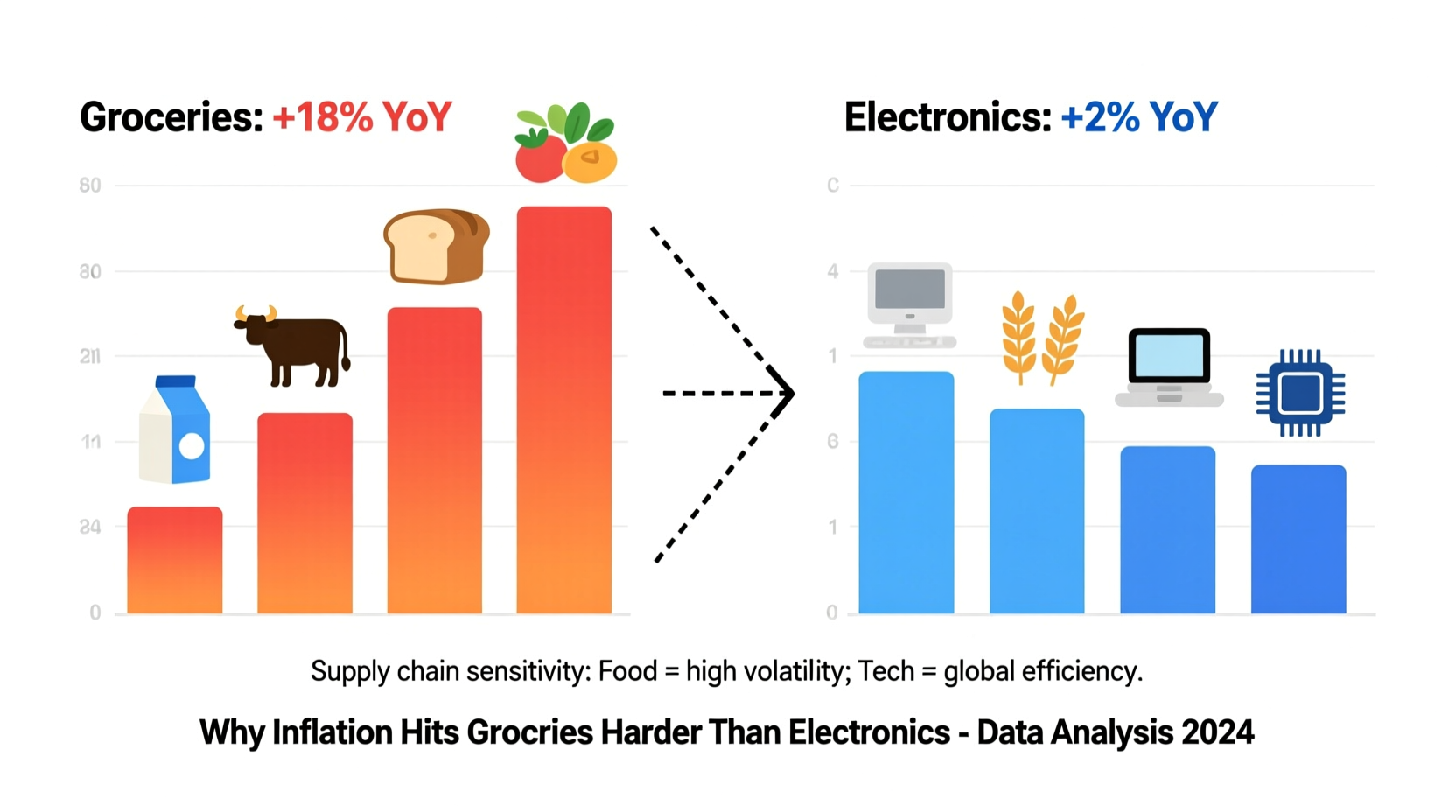

Inflation has been a dominant economic theme in recent years, but its impact isn’t felt equally across all sectors. While consumers may notice rising prices on almost everything, the sharp increase in grocery bills stands out compared to the relatively stable or even declining prices of many electronics. This disparity raises an important question: why does inflation seem to hit the grocery aisle harder than the tech store? The answer lies in fundamental differences in production, supply chain resilience, consumer demand behavior, and global market structures.

Understanding this divergence isn't just about economics—it affects household budgets, spending habits, and long-term financial planning. By examining the structural forces behind food and electronics pricing, we can better anticipate future trends and make smarter purchasing decisions.

Supply Chain Complexity and Vulnerability

The journey from farm to fork is vastly different from that of a smartphone from factory to shelf. Grocery supply chains are inherently more fragile due to their dependence on biological inputs—crops grow only under specific conditions, livestock require feed and care, and both are vulnerable to weather, pests, and disease.

In contrast, electronics rely on manufactured components produced in highly controlled environments. While disruptions like semiconductor shortages during the pandemic did cause temporary price spikes, these were often mitigated through inventory management, automation, and diversified sourcing over time.

| Factor | Grocery Supply Chain | Electronics Supply Chain |

|---|---|---|

| Production Cycle | Seasonal, weather-dependent (months to years) | Continuous, factory-based (days to weeks) |

| Storage & Shelf Life | Limited; perishable goods spoil quickly | Long-term; components can be stored for months |

| Transportation Sensitivity | Refrigeration required; time-sensitive | Durable; less sensitive to delays |

| Input Cost Volatility | High (fuel, fertilizer, labor) | Moderate (metals, chips, energy) |

When inflation drives up fuel and fertilizer costs, those increases are passed directly into food production. A gallon of diesel used in harvesting or transporting milk translates quickly into higher retail prices. Electronics, while not immune, benefit from economies of scale and long-term contracts that buffer short-term input cost swings.

Demand Elasticity and Consumer Behavior

Elasticity—the degree to which demand changes in response to price—is a key factor in how inflation manifests. Groceries are inelastic: people must eat regardless of price. Even if milk doubles in cost, most households still buy it. This gives producers and retailers more leeway to pass on cost increases without losing significant sales volume.

Electronics, however, are largely elastic. If smartphones become too expensive, consumers delay upgrades or switch to cheaper models. Companies like Apple and Samsung respond by offering tiered product lines or extending support for older devices to maintain market share.

This behavioral difference means food producers face less pressure to absorb inflationary costs themselves. In contrast, electronics manufacturers often absorb margin losses or innovate to reduce per-unit costs rather than risk losing customers.

“Food is non-negotiable spending. When inflation hits, households cut discretionary purchases first—electronics, travel, dining out—before touching groceries.” — Dr. Lena Patel, Senior Economist at the Brookings Institution

Global Trade and Geopolitical Exposure

Grocery markets are deeply affected by regional instability and trade restrictions. The war in Ukraine disrupted wheat, sunflower oil, and fertilizer exports, sending shockwaves through global food prices. Droughts in the Horn of Africa, floods in Pakistan, and export bans from India on rice have all contributed to volatility.

While electronics also depend on global supply chains—especially rare earth metals and semiconductors—manufacturers have spent decades building redundancy. For example, after U.S.-China tensions disrupted chip supplies, companies shifted production to Vietnam, Malaysia, and India. Additionally, many electronic components are fungible and easily substituted.

Foods, particularly fresh produce and animal proteins, are far less substitutable. You can’t swap Argentine beef with Korean beef without logistical and regulatory hurdles. This lack of flexibility amplifies inflation’s impact on grocery shelves.

Mini Case Study: Wheat Prices and Bread Costs (2022–2023)

In early 2022, Russia’s invasion of Ukraine sent global wheat futures soaring by over 40% within weeks. Ukraine and Russia together account for nearly 30% of global wheat exports. As shipping routes froze and insurance costs spiked, flour prices rose sharply.

By mid-2022, a loaf of bread in the U.S. had increased by 18% year-over-year, according to the Bureau of Labor Statistics. In Egypt, which imports 85% of its wheat from the region, the government had to expand subsidies to prevent social unrest.

In contrast, despite simultaneous inflation, laptop prices remained stable or declined slightly. Dell and HP absorbed higher component costs by streamlining logistics and reducing marketing spend, knowing that price sensitivity among buyers was high.

This case illustrates how localized agricultural shocks can ripple through food systems globally, while electronics firms insulate consumers through operational agility.

Technological Advancement vs. Natural Limits

One of the most overlooked reasons for the price gap is the role of innovation. Electronics benefit from Moore’s Law—the observation that computing power doubles approximately every two years while costs halve. Even amid inflation, continuous improvements in efficiency, miniaturization, and manufacturing keep downward pressure on prices.

Smartphones today offer more features at lower real prices than a decade ago. TVs, once luxury items, are now affordable for most households due to advances in LCD and OLED technology.

Grocery production lacks such exponential progress. Crop yields improve incrementally—around 1–2% per year—due to selective breeding and precision farming. But these gains are increasingly offset by climate change, soil degradation, and water scarcity. There’s no “Moore’s Law” for tomatoes or chicken.

Furthermore, labor costs in agriculture have risen faster than in tech manufacturing. Farm workers, truck drivers, and grocery clerks are subject to minimum wage laws and union negotiations, pushing up operating expenses that get passed to consumers.

Pricing Strategies and Retail Markup Practices

Retailers treat groceries and electronics very differently when adjusting prices. Grocery stores operate on thin margins—typically 1–3%—so even small cost increases require immediate price adjustments to remain profitable.

Electronics retailers, on the other hand, often use loss leaders—selling certain models below cost to attract customers who may then purchase accessories or warranties. This strategy allows them to maintain price stability even during inflationary periods.

Additionally, electronics benefit from rapid inventory turnover and promotional cycles. Black Friday, Prime Day, and back-to-school sales create predictable discount windows that help manage consumer expectations. Groceries don’t have equivalent events. There’s no “Prime Day for Pasta,” so price hikes feel more abrupt and unavoidable.

Checklist: How to Mitigate Inflation’s Impact on Your Household Budget

- Buy groceries in bulk when possible, especially non-perishables like rice, beans, and canned goods.

- Switch to store brands—they’re often 20–40% cheaper than national brands with similar quality.

- Plan meals weekly to reduce waste and avoid impulse buys.

- Delay electronics upgrades unless necessary; extend device life with cases and screen protectors.

- Compare refurbished electronics from certified sellers—often come with warranties at 30–50% off.

- Use cashback apps or credit card rewards for grocery shopping to offset rising costs.

- Shop later in the day when stores mark down perishable items nearing expiration.

Expert Insight: The Role of Speculation and Market Structure

Financial markets also play a role. Agricultural commodities are traded on exchanges like corn, soybeans, and sugar. Speculative trading can amplify price swings during uncertain times, making food prices more volatile than they might otherwise be.

“Commodity speculation doesn’t change the fundamentals, but it can accelerate price movements,” says Michael Tran, Director of Energy Research at RBC Capital Markets. “When investors flock to ‘safe’ assets during crises, they sometimes pile into food commodities, creating artificial demand and inflationary pressure.”

Electronics, in contrast, aren’t subject to speculative trading. You can’t buy a futures contract on iPhone components the way you can on wheat. Their prices are determined more by corporate strategy and competition than market sentiment.

FAQ

Why haven’t electronics prices gone up during inflation?

While some components faced temporary shortages (e.g., GPUs during the crypto boom), long-term trends in automation, global manufacturing scale, and planned obsolescence allow companies to maintain or reduce prices. Competition keeps margins tight, forcing innovation over price hikes.

Are grocery prices expected to keep rising?

Yes, but at a slowing pace. The USDA projects food-at-home prices to rise 2.5–3.5% annually over the next two years, driven by persistent labor and transportation costs. Climate-related disruptions could cause short-term spikes.

Can I really save money buying generic electronics?

Absolutely. Many store-brand headphones, chargers, and smart home devices are made in the same factories as name brands. Look for certifications like “Made for iPhone” or IEEE standards to ensure compatibility and safety.

Conclusion: Navigating the New Normal

The uneven impact of inflation across grocery and electronics markets reflects deeper structural realities—not just of economics, but of biology, technology, and human behavior. Food, as a basic necessity with complex, fragile supply chains, will always be more vulnerable to cost pressures. Electronics, powered by relentless innovation and global scale, enjoy built-in defenses against inflation.

This doesn’t mean consumers are powerless. By understanding these dynamics, shoppers can make informed choices: buying seasonal produce, embracing refurbished tech, and leveraging store loyalty programs. Awareness turns inflation from a passive burden into an active challenge—one that can be managed with knowledge and strategy.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?