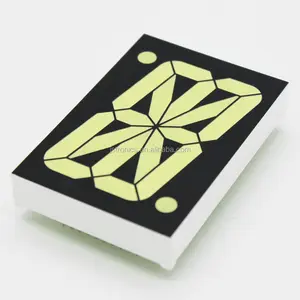

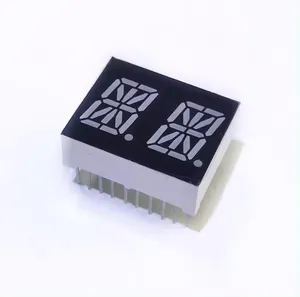

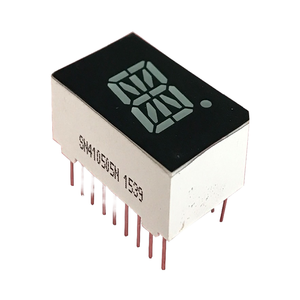

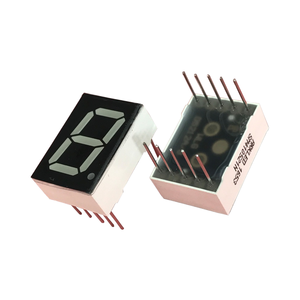

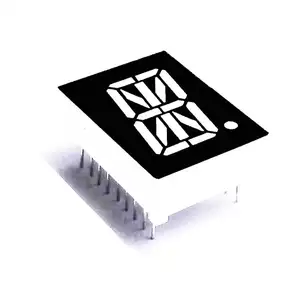

16 Segment Display Font

About 16 segment display font

Where to Find 16 Segment Display Font Suppliers?

China remains the central hub for 16 segment display font manufacturing, with key production clusters in Shenzhen and Dongguan offering specialized expertise in custom character displays. These regions host vertically integrated supply chains that support rapid prototyping and scalable production of COB (Chip-on-Board), STN, and TN LCD modules tailored for industrial instrumentation, consumer electronics, and embedded systems.

Suppliers in this ecosystem typically operate dedicated LCD fabrication lines with in-house capabilities spanning glass cutting, electrode patterning, sealing, and driver IC integration. The proximity of material suppliers—such as ITO glass, polarizers, and epoxy resins—enables lead times averaging 15–25 days for standard orders and 30–45 days for fully customized designs. Buyers benefit from localized logistics networks and established export channels, particularly through Shenzhen’s Yantian Port, which facilitates efficient global distribution.

How to Choose 16 Segment Display Font Suppliers?

Selecting reliable partners requires a structured evaluation based on technical capability, quality assurance, and transaction reliability:

Technical & Customization Capabilities

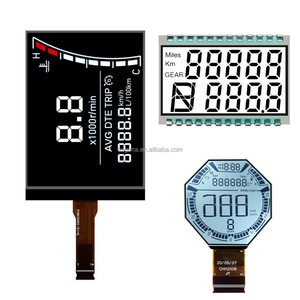

Prioritize suppliers offering customization across size, color (yellow-green, blue, or black mode), pin configuration, viewing angle, and font definition. Verified providers support COB integration, serial interface options (I²C, SPI), and sunlight-readable variants using STN or FSTN technologies. Confirm access to design tools for segment mapping and character library development, especially for non-Latin scripts or proprietary symbols.

Production Capacity and Quality Assurance

Assess infrastructure maturity through objective indicators:

- Minimum monthly output capacity exceeding 50,000 units

- In-house tooling and mold-making capabilities for rapid NPI (New Product Introduction)

- Compliance with RoHS and ISO 9001 standards as baseline quality benchmarks

Cross-reference online performance metrics such as on-time delivery rates (>97%) and reorder frequency to validate operational consistency.

Procurement Risk Mitigation

Utilize secure transaction mechanisms where available, particularly for initial engagements. Require detailed product specifications including contrast ratio, operating temperature range (-10°C to +60°C typical), and drive voltage. Conduct sample testing to verify optical clarity, segment uniformity, and long-term stability under continuous operation before scaling orders.

What Are the Best 16 Segment Display Font Suppliers?

| Company Name | Main Products | Customization Options | Min. Order Quantity | Avg. Unit Price (USD) | On-Time Delivery | Avg. Response Time | Reorder Rate | Online Revenue |

|---|---|---|---|---|---|---|---|---|

| Shenzhen Zhongheda Technology Co., Ltd. | LCD Modules (239), OLED/E-Paper Modules (112) | Segment code, COB, size | 1–9 pieces | $0.80–3.70 | 100% | ≤1h | <15% | US $30,000+ |

| Shenzhen Brilliant Crystal Technologic Co., Ltd. | LCD Modules (167), Character Displays (15) | Interface (I²C, SPI), readability | 300–3000 pieces | $1.70–17.00 | 100% | ≤3h | 100% | US $400+ |

| Shenzhen Genyu Optical Co., Ltd. | Custom LCD Panels, Monochrome Displays | Color, size, logo, packaging, graphic | 10–1000 pieces | $0.50–6.00 | 100% | ≤2h | 26% | US $230,000+ |

| Dongguan Houke Electronic Co., Ltd. | LED Segment Displays, Pin Configurations | Pin layout, brightness, LED color, PCB | 10–3000 pieces | $0.35–1.13 | 99% | ≤2h | 15% | US $360,000+ |

| MEEKEE CO., LTD. | Digital Signage, Smart Interactive Displays | Flexible screen, app control, USB interface | 1 box (pre-assembled unit) | $12.00–24.99 | 80% | ≤2h | <15% | US $1,000+ |

Performance Analysis

Shenzhen-based suppliers dominate responsiveness and low-MOQ flexibility, enabling prototyping at minimal volume. Shenzhen Zhongheda and Genyu Optical offer broad customization with MOQs starting at 10 units, ideal for R&D phases. In contrast, Shenzhen Brilliant Crystal stands out with a 100% reorder rate, indicating strong customer retention likely driven by consistent quality in standardized character modules despite higher MOQs (300+).

Dongguan Houke provides the lowest per-unit pricing ($0.35) for high-volume buyers, supported by robust production scalability and compliance with RoHS standards. MEEKEE differentiates with smart-controlled flexible LED arrays, though its lower on-time delivery rate (80%) suggests potential fulfillment risks. For mission-critical applications, prioritize suppliers with documented quality management systems and proven export experience to North America or EU markets.

FAQs

What is the typical MOQ for 16 segment display fonts?

MOQ varies significantly: prototype-friendly suppliers accept orders as low as 1–10 pieces, while high-efficiency manufacturers require 300–3000 units for cost-effective runs. Negotiation may reduce MOQs for recurring contracts.

How long does customization take?

Custom tooling and font rendering typically require 20–35 days, including design approval and sample validation. Rapid-turnaround suppliers can deliver pre-configured variants within 10–15 days.

Are 16 segment displays RoHS compliant?

Most reputable suppliers confirm RoHS compliance, particularly those targeting European markets. Request compliance documentation and batch-specific test reports to ensure regulatory alignment.

Can suppliers provide character mapping files?

Yes, leading vendors supply datasheets with segment addressing tables, ASCII mappings, and controller compatibility details (e.g., HD44780, ST7066). Custom font definitions can be programmed upon request.

What are common interface types for 16 segment displays?

Standard interfaces include parallel, I²C, and 3-wire SPI. Some models integrate driver ICs for direct microcontroller connection, reducing external component count in embedded applications.