Additive Manufacturing 3d Printing Prototype

1/26

1/26

1/8

1/8

1/23

1/23

1/23

1/23

1/18

1/18

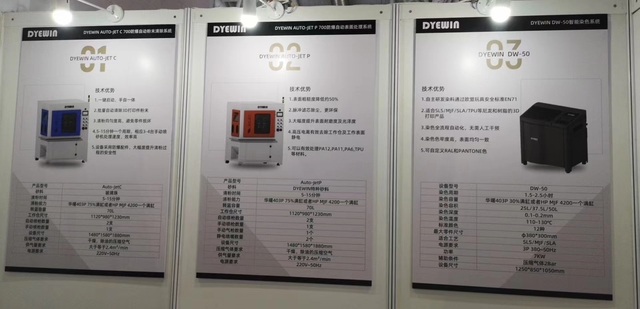

About additive manufacturing 3d printing prototype

Where to Find Additive Manufacturing 3D Printing Prototype Suppliers?

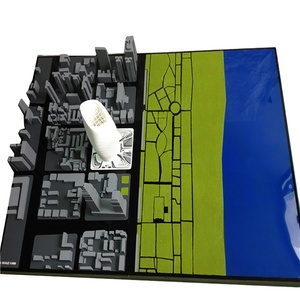

China remains a dominant force in the global additive manufacturing sector, with key industrial clusters concentrated in Guangdong and Fujian provinces. These regions host vertically integrated ecosystems combining advanced material science, precision machining, and digital fabrication services. Guangdong—home to Shenzhen and Guangzhou—accounts for over 50% of China’s rapid prototyping output, supported by mature supply chains for polymers, metals, and post-processing equipment. Xiamen and Dongguan have emerged as specialized hubs for metal-based additive manufacturing, particularly for aerospace, medical, and automotive applications requiring high-tolerance components.

The region's infrastructure enables streamlined production cycles, with many suppliers operating end-to-end facilities that include CAD modeling, SLM/SLS/SLA printing, CNC finishing, and quality inspection—all within single campuses. This integration reduces inter-factory logistics delays and supports faster turnaround times, typically 7–14 days for standard prototypes. Buyers benefit from competitive pricing due to localized material sourcing and energy-efficient production lines, achieving cost reductions of 20–40% compared to Western counterparts. Additionally, proximity to ports like Shenzhen Yantian and Xiamen Haicang ensures efficient global shipping via air or sea freight.

How to Choose Additive Manufacturing 3D Printing Prototype Suppliers?

Selecting reliable partners requires rigorous evaluation across technical, operational, and transactional dimensions:

Technical Capabilities and Process Validation

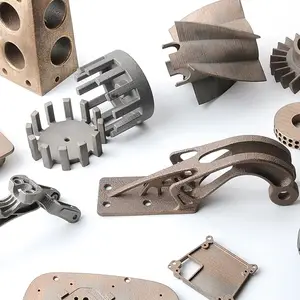

Confirm support for core additive technologies: Stereolithography (SLA), Selective Laser Sintering (SLS), Multi Jet Fusion (MJF), and Direct Metal Laser Sintering (DMLS). For metal prototyping, verify use of certified powders (e.g., stainless steel 316L, titanium Ti6Al4V, aluminum AlSi10Mg) and adherence to ASTM F887 or ISO/ASTM 52900 standards. Request build volume specifications, layer resolution (down to 25–50μm), and post-processing options such as heat treatment, polishing, or coating.

Production Infrastructure Assessment

Evaluate supplier capabilities through objective benchmarks:

- Minimum facility size of 2,000m² indicating scalable operations

- In-house access to CNC machining, EDM, and surface finishing units for hybrid manufacturing

- Dedicated QA labs equipped with CMM, optical scanners, and mechanical testers

Cross-reference online performance metrics: target on-time delivery ≥95%, response time ≤8 hours, and reorder rates above 50% as indicators of service consistency.

Quality Assurance and Compliance

Prioritize suppliers demonstrating formal quality management systems. While ISO 9001 certification is not universally listed, consistent on-time delivery and repeat order rates suggest effective internal controls. For regulated industries (medical, aerospace), require evidence of material traceability, process validation reports, and compliance with RoHS or biocompatibility standards (ISO 10993).

Transaction Security and Sampling Protocols

Utilize secure payment methods with milestone-based releases tied to prototype approval. Conduct sampling before full-scale orders—most suppliers accommodate small batches (1–100 units) at unit costs ranging $0.50–$30 depending on complexity and material. Benchmark dimensional accuracy against design files using coordinate measurement tools prior to volume production.

What Are the Best Additive Manufacturing 3D Printing Prototype Suppliers?

| Company Name | Location | Main Materials | Processing Techniques | On-Time Delivery | Avg. Response | Online Revenue | Reorder Rate | Min. Order Flexibility |

|---|---|---|---|---|---|---|---|---|

| Pulesheng Technology (Guangdong) Co., Ltd. | Guangdong, CN | Stainless Steel, Nylon, Resin | SLM, Powder Bed Fusion, Post-Press Finishing | 100% | ≤11h | US $100+ | - | 2 pieces |

| Shenzhen Heruiyun Technology Co., Ltd. | Shenzhen, CN | Nylon, High-Toughness Resin, Plastics | SLA, SLS, Rapid Tooling, OEM Molding | 100% | ≤1h | US $7,000+ | 27% | 10 pieces |

| Guangdong Fohan Technology Co., Ltd. | Guangdong, CN | Stainless Steel, Nylon, Full-Color Polymer, Resin | MJF, SLM, Casting, Digital Impression | 86% | ≤8h | US $10,000+ | 60% | 1 piece / 100g |

| Guangzhou Gaojie Model Design & Manufacturing Co., Ltd. | Guangzhou, CN | Plastic, Construction Composites | SLS, CNC Machining, Enclosure Fabrication | 100% | ≤5h | US $30,000+ | 80% | 1 unit |

| Xiamen Inone Technology Co., Ltd. | Xiamen, CN | Titanium, Aluminum, Copper, Heat-Resistant Alloys | AM for Heat Exchangers, Custom Metal Parts | 100% | ≤1h | US $1,000+ | 100% | 100 pieces |

Performance Analysis

Guangzhou Gaojie leads in customer retention with an 80% reorder rate and robust multi-process capabilities, ideal for low-volume plastic enclosures and construction-scale printing. Xiamen Inone stands out for high-value metal components, achieving a perfect 100% reorder rate despite higher MOQs, reflecting strong client satisfaction in thermal system applications. Shenzhen Heruiyun and Pulesheng offer broad polymer processing with sub-10-hour responsiveness, suitable for fast-turnaround SLA/SLS prototypes. Guangdong Fohan provides exceptional flexibility with single-piece ordering and full-color MJF options, though its 86% on-time delivery suggests potential logistical constraints during peak demand. Suppliers based in Shenzhen and Xiamen demonstrate superior communication efficiency, with average response times under 5 hours—critical for iterative design feedback loops.

FAQs

How to verify additive manufacturing supplier reliability?

Assess consistency through documented delivery records, response speed, and reorder behavior. Request sample parts to validate surface finish, dimensional accuracy, and material properties. For critical applications, conduct virtual factory audits to observe printer calibration, powder handling procedures, and QA workflows.

What is the typical lead time for 3D printed prototypes?

Standard lead times range from 5 to 10 business days for non-metallic parts and 10–15 days for metal prints, including post-processing. Expedited services may reduce timelines to 3–5 days at a premium. Allow additional time for international shipping: 3–7 days via express courier.

Are there minimum order quantity (MOQ) limitations?

MOQs vary significantly: some suppliers accept single-unit orders (especially for resin or MJF), while others require 10–100 pieces for nylon or metal builds to optimize batch efficiency. Negotiate lower MOQs for initial sampling, with scalability for future production runs.

Can suppliers handle custom materials or hybrid manufacturing?

Yes, leading providers support OEM/ODM projects involving proprietary resins, filled nylons, or composite materials. Many combine additive processes with CNC machining, welding, or insert molding for functional assemblies. Provide detailed CAD files and material specifications early in discussions.

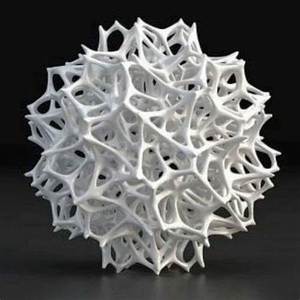

What payment and logistics terms are common?

Common payment structures include T/T, L/C, or platform-backed escrow. Most suppliers offer FOB pricing; buyers arrange final shipping. Air freight is recommended for prototypes (<5 kg), while sea freight applies for bulk production. Confirm packaging standards to prevent transit damage, especially for fragile lattice structures.