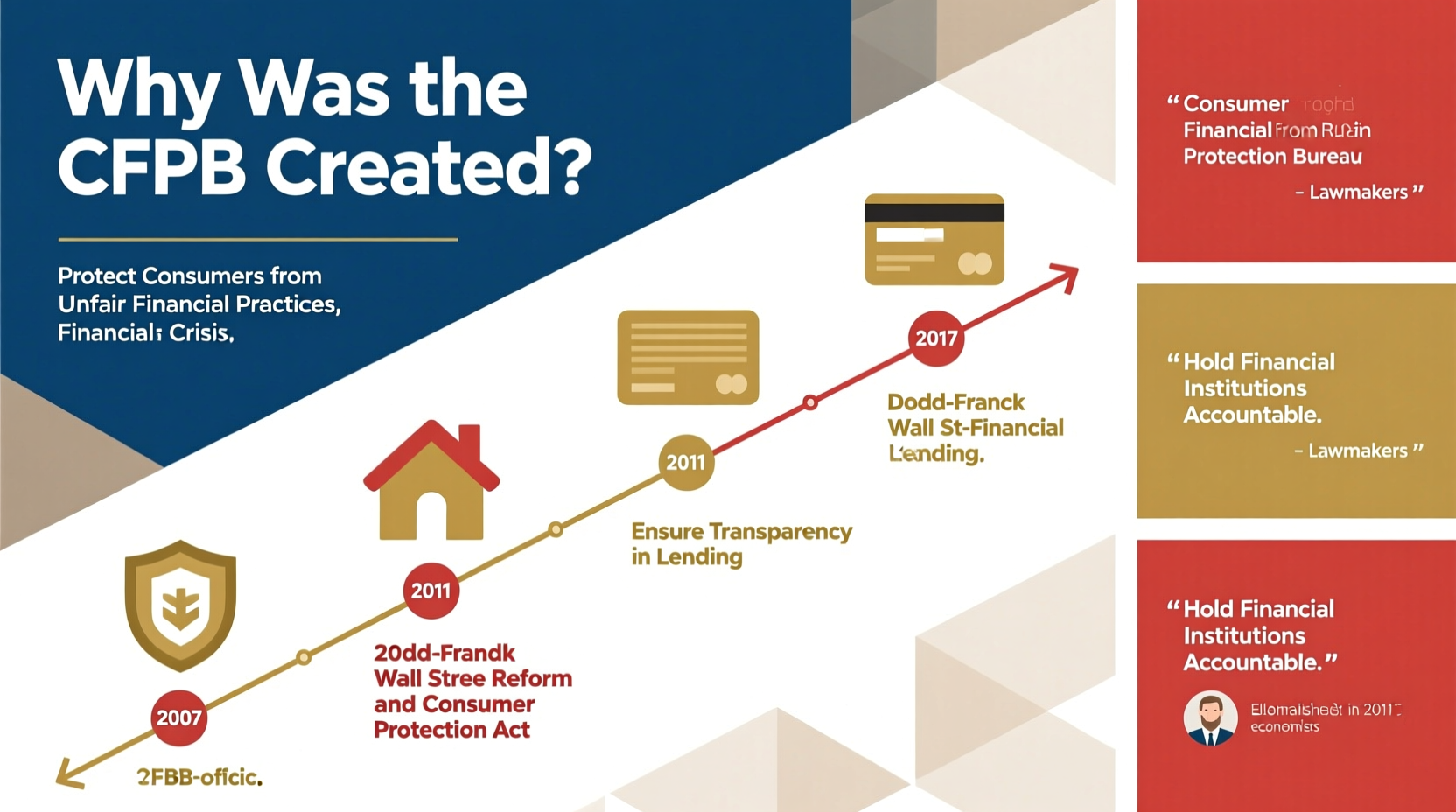

In the aftermath of the 2008 financial crisis, millions of Americans lost homes, jobs, and life savings due to predatory lending, misleading credit products, and a lack of transparency in financial services. In response, Congress passed the Dodd-Frank Wall Street Reform and Consumer Protection Act in 2010, which established the Consumer Financial Protection Bureau (CFPB). The creation of the CFPB marked a pivotal shift in how the United States regulates consumer finance, placing a renewed focus on protecting individuals from abusive practices and ensuring fair access to financial products.

The CFPB was not born in isolation—it emerged from decades of regulatory gaps, growing consumer debt, and mounting evidence that existing agencies were ill-equipped to safeguard everyday people. Understanding why the CFPB was created requires examining the economic conditions that led to its formation, the legislative intent behind it, and the ongoing role it plays in shaping a more equitable financial system.

The Historical Context: A Crisis That Demanded Change

Prior to 2008, consumer financial protection in the U.S. was fragmented across multiple federal agencies—such as the Federal Reserve, the Office of the Comptroller of the Currency (OCC), and the Federal Trade Commission (FTC)—each with overlapping responsibilities and limited enforcement power. This patchwork approach left consumers vulnerable to deceptive mortgage terms, high-interest payday loans, and unfair credit card practices.

The subprime mortgage crisis exposed these weaknesses dramatically. Lenders offered adjustable-rate mortgages with teaser rates that ballooned after a few years, often without fully disclosing risks. Many borrowers were steered into costly loan products they didn’t understand or qualify for. When housing prices fell and interest rates reset, defaults surged, triggering a global recession.

Economists and policymakers recognized that while Wall Street institutions were regulated for systemic risk, no single agency had the mandate or authority to protect individual consumers. The absence of a dedicated watchdog allowed harmful financial products to proliferate unchecked. It became clear that a new institution was needed—one solely focused on consumer interests.

“Before the CFPB, there was nobody whose primary job was to look out for consumers in the financial marketplace.” — Elizabeth Warren, Original Architect of the CFPB

The Legislative Birth of the CFPB

The Dodd-Frank Act, signed into law by President Barack Obama on July 21, 2010, formally created the CFPB. Title X of the act, known as the Consumer Financial Protection Act, granted the bureau broad authority to regulate consumer financial products and services, including:

- Mortgages

- Credit cards

- Student loans

- Payday loans

- Banking accounts

- Credit reporting

The CFPB was designed to consolidate rulemaking and enforcement powers previously scattered among seven different agencies. By centralizing oversight, the bureau could develop consistent standards, conduct research on consumer behavior, and take action against companies engaging in unfair, deceptive, or abusive acts or practices (UDAAP).

One of the most significant structural features of the CFPB is its independence. Funded through the Federal Reserve rather than congressional appropriations, it operates with greater autonomy than many other federal agencies. Critics have debated this design, but supporters argue it insulates the bureau from political pressure when enforcing consumer protections.

Core Purpose and Key Responsibilities

The official mission of the CFPB is “to make markets for consumer financial products and services work fairly for Americans, whether they are applying for a mortgage, choosing a credit card, or using any number of other financial products.” This mission breaks down into four main functions:

- Rulemaking: Develop clear, enforceable rules for financial institutions.

- Supervision: Monitor banks, credit unions, and non-bank entities (like payday lenders and debt collectors) to ensure compliance.

- Enforcement: Investigate violations and impose penalties when necessary.

- Consumer Education: Provide tools and resources to help people make informed financial decisions.

Since its inception, the CFPB has taken over 200 enforcement actions, returning more than $12 billion to affected consumers. Notable cases include:

- A $100 million penalty against Wells Fargo for opening unauthorized accounts.

- Action against Navient for failing borrowers with student loans.

- Cracking down on predatory auto-lending practices that targeted low-income communities.

How the CFPB Impacts Everyday Consumers

The bureau’s influence extends beyond legal actions. It has introduced standardized forms like the Know Before You Owe mortgage disclosures, making it easier for homebuyers to compare loan terms. It maintains a public database of consumer complaints, which helps identify emerging trends and holds companies accountable.

Additionally, the CFPB conducts extensive research on topics such as medical debt, credit scoring models, and fintech apps. These insights inform future regulations and help level the playing field for underserved populations.

Timeline of Major CFPB Milestones

Understanding the evolution of the CFPB reveals how its role has expanded despite political challenges:

| Year | Milestone |

|---|---|

| 2010 | Dodd-Frank Act establishes the CFPB; Elizabeth Warren appointed as special advisor to set up the bureau. |

| 2011 | Richard Cordray becomes first confirmed director after political standoff. |

| 2013 | Launches public Consumer Complaint Database. |

| 2016 | Issues rule to curb payday lending abuses (later rolled back under subsequent administration). |

| 2020 | Expands supervision to large non-bank fintech companies. |

| 2023 | Proposes ban on medical debt in credit reports, aiming to improve credit fairness. |

Challenges and Controversies

Despite its achievements, the CFPB has faced persistent opposition. Some lawmakers and industry groups argue it overreaches, stifles innovation, or concentrates too much power in a single agency led by one person. Legal battles have challenged its funding structure and rulemaking authority.

In 2018, the Supreme Court declined to dismantle the bureau but later, in 2020 (*Seila Law v. CFPB*), ruled that the president must have the power to remove the director at will—a modification to its original independent design.

Nonetheless, public support remains strong. Surveys show that a majority of Americans believe financial institutions need stricter oversight, and many appreciate having a centralized place to report problems.

Mini Case Study: Sarah’s Experience with Credit Reporting

Sarah, a teacher from Ohio, applied for a car loan only to be denied due to poor credit. Confused, she discovered her report included a $1,200 medical bill she never received—and had already been paid by insurance. After filing a complaint with the CFPB, the credit bureau investigated and removed the error within 30 days. Her score improved by 70 points, allowing her to secure financing at a fair rate.

This scenario illustrates how the CFPB’s complaint system empowers individuals. More than 70% of complaints receive a response from the company within 15 days, and many result in resolutions or corrections.

What You Can Do: A Consumer Action Checklist

The CFPB exists to serve you. Here’s how to make the most of its resources:

- ✅ Review your credit report annually at AnnualCreditReport.com.

- ✅ Use CFPB’s online tools like the Loan Simulator or Debt Payoff Calculator.

- ✅ File a complaint if a financial company misleads you or refuses to fix an error.

- ✅ Report suspected scams or unfair practices through the CFPB portal.

- ✅ Stay informed by subscribing to CFPB alerts and publications.

Frequently Asked Questions

What types of companies does the CFPB regulate?

The CFPB oversees banks, credit unions, payday lenders, debt collectors, mortgage servicers, credit reporting agencies, and increasingly, fintech firms and private student loan providers. Its jurisdiction applies to institutions offering consumer financial products, especially those with assets over $10 billion.

Can the CFPB help me get a refund or compensation?

While the CFPB doesn’t provide direct financial relief, it forwards complaints to companies and monitors their responses. In enforcement cases, it can require firms to pay redress to harmed consumers—often distributing funds through court-approved processes.

Is the CFPB still active today?

Yes. Under current leadership, the CFPB continues to prioritize issues like digital finance, racial equity in lending, overdraft fees, and buy-now-pay-later services. It remains a key player in shaping modern consumer financial policy.

Conclusion: A Guardian in Your Corner

The creation of the CFPB was a direct response to a broken system—one that prioritized profits over people. Today, it stands as the only federal agency with the sole mission of protecting consumers in the financial marketplace. Whether you're buying a home, managing debt, or simply checking your credit, the bureau offers tools, advocacy, and accountability that didn’t exist before 2010.

Knowledge is power. Take advantage of the CFPB’s free resources, speak up when something seems wrong, and encourage others to do the same. A fairer financial future starts with informed, empowered consumers.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?