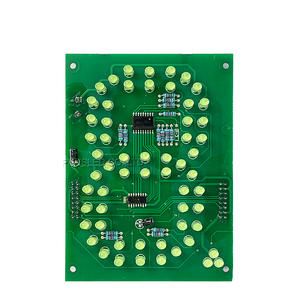

4 Digit 7 Segment Display Datasheet Pdf

About 4 digit 7 segment display datasheet pdf

Where to Find 4 Digit 7 Segment Display Suppliers?

China remains the global epicenter for LED display manufacturing, with key production hubs in Shenzhen, Dongguan, and Ningbo driving innovation and cost efficiency in 4-digit 7-segment displays. These regions host vertically integrated supply chains encompassing epitaxial wafer growth, chip packaging, and final assembly, enabling rapid prototyping and high-volume output. Shenzhen and Dongguan specialize in surface-mount device (SMD) and dual in-line package (DIP) LED modules, leveraging proximity to semiconductor material suppliers and electronics OEMs.

The industrial clusters support scalable production with average monthly outputs exceeding 500,000 units per facility. Integration of automated bonding and testing lines reduces defect rates and ensures consistent luminance across batches. Buyers benefit from localized component sourcing—such as GaAsP and AlGaInP die materials—and access to specialized packaging techniques including water-clear, diffused, and tinted epoxy encapsulation. Typical lead times range from 15–25 days for standard orders, with DIP configurations dominating inventory due to their compatibility with through-hole PCB mounting.

How to Choose 4 Digit 7 Segment Display Suppliers?

Evaluate potential partners using the following technical and operational criteria:

Technical Documentation & Compliance

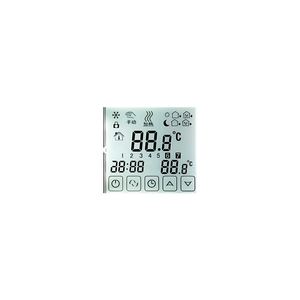

Confirm availability of comprehensive datasheets in PDF format detailing electrical characteristics (forward voltage, viewing angle, luminous intensity), pin configuration, multiplexing behavior, and thermal ratings. Verify compliance with RoHS and REACH directives for hazardous substance restrictions. For export to regulated markets, ensure test reports are available for EMC and environmental durability.

Production Capacity and Scalability

Assess infrastructure maturity through measurable indicators:

- Minimum factory area exceeding 2,000m² to support dedicated SMT and DIP production lines

- In-house mold and diffusion film customization capabilities for bespoke color, brightness, and lens optics

- Monthly production capacity above 300,000 units to accommodate bulk procurement

Cross-reference on-time delivery performance (target ≥96%) and response time metrics (ideally ≤8 hours) to gauge operational reliability.

Procurement and Transaction Security

Prioritize suppliers offering transparent pricing structures with clearly defined minimum order quantities (MOQs). Utilize secure transaction platforms that provide payment escrow and dispute resolution mechanisms. Request sample units to validate photometric performance against published specifications before scaling to full production runs.

What Are the Best 4 Digit 7 Segment Display Suppliers?

| Company Name | Location | Main Products (Listings) | On-Time Delivery | Avg. Response | Reorder Rate | Online Revenue | Min. Price (USD) | Lowest MOQ |

|---|---|---|---|---|---|---|---|---|

| Shenzhen Newshine Optics Co., Ltd. | Shenzhen, CN | LED Display, Digital Signage (Customization options) | 98% | ≤8h | 27% | $50,000+ | $0.20 | 1,000 pcs |

| Dongguan Asram Optoelectronic Co., Ltd. | Dongguan, CN | Digital Signage (158), LED Display (99) | 100% | ≤4h | - | - | $200/set | 1 pc/set |

| Ningbo Junsheng Electronics Co., Ltd. | Ningbo, CN | SMD LED (127), LED Display (88) | 96% | ≤8h | <15% | $10,000+ | $0.30 | 10 pcs |

| Hangzhou Sangao Optoelectronic Technology Co., Ltd. | Hangzhou, CN | LED Display (30), Digital Signage (16) | 100% | ≤20h | - | - | $0.17 | 1,000 pcs |

| Shenzhen Wanzhou Optoelectronics Co., Ltd. | Shenzhen, CN | LED Display (89), Digital Signage (69) | 100% | ≤6h | <15% | $170,000+ | $0.31 | 10,000 pcs |

Performance Analysis

Hangzhou Sangao offers the lowest unit pricing at $0.17, making it ideal for high-volume contracts requiring cost-optimized components. Dongguan Asram stands out for low-MOQ flexibility, accommodating single-unit or set-based purchases suitable for R&D and pilot testing despite higher absolute pricing. Shenzhen Newshine balances competitive pricing ($0.20) with strong reorder activity (27%), indicating customer satisfaction and consistent quality. Shenzhen Wanzhou demonstrates robust export volume (>$170K revenue) and fast response times, though its 10,000-piece MOQ limits suitability for small-scale buyers. Suppliers with 100% on-time delivery records—Asram, Sangao, and Wanzhou—should be prioritized for time-sensitive deployments.

FAQs

How to verify 4 digit 7 segment display supplier reliability?

Validate technical claims by requesting product datasheets in PDF format with measurable parameters such as forward current, viewing angle, and dominant wavelength. Confirm supplier track record via verifiable transaction history, on-time delivery rate, and third-party platform reviews. Conduct video audits to assess cleanroom standards, automated optical inspection (AOI) systems, and aging test procedures.

What is the typical sampling timeline for 7 segment displays?

Standard sample processing takes 7–14 days, depending on customization requirements. Non-custom units ship within one week, while modified configurations (e.g., specific color diffusion or logo printing) may extend to 20 days. Air freight adds 5–7 days for international delivery.

Can suppliers provide customized 4 digit 7 segment displays?

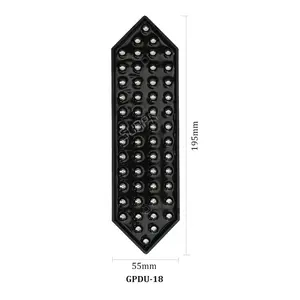

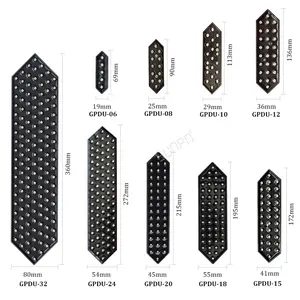

Yes, multiple suppliers offer customization in color (red, blue, green, yellow), lens type (diffused, water-clear), and packaging (tape & reel, tray). Some support custom labeling, branding, and pinout modifications. Minimum order thresholds apply, typically starting at 1,000 units for printed circuit-level changes.

Do manufacturers offer free samples?

Sample policies vary: some suppliers provide 1–3 free units for qualified buyers committing to future volume orders. Others charge a nominal fee covering material and handling, often refundable upon order placement. High-value or customized samples usually require full cost recovery.

What are common MOQ and pricing structures?

MOQs range from 10 pieces for niche SMD variants to 10,000 units for standard DIP models. Unit prices decrease with volume—commonly $0.20–$0.60 for red DIP displays at 1,000+ quantities. Larger orders (≥10,000 pcs) achieve sub-$0.30 pricing. Set-based products like digital counters maintain higher price points due to integrated driver circuits.