When you make a credit card payment—whether it's toward your monthly bill, a purchase, or a balance transfer—it’s natural to expect that the transaction will appear immediately in your account. But sometimes, nothing shows up. No confirmation. No pending status. Just silence. This can be unsettling, especially if you're trying to avoid late fees, manage cash flow, or track your spending. The good news is, there are logical explanations for why your credit card payment isn’t showing as a pending transaction—and most of them are temporary.

This guide breaks down the mechanics behind pending transactions, explains common causes for delays, and gives you actionable steps to verify whether your payment went through. Whether you paid online, by phone, or through a third-party app, understanding this process can save you stress and protect your credit score.

How Pending Transactions Work on Credit Cards

When you initiate a credit card payment, it doesn’t instantly reflect in your available balance. Instead, it enters a \"pending\" state—a temporary placeholder indicating that the transaction has been initiated but not yet fully processed. During this phase, the bank verifies funds, confirms routing details, and prepares to settle the amount against your outstanding balance.

The timeline varies based on several factors: the type of payment (ACH, wire, instant transfer), the time of day it was made, the financial institutions involved, and even weekends or holidays. Most standard online payments via ACH (Automated Clearing House) take 1–3 business days to post, though they may appear as “pending” within minutes or hours.

It’s important to distinguish between:

- Pending transaction: A temporary record indicating the payment is being processed.

- Posted transaction: The finalized entry reflected in your statement and balance.

Not seeing a pending status doesn’t always mean the payment failed—but it does warrant attention, especially close to a due date.

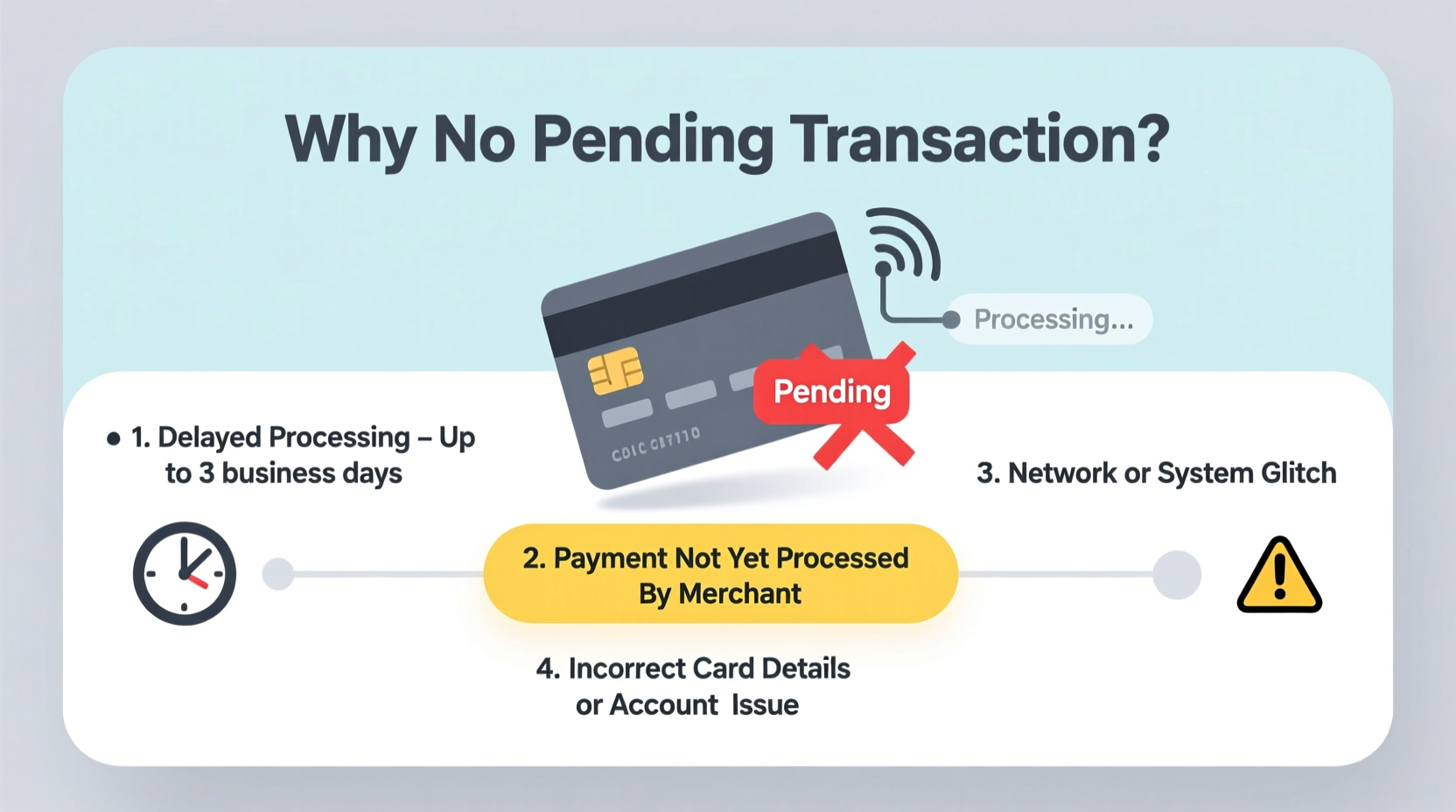

Common Reasons Why Your Payment Isn’t Showing as Pending

There are multiple points where a payment can get delayed before appearing in your account. Here are the most frequent culprits:

1. Processing Timeframes Based on Payment Method

Different payment methods have different processing speeds:

| Payment Method | Typical Pending Appearance | Full Posting Time |

|---|---|---|

| Online Bill Pay (ACH) | Within 1–24 hours | 1–3 business days |

| Instant Transfer (via app) | Immediately | Same day |

| Phone or Mail Payment | 24–72 hours | 3–5 business days |

| Third-Party Platforms (PayPal, Venmo) | Varies (often delayed) | Up to 5 days |

If you used standard online banking without expedited service, waiting 24 hours before expecting a pending status is reasonable.

2. Weekends and Bank Holidays

Banks and credit card issuers typically operate on business days—Monday through Friday. Payments made on weekends or public holidays won’t begin processing until the next business day. For example, a payment submitted Sunday evening might not start processing until Monday morning, delaying both the pending appearance and final posting.

3. Technical Glitches or System Maintenance

Occasionally, your bank or credit card provider may experience backend system outages, server maintenance, or synchronization errors. These can temporarily prevent transactions from appearing in your online portal—even if the payment was successfully sent. Refreshing the page or logging out and back in may resolve display issues.

4. Incorrect Account Information

If you accidentally entered the wrong credit card number, routing number, or payment amount, the transaction could be rejected or misrouted. In such cases, no pending transaction appears because the system either blocks it outright or routes it to another account (which requires investigation).

5. Third-Party Delays (e.g., Payment Aggregators)

Using platforms like PayPal, Zelle, or digital wallets adds an extra layer. These services often batch transactions and submit them later. So while PayPal may show a completed payment, your credit card issuer hasn’t yet received the data—creating a gap in visibility.

“Consumers often assume real-time syncing across all financial systems, but legacy infrastructure still governs much of U.S. banking. Delays under 48 hours are usually normal.” — Sarah Lin, Senior Financial Analyst at Consumer Finance Watch

Step-by-Step: What to Do When Your Payment Doesn’t Appear

If your payment hasn’t shown up as pending and you’re concerned about missing a deadline, follow this structured approach:

- Wait at least 24 hours (or until the next business day)

Especially if you paid after hours, on a weekend, or via standard ACH. Rushing to conclusions too early creates unnecessary stress. - Check your payment confirmation

Review your email inbox for a receipt from your bank or payment platform. Look for a transaction ID, timestamp, and recipient details. If there’s no confirmation, the payment may not have gone through. - Log into your bank and credit card portals separately

Sometimes, one system updates faster than the other. Verify whether the outgoing payment appears in your checking account activity—even if it’s not yet visible on your credit card side. - Call your credit card issuer’s customer service

Use the number on the back of your card. Provide the payment date, amount, and method. Ask specifically: “Was this payment received and is it being processed?” They can check internal logs beyond what’s visible online. - Request written confirmation

If the agent confirms receipt, ask for a case number or supervisor name. Keep notes. This protects you in case of disputes or late fee charges. - Monitor daily for 3 business days

If nothing appears after three full business days, escalate with a formal inquiry or dispute request.

Mini Case Study: Emma’s Missing $400 Payment

Emma scheduled a $400 credit card payment on Friday afternoon using her bank’s online bill pay system. She expected it to appear as pending by Saturday morning. It didn’t. By Sunday night, she was anxious—her due date was Monday, and her online account still showed zero activity.

She checked her bank statement and found the outgoing transfer had cleared her checking account on Friday. That meant the money was gone—but not credited to her credit card. On Monday morning, she called the credit card company. The representative confirmed they hadn’t received the payment yet but assured her that since it originated from bill pay, it would arrive by Wednesday at the latest. Because the payment left her account before the due date, they marked her account as current and waived any potential late fee.

The key takeaway: just because it’s not visible doesn’t mean it’s not coming. Verifying the source transaction and communicating proactively prevented damage to her credit history.

Do’s and Don’ts When a Payment Is Missing

| Action | Do | Don't |

|---|---|---|

| Timing | Wait 24–48 hours before panicking | Assume immediate failure right away |

| Verification | Check both sending and receiving accounts | Rely solely on one app or dashboard |

| Communication | Call customer service with transaction details | Yell or demand unrealistic fixes |

| Prevention | Schedule payments early; use calendar alerts | Wait until the due date to pay |

Frequently Asked Questions

Can a payment go through even if it’s not showing as pending?

Yes. Some banks only display transactions once they’re fully posted. Others show them as pending during processing. Absence of a pending tag doesn’t confirm failure—especially if your bank sent a confirmation email.

Will I be charged a late fee if the payment doesn’t appear on time?

Not necessarily. Most major credit card issuers consider the payment date—not the posting date—when determining late fees. If you paid by the due date via a traceable method, you can dispute any penalty. Always keep proof of payment.

What happens if my payment never posts?

If a payment truly fails to post after five business days, contact both your bank and credit card company. Request a trace on the transaction. If funds were debited from your account but not credited, this becomes a reconciliation issue that either institution must resolve—often resulting in a refund or manual credit.

Final Checklist: Confirming Your Payment Status

- ✅ Received a confirmation email or receipt from your bank?

- ✅ Verified the correct credit card and payment amount?

- ✅ Checked your checking account to see if funds were withdrawn?

- ✅ Waited at least 24 business hours since submission?

- ✅ Called the credit card issuer and documented the conversation?

- ✅ Marked your calendar to follow up in 48 hours if unresolved?

Conclusion: Stay Calm, Stay Informed, Take Action

Missing pending transactions are more common than most people realize—and rarely indicate disaster. Banking systems juggle millions of transactions daily, and slight delays are part of the process. However, awareness and proactive verification are your best defenses against late fees, credit score damage, or unnecessary stress.

Instead of reacting with alarm, use this moment to refine your payment habits. Schedule transfers earlier. Use direct auto-pay for critical bills. Keep digital records. And remember: visibility doesn’t always equal validity. A payment can be perfectly valid even if it’s invisible for a short time.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?