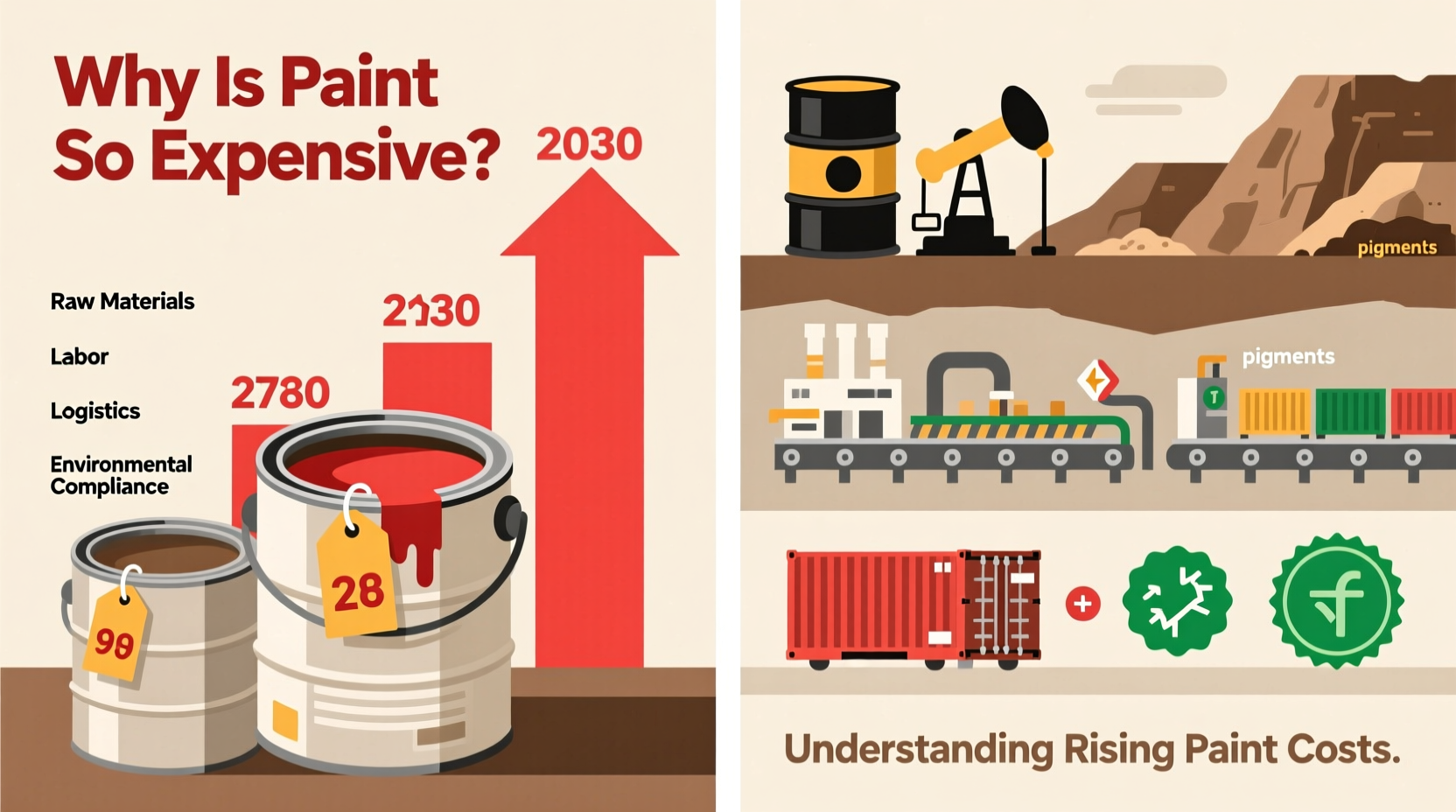

In recent years, both homeowners and professional painters have noticed a significant jump in the price of paint. What once cost $30 per gallon now regularly exceeds $50—even for standard interior latex options. This isn’t just inflation; it’s the result of complex economic, environmental, and industrial shifts converging across the global supply chain. Understanding these forces helps consumers make informed purchasing decisions and anticipate future trends in home improvement budgets.

The Hidden Drivers Behind Rising Paint Prices

Premium finishes and brand names aren’t solely responsible for today’s high paint prices. The increase stems from deeper structural changes in how paint is manufactured and distributed. Key components like resins, titanium dioxide, solvents, and packaging materials have all become more expensive due to fluctuating raw material markets and energy costs.

Titanium dioxide (TiO₂), one of the most critical ingredients in providing opacity and brightness, has seen substantial price hikes. Supply constraints from major producers—especially in China and Europe—coupled with increased global demand, have tightened availability. In 2022 alone, TiO₂ prices rose by over 20%, directly impacting formulation costs for manufacturers.

Additionally, acrylic resins—used in water-based paints for durability and adhesion—are derived from petrochemicals. As crude oil and natural gas prices surged following geopolitical disruptions and post-pandemic recovery, resin production became more costly. Since resins can account for up to 40% of a paint’s total material cost, even small increases here ripple through to retail pricing.

Supply Chain Disruptions and Manufacturing Challenges

The pandemic exposed vulnerabilities in global logistics that continue to affect industries reliant on just-in-time delivery. For paint manufacturers, delays in receiving key chemicals, pigments, and containers led to production slowdowns and inventory shortages. While some recovery has occurred, new challenges—including port congestion, labor shortages, and rising freight costs—have kept pressure on margins.

Paint production facilities also face regulatory and environmental hurdles. Stricter emissions standards require upgrades to manufacturing equipment, which translates into capital investment passed on to consumers. Some smaller regional manufacturers have exited the market altogether, reducing competition and contributing to price consolidation among larger brands.

“Raw material volatility has been unprecedented. We’ve had to adjust pricing multiple times a year just to keep pace.” — Mark Reynolds, Operations Director at Midwest Coatings Group

Energy Costs and Transportation Expenses

Paint is heavy and bulky, making shipping a major component of its final cost. Diesel fuel prices, which peaked in 2022 and remain elevated, significantly impact transportation logistics. A single truckload carrying 100 gallons of paint can incur hundreds of dollars more in freight charges than just three years ago.

Manufacturing itself is energy-intensive. Mixing, grinding, and packaging operations require large amounts of electricity and heat. With utility rates climbing across North America and Europe, factories must absorb higher operating expenses—or pass them along.

| Cost Factor | Pre-2020 Average | Current Estimate (2024) | % Increase |

|---|---|---|---|

| Acrylic Resin (per lb) | $1.10 | $1.75 | 59% |

| Titanium Dioxide (per lb) | $1.30 | $1.80 | 38% |

| Diesel Fuel (per gallon) | $2.75 | $4.10 | 49% |

| Average Premium Paint (per gallon) | $35 | $55 | 57% |

Brand Consolidation and Market Power

The paint industry has undergone significant consolidation over the past decade. Major corporations like Sherwin-Williams, PPG Industries, and Benjamin Moore dominate shelf space and influence wholesale pricing. With fewer competitors, especially in specialty and eco-friendly segments, there’s less incentive to engage in aggressive price competition.

These companies also invest heavily in research and development for low-VOC (volatile organic compound) formulas, enhanced durability, and mold resistance—features that justify premium pricing. While beneficial for performance and sustainability, such innovations come at a cost that filters down to consumers.

Independent retailers often struggle to negotiate favorable terms with these large suppliers, further limiting their ability to offer competitive pricing. Online discounters attempt to fill this gap but may lack local color-matching services or expert advice, creating a trade-off between savings and service quality.

Real-World Impact: A Contractor’s Perspective

Carlos Mendez, a painting contractor based in Denver, Colorado, has operated his business for over 15 years. In 2021, he typically paid $38 per gallon for high-quality exterior acrylic. By 2024, that same product now costs $58—a $20 increase per gallon. On a typical two-story home requiring 40 gallons, this adds $800 to the job’s material cost alone.

To maintain profitability without alienating clients, Carlos adjusted his quoting model. He now includes a “material escalation clause” in contracts, allowing for mid-project price adjustments if input costs rise unexpectedly. He’s also shifted client conversations toward long-term value: “I explain that spending $55 instead of $35 per gallon might save them repainting five years sooner,” he says.

This shift reflects a broader trend: professionals and DIYers alike are reevaluating what they’re paying for—not just paint, but longevity, coverage, and finish quality.

Smart Strategies for Managing Paint Costs

While you can’t control global commodity markets, you can adopt smarter purchasing and application practices to reduce overall expenditure.

- Plan projects strategically: Schedule painting during slower seasons (November–February) when stores often run promotions.

- Compare unit prices: Check cost per square foot of coverage, not just per gallon. A pricier paint that covers better may be cheaper in the long run.

- Buy only what you need: Use online calculators to estimate quantities accurately and avoid waste.

- Consider store brands: Retailers like Home Depot (Behr) and Lowe’s (Valspar) offer quality alternatives to national brands at lower price points.

- Maintain surfaces: Proper prep work extends paint life, delaying the need for full repaints.

Frequently Asked Questions

Why has paint gotten more expensive if I’m not buying premium brands?

Even standard-grade paints rely on the same core raw materials as premium ones. When resin or pigment costs rise, manufacturers adjust pricing across all product tiers. Basic formulations may see smaller percentage increases, but no segment is immune to supply chain pressures.

Will paint prices ever go back down?

It’s unlikely they’ll return to pre-2020 levels. Structural changes—higher baseline energy costs, tighter environmental regulations, and ongoing supply concentration—suggest a new pricing floor has been established. However, periods of stable raw material markets could slow or pause further increases.

Is expensive paint worth it?

Often, yes. Higher-priced paints typically contain more solids and binders, resulting in better coverage, fewer coats, longer lifespan, and easier cleaning. Over time, these benefits can offset the initial cost difference, especially in high-traffic or moisture-prone areas.

Conclusion: Making Informed Choices in a High-Cost Market

Rising paint costs reflect a confluence of global economic forces far beyond simple markup. From petrochemical dependencies to transportation realities and corporate market dynamics, the price on the shelf tells a much broader story. Awareness empowers consumers to shop smarter, prioritize quality where it matters, and plan projects with realistic expectations.

As material costs stabilize in the coming years, those who understand the \"why\" behind the price tag will be best positioned to make cost-effective, durable choices for their homes and businesses.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?