4 Digit 7 Segment Display Schematic

1/27

1/27

1/20

1/20

1/30

1/30

1/11

1/11

1/45

1/45

About 4 digit 7 segment display schematic

Where to Find 4 Digit 7 Segment Display Schematic Suppliers?

China's electronics manufacturing ecosystem offers a concentrated base of suppliers specializing in segmented display modules, with key production hubs in Guangdong, Hubei, and Hunan provinces. These regions host vertically integrated facilities capable of producing both LED and LCD-based 4-digit 7-segment displays, often including full schematic integration and interface support such as MODBUS RTU or RS485 protocols. Shenzhen and Dongguan serve as primary innovation centers for optoelectronics, enabling rapid prototyping and low-volume customization, while Wuhan and Changsha focus on mid-to-high volume industrial display production with strong R&D alignment.

The industrial clusters benefit from proximity to semiconductor packaging lines, PCB fabrication networks, and surface-mount technology (SMT) assembly units, reducing component lead times by up to 30%. This integration supports flexible order fulfillment, with standard product lead times averaging 15–25 days and expedited sampling available within 7–10 days. Buyers gain access to scalable production runs—from single-piece prototypes to bulk orders exceeding 1,000 units—with consistent adherence to international quality benchmarks.

How to Choose 4 Digit 7 Segment Display Schematic Suppliers?

Prioritize these verification criteria when evaluating potential partners:

Technical Expertise & Design Support

Confirm supplier capability in providing complete schematic documentation, pin configuration details, and compatibility with common microcontroller interfaces (e.g., I²C, SPI, UART). For embedded applications, verify availability of datasheets, timing diagrams, and circuit layout recommendations. Suppliers offering MODBUS or RS485-enabled models should demonstrate protocol-level testing validation.

Production Capacity & Customization Flexibility

Assess infrastructure maturity through key indicators:

- Minimum monthly output capacity exceeding 50,000 units

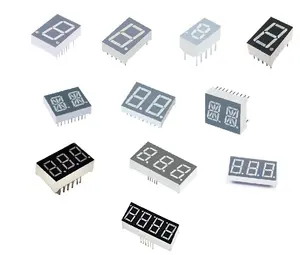

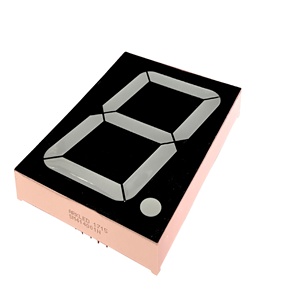

- In-house design tools for custom segment layouts, digit sizes (ranging from 0.56” to 8”), and color configurations (red, green, white, blue)

- Support for low MOQs (as low as 1 piece) and scalable ramp-up to tens of thousands

- Customization options including brightness levels, viewing angles, epoxy sealing for outdoor use, and PCB form factor adaptation

Cross-reference online transaction data with reorder rates and response times to assess operational reliability.

Quality Assurance & Transaction Security

While formal ISO 9001 certification is not universally listed, prioritize suppliers demonstrating consistent on-time delivery performance (target ≥99%) and sub-10-hour average response times. Look for evidence of internal QA processes such as aging tests, solder joint inspection, and ESD protection measures. Use secure payment mechanisms that align with order milestones, especially for first-time engagements. Request physical or digital samples to validate luminance uniformity, multiplexing stability, and driver compatibility prior to mass procurement.

What Are the Best 4 Digit 7 Segment Display Schematic Suppliers?

| Company Name | Main Products | Price Range (Unit) | Min. Order Quantity | On-Time Delivery | Avg. Response | Reorder Rate | Online Revenue |

|---|---|---|---|---|---|---|---|

| Wuhan Miaoxin Intelligent Technology Co., Ltd. | Digital Signage, LED Displays, Segment Modules | $9.88–$515 | 1 piece/set | 100% | ≤4h | 23% | US $20,000+ |

| Changsha Sunman Electronics Co., Ltd. | LCD Modules, Segment Displays, Graphic Displays | $1.00–$3.50 | 1–10 pieces | 100% | ≤17h | <15% | US $10,000+ |

| Shenzhen Kerun Optoelectronics Inc. | LED Displays, 7-Segment Digital Tubes | $0.18–$0.68 | 1–1000 pieces | 100% | ≤9h | - | US $80+ |

| Changsha Jiarui Technology Co.,ltd | LCD Modules, Segment & Character Displays | $0.30–$2.00 | 100 pieces | 100% | ≤4h | 25% | US $50,000+ |

| Dongguan Houke Electronic Co., Ltd. | Custom LED Displays, Pin Configuration Options | $0.35–$2.80 | 1–1000 pieces | 99% | ≤2h | <15% | US $360,000+ |

Performance Analysis

Wuhan Miaoxin stands out for high-end industrial applications, offering MODBUS-integrated and RS485-enabled large-format displays priced above $9.88/unit, suitable for automation and control panels. Changsha Sunman and Jiarui provide cost-effective LCD-based solutions ideal for metering and instrumentation, with pricing below $1.50/unit at scale. Shenzhen Kerun delivers aggressive pricing for standard LED segments ($0.18–$0.68), particularly competitive for orders over 1,000 units. Dongguan Houke excels in customization depth—supporting tailored pinouts, brightness, size, and mold designs—with the fastest average response time (≤2h) and highest reported online revenue, indicating robust export activity. All top-tier suppliers maintain perfect or near-perfect on-time delivery records, minimizing supply chain disruption risks.

FAQs

Do suppliers provide schematics and technical drawings?

Yes, most suppliers offer basic wiring diagrams, pinouts, and interface protocols upon request. For advanced integration, confirm availability of detailed schematics, timing charts, and driver IC compatibility (e.g., TM1650, HT16K33) before order placement.

What is the typical lead time for samples?

Standard sample lead time ranges from 5 to 10 days. Customized versions requiring new molds or PCB revisions may take 15–25 days. Air shipping adds 3–7 days for international delivery.

Can I order a single unit for testing?

Yes, multiple suppliers—including Wuhan Miaoxin, Changsha Sunman, and Dongguan Houke—support single-piece orders, enabling prototype validation without volume commitment.

Are RoHS and CE compliance certifications available?

Compliance varies by manufacturer. Request official certification documents or third-party test reports if regulatory conformity is required for end-market sales in Europe or North America.

How does pricing scale with volume?

Significant discounts apply at scale: per-unit prices for LED 7-segment displays can drop by 30–60% when ordering 1,000+ units. Negotiate tiered pricing based on forecasted annual volumes to optimize long-term procurement costs.