals, clinics, specialists | Standalone dental offices |

| Integration with Medical Records | Standard (EHR systems) | Limited or nonexistent |

Practical Tips for Navigating Dual Coverage

Until dental and medical insurance become more unified, patients must manage both systems effectively. Here’s how:

Checklist: Maximizing Your Dental Benefits

- Review your plan’s annual maximum and utilization history

- Schedule preventive visits every six months to stay within covered tiers

- Ask for a detailed treatment plan and pre-authorization for major work

- Confirm whether your dentist is in-network to avoid surprise bills

- Track expiration dates for benefits—most do not roll over

- Discuss payment plans for procedures exceeding your annual limit

Frequently Asked Questions

Does the Affordable Care Act include dental coverage?

The ACA requires pediatric dental coverage as one of the ten essential health benefits, but adult dental is not mandatory. Some marketplace plans offer it as a standalone option or embedded benefit, but many do not.

Can I use my HSA or FSA for dental expenses?

Yes. Both Health Savings Accounts (HSA) and Flexible Spending Accounts (FSA) can be used for qualified dental treatments, including orthodontia and cosmetic procedures deemed medically necessary (e.g., after trauma).

Why don’t all health plans cover root canals or crowns?

Dental plans categorize these as “major” services and apply lower reimbursement rates to control costs. Because dental insurance operates on a benefits design rather than risk pooling, insurers limit exposure through tiered coverage and annual caps.

Looking Ahead: Toward Integrated Care

The future of healthcare may lie in greater integration of dental and medical services. Pilot programs in states like Oregon and Massachusetts have shown that combining dental screenings with primary care visits reduces long-term costs and improves outcomes for high-risk populations. Electronic health record vendors are beginning to support dual coding, and value-based payment models are incentivizing holistic care.

Employers and insurers are also exploring bundled offerings. For instance, some companies now provide “total health” plans that include tele-dentistry, preventive oral screenings, and shared data platforms. As evidence mounts that oral health impacts overall well-being, pressure will grow to dismantle outdated silos.

“We treat the mouth as if it’s disconnected from the body, but biology doesn’t work that way. Real healthcare reform must include dental equity.” — Dr. Raul Garcia, Former Chief Dental Officer, U.S. Public Health Service

Take Action Today

While systemic change takes time, individuals can take steps now. Review your current dental coverage, communicate with both your dentist and doctor about interconnected health concerns, and advocate for inclusive policies at work or through community health initiatives. Share this knowledge with others who may not realize how deeply oral health affects overall wellness. The path to whole-person care starts with awareness—and action.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?