Rising rent, soaring grocery bills, and stagnant wages have made daily life increasingly unaffordable for millions. Across major cities and even smaller towns, people are asking: why is it so expensive to live? The answer lies in a complex web of economic forces, policy decisions, and global trends that converge to shape the modern cost of living. Understanding these underlying factors isn't just about awareness—it's essential for making informed financial choices and advocating for systemic change.

Housing: The Primary Driver of High Living Costs

No single factor impacts the cost of living more than housing. In urban centers like San Francisco, New York, London, and Sydney, median rents consume over half of the average resident’s income. Even in less prominent markets, housing prices have outpaced wage growth for decades.

Several dynamics contribute to this crisis:

- Supply shortages: Zoning laws, construction delays, and NIMBYism (Not In My Backyard) restrict new housing development, especially affordable units.

- Investor demand: Institutional investors and foreign buyers treat real estate as an asset class, inflating prices beyond what local residents can afford.

- Urbanization: More people are moving to cities for jobs and amenities, increasing competition for limited space.

Inflation and Everyday Expenses

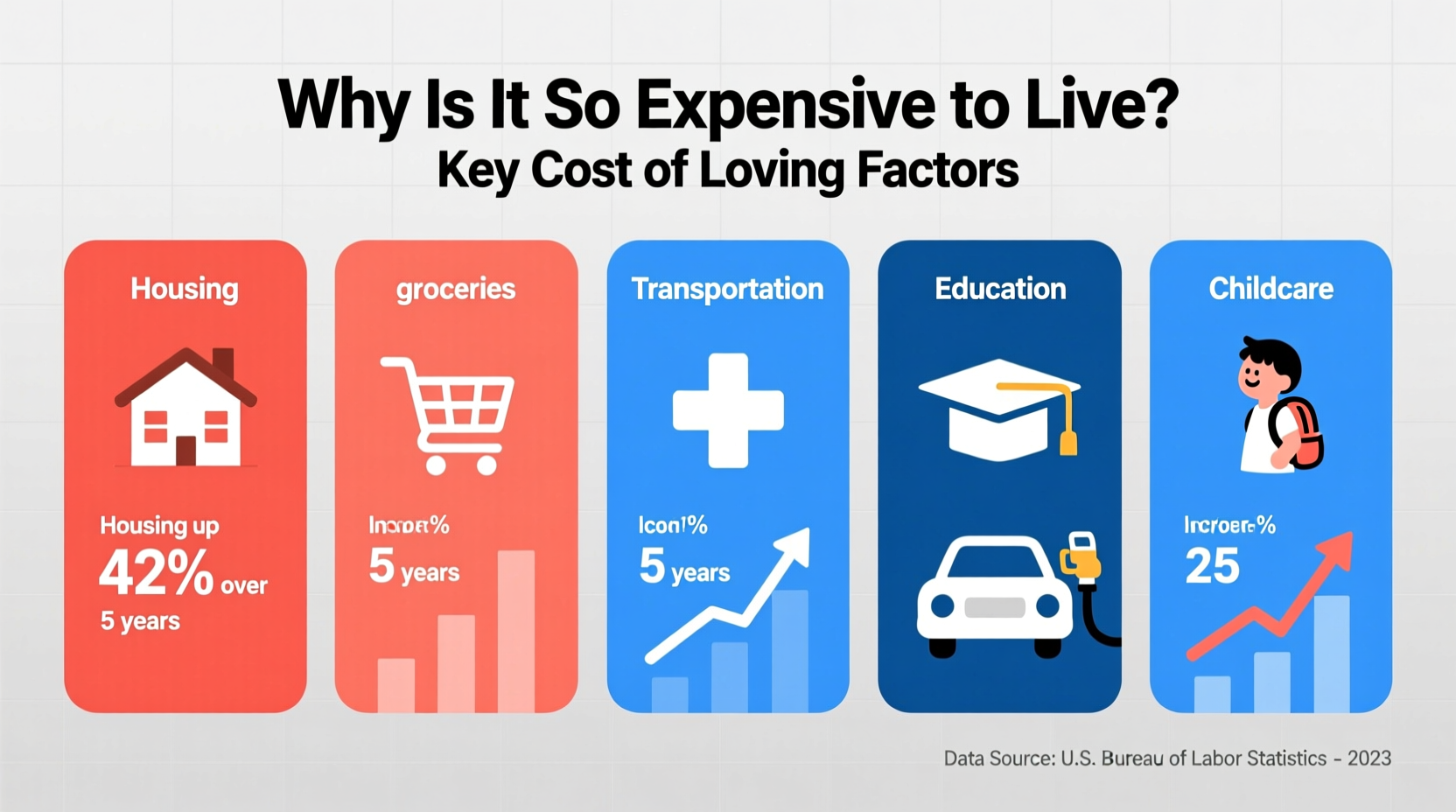

While housing dominates budgets, inflation has pushed up the price of nearly everything else. From groceries to transportation, household essentials now cost significantly more than they did just five years ago.

The U.S. Bureau of Labor Statistics reported that food prices rose 11% between 2021 and 2023—the largest increase in over four decades. Similarly, energy costs fluctuate with geopolitical tensions and supply chain disruptions, directly affecting heating, cooling, and fuel bills.

| Expense Category | Avg. Annual Increase (2020–2023) | Primary Causes |

|---|---|---|

| Housing | 7.2% | Low supply, investor demand, urban migration |

| Food | 5.8% | Climate events, labor shortages, supply chains |

| Healthcare | 4.5% | Administrative overhead, drug pricing, insurance models |

| Transportation | 6.1% | Fuel volatility, vehicle scarcity, maintenance costs |

“Housing is the anchor of the cost-of-living crisis. When rent consumes 50% of your paycheck, every other expense becomes a trade-off.” — Dr. Lena Patel, Urban Economist at Columbia University

Wage Stagnation vs. Rising Productivity

Despite consistent gains in worker productivity, wages have not kept pace. Between 1979 and 2020, U.S. productivity grew by 61.8%, while hourly compensation increased by only 17.5%, according to the Economic Policy Institute.

This disconnect means workers are producing more value but receiving a shrinking share of it. Meanwhile, corporate profits and executive pay have surged. The result? A growing affordability gap where even full-time employment doesn’t guarantee financial stability.

Minimum wage levels in many regions haven’t been adjusted for inflation in years. For example, the federal minimum wage in the U.S. remains $7.25 per hour—unchanged since 2009. At that rate, a full-time worker earns just $15,080 annually, far below the poverty line for a family of two.

Mini Case Study: Maria’s Budget in Austin, Texas

Maria works 40 hours a week as a medical assistant, earning $18/hour—above minimum wage but not enough to keep up with Austin’s rapid gentrification. Her monthly take-home pay is about $2,800 after taxes.

- Rent: $1,400 (50% of income)

- Groceries: $400

- Car payment & gas: $350

- Health insurance: $250

- Utilities: $180

- Phone & internet: $120

- Remaining: $100 for emergencies, savings, or leisure

Maria represents millions who are “working poor”—employed full time yet living paycheck to paycheck. One unexpected expense could push her into debt.

Healthcare and Education: Hidden Financial Burdens

In countries without universal healthcare, medical expenses remain a leading cause of bankruptcy. Even with insurance, high deductibles, co-pays, and prescription costs add up quickly. A single emergency room visit can cost thousands, regardless of outcome.

Similarly, education costs have skyrocketed. In the U.S., average tuition at public four-year institutions has more than tripled since 1990, after adjusting for inflation. Student loan debt now exceeds $1.7 trillion nationally, delaying homeownership, marriage, and retirement for millions.

Geographic Disparities and Regional Pressures

Cost of living varies dramatically by location. While nominal salaries may be higher in cities, purchasing power often declines due to inflated prices. For instance, a salary of $80,000 in rural Kansas goes much further than the same income in Manhattan.

Remote work has shifted some dynamics, enabling people to relocate to lower-cost areas. However, this influx has also driven up prices in previously affordable towns, from Asheville, NC, to Boise, ID. Gentrification follows mobility, pushing long-term residents out.

Checklist: Reducing Personal Cost of Living Pressure

- Evaluate housing options: Can you downsize, move farther from the city, or find a roommate?

- Negotiate bills: Call providers to lower cable, internet, or phone rates.

- Cook at home: Reduce dining-out frequency; meal prep weekly.

- Use public transit or carpool: Cut fuel and parking costs.

- Shop generic brands: Often equivalent quality at lower prices.

- Review subscriptions: Cancel unused streaming services or memberships.

- Build a small emergency fund: Even $500 can prevent debt from minor crises.

FAQ

Why hasn’t my salary increased if everything costs more?

Wage increases often lag behind inflation, especially in non-unionized sectors. Employers may offer minimal raises despite rising profits, leaving employees absorbing cost increases. Additionally, many companies use performance-based adjustments rather than automatic cost-of-living increases.

Is moving to a cheaper city worth it?

It can be, but consider job availability, remote work flexibility, and relocation costs. Some lower-cost areas have fewer healthcare facilities, public services, or career opportunities. Run a full budget comparison before deciding.

How do interest rates affect the cost of living?

Higher interest rates increase borrowing costs for mortgages, car loans, and credit cards. They also slow economic activity, which can lead to job uncertainty. Conversely, low rates can fuel asset bubbles, making housing and investments less accessible to average earners.

Conclusion: Taking Action in an Expensive World

The high cost of living isn’t inevitable—it’s the result of policy choices, market structures, and global economic shifts. While individuals can adopt smarter spending habits and seek better-paying jobs, lasting change requires collective action: building affordable housing, strengthening labor rights, expanding access to healthcare and education, and reforming tax systems.

You don’t have to accept financial strain as normal. Start by auditing your expenses, advocating for fair wages, and supporting local initiatives that promote affordability. Share your experiences, vote for housing-forward policies, and join community efforts to make living costs sustainable for everyone.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?